Usually, getting some extra cash is a reason to celebrate. But could an inheritance or other unexpected windfall stop you from getting government benefits that you depend on? Unfortunately, the answer is “yes.”

While receiving an inheritance seems like it should help, not hurt, government program rules can mean extra assets cost you the monthly support checks you rely on. In effect, your inheritance can end up going to the government. It’s not fair—but learning the specifics on handling added money can save your benefits.

As experienced elder lawyers, we’ve seen firsthand how mishandled inheritances lead to painful benefit losses. Our attorneys regularly counsel Social Security supplemental security income beneficiaries on handling inheritances so they don’t lose out.

We’ll talk about some proactive steps you can take in this blog post to keep both your new assets and old benefits.

When you’re getting government benefits, getting an inheritance can be both good and bad. Even though extra cash is nice, it can put your important benefits at risk. Many of my clients have had this happen to them: one day they’re celebrating an unexpected windfall, and the next they’re freaking out because they might lose their monthly income or health insurance.

The Inheritance Dilemma

When you inherit money while receiving government benefits like Medicaid or Supplemental Security Income (SSI), you face a serious dilemma. These programs are means-tested, which means they’re designed for folks with limited income and assets. An inheritance can suddenly push you over these limits.

Most people don’t realize they need to report inheritance money quickly – usually within 10 days of receiving it. If you don’t report it, you might have to pay back benefits you weren’t eligible for, plus face penalties or even benefit suspension.

How Different Benefits Programs View Inheritances

Different benefit programs have different rules about inheritances Let’s break it down

Medicaid and Inheritances

For Medicaid recipients, an inheritance is viewed as both income and assets:

- In the month received: The inheritance counts as unearned income

- Following months: Any remaining money counts as an asset

Most states only let Medicaid recipients have $2,000 in assets and about $2,901 a month in income (2025 numbers), so even a small inheritance can be a problem.

For example, if Albert who lives in a Medicaid-funded nursing home gets a $10,000 inheritance, he’ll be ineligible for Medicaid that month He’ll need to pay his own nursing home bill and spend down the remainder quickly to regain eligibility.

Note: California is an exception – Medi-Cal beneficiaries can have unlimited assets (as of January 2024) and can gift inheritance in the month received.

SSI and Inheritances

For SSI recipients, the rules are even stricter:

- Individual resource limit: $2,000

- Couple resource limit: $3,000

- Monthly income limit: $967 for individuals, $1,450 for couples (2025 figures)

Even a small inheritance can disrupt these benefits. Unlike Medicaid, if you refuse an inheritance to maintain SSI eligibility, the Social Security Administration might consider it “constructively received” anyway, potentially making you ineligible for up to three years!

Do I Have to Accept the Inheritance?

You might be tempted to just refuse the inheritance, but this isn’t recommended:

-

For Medicaid recipients: Disclaiming an inheritance is considered a violation of Medicaid’s Look-Back Rule, potentially resulting in a penalty period.

-

For SSI recipients: Refusing an inheritance is typically considered “transferring resources,” which could make you ineligible for up to three years.

The best approach is usually to accept the inheritance and then implement appropriate strategies to maintain benefit eligibility.

Smart Ways to Keep Both Your Benefits and Inheritance

Don’t panic! There are several ways to protect your benefits while still benefiting from an inheritance:

1. Special Needs Trusts

Special needs trusts, which are also known as supplemental needs trusts, help people who get benefits keep their eligibility:

- The money in the trust doesn’t count toward income/asset limits

- Funds must be used for expenses not covered by government benefits

- A trustee manages the money, not the beneficiary

There are three main types:

| Trust Type | Funded By | Key Features |

|---|---|---|

| First Party Trust | Beneficiary’s own money | Must be under age 65, irrevocable, Medicaid payback required |

| Third Party Trust | Someone else’s money | No age restrictions, can be revocable/irrevocable, no Medicaid payback |

| Pooled Trust | Multiple beneficiaries | Managed by nonprofit, can be first or third party |

2. ABLE Accounts

If your disability began before age 26 (increasing to 46 in 2026), an ABLE account is worth considering:

- Up to $100,000 can be held without affecting SSI benefits

- Annual contributions limited to $19,000 (2025)

