In a relay race, any runner will tell you that handoffs are the difference between winning and losing. No matter how fast you are, you have no chance if you can’t pass the baton smoothly from one person to the next.

When it comes to building wealth, you have your own handoff to manage. You need to start thinking about how you’ll pass your wealth to the next generation today. After all, the latest studies show that 10 out of 10 people are going to die someday. No one gets out of this life alive—not even you!.

Whether you’re the first person in your family to pass on generational wealth or you’re next in line to inherit it, the steps you take right now can give your family the opportunity to embrace your legacy and build on it long after you’re gone.

Have you ever wondered what it really means when people talk about “generational wealth”? Maybe you’ve heard the term thrown around in financial discussions but aren’t quite sure what it looks like in practice. You’re not alone! As someone who’s spent years researching financial independence, I can tell you that understanding generational wealth is crucial whether you’re trying to build it or maintain what you’ve inherited

What Is Generational Wealth?

In simple terms, generational wealth refers to financial assets that are passed down from one generation of a family to the next. These assets can include:

- Cash and savings

- Real estate properties

- Investment portfolios (stocks, bonds, mutual funds)

- Family businesses

- Valuable collections or heirlooms

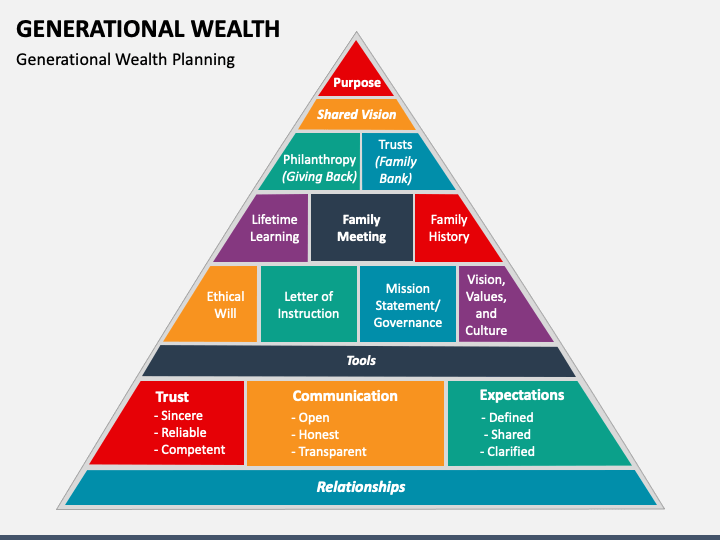

But generational wealth isn’t just about physical assets It also encompasses the knowledge, values, and financial habits that help shape the character of future generations who will inherit the wealth

As Ramsey Solutions puts it: “You can’t put a price tag on character—that’s the secret sauce that really helps you and your loved ones handle the responsibility of managing generational wealth so it lasts.”

Why Generational Wealth Matters More Than Ever

The Great Transfer of Wealth is currently underway, with approximately $14 trillion expected to transition from baby boomers to next-generation leaders in this decade alone. This makes generational wealth a hot topic for families across all wealth brackets.

But here’s a sobering statistic: Only one-third of families succeed in maintaining their wealth into the next generation, and a shocking 9 out of 10 wealthy families lose ALL their wealth by the third generation.

Why does this happen? Often because families:

- Don’t talk openly about money

- Fail to prepare the next generation for managing wealth

- Lack proper estate planning

- Don’t pass on financial literacy along with the assets

What Generational Wealth Looks Like in Practice

1. Financial Security and Freedom

Families that have been wealthy for generations have built a safety net that lasts longer than one lifetime. This might look like:

- Having no debt (except perhaps some strategic mortgage debt)

- Substantial emergency funds (beyond the standard 3-6 months)

- Multiple income streams that aren’t dependent on active work

- The ability to weather financial crises without long-term damage

2. Educational Advantages

One of the most visible manifestations of generational wealth is educational opportunity:

- Children attending quality schools without accumulating student loan debt

- Access to specialized education, tutoring, and enrichment programs

- The ability to pursue additional degrees or professional development without financial strain

- Educational funds set aside for future generations (like 529 plans or ESAs)

3. Real Estate Holdings

Property is often a cornerstone of generational wealth:

- Primary residences owned outright (no mortgage)

