Hey there! So you’ve got an old 401(k) from a previous job just sitting around, and you’re wondering what to do with it? You’re definitely not alone. With millions of Americans switching jobs each year (about 3.8 million people quit their jobs monthly in 2023!), there’s a lot of “orphaned” retirement money out there.

I’ve helped many friends navigate this exact situation, and today I’m gonna break down all your options for rolling over that 401(k). The good news? You’ve got choices! The bad news? Not all choices are created equal, and making the wrong one could cost you thousands in taxes and missed growth opportunities.

Let’s dive into the world of 401(k) rollovers and find the best home for your hard-earned retirement savings!

What Exactly Is a 401(k) Rollover?

Before we jump into your options let’s clarify what we’re talking about. A 401(k) rollover simply means transferring money from your old employer-sponsored retirement plan into another retirement account. The beauty of rollovers is that, when done correctly you won’t pay any taxes on the money during the transfer.

Think of it like changing apartments – you’re moving your stuff (money) from one place to another but it’s still your stuff!

Your 4 Main Options for an Old 401(k)

When you leave a job with a 401(k), you basically have four paths forward:

- Cash out your 401(k)

- Leave the money in your old employer’s plan ️

- Roll the money into your new employer’s 401(k) plan

- Roll the funds into an IRA

Let’s look at each option in detail, cuz the choice you make can have serious implications for your retirement savings.

Option 1: Cash Out Your 401(k)

I’m just gonna be straight with you – this is usually the WORST option. Here’s why:

- You’ll pay income taxes on every penny

- If you’re under 59½, add an extra 10% early withdrawal penalty

- You’ll miss out on years or decades of tax-advantaged growth

- Your future self will probably be super mad at present-day you

As an example, if you cash out $50,000 before the age of 55, you could lose about $20,500 in taxes and penalties. That’s the same as taking a stack of $20 bills and setting them on fire. Not a great financial strategy!.

Option 2: Leave the Money in Your Old 401(k)

This is the “do nothing” approach, and sometimes doing nothing is actually OK. Your money continues to grow tax-advantaged, and federal law provides strong creditor protection for 401(k) plans.

Some benefits:

- Your money keeps growing tax-deferred

- If you left your job at 55 or older, you can take penalty-free withdrawals

- Many employer plans offer institutionally priced (lower cost) investments

- Strong legal protection against creditors

But there are downsides:

- Can’t add new money to the account

- Limited investment choices

- Might have restrictions on withdrawal options

- Required minimum distributions (RMDs) starting at age 73 (or 75 for those born in 1960 or later)

- If your balance is small (under $7,000), your old employer might just send you the money or roll it to an IRA

Option 3: Roll Over to Your New Employer’s Plan

If your new job offers a 401(k), you might be able to roll your old 401(k) into it. This option has some nice benefits, especially for organizing your financial life.

Pros:

- Consolidates retirement accounts (less accounts to manage)

- Money continues growing tax-advantaged

- May offer good investment options with low institutional fees

- Strong legal protection against creditors

- Might let you delay RMDs if you’re still working after age 73

- Can take penalty-free withdrawals if you leave this job at 55+

Cons:

- Not all employers accept rollovers, so check first!

- Investment options limited to what your new plan offers

- Plan rules may restrict your access to the money

Option 4: Roll Over to an IRA

For most people, this is the BEST option. An Individual Retirement Account (IRA) lets you choose how to invest your money and gives you the most freedom.

Why an IRA rollover rocks:

- Pre-tax money continues growing tax-deferred

- Choose from thousands of investment options (not just the handful in most 401(k)s)

- More flexibility for withdrawals in specific situations (like first-time home purchase or education)

- Can roll over by source type (Roth assets to Roth IRA)

- Work with an investment pro who can help manage your investments

The downsides:

- Investment fees might be higher than in some 401(k) plans

- RMDs start at 73 (or 75 for those born in 1960 or later) even if you’re still working

- Federal legal protections aren’t as strong as 401(k)s (though many states offer some protection)

Direct vs. Indirect Rollovers: A HUGE Difference!

When rolling over your 401(k), HOW you do it matters almost as much as WHERE you put it. You’ve got two methods:

Direct Rollover (The Smart Way)

With a direct rollover, the money goes straight from your old retirement account to the new one without you touching it. The old plan sends the money directly to your new account provider.

Why this rocks: No taxes withheld, no chance of missing deadlines, and it’s done!

Indirect Rollover (The Risky Way)

In an indirect rollover, your old plan sends YOU the money first, and then you have 60 days to deposit it into a new retirement account.

The problem: Your plan must withhold 20% for taxes. You’ll have to find other ways to pay for the full amount if you want to roll it over. If you don’t file by the 60-day deadline, you may have to pay taxes and penalties on the whole amount!

