Taking out a mortgage to purchase a home is a major financial decision that most people make at some point in their lives. Along with the mortgage, many lenders encourage or require borrowers to purchase mortgage life insurance to protect the investment. But what happens when the mortgage is eventually paid off? Does the insurance coverage continue or does it end? Here is a detailed look at what happens to life insurance when the mortgage is paid.

Overview of Mortgage Life Insurance

Mortgage life insurance, also known as mortgage protection insurance, is a type of term life insurance specifically designed to cover the balance of a home mortgage loan. If the borrower dies while the mortgage is still active, the insurance payout goes directly to the lender to repay the remaining loan balance.

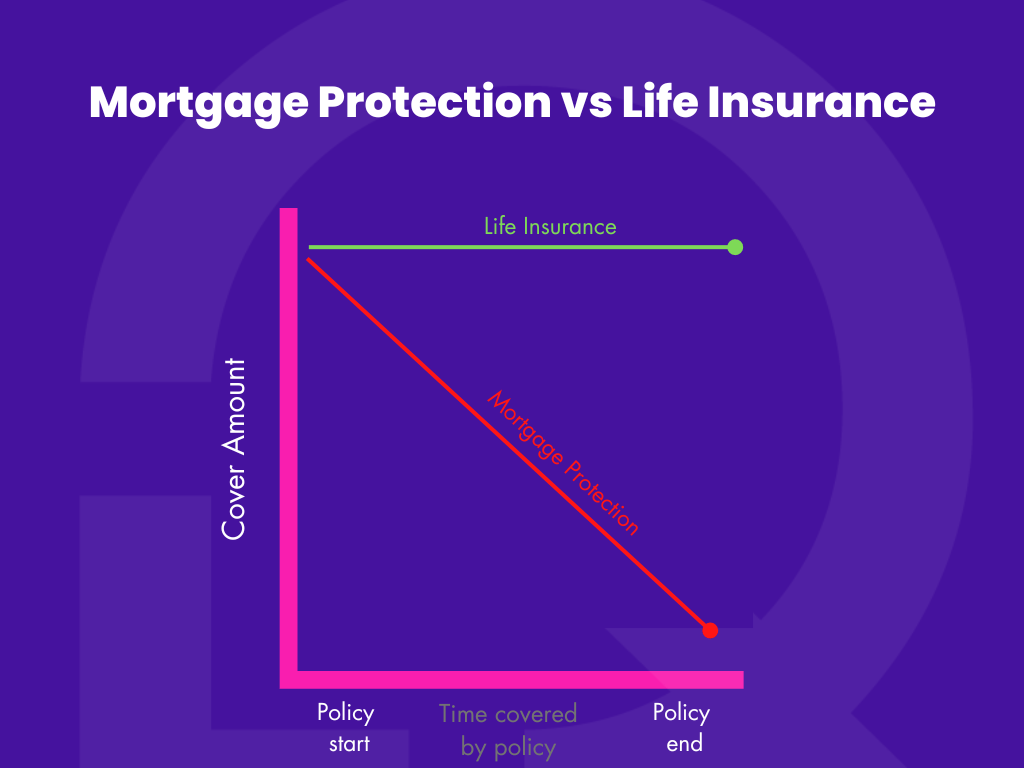

This protects family members from inheriting mortgage debt and helps ensure they can keep the home. Mortgage life insurance policies are structured as decreasing term policies where the death benefit decreases each year in line with the declining mortgage loan balance.

Policy Duration Matches Mortgage Term

A key characteristic of mortgage life insurance is that the duration of coverage matches the term of the mortgage. For example, if you take out a 30 year mortgage, the mortgage life insurance policy will be a 30 year term policy.

The death benefit and premiums are structured to decrease each year to correspond with the declining mortgage balance. So in year 1 the death benefit equals the original mortgage amount. In year 10 the death benefit is lower reflecting 10 years of mortgage payments.

This means the life insurance coverage expires when the mortgage is fully paid off. The policy is designed specifically to cover the mortgage – so when there is no remaining mortgage balance, there is no need for the coverage.

Options at Mortgage Payoff

So what happens when you actually pay off the mortgage? You have a few options with regards to your life insurance:

-

Let the policy lapse – This is the most common outcome. The mortgage insurance was put in place solely to cover the mortgage, so with no remaining mortgage debt there is no need to continue the coverage. Many borrowers let the policy lapse at mortgage payoff.

-

Convert to permanent policy – Some mortgage life policies include an option to convert to a permanent life insurance policy, such as whole life or universal life, at mortgage payoff. This allows you to maintain life insurance coverage for other needs.

-

Obtain new policy – You may decide you still need life insurance coverage even though the mortgage is paid off. In this case, you would take out a new policy. Often a term life policy is a more cost effective option than continuing mortgage life insurance.

Considerations at Mortgage Payoff

Here are some key considerations as you approach mortgage payoff:

-

Do you still need life insurance? Look at your overall financial situation, income needs, dependents, and other debts. Life insurance can still provide value even without a mortgage.

-

Compare costs of continuing mortgage insurance vs. new coverage. Mortgage life tends to be more expensive.

-

Make sure beneficiaries are updated if obtaining new coverage. Mortgage policies pay the lender, but new policies should name the desired recipients.

-

Review conversion requirements if you want to keep mortgage life insurance. This option is not always available.

-

Consider cancelling mortgage insurance even if you keep the policy – this eliminates fees while retaining coverage.

