The current average mortgage rate for someone with a good credit score (700) was 7.42% as of January 3, 2025, according to Curinos data. Your credit scores can directly impact your eligibility for a mortgage and the interest rate you receive. You may need a score in the high 700s (or higher) to get the best interest rate.

The current average mortgage rate on a conventional 30-year fixed-rate mortgage for someone with a good credit score of 700 was 7.42% as of January 3, 2025, according to Curinos data. You generally need a credit score of at least 580 to qualify for a mortgage, and a score of 760 or higher to get the best interest rate.

Your credit score is one of the most important factors lenders consider when determining the interest rates and terms you’ll qualify for. But you don’t need a perfect score of 850 to get the lowest rates. Here’s a breakdown of typical credit score tiers and what kind of rates you can expect with each.

How Credit Scores Impact Interest Rates

Lenders use your credit score as an indicator of how likely you are to repay a loan. The higher your score, the less risky you generally appear. As a result, borrowers with higher scores are rewarded with lower interest rates.

On the flip side, lower credit scores suggest higher risk. So if your score is on the lower end, you’ll typically pay more in interest.

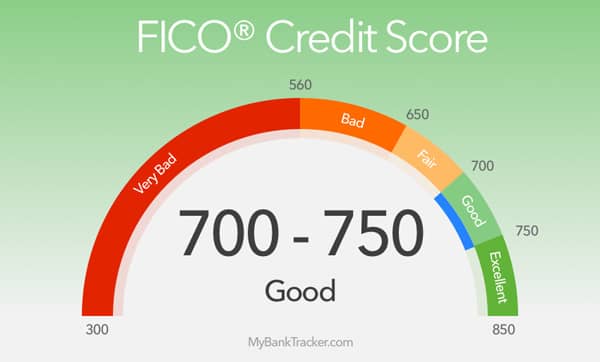

Most lenders rely on scores from the FICO scoring model, which range from 300 to 850. Your specific FICO score depends on information in your credit reports from the three major bureaus – Equifax, Experian, and TransUnion.

Credit Score Tiers and Typical Interest Rates

The FICO score scale is commonly divided into the following tiers:

- Poor: 300 to 579

- Fair: 580 to 669

- Good: 670 to 739

- Very Good: 740 to 799

- Exceptional: 800 to 850

As you move up into a higher tier, lenders view you as lower risk and will likely offer better rates.

Here’s an overview of the typical interest rates for key lending products at each tier

Mortgages

- Poor (below 580): May not qualify

- Fair (580-669): 4.5% to 5.5%

- Good (670-739): 3.75% to 4.5%

- Very Good (740-799): 3.25% to 4%

- Exceptional (800-850): 2.75% to 3.5%

Auto Loans

- Poor (below 580): 7% to 11%

- Fair (580-669): 4% to 7%

- Good (670-739): 3% to 5%

- Very Good (740-799): 2% to 4%

- Exceptional (800-850): 1.5% to 3%

Personal Loans

- Poor (below 580): May not qualify

- Fair (580-669): 11% to 15%

- Good (670-739): 8% to 12%

- Very Good (740-799): 6% to 10%

- Exceptional (800-850): 4% to 8%

As you can see, the interest rate differences between tiers can be substantial. For example, on a $300,000 mortgage, improving your credit score from fair to very good could save over $100 per month and nearly $50,000 over the life of the loan.

What’s the Best Credit Score for Low Rates?

Based on the tiers above, a credit score of 740 or higher is generally considered excellent and will qualify you for the lowest rates on loans and credit cards.

However, according to credit expert John Ulzheimer a score of 760 is sufficient to get the very best rates from lenders. Anything above 760 won’t typically result in any additional savings.

So while it’s great to aim for the highest scores possible, a 760 FICO score is really the sweet spot for optimal rates.

How to Check Your Credit Score

The first step is knowing your current credit score. You can check your FICO score for free through many banks and credit card issuers.

