Into each life some debt must fall, to borrow the famous adage about rain. And, in the same way that April showers bring May flowers, the right kind of debt in the various stages of life can cultivate a prosperous future. Your first student loan, car loan or mortgage, for example, is often viewed as a rite of passage.

But with total consumer debt in the U.S. now approaching $17 trillion,1 its critical to get a handle on the differences in debt by age group and the unique circumstances facing each generation to make sure you arent flooded by debt.

From Gen Z to Baby Boomers, heres a breakdown of each cohort, the types of debt they commonly carry and their average debt loads—which you can use as a benchmark to compare yourself against.

Homeownership is often considered part of the American dream but it comes with a hefty price tag in the form of a mortgage. With home prices and mortgage rates on the rise over the past few years many Americans are shouldering more mortgage debt than ever before. But what is the typical mortgage debt burden for U.S. homeowners? Let’s take a look at the numbers.

The National Picture

In the third quarter of 2024, the average mortgage balance for American homeowners stood at $252,505 according to Experian. This was up nearly 3.3% from $244,498 in 2023.

To put this in perspective, back in 2019 the average mortgage debt was $210,237. So mortgage balances have risen steadily over the past five years along with home prices.

The total mortgage debt owed by all U.S homeowners was $1211 trillion as of Q3 2024. That’s an increase of 4.2% from $11.62 trillion in 2023. While sobering, keep in mind that mortgages make up the lion’s share of overall household debt.

Mortgage Debt by Generation

Mortgage debt tends to track closely with age and life stage. Younger homeowners who have recently purchased their first home generally carry the highest mortgage balances.

The breakdown by generation shows:

- Generation Z (ages 18-27): $249,744 average mortgage balance

- Millennials (ages 28-43): $312,014 average mortgage balance

- Generation X (ages 44-59): $283,677 average mortgage balance

- Baby Boomers (ages 60-78): $194,334 average mortgage balance

- Silent Generation (ages 79+): $146,015 average mortgage balance

So Millennials, who are in the prime home-buying years, carry the highest mortgage debt on average. But Generation Z is not far behind as more enter the housing market for the first time.

Mortgage Debt by State

There is also significant variation in average mortgage balances across different states. This generally correlates with differences in home prices and costs of living.

According to Q3 2024 data, the states with the highest average mortgage debt were:

- District of Columbia: $507,584

- California: $445,250

- Hawaii: $409,068

- Washington: $351,622

- Colorado: $342,594

On the opposite end of the spectrum, the states with the lowest average mortgage balances were:

- West Virginia: $132,679

- Ohio: $149,427

- Mississippi: $149,784

- Indiana: $152,712

- Kentucky: $155,649

So homeowners in West Virginia and Mississippi owe less than a third on their mortgages compared to those in D.C. or California. Local real estate markets play a major role in mortgage debt burdens.

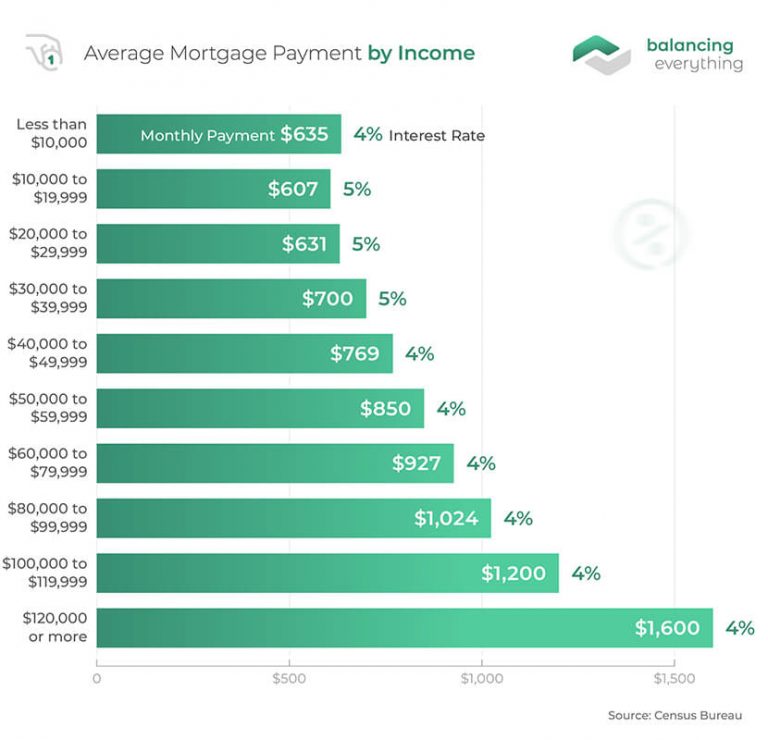

Mortgage Debt Compared to Income

While looking at total mortgage debt gives us a sense of scope, comparing it to income shows the relative burden for families.

