The current average mortgage rate for someone with a good credit score (700) was 7.42% as of January 3, 2025, according to Curinos data. Your credit scores can directly impact your eligibility for a mortgage and the interest rate you receive. You may need a score in the high 700s (or higher) to get the best interest rate.

The current average mortgage rate on a conventional 30-year fixed-rate mortgage for someone with a good credit score of 700 was 7.42% as of January 3, 2025, according to Curinos data. You generally need a credit score of at least 580 to qualify for a mortgage, and a score of 760 or higher to get the best interest rate.

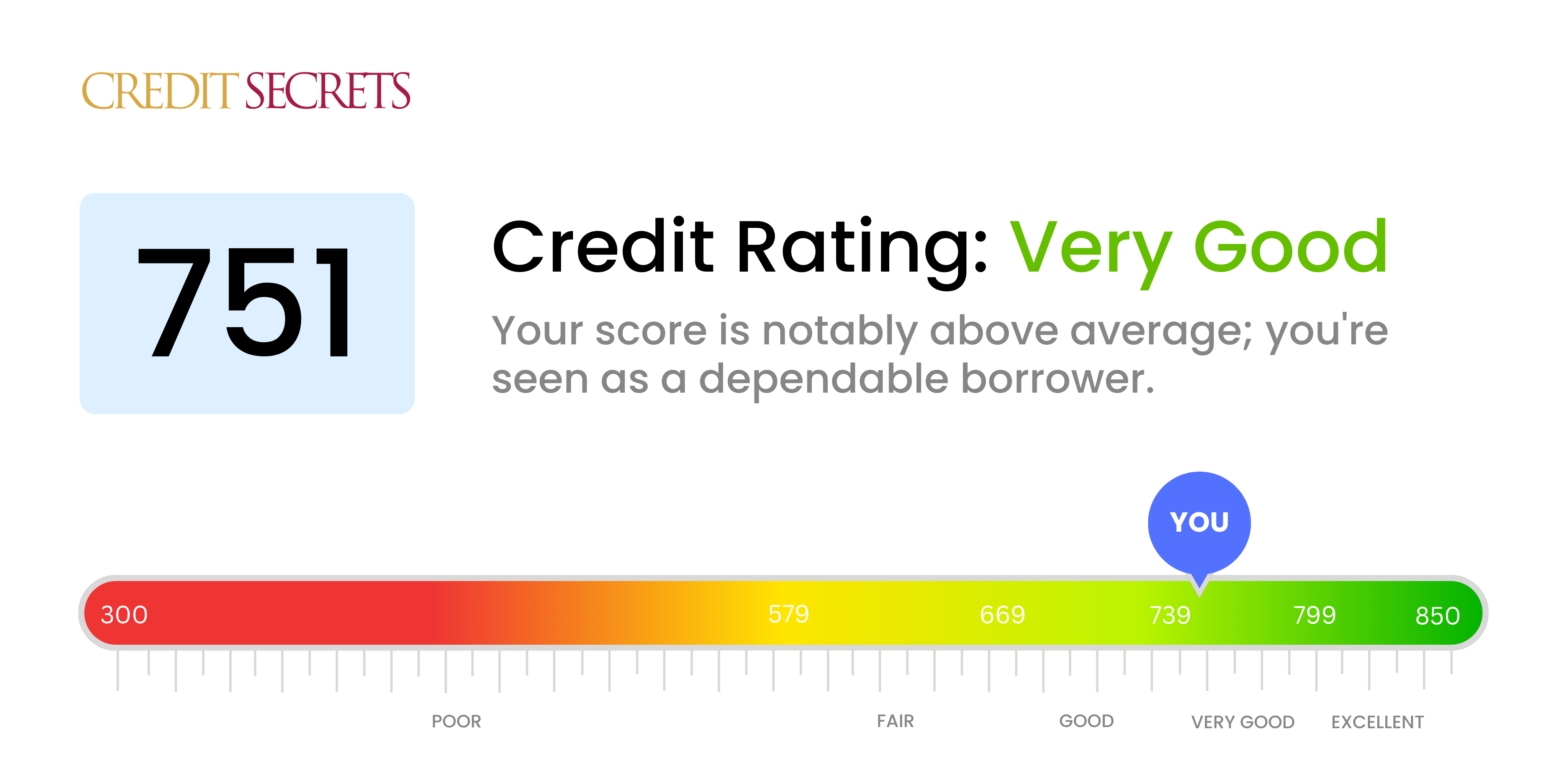

Your credit score is one of the most important factors that determines the interest rate you will get on a loan. Specifically, a credit score of 751 is considered excellent by most lenders and will qualify you for the best interest rates available. In this article, we’ll look at exactly what interest rate ranges you can expect with a 751 credit score on different types of loans.