- Funds can be used for qualified disability expenses

- Anyone can contribute to your ABLE account

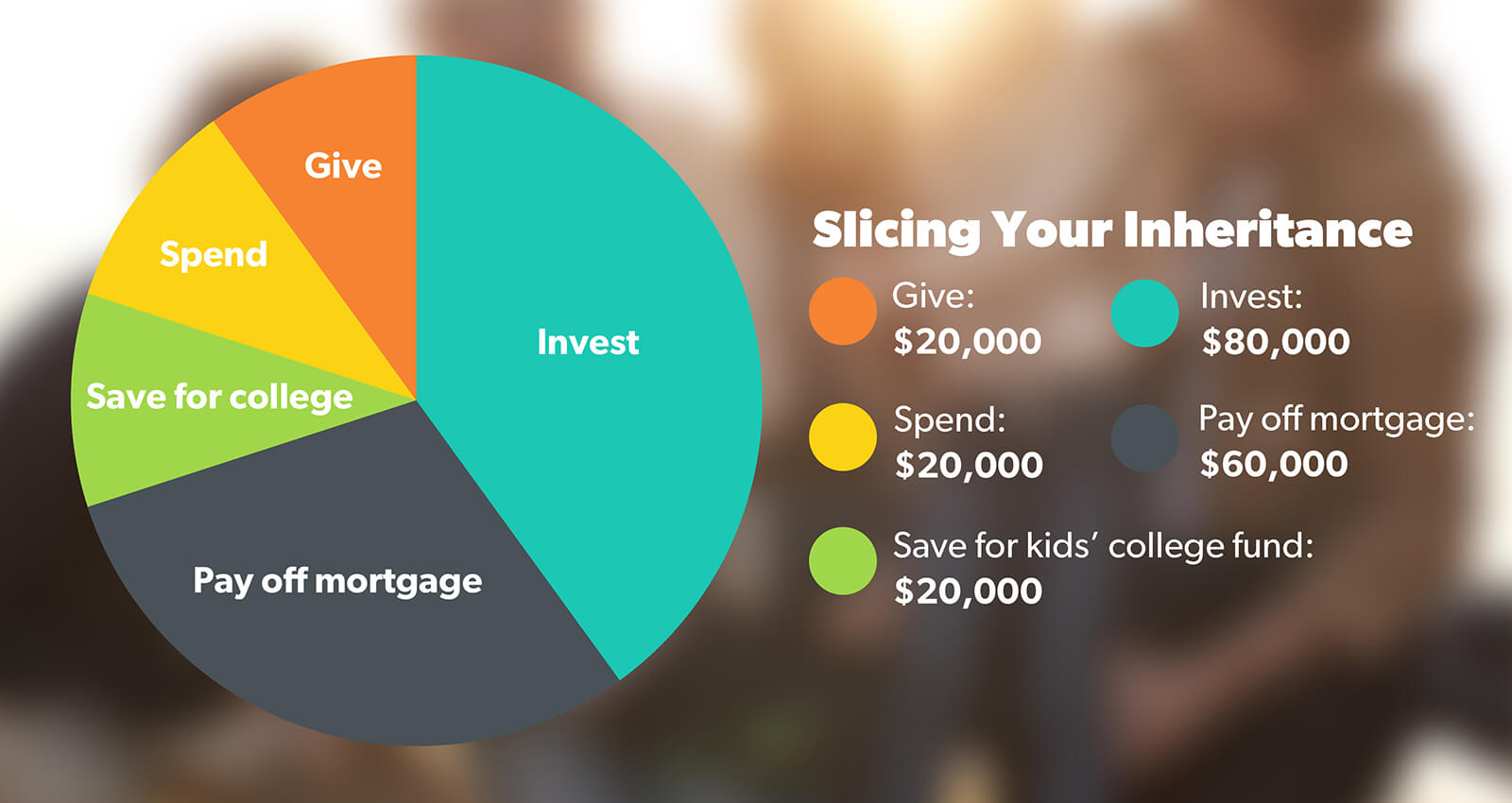

3. Strategic Spend Down

For smaller inheritances, spending down assets quickly might be the simplest solution:

- Pay off debts

- Make home modifications for safety and accessibility

- Purchase necessary household items or vehicle

- Prepay rent, utilities, or insurance

- Buy an Irrevocable Funeral Trust to cover funeral/burial costs

Remember to keep receipts for all purchases in case you need to prove how the money was spent.

4. Medicaid Asset Protection Trusts (MAPTs)

For larger inheritances, a MAPT might be worth considering:

- Assets in these irrevocable trusts don’t count toward Medicaid’s asset limit

- Protects assets from Medicaid Estate Recovery after death

- Must be set up well in advance (subject to the 5-year Look-Back Rule)

5. Modern Half a Loaf Strategy

This complex strategy involves:

- Gifting approximately half of excess assets to a loved one

- Using the other half to buy a short-term Medicaid Compliant Annuity

- Using annuity income to pay for care during the resulting penalty period

This approach is not for everyone and requires professional guidance.

Real-Life Examples

Let’s see how these strategies might work in real situations:

Example 1: Small inheritance while on SSI

Maria receives SSI benefits of $950/month and inherits $5,000 from her uncle. This puts her over the $2,000 asset limit. She reports the inheritance promptly and works with a benefits planner to:

- Buy a reliable used refrigerator ($800)

- Replace her worn mattress ($600)

- Pre-pay her rent for two months ($1,800)

- Purchase an irrevocable funeral trust ($1,500)

- Buy necessary clothing and household supplies ($300)

After spending down to below $2,000 in assets, her SSI benefits continue uninterrupted.

Example 2: Large inheritance while on Medicaid

Thomas receives home care services through Medicaid. His father passes away, leaving him $100,000. He consults with a Medicaid planner who helps him establish a first-party special needs trust. The trust pays for:

- Home modifications to improve accessibility

- A reliable vehicle for medical appointments

- Specialized equipment not covered by Medicaid

- Additional caregiver hours when needed

Thomas maintains his essential Medicaid benefits while improving his quality of life.