If you don’t have a good reason not to, ALWAYS use the direct rollover method.

Will I Pay Taxes on My 401(k) Rollover?

Great question! The answer depends on what type of accounts you’re moving between:

- Traditional 401(k) to traditional 401(k) or traditional IRA: No taxes when you transfer! (You’ll pay taxes when you withdraw in retirement)

- Traditional 401(k) to Roth 401(k) or Roth IRA: YES, you’ll pay taxes now (this is called a Roth conversion)

- Roth 401(k) to Roth 401(k) or Roth IRA: No taxes (except on employer contributions, which are always treated as traditional)

If you’re confused about whether your rollover will trigger taxes, talk to a tax advisor. This isn’t something you wanna mess up!

Special Rules and Limitations to Know About

The One-Rollover-Per-Year Rule for IRAs

If you’re rolling money between IRAs, you can only make one rollover from an IRA to another (or the same) IRA in any 12-month period. This applies across all your IRAs (they’re treated as one for this purpose).

Good news: This rule doesn’t apply to:

- Rollovers from traditional IRAs to Roth IRAs (conversions)

- Trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers

- Plan-to-IRA rollovers

- Plan-to-plan rollovers

What Can’t Be Rolled Over?

Not every distribution qualifies for rollover. Here’s what you can’t roll over:

From IRAs:

- Required minimum distributions

- Distributions of excess contributions and related earnings

From 401(k) plans:

- Required minimum distributions

- Loans treated as distributions

- Hardship distributions

- Distributions of excess contributions

- Certain other specialized distributions

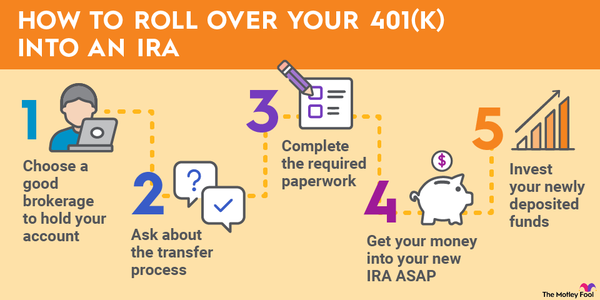

How to Complete Your 401(k) Rollover: A Step-by-Step Guide

Alright, so you’ve decided to roll over your 401(k). Here’s how to make it happen:

- Choose where you want to move your money (new employer plan or IRA)

- Open your new account (if you don’t already have one)

- Contact your old plan administrator and request a direct rollover

- Complete the rollover paperwork from both your old and new plans

- Wait for the transfer to complete (usually takes 2-4 weeks)

- Select investments in your new account (don’t skip this! Your money might sit in cash until you invest it)

My Personal Take: What’s Usually the Best Option?

Okay, I’ve laid out all the options, but if you’re asking what I typically recommend to my friends – rolling over to an IRA usually gives you the most flexibility and control. Here’s why I like this option:

- You get access to waaaay more investment choices

- You can choose a provider with low fees (shop around!)

- You can work with a financial advisor to help manage the investments

- You maintain more control over your retirement money

That said, every situation is different! If you have an amazing new 401(k) with super low fees and great investment options, rolling into that plan might make sense. Or if you’ve got company stock with unrealized gains, special considerations apply (look up “net unrealized appreciation” or NUA).

Common Mistakes to Avoid with 401(k) Rollovers

I’ve seen people mess up their rollovers in several ways. Don’t be one of them!

- Cashing out “just for a bit” – Even if you plan to redeposit it, taking the cash is risky and can lead to taxes

- Missing the 60-day deadline for indirect rollovers

- Not accounting for the 20% tax withholding in indirect rollovers

- Forgetting to invest the money after it’s rolled over

- Rolling over company stock without considering NUA tax treatment

- Not checking fees and investment options at the new provider

Final Thoughts: Make an Informed Decision

When it comes to your 401(k) rollover, take your time and do your homework. Consider:

- Comparing fees and expenses between options

- Reviewing investment choices available

- Understanding any special tax implications

- Thinking about when and how you’ll need to access the money

Remember, this is YOUR retirement money we’re talking about! A thoughtful decision now can mean thousands of extra dollars in retirement later.

If all this seems overwhelming, don’t hesitate to speak with a financial professional. Sometimes paying for a bit of expert guidance can save you from costly mistakes.

Have you gone through a 401(k) rollover? What option did you choose? I’d love to hear about your experiences in the comments!

Disclaimer: This article provides general information about 401(k) rollovers and shouldn’t be considered personalized financial advice. Everyone’s situation is different! Please consult with a qualified financial advisor or tax professional before making decisions about your retirement accounts.