- Investment properties generating rental income

- Vacation homes that appreciate in value

- Land holdings that may appreciate significantly over generations

4. Business Ownership

Family businesses represent another common form of generational wealth:

- Established enterprises with stable customer bases

- Businesses structured to facilitate smooth succession planning

- Diversified business interests that can adapt to changing markets

- Professional networks and connections that benefit future generations

5. Investment Portfolios

Substantial investment portfolios are a hallmark of generational wealth:

- Diversified investments across various asset classes

- Dividend-producing stocks providing passive income

- Tax-advantaged retirement accounts maxed out annually

- Strategic investments that balance growth and preservation

The Wealth Gap and Generational Wealth

It’s important to acknowledge that generational wealth contributes significantly to economic inequality. According to the Federal Reserve, the top 10% of the U.S. population holds 74% of the country’s wealth, while the bottom 50% holds just 2%.

The racial wealth gap is particularly stark. It was found that the average White family had about six times as much money as the average Black family and five times as much as the average Hispanic family.

This inequality persists because intergenerational transfers tend to flow to families that already have substantial resources. Nearly 40% of intergenerational wealth transfers go to households in the top 10% by income, while only about 20% go to families in the bottom 50%.

How to Build Generational Wealth

Building wealth that lasts for generations isn’t a quick process, but it’s absolutely achievable with dedication and strategy. Here’s how to get started:

1. Create a Strong Financial Foundation

Before focusing on generational wealth, you need to:

- Get out of debt (everything except possibly your mortgage)

- Build an emergency fund of 3-6 months of expenses

- Develop solid money management habits

2. Invest Consistently

The most reliable path to building wealth is consistent investing:

- Aim to invest at least 15% of your income for retirement

- Focus on diversified investments like mutual funds

- Utilize tax-advantaged accounts like 401(k)s and Roth IRAs

- Consider working with a financial advisor to optimize your strategy

3. Consider Real Estate

Property ownership can be a powerful wealth-building tool:

- Pay off your primary residence early if possible

- Explore rental property investments

- Research commercial real estate opportunities

- Look into REITs (Real Estate Investment Trusts) if direct ownership isn’t feasible

4. Build or Invest in Businesses

Business ownership represents another path to generational wealth:

- Start a business with longevity potential

- Invest in established businesses with growth potential

- Consider franchise opportunities with proven models

- Look for businesses that could eventually operate without your direct involvement

Transferring Generational Wealth Effectively

Building wealth is only half the battle—you also need to ensure it successfully transfers to future generations. Here’s how:

1. Estate Planning Is Essential

Proper estate planning helps minimize taxes and ensures your wishes are carried out:

- Create a will (everyone over 18 should have one!)

- Consider trusts for more complex situations

- Review and update your plans regularly

- If your net worth exceeds $1 million, consult with an estate planning professional

2. Tax Considerations

Understanding the tax implications of wealth transfers is crucial:

- As of 2024, the federal estate tax exemption is $13.61 million per individual

- Six states currently have inheritance taxes, though spouses and children are often exempt

- Annual gift tax exclusions ($18,000 per recipient in 2024) allow for tax-free wealth transfers during your lifetime

- Strategic charitable giving can also provide tax benefits

3. Education and Preparation

Perhaps the most important aspect of successful wealth transfer is preparing the next generation:

- Talk openly with your family about money and values

- Involve children in age-appropriate financial discussions

- Share not just what you’ve learned but also your mistakes

- Consider financial literacy courses or books for the whole family

Common Pitfalls in Generational Wealth Transfer

To avoid becoming that 3rd-generation statistic, watch out for these common pitfalls:

1. Misalignment of Goals and Priorities

When family members aren’t on the same page about financial goals and values, conflict often follows. Regular family discussions about financial priorities can help maintain alignment across generations.

2. Lack of Connection and Cohesion

Wealth alone can’t hold a family together. Building strong relationships through regular communication and shared experiences creates the foundation needed for successful wealth transfer.

3. Unrealistic Expectations and Entitlement

Open conversations about roles, responsibilities, and expectations are essential. The next generation needs to understand both the privileges and responsibilities that come with inherited wealth.

4. Inadequate Training and Education

Taking on the management of significant wealth requires specific skills and knowledge. Equipping the next generation through education, mentorship, and gradual increasing responsibility is vital.

