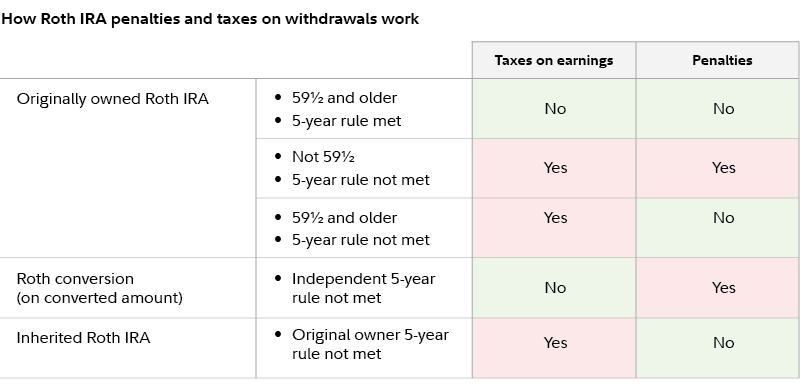

Making tax-free withdrawals from a Roth IRA depends on when — and what — you’re withdrawing. Otherwise, taxes and penalties could apply.

The products shown on this page are mostly or entirely from our advertising partners. They pay us when you click on one of their links and then do something on our site. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not provide advisory or brokerage services, and it does not tell investors whether to buy or sell certain stocks, bonds, or other investments.

A qualified distribution is a withdrawal of investment earnings without taxes or penalties. If you want to take money out of a Roth IRA, the account must be at least five years old and one of the conditions below must be met:

A non-qualified distribution is when withdrawing investment earnings incurs taxes, penalties, or both. The penalty for a non-qualified distribution is 10%. Jump to the full list of non-qualified distributions.

Each type of retirement account comes with specific tax advantages. With a Roth IRA, contributions arent tax-deductible, but the earnings grow tax-free. In some circumstances, savers can make qualified withdrawals without taxes or penalties.

Whether a withdrawal is considered “qualified” depends on factors such as your age, length of time the account has been open, withdrawal purpose and more.

Are you thinking about taking money out of your Roth IRA before you retire? Maybe you need the money for an emergency or want to take that dream vacation. If you want to know what will happen with your taxes when you take a nonqualified distribution from your Roth IRA, read this first.

It took me hours to research this subject so you don’t have to. I’ll explain everything you need to know about the tax and penalty effects of nonqualified Roth IRA distributions in simple terms. Believe me, knowing these rules could help you avoid paying thousands of dollars in taxes and fines that you don’t need to.

What Exactly Is a Nonqualified Roth IRA Distribution?

First things first – let’s get clear on what we’re talking about. A nonqualified Roth IRA distribution is basically any withdrawal that doesn’t meet the IRS requirements for being “qualified.”

In simpler terms it’s when you take money out of your Roth IRA and the IRS says “Hold up, you gotta pay some taxes on that!”

The IRS has specific criteria for what counts as a qualified distribution:

- The withdrawal occurs at least 5 years after you first opened and funded your Roth IRA (this is called the “five-year rule”)

- AND one of the following must be true:

- You’re at least 59½ years old

- You have a permanent disability

- The money goes to your beneficiary or estate after your death

- You’re withdrawing up to $10,000 to buy your first home

- You’re withdrawing up to $5,000 for a new child’s birth or adoption

Anything that doesn’t meet these requirements? That’s a nonqualified distribution

Contributions vs. Earnings: A Critical Distinction

Here’s something many people don’t realize – the rules for Roth IRA distributions work differently depending on whether you’re taking out contributions or earnings.

Contributions: Since you’ve already paid taxes on the money you put into your Roth IRA (that’s why they’re called “after-tax contributions”), you can actually withdraw your contributions at any time without paying taxes or penalties. This is one of the coolest features of Roth IRAs!

Earnings: This is where things get tricky. The money you’ve earned in your account (the investment returns you’ve received) could be taxed and even subject to penalties if you don’t follow the rules I already talked about.

The Tax Consequences of Nonqualified Distributions

When you take a nonqualified distribution from your Roth IRA, here’s what happens tax-wise:

-

Ordinary Income Tax: The earnings portion of your distribution will be taxed as ordinary income. This means it gets added to your other income for the year and taxed at your regular income tax rate.

-

10% Early Withdrawal Penalty: If you’re under age 59½, you’ll typically also face a 10% early withdrawal penalty on the earnings portion of your distribution.

Let me give you a real-world example:

Let’s say you have a Roth IRA worth $100,000. Of that amount, $70,000 represents your contributions, and $30,000 is earnings. If you withdraw $20,000 before age 59½ and before meeting the five-year rule, here’s what happens:

- First $20,000 is considered to come from your contributions, so no taxes or penalties on this amount

- If you withdrew $80,000, then $70,000 would be contributions (tax and penalty free) and $10,000 would be earnings subject to taxes and the 10% penalty

So in this second scenario, you’d pay:

- Income tax on $10,000 (depends on your tax bracket)

- 10% penalty on $10,000 = $1,000

That’s potentially thousands in taxes you might not have expected!