What You Must Do Immediately After Receiving an Inheritance

If you’ve just received an inheritance, don’t delay:

- Report it promptly – Usually within 10 days to your benefits agencies

- Contact a professional – A Medicaid planner or elder law attorney can help navigate your options

- Don’t give away the money – This could trigger penalties

- Document everything – Keep detailed records of how you spend inheritance funds

- Consider your options – Determine which strategy works best for your situation

Common Mistakes to Avoid

People often make these costly errors when dealing with inheritances:

❌ Hiding the inheritance from benefit agencies

❌ Giving away money to family members without proper planning

❌ Spending inheritance on luxury items rather than necessities

❌ Waiting too long to implement a protection strategy

❌ Trying to navigate complex benefits rules without professional help

When to Get Professional Help

The rules surrounding benefits and inheritances are incredibly complex and vary by state. Working with an expert is almost always worth the investment. Consider contacting:

- A Medicaid planner

- An elder law attorney

- Your local Area Agency on Aging

- A financial advisor experienced with special needs planning

The Eldercare Locator (1-800-677-1116) can help you find local resources.

Final Thoughts

Receiving an inheritance while on benefits doesn’t have to be a disaster. With proper planning and quick action, you can often preserve both your benefits and make good use of your inheritance to improve your quality of life.

The key is understanding the rules, acting quickly, and getting professional guidance tailored to your specific situation. Don’t try to navigate these complex waters alone – the stakes are simply too high.

Remember, an inheritance is meant to be a blessing, not a burden. With the right approach, it can enhance your life without disrupting the essential benefits you depend on.

What worked for you when you had to deal with an inheritance while on benefits? Please share your story in the comments below.

What Inheritances Do NOT Count Towards SSI Resource Limits

The following inherited assets don’t count toward the SSI resource limits of $2,000 for an individual or $3,000 for a couple:

- Distributions from properly structured special needs trusts

- Contributions to ABLE accounts, up to $100,000

- The home the beneficiary lives in

- One vehicle for household transportation

- Household goods and personal effects

- Burial plots spaces for the beneficiary or their family

- Burial funds, up to $1,500 each for the beneficiary and spouse

- Property used as part of one’s trade or business

- Set aside money or property as part of a valid PASS plan

Not All Inheritances Are Treated Equally for SSI Eligibility

It would be nice if the government greeted every inheritance simply with congratulations rather than paperwork. But in the realm of needs-based benefits, officials make distinctions based on the form inheritances take.

What Happens If You Inherit Money While On Social Security Disability? // Elder Needs Law

FAQ

How do I stop inheritance affecting my benefits?

A person writing a will wishing to benefit someone who is receiving benefits, but wanting to ensure that they do not lose these means tested benefits, should consider the following: Trusts: Setting up a trust can be a way to protect your inheritance.

Does getting an inheritance affect benefits?

Yes, an inheritance can affect your government benefits, particularly needs-based programs like Supplemental Security Income (SSI), by counting as a resource or income. However, Social Security Disability Insurance (SSDI) is not affected by an inheritance because it is an earned benefit based on your work history, not your current income or assets.

Can you lose your Social Security benefits if you inherit money?

An inheritance does not affect Social Security retirement benefits because they are based on your work history, not your current income or resources.

Can welfare take inheritance money?

If you don’t have a trust, the inheritance you receive might be seen as extra income or assets, which could stop you from getting government benefits or make them less valuable. When it comes to Medicaid, you might have to spend down the inheritance until you reach the Medicaid income limit in your state.

What happens if you receive an inheritance?

Receiving an inheritance may require welfare recipients to reimburse benefits if the inheritance affects their eligibility. Programs like SSI and Medicaid can get back benefits that were paid during times when a person wasn’t eligible because they didn’t report or lied about having assets.

Can inheritance affect SSI benefits?

While receiving an inheritance can be a blessing, it also can interrupt your benefits at the same time you’re grieving the loss of a loved one. But with careful planning and professional guidance, you may be able to keep both SSI benefits and inheritance assets—and enjoy a more secure financial future. How can inheritance affect SSI eligibility?

What happens if I receive an inheritance from Social Security?

Immediately after receiving an inheritance, you should notify your local Social Security office. If your inheritance exceeds $963, you’ll be ineligible for benefits for at least one month. You’ll remain ineligible as long as your resources are more than $2,000.

How does inheritance impact welfare benefits?

Explore how inheritance impacts welfare benefits, including asset thresholds, reporting obligations, and potential reimbursement requirements. Receiving an inheritance can significantly impact individuals on welfare or public assistance programs.

Can I inherit money while on SSI?

Inheriting money while on SSI benefits requires careful planning and consideration. By understanding the rules and regulations, you can take steps to protect your eligibility and ensure that the inheritance benefits the individual receiving SSI.

What happens if my inheritance exceeds the asset limit?

If the inheritance amount exceeds the asset limit, you may lose your SSI benefits. However, there are ways to manage inheritances and still maintain your eligibility. It’s crucial to report any inheritances to the Social Security Administration (SSA) within 10 days of the month following the month you received the inheritance.