Alternatives to Mortgage Life Insurance

Mortgage life insurance meets a specific need – paying off a mortgage balance if you die during the loan term. But it has some disadvantages such as high cost and decreasing coverage. Here are some alternatives to consider:

-

Term life insurance – More affordable and provides level death benefit. Proceeds can go towards mortgage or other needs.

-

Whole/permanent life insurance – Offers lifelong coverage and cash value accumulation. More expensive but more flexibility.

-

Disability insurance – Covers mortgage payments if you become disabled and cannot work.

-

Savings/investments – Self-insure by building up a liquid pool of assets.

The Bottom Line

Mortgage life insurance is designed specifically to cover an active mortgage loan. So when the mortgage is fully paid off, the need for the coverage goes away. Most borrowers let the policy lapse at that point, but some convert to permanent insurance or take out a new policy. The key is evaluating ongoing life insurance needs at mortgage payoff and choosing the most cost effective way to meet them. With some foresight, you can develop a strategy to provide financial protection for your family that extends well beyond the end of your mortgage term.

What Is Mortgage Life Insurance?

A mortgage life insurance policy is a term life policy designed specifically to repay mortgage debts and associated costs in the event of the death of the borrower.

These policies differ from traditional life insurance policies. With a traditional policy, the death benefit is paid out when the borrower dies. However, a mortgage life insurance policy does not pay unless the borrower dies while the mortgage itself is still in existence, and where the beneficiary is the mortgage lender. The term of the life insurance policy matches that of the mortgage, and the death benefit is usually reduced each year to correspond with the new amortized mortgage balance outstanding as mortgage payments are made.

- A mortgage life insurance policy pays a death benefit to the lender if a home borrower dies during the term of a mortgage loan.

- These term policies are structured to match the number of years remaining on a mortgage, with death benefit amounts that adjust annually to reflect the reduced mortgage balance left after each year.

- Borrowers who are required by their lender to take out mortgage life insurance may also elect permanent life insurance, where they are able to name new beneficiaries after the mortgage obligation has been satisfied.

Understanding Mortgage Life Insurance

There are two basic types of mortgage life insurance: decreasing term insurance, where the size of the policy decreases with the outstanding balance of the mortgage until both reach zero; and level term insurance, where the size of the policy does not decrease. Level term insurance would be appropriate for a borrower with an interest-only mortgage.

Before buying mortgage life insurance, a potential policyholder should carefully examine and analyze the terms, costs, and benefits of the policy. Remember, there are two lifespans to consider—the lifespan of the policyholder and the lifespan of the mortgage. Its also important to investigate whether one could get the same level of coverage for your family at a lower cost—and with fewer restrictions—by buying term life insurance.

Mortgage life insurance should not be confused with private mortgage insurance (PMI), a product often required by people who take out a mortgage for less than 80% of the value of their home.

What happens to the life insurance surety when you pay off your home loan

FAQ

Is there life insurance that pays off your mortgage?

Both term insurance and mortgage life insurance provide a means of paying off your mortgage. With either type of insurance, you pay regular premiums to keep the coverage in force. But with mortgage life insurance, your mortgage lender is the beneficiary of the policy rather than beneficiaries you designate.

What happens to home insurance when you pay off mortgage?

Once your loan is paid off, you’ll have to pay your home insurance premiums and property taxes out of pocket, instead of through an escrow account.Apr 7, 2025

Do I need life insurance if I have no debt?

What happens when my mortgage is paid off?

The lender will send you a closing letter and a discharge note to confirm you have paid off your mortgage. You will also receive some paperwork that will need completing. After this is complete, your mortgage lender will remove the charge on your property.

Does mortgage life insurance pay a death benefit?

The term of the life insurance policy matches that of the mortgage, and the death benefit is usually reduced each year to correspond with the new amortized mortgage balance outstanding as mortgage payments are made. A mortgage life insurance policy pays a death benefit to the lender if a home borrower dies during the term of a mortgage loan.

What happens if you pay off a mortgage with life insurance?

With level cover life insurance, the lump sum payout remains the same throughout the policy term. It is typically used for interest-only mortgages but can also be used to pay off other debts such as loans and credit cards. What happens when the mortgage is paid off?

How does mortgage life insurance work?

Mortgage life insurance policies have a specified period of coverage — generally 15 or 30 years — and the death benefit can be structured in one of three ways: Decreasing: The death benefit may be fixed for the first few years of coverage, but then decrease at a specified rate over the life of the policy.

Do you need mortgage life insurance if you die?

The death benefit of mortgage life insurance is equal to your mortgage balance. You typically don’t need mortgage life insurance if you have sufficient life insurance coverage, such as term life insurance. Mortgage life insurance is term life insurance that pays the balance of your mortgage if you die during the term of the policy.

Do mortgage life insurance policies cost more than term life insurance?

Since mortgage life insurance policies don’t factor your health into pricing, they generally cost more than a term life insurance policy for the amount of coverage you get. You can typically get more value in a term life insurance policy if you don’t have any health conditions. You can’t spend the death benefit on whatever you want.

Why is mortgage life insurance so expensive?

Mortgage life insurance can be expensive for the level of coverage you can receive since there’s no medical exam. Additionally, your cost per dollar of coverage increases with time since premiums are level while the death benefit decreases. Mortgage life insurance lacks the cash value growth component of permanent life insurance.