Its easy to feel like everyone has their financial act together—everyone, that is, except you. But the truth is, many people are anxious about their financial standing and wonder how theyre doing, especially when it comes to retirement savings.

To get a sense for how youre doing compared to other people, you may want to look at the average retirement savings by age. That way, you can see how much other people who have worked and saved for about the same amount of time as you have saved for retirement. Of course, youll also want to see if youre on track for your retirement—fortunately Fidelity does have an easy guideline that can help (more on that later).

Have you ever stared at your 401(k) statement wondering if your money is actually growing enough? You’re not alone One of the most common questions people ask is “What is a good rate of return on my 401(k)?” Let’s dive into this important topic and help you understand what you should expect from your retirement investments

The Typical 401(k) Return Range: What’s Normal?

When it comes to 401(k) returns, there’s no magic number that works for everyone. However, most financial experts suggest that a good 401(k) return typically falls between 5% and 8% annually over the long term. According to data from Investopedia, the five-year average was a comfortable 97% in 2024, which is actually pretty solid!

But here’s the thing – your actual returns will depend on several factors

- Your investment choices within the 401(k)

- Your asset allocation (stocks vs. bonds vs. cash)

- Current market conditions

- Your risk tolerance

- How many years you have until retirement

As Mark Charnet, founder and CEO of American Prosperity Group, points out: “Assuming your 401(k) balance is currently $100,000, it will grow to $320,713 if the constant annual rate of return is 6% and nothing is added to the account over 20 years.”

Understanding Your 401(k) Asset Allocation

The biggest factor affecting your returns? Your asset allocation. Let me break this down in simple terms:

The 60/40 Portfolio

Many investors use what’s called a “moderately aggressive” allocation – roughly 60% stocks and 40% fixed-income/cash. This balanced approach aims to provide growth through stocks while reducing volatility with bonds and cash positions. With this allocation, you can typically expect returns in that 5-8% range we mentioned earlier.

More Aggressive Allocations

If you’re younger or more willing to take risks, you might choose a more risky portfolio with some stocks, some fixed-income investments, and some cash. Over time, this might lead to higher returns in the double digits, but there will be more ups and downs along the way.

Conservative Allocations

Are you getting close to retirement? You might want a more conservative mix of investments, such as stocks, bonds, and cash. This would give you more security, but the return is probably only 2% to 3%, based on the current interest rates.

As Melissa Horton from Investopedia wisely notes, “An individual with a long time horizon typically takes on more risk within a portfolio than someone who is near retirement.”

How Your 401(k) Returns Compare to Others

I always tell my clients it’s helpful to compare your returns to some benchmarks. Here’s what the data shows for average 401(k) balances by generation (from Fidelity’s Q4 2024 data):

| Generation | Average 401(k) Balance | Employee Contribution | Employer Contribution |

|---|---|---|---|

| Baby Boomers | $249,300 | 11.9% | 5.0% |

| Gen X | $192,300 | 10.2% | 5.0% |

| Millennials | $67,300 | 8.7% | 4.6% |

| Gen Z | $13,500 | 7.2% | 3.7% |

When both employees and employers’ contributions are taken into account, the average savings rate was 14. 1 percent in 2024, which is pretty close to the 2015 percent that Fidelity suggests for keeping up your lifestyle in retirement.

Factors That Impact Your 401(k) Returns

Several things can affect how your 401(k) performs:

1. Market Conditions

The stock market goes through cycles. During bull markets, your returns might be well above average, while bear markets could temporarily drag them down. Remember – retirement investing is a marathon, not a sprint!

2. Fees

This is something many people overlook! According to U.S. News, 401(k) fees can range from less than 1% to 5% or more of your total assets. Higher fees eat into your returns, so it’s worth understanding what you’re paying.

3. Your Investment Choices

Most 401(k) plans offer various mutual funds and ETFs. Your selection within these options significantly impacts your returns.

4. Consistency of Contributions

The power of compound interest works best when you’re consistently adding to your investments. As Jared Weitz, CEO of United Capital Source Inc., explains, “The power of compound interest means your money can potentially double every 10 years with a 7% return.”