Final Thoughts: Building a Legacy Beyond Money

There is more to generational wealth than just money, even though money is an important part of it. It’s about leaving your family with values, knowledge, and a sense of purpose that will guide them for years to come.

“Money is a wonderful servant but a terrible master,” my grandfather once said. The most valuable thing you can leave your children is probably the knowledge of how to use money to help them instead of letting it define them.

The Bible puts it well in Proverbs 13:22: “A good man leaves an inheritance to his children’s children.” With thoughtful planning and preparation, you can be the one who changes your family tree forever.

Have you started building your generational wealth plan? What steps are you taking to ensure it lasts beyond your lifetime? I’d love to hear your thoughts in the comments below!

What Is Generational Wealth?

Wealth that is passed down from one generation to the next is called “generational wealth.” It includes investments, real estate, cash, and anything else with a monetary value.

But generational wealth isn’t just about the physical stuff. Just as important (and probably even more important) are the things you pass on that you can’t see or touch—like wisdom, values and habits that help shape the character of the generation who will inherit the wealth.

You can’t put a price tag on character—that’s the secret sauce that really helps you and your loved ones handle the responsibility of managing generational wealth so it lasts.

Teach Your Kids About Money

Remember that generational wealth isn’t just the money and stuff you leave behind for your kids. It’s also about the knowledge, wisdom and skills you pass down to them too.

You can teach them by talking about money in everyday conversations, sharing where you’ve messed up, and modeling wise behavior with money. In the long run, getting your kids ready to do well as adults will be one of the best gifts you could ever give them.

The truth is that you can teach your kids about money at a young age and show them how to spend, save, and give as they get older. If you want to learn more, Dave and his daughter Rachel Cruze talk about how to make the generational handoff in their best-selling book, Smart Money Smart Kids.

How to Build Generational Wealth (IMPORTANT)

FAQ

What are examples of generational wealth?

Examples of generational wealth include:Financial wealth (money, savings, investments)Assets (house, real estate, collectables, precious metals/gems)Business ownership. Intellectual property (patents, copyrights, trademarks)Charitable foundation or endowment.

How much money is considered generational wealth?

There’s no universal dollar amount for generational wealth, but a common guideline suggests that properly managed and invested, $5 to $10 million is a strong starting point to ensure wealth lasts for multiple generations, while other sources consider amounts like $1. 5 million per child or a general seven-figure inheritance to be the baseline for generational wealth.

How do you know if you have generational wealth?

Any assets or finances passed on from parents or inheritance is generational wealth. It’s more a matter of how much wealth you have from that.

What destroys generational wealth?

Poor money management: if you don’t learn about money and plan ahead, it can be hard to keep track of your assets, and it could cause generations of wealth to slowly disappear.

What is generational wealth?

Generational wealth involves passing financial assets like cash, real estate, and family businesses to future generations. Most generational wealth in the U. S. is transferred at death as an inheritance, with only 2% of inheritances exceeding $1 million. Wealthy families can reduce estate or inheritance taxes using trusts and smart estate planning.

How can generational wealth be handed down from one generation to the next?

There are several ways that generational wealth can be passed down from one generation to the next. Most generational wealth is in the form of an inheritance received by heirs after a family member dies.

What is the future of generational wealth?

The future of generational wealth likely includes increased emphasis on global mobility, digital assets, and sustainable investing. Families who can successfully navigate these trends while maintaining strong financial foundations will be best positioned to preserve and grow their wealth across generations.

How to build generational wealth?

Investing in the market is a great way to build generational wealth and does not have to be high risk or complex if you start small and start early. Financial investments such as stocks and bonds build compounding interest over time which makes them attractive for building generational wealth because of the long-term benefits.

What is generational wealth transfer?

Generational wealth transfers can include cash, real estate, bonds, investments, and even businesses. However, Generational Wealth is a holistic and strategic approach to building long-term financial stability that can be passed down between generations. Generational Wealth is one of the most advantageous gifts a person can be given.

What assets can be inherited as generational wealth?

Money, real estate, and stock portfolios are just a few types of assets that can be inherited as generational wealth. If you’re thinking about buying a house, then perhaps part of your goal is generational wealth building. Creating and sharing generational wealth is closely related to estate planning.