What Does A 751 Credit Score Mean?

Credit scores range from 300 to 850, with higher scores indicating better credit and lower risk to lenders A 751 credit score falls in the range of 740-799, which is categorized as “very good” by FICO.

Specifically, a 751 credit score means:

- You have a long and well-established credit history.

- You make payments on time and have low credit utilization.

- You have a mix of credit types, including installment loans and credit cards.

- You have few or no recent credit inquiries.

- You have no negative items like bankruptcies, foreclosures, liens, wage garnishments, etc.

With this strong credit profile a 751 score indicates to lenders that you are an extremely low credit risk. You will qualify for the best loan terms like low interest rates.

Interest Rates For Different Loan Types

The exact interest rate you will get depends on the type of loan as well as current market rates Here are the average interest rates you can expect with a 751 FICO score

Mortgage Rates

- Conventional 30-year fixed: 3.5% to 4.5%

- Conventional 15-year fixed: 2.75% to 3.75%

- FHA 30-year fixed: 2.75% to 3.75%

- VA 30-year fixed: 2.5% to 3.25%

- Jumbo 30-year fixed: 3.375% to 4.125%

As you can see, a 751 credit score will qualify you for the lowest mortgage rates across all loan types. This will save you tens of thousands of dollars in interest over the life of the loan compared to a lower credit score.

Auto Loan Rates

- New car: 2% to 4%

- Used car: 2.5% to 5%

With excellent credit, you can qualify for 0% APR offers from car manufacturers as well as discounts from auto lenders. This allows you to save substantially on your auto loan.

Personal Loan Rates

- Unsecured: 6% to 12%

- Secured: 4% to 9%

Personal loan rates encompass a wide range, but your 751 score will place you on the lower end. Lenders will see you as a minimal risk and offer their best advertised rates.

Student Loan Rates

- Undergraduate: 3.5% to 6%

- Graduate: 5% to 7%

- Parent PLUS: 6% to 8%

- Private: 2% to 6%

Federal student loan rates are fixed, but private lenders will offer their lowest rates to borrowers with excellent credit like a 751 score. This allows you to minimize interest costs on student loans for yourself or your children.

What Affects Your Exact Interest Rate

Within each loan category, your exact interest rate will depend on a few additional key factors:

Your debt-to-income ratio – The lower your DTI, the better your rate on most loans. Lenders want to see you aren’t overextended.

Loan term – Shorter terms often mean lower rates. A 15-year mortgage will have a lower rate than a 30-year mortgage, for example.

Type of lender – Online lenders and credit unions may offer lower interest rates than traditional banks.

Your location – Interest rates can vary by state, city, and even zip code. Shop around locally.

Market rates – General interest rate trends impact the rates lenders offer. Keep an eye on rate changes.

Down payment amount – A higher down payment or trade-in on a loan may result in a lower interest rate.

So in addition to your 751 credit score, pay attention to these factors when applying for a loan to land the lowest rate possible.

How To Get The Best Interest Rate With A 751 Credit Score

Here are a few tips for securing the lowest interest rate when your credit score is 751:

-

Shop around – Apply with several lenders and compare interest rate quotes. Even small differences can save you thousands.

-

Ask about discounts – Many lenders offer interest rate discounts for setting up autopay, having an existing account, or other factors.

-

Increase your down payment – Putting down 20% or more on a mortgage or auto loan looks attractive to lenders.

-

Lower your debt – Pay down balances before applying for the loan to decrease your DTI.

-

Check for errors on your credit reports – Correct any mistakes so your credit score isn’t erroneously lowered.

-

Limit credit applications – Too many hard inquiries from loan applications in a short timeframe can ding your score.

-

Consider a shorter term – Opt for a 15-year mortgage, 3-year auto loan, etc. to receive a lower interest rate.

By leveraging your excellent 751 credit score strategically during the loan process, you can lock in the most favorable interest rate and save money.