When should I roll over?

You have 60 days from the date you get money from an IRA or retirement plan to move it to another plan or IRA. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control.

You generally cannot make more than one rollover from the same IRA within a 1-year period. During this year, you also can’t make a rollover from the IRA to which the distribution was rolled over.

Beginning after January 1, 2015, you can make only one rollover from an IRA to another (or the same) IRA in any 12-month period, regardless of the number of IRAs you own (Announcement 2014-15 and Announcement 2014-32). The limit will apply by aggregating all of an individual’s IRAs, including SEP and SIMPLE IRAs as well as traditional and Roth IRAs, effectively treating them as one IRA for purposes of the limit.

The one-per year limit does not apply to:

- rollovers from traditional IRAs to Roth IRAs (conversions)

- trustee-to-trustee transfers to another IRA

- IRA-to-plan rollovers

- plan-to-IRA rollovers

- plan-to-plan rollovers

Background of the one-per-year rule

Under the basic rollover rule, you dont have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan (including an IRA) within 60 days (Internal Revenue Code Section 408(d)(3)); also see FAQs: Waivers of the 60-day rollover requirement). Internal Revenue Code Section 408(d)(3)(B) limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1. 408-4(b)(4)(ii), which came out in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs), said that this limit only applied to one IRA at a time. This means that rolling over money from one IRA to another would not affect rolling over money from other IRAs owned by the same person. The Tax Court said in 2014, though, that you can’t make a non-taxable rollover from one IRA to another if you’ve already done so from any of your IRAs in the past year (Bobrow v. Commissioner, T. C. Memo. 2014-21).

How to Rollover a 401K to an IRA #money #stockmarket #passiveinvesting #millionaire

FAQ

What can I roll my 401k into without penalty?

Assuming the money in your 401(k) is pre-tax, you can just roll it into a Traditional IRA (also known as a Rollover IRA). There are no penalties or taxes for doing this.

What is the best thing to roll a 401k into?

It’s probably best to move it to an IRA (be it a roll over IRA, traditional IRA, or Roth depending on what current tax type it is in your 401k – note that a rollover IRA and traditional IRA are functionally the same thing and can be combined if you’d like).

How much will $10,000 in a 401k be worth in 20 years?

A $10,000 401(k) investment could be worth anywhere from about $37,000 to over $67,000 in 2020, depending on the annual rate of return, which can be anywhere from 5% to 10%.

Is it better to roll 401k into a Roth or traditional IRA?

If you want to keep things simple and preserve the tax treatment of a 401(k), a traditional IRA is an easy choice. A Roth IRA may be good if you wish to minimize your tax bill in retirement. The catch is that if you choose a Roth, you’ll probably have to pay a lot of taxes today, unless your old account was a Roth 401(k).

What is a 401(k) rollover?

What Is a 401 (k) Rollover? A 401 (k) rollover simply allows you to transfer your retirement savings from a 401 (k) you had at a previous job into an IRA or another 401 (k) with your new employer. And you won’t have to pay any taxes on the money you transfer (in most cases).

How do I roll over my 401(k)?

1. Decide where to roll over your 401 (k). You can roll over a 401 (k) into your current 401 (k), an IRA, or cash it out. (Though cashing out is not technically a rollover, we include this option for those looking at all of their options. ) If your current employer offers a Roth 401 (k), you may also roll over your traditional 401 (k) there.

Can a 401(k) rollover save you money?

Some people who just quit their job may have to decide if and how their 401(k) should follow them. A 401 (k) rollover can help you consolidate your retirement savings into fewer accounts, open up additional investment options, and even save you money in certain circumstances. Image source: The Motley Fool. What is a 401 (k) rollover?.

Can a 401(k) rollover be a tax penalty?

Generally, there aren’t any tax penalties associated with a 401 (k) rollover into another 401 (k), as long as the money goes straight from the old account to the new account. To roll over from one 401 (k) to another, contact the plan administrator at your old job and ask if you can do a direct rollover. 3. Keep your 401 (k) with a former employer

Should I roll over my 401(k) to an IRA?

Most people come out way ahead by doing a direct transfer rollover to an IRA (more on how that works later). Option 3: Roll over the money into your new employer’s plan. Rolling your money over to your new 401 (k) plan has some benefits. It simplifies your investments by putting all your retirement savings in one place.

Can I roll over my 401(k) to a new employer?

Roll over your 401 (k) into a new employer’s plan Not all employers will accept a rollover from a previous employer’s plan, so check with your new employer before making any decisions. Your money has the chance to continue to grow tax-advantaged. Consolidating your 401 (k)s can make it easier to manage your retirement savings.