According to Federal Reserve data, the median debt-to-income ratio for mortgage borrowers was 107% in 2022. In other words, the typical homeowner owed slightly more in mortgage debt than their yearly income.

Financial experts generally recommend keeping your debt-to-income ratio below 36% to qualify for a mortgage. But many stretch their budgets to buy homes, especially in high cost-of-living areas.

Hawaii and Idaho have the highest debt-to-income ratios at 233% and 215% respectively. New York and Washington D.C. have the lowest at 99% and 56%. So location is again a major factor.

The Bigger Picture of Household Debt

While mortgages make up the largest share of household debt, other obligations also weigh on Americans’ finances. According to the ConsumerAffairs Research Team, here is the breakdown of total household debt:

- Mortgages: $12.25 trillion

- Auto loans: $1.61 trillion

- Credit cards: $1.13 trillion

- Student loans: $1.77 trillion

So the nearly $13 trillion mortgage debt should be considered alongside other consumer debts that families juggle.

Is Mortgage Debt a Problem?

The steady rise in mortgage balances naturally raises concerns over whether U.S. households are becoming overleveraged. However, when measured as a percentage of disposable income, total household debt service payments have actually decreased over the past decade.

While mortgage debt is at record highs, low interest rates have helped keep it manageable for most homeowners. And paying down a mortgage builds equity, unlike credit card or auto debt.

Still, with mortgage rates climbing over the past two years, the cost burden could quickly become unsustainable for some families. This especially applies to recent buyers who stretched to afford rapidly inflating home prices.

High mortgage debt also makes households more vulnerable to economic downturns. If the economy enters a recession, widespread job losses could lead to mortgage delinquencies and foreclosures.

Key Takeaways

-

The average mortgage debt for American homeowners is now over $250,000 and rising steadily.

-

But mortgage burdens vary significantly based on age, location, and income. Millennials and coastal states carry the highest balances on average.

-

While mortgage debt is at all-time highs, low rates have kept it affordable for most homeowners so far.

-

If rates rise further or the economy falters, high mortgage balances could become problematic for many U.S. households.

Homeownership remains aspirational for many Americans. But climbing home prices and interest rates have led to surging mortgage debt burdens over the past few years. As we enter an uncertain economic period, this mounting mortgage debt will be an important area to monitor.

Tips to Help You Reduce or Manage Debt

Even if your total debt load is below average for your cohort, its still important to keep debt in check relative to your income. If you find that youre struggling to make your debt payments, or you have little left over to put toward monthly savings for retirement and other priorities, your debt load is too high. Here are some practical tips for reducing debt:

- Develop a budget to track your income and expenses.

- Identify areas where you can cut costs and allocate more funds to debt repayment.

- Create a debt repayment plan and stick to it.

- Prioritize paying off high-interest debt first, or consider consolidating your higher-interest debts into a lower-interest form of credit.

- Seek guidance or education to make informed decisions about managing debt, investments and long-term financial planning.

Each generation faces unique challenges and opportunities when it comes to debt, so its crucial to adapt your financial strategies as you move through lifes different stages. By being proactive, you can improve your financial well-being and secure a more comfortable future, regardless of your age.

READ MORE: The Ultimate Guide to Personal Finance

Average American Debt Load

The average American owed $103,358 in consumer debt in the second quarter of 2023, the latest data available, according to credit bureau Experian.2 That breaks down into $241,815 on average in mortgage debt, and an average of $23,317 in non-mortgage debt (including credit card, student loan, auto loan and personal loan debt).

But these debt balances vary greatly depending on age group. To get a truer picture of debt in America, you need to drill down by generation, as detailed below.

The adult members of Generation Z (ages 18 to 26) are at the age where theyre starting to accumulate debt—especially through student loans and car loans. While some in this cohort may have purchased a home, many are still relatively young and continuing to live at home, so its certainly not the norm for this age group.

Compared to the other generations, Gen Z has the lowest average credit card debt load and is second only to the Silent Generation (age 78+) for average non-mortgage debt overall. This is important because too much non-mortgage debt—especially high-interest credit card debt—can become a drag on a young adults ability to save in preparation for the next financial stages of life.

If youre in this cohort and trying to keep debt to a minimum while in school, part-time income can be part of the solution, as can these real-world tips to help Gen Z increase savings.

|

Type of debt |

Average amount |

|

Mortgage |

$229,897 |

|

Credit card |

$3,148 |

|

Total non-mortgage* |

$15,105 |

Source: Experian, Q2 2023; *includes credit card, student loan, personal loan, and auto loan debt

The average mortgage balance for Millennials (ages 27 to 42) is the highest among all age groups. This tracks, given that homeowners in this cohort would likely have purchased their home more recently and be closer to the beginning of their amortization period than older homeowners.