The Impact Of A Higher Or Lower Credit Score

How much does your interest rate fluctuate based on your exact credit score? Here’s an example using 30-year fixed mortgage rates:

| Credit Score | Interest Rate |

|---|---|

| 781+ | 3.25% |

| 751 | 3.625% |

| 701 | 4.125% |

| 661 | 4.75% |

| 621 | 5.25% |

| 581 | 5.75% |

As you can see, someone with a credit score of 781 may pay around 0.375% less than someone with a 751 credit score, which can add up to thousands of dollars over the loan repayment period.

On the other hand, a borrower with a fair credit score of 621 will pay close to 2.5% higher interest. This demonstrates the significant impact your credit score can have on mortgage rates specifically.

How To Improve Your Credit Score

If your credit score is currently below 751, all hope is not lost. Here are some tips for improving your credit score to qualify for better interest rates:

-

Pay all bills on time – Delinquent payments can crush your credit score. Set up autopay or reminders to avoid lateness.

-

Keep balances low – High credit utilization hurts your score. Aim to keep balances under 30% of your credit limit.

-

Avoid applying for too much credit – Each application causes a hard inquiry that can ding your score temporarily.

-

Monitor your credit reports – Dispute any errors with the credit bureaus to maximize your score.

-

Consider a credit builder loan – These installment loans can help demonstrate you can manage credit responsibly.

With diligence and smart financial habits, you can improve your credit score over time and earn access to the lowest interest rates.

The Bottom Line

A credit score of 751 or higher is considered excellent and will qualify you for the very best loan terms and the lowest interest rates. On a mortgage, you can expect rates between 3.5% and 4.5% with a 751 FICO score. Rates for auto loans, student loans, and personal loans will also be on the lower end of the spectrum.

Focus on the other factors lenders consider, like your DTI and down payment amount, to make sure you land the ideal rate for your situation. Check your score periodically and aim for small improvements over time. Even gaining just 30 points can save you thousands on a mortgage or other long-term loan.

How Credit Scores Affect Mortgage Rates

Your credit score can directly impact your eligibility for different types of mortgages and the interest rate you receive. Generally, a higher credit score can help you qualify for more types of mortgages, a larger loan, a lower down payment and a lower interest rate.

However, unlike when you apply for most loans or credit cards, mortgage lenders tend to request credit scores based on all three of your credit reports and use specific credit scoring models.

Heres a closer look at credit scores and how they can affect your options and rates when you apply for a mortgage.

A credit score is a number that creditors can use to assess the risk that a consumer will miss a payment by at least 90 days. There are many types of credit scores available, and credit scoring companies like FICO and VantageScore® regularly release new versions and types.

Most credit scores analyze your credit report from one of the major credit bureausâExperian, TransUnion or Equifaxâto determine a score. Many credit scores, including the scores commonly used for mortgages, range from 300 to 850. A higher score is better because it indicates the person is less likely to miss a payment.

Most scores consider similar factors, such as your payment history and credit utilization ratio, but the specific factors and weighting depend on the type of credit score.

Mortgage Lenders Generally Use Older Credit Scores

Many mortgage lenders use classic FICO® Scores when reviewing mortgage applications. There are three classic scores, one for each credit bureau:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO Risk Score 04

In October 2022, the Federal Housing Finance Agency (FHFA) announced that mortgage lenders will be required to deliver newer FICO 10 T and VantageScore 4.0 credit scores when selling mortgages to Fannie Mae or Freddie Macâa common arrangement. There was an estimated implementation timeline for late 2025. But in early 2025, that was revised to a “to-be-determined” date.

How Good Is a 751 Credit Score? – CreditGuide360.com

FAQ

What is the interest rate for a 751 credit score auto loan?

Car Loan Interest Rates for Prime Credit Scores (661 – 780)

A score in this range indicates that you’re financially responsible when it comes to managing your credit. Average APR rates for someone with a credit score of 661-780 are 5.82% for a new car, or 7.83% if you’re buying a used car.

What home interest rate can I get with a 750 credit score?

| FICO Score | Mortgage APR* | Monthly Payment* |

|---|---|---|

| 760-850 | 7.242% | $2,746 |

| 700-759 | 7.449% | $2,803 |

| 680-699 | 7.555% | $2,832 |

| 660-679 | 7.609% | $2,847 |

Can I buy a house with a 751 credit score?

With your good 751 credit score, you could expect the highest quality mortgage programs and the best rate &terms.

What interest rate can I get with a 710 credit score?