Setting Realistic Expectations for Your 401(k)

I think it’s super important to be realistic about what your 401(k) can do. Here’s what I tell folks:

- Short-term returns are unpredictable: In any given year, your returns could be negative or well into the double digits.

- Long-term averages matter more: Focus on 5, 10, and 20-year performance rather than what happened last quarter.

- Adjust expectations based on allocation: The more conservative your portfolio, the lower your expected return should be.

Let’s look at a real-world example: If you earn $50,000 annually and set aside 10% of your wages each year, with a 7% annual return, you could potentially have $497,444 by retirement (assuming you start at age 45 with $1,000 and retire at 65).

How to Improve Your 401(k) Returns

Want better returns? Here are some actionable steps:

1. Maximize Employer Matching

This is FREE MONEY, people! As Robert Johnson, professor of finance at Creighton University, advises, “At minimum, one should contribute the amount needed to earn the maximum employer match.”

2. Consider Your Time Horizon

The further you are from retirement, the more aggressive your allocation can typically be. Many successful investors gradually shift to more conservative investments as they approach retirement age.

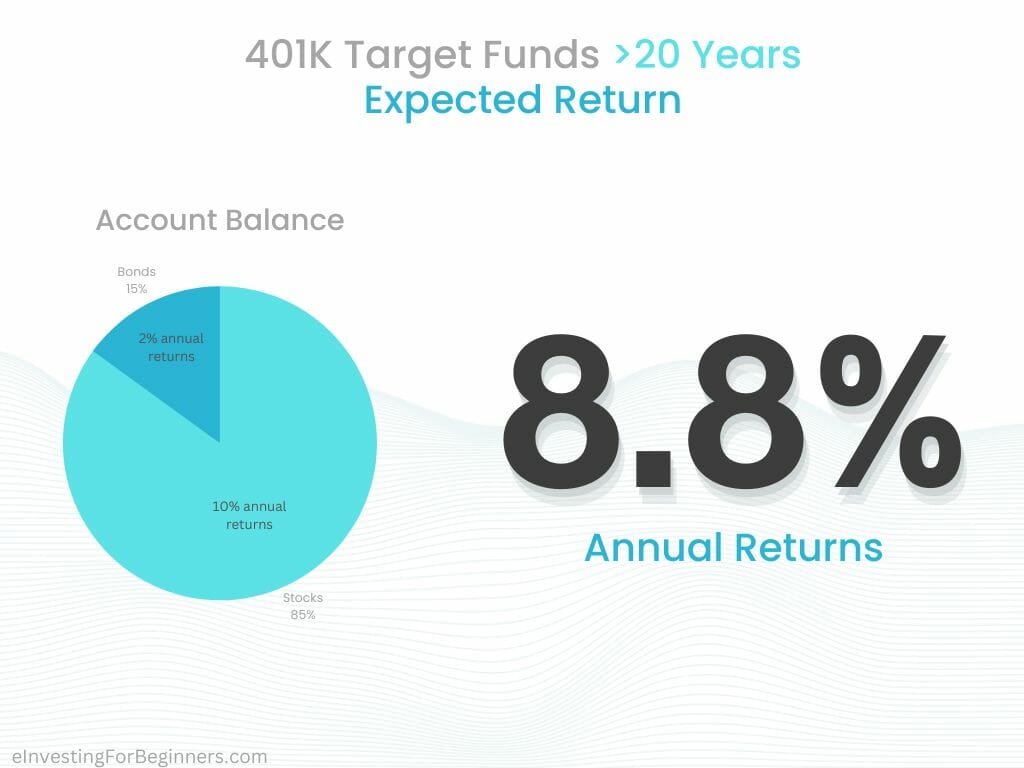

3. Use Target-Date Funds

If choosing an investment feels too hard, target-date funds are becoming more and more popular. These funds will change your allocation automatically based on when you plan to retire.

4. Regularly Review and Rebalance

Markets change, and so should your portfolio. I recommend reviewing your allocation at least once a year.

5. Minimize Fees

Look for lower-cost investment options within your plan. Even a 1% difference in fees can significantly impact your long-term returns.

Is Your 401(k) Performance on Track?

