The Fair and Accurate Credit Transactions Act (FACT Act or FACTA) is an important piece of federal legislation passed in 2003 that has had a major impact on consumer rights and identity theft prevention. In this article, we’ll provide an overview of what the FACT Act does, its key provisions, and why it matters for consumers.

A Brief History

The FACT Act was signed into law by President George W. Bush on December 4, 2003 as an amendment to the earlier Fair Credit Reporting Act (FCRA). The FCRA, originally passed in 1970, regulated credit reporting agencies and the use of consumer credit reports.

With the rise of identity theft and e-commerce in the 1990s and early 2000s, an update was needed to address new threats to consumers. The FACT Act added provisions to help prevent identity theft, increase the accuracy of consumer records, and expand consumer access to credit data.

Key Provisions of the FACT Act

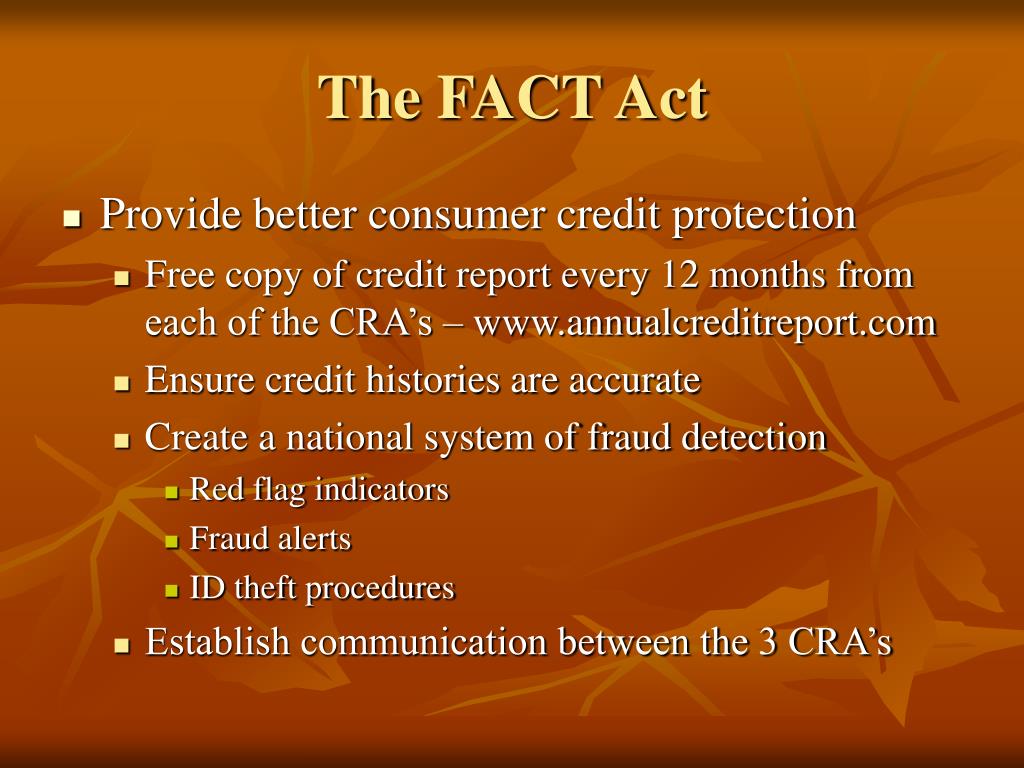

The FACT Act contains several important titles that expanded consumer rights and identity theft protections:

Free Annual Credit Reports

One of the best-known parts of the FACT Act is that it entitles consumers to receive one free credit report per year from each of the three major national credit bureaus – Equifax, Experian, and TransUnion Consumers can request these reports at AnnualCreditReportcom.

Regularly checking credit reports makes it easier to catch mistakes and signs of potential identity theft early.

Identity Theft Protections

A major focus of the FACT Act is preventing and mitigating identity theft. Key identity theft provisions include:

-

Fraud alerts – Consumers can place an initial 90 day fraud alert if identity theft is suspected. An extended 7 year alert is also available. The alerts notify creditors to take extra steps to verify the consumer’s identity before issuing credit.

-

Active duty alerts – Service members can place an active duty alert to protect their identity during deployment.

-

Credit report blocks – Identity theft victims can block fraudulent information on their credit report from being reported.

-

Truncation of card numbers – Merchants must truncate credit card numbers on receipts to just the last 5 digits.

-

Red Flags Rule – Creditors and financial institutions must detect and respond to indicators of possible identity theft.

Accuracy and Privacy

Other key FACT Act provisions aim to improve record accuracy and privacy:

-

Dispute process – Clear procedures requiring credit bureaus to investigate disputed information.

-

Fraud alerts – Requirement for credit bureaus to notify each other of fraud alerts placed by consumers.

-

Affiliate sharing opt-out – Consumers can opt-out of affiliate data sharing among financial institutions.

-

Medical privacy – Strict limits on credit report use of medical debt information.