At the same time, most Millennials will have finished their postsecondary education, so student loans are a major factor; and many will have taken on car loans as they enter the job market and develop their careers. Also an increase in expenses as Millennials start to raise families often requires additional credit. Not surprisingly then, credit card balances and total non-mortgage debt swell at this stage—theyre about twice the size of Gen Zs.

|

Type of debt |

Average amount |

|

Mortgage |

$295,689 |

|

Credit card |

$6,274 |

|

Total non-mortgage* |

$29,702 |

Source: Experian, Q2 2023; *includes credit card, student loan, personal loan, and auto loan debt

Gen X (ages 43 to 58) not only carries the most debt on average of all the generations, but is also the debt leader in credit card and total non-mortgage debt. This is indicative of the competing priorities at this life stage, including raising tweens and teens (and possibly saving for their college education), paying down mortgage debt and saving for retirement.

Indeed, those who are ages 45 to 54—prime Gen Xers—spend the most of all age groups on pensions and Social Security, according to federal data on consumer spending in 2022.3 To see how you measure up on your own retirement savings, check out the median retirement savings by age.

|

Type of debt |

Average amount |

|

Mortgage |

$277,153 |

|

Credit card |

$8,870 |

|

Total non-mortgage* |

$32,190 |

Source: Experian, Q2 2023; *includes credit card, student loan, personal loan, and auto loan debt

Boomers (ages 59 to 77) have had more time to pay down their mortgages, and so have lower mortgage debt than their younger counterparts. At the same time, however, many Boomers are now retired and may find that their retirement income falls short, especially during this period of high inflation and rising prices. As such, some might be tapping into the equity in their properties or turning to credit cards (this cohort has the second-highest average credit card balance of all the age groups) to cover expenses such as home improvements or healthcare costs.

While Medicare covers some expenses for retirees, there are many out-of-pocket costs, including dental services or long-term care, leading some to purchase private insurance.4 According to 2022 federal data on consumer spending, households led by someone who is 65 or older spent the most of all Americans—an average of $7,540 annually—on healthcare costs, including health insurance, medical services, drugs and medical supplies.3

|

Type of debt |

Average amount |

|

Mortgage |

$190,441 |

|

Credit card |

$6,601 |

|

Total non-mortgage* |

$19,203 |

Source: Experian, Q2 2023; *includes credit card, student loan, personal loan, and auto loan debt

Who does the US Owe its $35 Trillion debt? (National Debt Explained)

FAQ

How much does the average American owe on their mortgage?

| Debt type | Average balance (2023 ) | Average balance (2024) |

|---|---|---|

| Mortgage debt (Excluding HELOCs) | $244,498 | $252,505 |

| HELOCs | $42,139 | $45,157 |

| Auto loan | $23,792 | $24,297 |

| Credit card debt | $6,501 | $6,730 |

How much does the average person pay on their mortgage?

| Year | Median monthly mortgage payment | Average yearly interest rate |

|---|---|---|

| 2023 | $2,268 | 7.00% |

| 2021 | $1,525 | 3.15% |

| 2019 | $1,242 | 4.13% |

| 2017 | $1,250 | 4.14% |

What is the average age people pay off their mortgage?

What is the average debt for a 30 40 year old?

Average American Debt by Age

Here’s a look at how much nonmortgage debt Americans have by age group, and the average non-mortgage per capita debt for each group: 18-29-year-olds: $69 billion total, $12,871 average. 30-39-year-olds: $1.17 trillion, $26,532 average. 40-49-year-olds: $1.13 trillion $27,838 average.

How much do Americans owe a mortgage?

The average American owed $215,655 as of 2020, which increased from $213,599 in 2019. However, this is simply an average, as Americans do owe varying amounts. Many people see mortgages as the best way to own a home, which has been the American dream since the 1960s.

Who owes the most mortgages in America?

Mortgages make up the highest percentage of household debt nationwide, with the average American owing $252,505. Millennials have the highest average mortgage debt at $312,014, with Gen X close behind at $283,677. The District of Columbia, California and Hawaii have the highest average mortgage balance per borrower.

What is the average debt an American owes?

The average debt an American owes is $105,056 across mortgage loans, home equity lines of credit, auto loans, credit card debt, student loan debt, and other debts like personal loans. Data from Experian breaks down the average debt a consumer holds based on type, age, credit score, and state.

How much debt does the average household have?

The average household also held $10,643.42 in debt secured by other residential property – think second and vacation homes. (Only 4.4% of households reported that type of debt). Let’s dive into residential home debt in this post and talk about the averages and summary statistics for a few types of breakdowns.

How much debt does the US have?

Total amounts of debt, as well as debt to income and debt to asset ratios, vary significantly among different demographic groups. Total household debt in the U.S. reached $17.5 trillion at the end of 2023. However, debt payments as a percentage of personal income stood at only 9.8%, lower than historical averages.

How much money do Americans spend on debt?

The average American spends about 11% of their monthly income on debt payments, according to the most recent debt payment-to-income ratio of 11.3% from the third quarter of 2024. Despite debt increasing overall, Americans are still spending less of their income on debt than in most of the 2000s. Data source: Experian (2025), Federal Reserve (2025).