One question I get all the time is: “How do I know if my 401(k) is performing well?” Here’s a simple approach:

- Compare to similar funds: Look at how your investments are performing compared to other funds with similar objectives.

- Check against benchmarks: See how your returns stack up against relevant market indexes.

- Consider your personal goals: Are you on track to meet your retirement savings target?

Remember that it’s normal for your returns to lag behind pure market indexes by 1-2% due to fees and expenses.

What About Actual Average 401(k) Balances?

According to Fidelity data from Q4 2024, the average 401(k) balance was $131,700. But averages can be misleading – your target should be based on your personal retirement needs.

A better approach is to aim for savings milestones based on your age and income. Fidelity suggests saving:

- 1x your salary by age 30

- 3x your salary by age 40

- 6x your salary by age 50

- 10x your salary by age 67

The Bottom Line: Be Realistic and Stay Consistent

When it comes to 401(k) returns, consistency trumps perfection. A good rate of return is one that keeps you on track to meet your retirement goals, which will vary from person to person.

For most people, expecting 5-8% annual returns over the long term is reasonable with a balanced portfolio. Higher returns are possible with more aggressive allocations, but they come with increased risk and volatility.

Remember these key points:

- Focus on long-term performance

- Adjust your allocation based on your age and risk tolerance

- Minimize fees whenever possible

- Contribute consistently

- Take full advantage of employer matching

The most important thing is to start saving early and stay invested through market ups and downs. Your future self will thank you!

FAQs About 401(k) Returns

Can I expect a 10% return on my 401(k)?

While possible in some years, a consistent 10% return over many decades would be above average. The 5-8% range is more realistic for long-term planning.

How do I know if my 401(k) fees are too high?

Check your plan documents or ask your HR department. Fees below 1% are considered good, while anything above 2% might be worth investigating alternatives.

Should I change my investments when the market drops?

Generally no! Market timing rarely works and often leads to worse results. Stick with your long-term plan unless your goals or time horizon have changed.

Is a 7% return on my 401(k) good?

Yes! A 7% return falls right in the middle of the expected 5-8% range for a typical 401(k) and is considered quite solid for long-term retirement planning.

How much should I be contributing to my 401(k)?

Aim to save at least 15% of your income (including employer match) for retirement. At minimum, contribute enough to get your full employer match.

Remember, retirement planning isn’t one-size-fits-all. Your perfect 401(k) strategy depends on your personal situation, goals, and comfort with risk. When in doubt, consult with a financial advisor who can provide personalized guidance for your unique circumstances.

Average retirement savings by age

Nailing down retirement savings by age can be difficult because people may have money saved outside of 401(k)s and IRAs. Real estate, brokerage accounts, savings accounts, nonretirement CDs—and even health savings accounts—could all be earmarked for someones retirement. But a look at 401(k) and IRA balances can give you a rough measure of how you are doing compared to your peers.

Source: Fidelity Investments Q4 2024 401(k) data based on 26,700 corporate defined contribution plans and 24. 5 million participants as of December 31, 2024. These figures include the advisor-sold market but exclude the tax-exempt market. Excluded from the behavioral statistics are nonqualified defined contribution plans and plans for Fidelitys own employees.

The power of consistently investing for retirement

Another way to measure how you are doing is to look at data for people who have been contributing to their workplace retirement plan for years and years. Being in the same plan with the same employer may provide some stability and routine, which may be helpful for saving over a long period of time.

Fidelity Investments Q4 2024 401(k) data based on 26,700 corporate defined contribution plans and 24. 5 million participants as of December 31, 2024. These figures include the advisor-sold market but exclude the tax-exempt market. Excluded from the behavioral statistics are nonqualified defined contribution plans and plans for Fidelitys own employees. Gen X is made up of people born between 1965 and 1980, Baby Boomers are people born between 1946 and 1964, Millennials are people born between 1981 and 1996, and Gen Z is made up of people born between 1997 and 2012.

If you want to keep saving money after changing jobs, make sure you can save at least as much as you were saving at your old job. If you cant swing it right away, make an appointment with yourself to check your retirement savings rate again in a few months.