-

Credit score disclosures – Lenders required to disclose credit scores and rating factors when taking adverse action on a loan.

Why the FACT Act Matters

The provisions of the FACT Act help consumers in several key ways:

-

Preventing identity theft through fraud alerts, credit freezes, and hiding full credit card info.

-

Making it easier to detect identity theft or credit report errors with free annual reports.

-

Strengthening privacy by limiting sharing of sensitive medical information.

-

Increasing transparency with credit score disclosures.

While identity theft is still a major issue, the tools and protections of the FACT Act have been crucial for consumers. Credit reporting practices are also more transparent and fair as a result of the legislation.

The Impact of FACTA

Unfortunately, identity theft continues to be a major problem, largely because of the increase in e-commerce, social networking, and other online activities. In 2023, the Federal Trade Commissions IdentityTheft.gov website received more than 1.1 million reports of identity theft.

One of the unintended consequences of FACTA is that it may have contributed to the amount of personally identifiable information that businesses are required to obtain from their customers. For example, a business that must confirm a customers identity or whereabouts more rigorously due to FACTA may need to request multiple forms of identification. While these changes might make consumers less vulnerable to identity theft in some respects, they also create the potential for computer hackers and other thieves to obtain more information that could be used in committing a crime.

FACTA is enforced by the Federal Trade Commission (FTC), which performs audits of credit bureaus and some financial institutions. If a creditor or reporting agency is not in compliance with FACTA rules, it may incur warnings or penalties from the FTC. The Consumer Financial Protection Bureau shares rule-making authority for the law with the FTC.

What Is the Fair and Accurate Credit Transactions Act (FACTA)?

The Fair and Accurate Credit Transactions Act (FACTA), also known as the FACT Act, is a federal law enacted by the U.S. Congress in 2003 to amend the Fair Credit Reporting Act passed in 1970. Its purpose was to enhance consumer protections, particularly with regard to identity theft. The best-known feature of the act is that it allows consumers free access to their credit reports at least once a year.

- The Fair and Accurate Credit Transactions Act (FACTA) is a federal law passed in 2003 to amend the Fair Credit Reporting Act.

- FACTA is principally known for its rules to protect against identity theft but also includes other consumer protections.

- Under FACTA, creditors and financial institutions must follow “red flag rules” to prevent and detect identity theft.

- The law also allows consumers to obtain free copies of their credit reports at least once a year from each of the three major credit bureaus.

- Unfortunately, identity theft is still a major problem that consumers should guard against.

What Is The FACT Act And How Does It Relate To FCRA? – Consumer Laws For You

FAQ

What is the purpose of the FACT Act?

… Transactions Act (FACT Act) is a federal law that was enacted in 2003 to help prevent identity theft and improve the accuracy of consumer credit reports

Who does the FACT Act impact?

The provisions in the Fair and Accurate Credit Transactions Act impacting banks include those related to: requirements that furnishers adopt identity theft prevention policies; fraud and active duty alerts; blocking the reporting of information a consumer identifies as related to identity theft; creditor requirements …

What accounts are covered under the FACT Act?

If your firm is either a financial institution or a creditor, you must then analyze whether it offers “covered accounts,” which are any accounts that either 1) your firm offers primarily for personal, family or household purposes and involve multiple payments (such as credit card, margin, checking or savings accounts), …

What does FACT Act amend?

This Act, amending the Fair Credit Reporting Act (FCRA), adds provisions designed to improve the accuracy of consumers’ credit-related records.

What is the fact act & how does it work?

Designed to help consumers check their credit reports for accuracy and detect identity theft early, the FACT Act gives every consumer the right to request a free report from each of the three major credit bureaus.

What is Facta & why does it matter?

Read on to learn what FACTA is, why it matters, and how it affects both consumers and businesses alike. What Is the Fair and Accurate Credit Transactions Act? The Fair and Accurate Credit Transactions Act, or FACTA, is a federal law that was passed in 2003 as an amendment to the Fair Credit Reporting Act (FCRA).

What is the fair and Accurate Credit Transactions Act (FACTA)?

The Fair and Accurate Credit Transactions Act, also known as FACT Act or FACTA, is a law that was enacted in 2003. It updated the Fair Credit Reporting Act (FCRA), which was passed in 1970. Most of the rules included in FACTA were protections from identity theft that weren’t in the FCRA. Earning passive income doesn’t need to be difficult.

Why was Facta passed?

FACTA was passed under the administration of then-President George W. Bush in response to increasing instances of identity theft. It amended the Fair Credit Reporting Act, passed in 1970, before identity theft had become a major concern.

How did Facta affect consumer protection?

In addition to its provisions to reduce identity theft, FACTA also contained measures designed to bolster consumer protection generally. For instance, it placed new requirements on mortgage lenders to disclose the credit scores and other factors that influenced their decision about whether or not to approve a loan application.

What does the Fair Credit Reporting Act do?

The Act also adds provisions designed to prevent and mitigate identity theft, including a section that enables consumers to place fraud alerts in their credit files, as well as other enhancements to the Fair Credit Reporting Act.