Here are some popular ways to check your score:

- Your bank or credit card’s online account portal

- Mobile apps like Credit Karma and Experian

- Getting your free annual credit reports from www.annualcreditreport.com

It’s a good idea to check your score from multiple sources to get a complete picture. Monitoring services like Credit Karma also let you check your score regularly to see how it changes over time.

Improving Your Credit Score

If your score falls short of that 760 target, there are steps you can take to boost it:

- Pay all bills on time

- Lower credit utilization ratio

- Avoid new credit inquiries before applying for a loan

- Pay down debts and resolve any issues on your credit reports

With diligent credit management, you can raise your score and potentially save thousands on interest costs over time. The effort is well worth it.

The Bottom Line

While an exceptional FICO score above 800 is great, a 760 credit score will qualify you for the very best rates on mortgages, auto loans, credit cards, and other lending products. Maintaining at least a “very good” score in the 740 to 799 range should be your target if you want to maximize savings on interest. Checking your score frequently and taking steps to improve it if needed can pay major dividends.

How to Improve Your Credit Score

There are many potential ways to improve your credit scores. The specifics will depend on whats affecting your credits cores today, but make an effort to:

You may also want to hold off on applying for new credit cards or loans if youre looking for a mortgage. Each application can lead to a hard inquiry and new accounts can lower the average age of your credit accountsâboth of these could hurt your credit scores a little. The additional monthly payment could also increase your DTI, which could make it harder or more expensive to get a mortgage.

Minimum Credit Score Requirements for Different Mortgages

You might be able to get a mortgage even if you dont have a good credit scoreâor any credit score. But many mortgage lenders have minimum credit score requirements for the various types of mortgages they offer.

The type of mortgage could affect your down payment, maximum loan amount, the home you can buy and the interest rate you receive. Different types of mortgages include:

- Conventional loans: Conventional mortgages are the most common type of mortgage. Lenders issue these loans directly to borrowers, and the loans arent part of government-backed programs. Lenders can set their own terms, including minimum credit score requirements, but 620 is a common threshold.

- Jumbo loans: Jumbo loans are conventional loans that have a higher balance than the current conventional loan limits for the area. These make them a type of non-conforming mortgage, and they tend to require a higher income and credit score than conforming conventional loans.

- FHA loans: Government-backed Federal Housing Administration (FHA) loans have less stringent requirements than conventional loans. You might qualify for an FHA loan with a 500 credit score if you put at least 10% down. Or, you can put as little as 3.5% down if your credit score is over 579.

- VA loans: Department of Veterans Affairs (VA) loans technically dont have a minimum credit score. However, lenders that participate in the VA program can set their own minimums. A credit score of 620 is a common requirement.

- USDA loans: U.S. Department of Agriculture (USDA) loans similarly dont have a set minimum credit score. However, lenders may require a credit score of at least 580, and youll need a 640 or higher if you want to go through a streamlined review process.

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional loan | 620 |

| Jumbo loan | 700 |

| FHA loan | 500 |

| VA loan | 620 |

| USDA loan | 580 |

The Magic Credit Score: How To Get The Best Mortgage Rates

FAQ

What credit score gives the best rates?

According to credit expert John Ulzheimer, a 760 will typically get you the best mortgage rate and a 720 score is all you need for the best interest rate for an auto loan. “I always tell people, shoot for 760 or better,” Ulzheimer told CNBC Select. “That way, they’re safe for all loan types and cards.”Feb 6, 2025

Is there a big difference between 750 and 800 credit scores?

A 750 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range (800-850), you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs.

How rare is a 700 credit score?

Which credit score will most likely give you the best interest rate?

Superprime (781 to 850): This is the best rating and is associated with strong financial responsibility. Lenders often give the best interest rates and loan terms to superprime borrowers. Prime (661–780): Prime credit is still good, and you should have an easy time getting approved for loans at good interest rates.