Exceptions to the 10% Early Withdrawal Penalty

Now, here’s some good news! Even if your distribution is nonqualified, you might be able to avoid the 10% early withdrawal penalty (though you’d still owe income tax on earnings) if you meet one of these exceptions:

- The distributions are part of a series of substantially equal periodic payments (SEPPs)

- You have unreimbursed medical expenses exceeding 7.5% of your adjusted gross income

- You’re paying medical insurance premiums after losing your job

- The withdrawal is for qualified higher education expenses

- The withdrawal is a qualified reservist distribution

- The withdrawal is for a qualified disaster recovery

It’s worth noting that these exceptions only apply to the 10% penalty. You’d still owe income tax on the earnings portion of your withdrawal.

The Five-Year Rule Explained

A lot of people get this rule wrong, so let me explain it better. If you want to take money out of your Roth IRA tax-free, you must wait at least five tax years. This is called the “five-year rule.”

The clock starts ticking on January 1 of the tax year when you made your first contribution. For example, if you made your first Roth IRA contribution in April 2023 for the 2022 tax year, your five-year period would begin on January 1, 2022.

Here’s the confusing part: Even if you’re over 59½, if you haven’t met the five-year rule, your earnings withdrawal will still be considered a nonqualified distribution!

Real-Life Example: The Cost of Nonqualified Distributions

Let’s look at a specific example to really understand the impact:

Sarah is 45 years old and needs $15,000 for home repairs. Her Roth IRA has $60,000 total – $40,000 in contributions and $20,000 in earnings. She’s had the account for only 3 years.

If Sarah withdraws $15,000:

- The entire $15,000 is considered to come from her contributions

- She pays $0 in taxes and $0 in penalties

But what if she needs $45,000 instead?

- $40,000 would be considered contributions (tax and penalty free)

- $5,000 would be considered earnings

- She would pay income tax on the $5,000

- She would also pay a 10% penalty of $500 (10% of $5,000)

If Sarah is in the 22% tax bracket, her total tax bill on this withdrawal would be:

- Income tax: $1,100 (22% of $5,000)

- Early withdrawal penalty: $500

- Total: $1,600

That’s money that could have stayed in her pocket!

How to Avoid Taxes and Penalties on Your Roth IRA Withdrawals

If you’re thinking about taking money from your Roth IRA, here are some strategies to minimize or avoid taxes and penalties:

-

Wait until you meet the qualified distribution requirements – If possible, wait until you’re 59½ and have met the five-year rule.

-

Withdraw only contributions – Since you can take out your contributions at any time tax and penalty-free, limit your withdrawals to just the amount you’ve contributed.

-

Check if you qualify for an exception – If you need to withdraw earnings, see if you qualify for one of the penalty exceptions listed earlier.

-

Consider other sources of funds first – Before tapping your Roth IRA, look at other options like an emergency fund, taxable investment account, or even a 401(k) loan if you have access to one.

-

Use a Roth 401(k) instead – If your employer offers a Roth 401(k), it might be a better option for retirement savings as it allows higher contribution limits than a Roth IRA.

Ordering Rules: How the IRS Treats Roth IRA Withdrawals

The IRS has specific “ordering rules” that determine which money comes out first when you take a distribution from your Roth IRA:

- Regular contributions come out first

- Conversion contributions come out second (on a first-in-first-out basis)

- Earnings come out last

This ordering system works in your favor since contributions (which come out first) aren’t subject to taxes or penalties!

Common Questions About Nonqualified Roth IRA Distributions

Do I pay taxes on all nonqualified distributions?

Not necessarily. You only pay taxes on the earnings portion of a nonqualified distribution. Your contributions can always be withdrawn tax and penalty-free.

How does the IRS know if my distribution is qualified?

When you take a distribution from your Roth IRA, your financial institution will report it to the IRS on Form 1099-R. You’ll need to report this distribution correctly on your tax return.

Can I put the money back if I change my mind?

Yes, but there’s a catch! You have 60 days to roll the money back into the same or another Roth IRA. However, you can only do one IRA rollover per 12-month period.

What if I’m over 59½ but haven’t met the five-year rule?

If you’re over 59½ but haven’t met the five-year rule, you won’t face the 10% early withdrawal penalty, but you’ll still owe income tax on any earnings you withdraw.

The Bottom Line: Think Twice Before Taking Nonqualified Distributions

Taking nonqualified distributions from your Roth IRA can be costly for two big reasons:

- The immediate cost of taxes and penalties

- The long-term opportunity cost of losing tax-free growth

Remember, Roth IRAs are designed for retirement savings. The tax-free growth potential is incredibly valuable over time, and tapping into your account early diminishes this benefit significantly.

Before making any withdrawals, I strongly recommend consulting with a tax professional or financial advisor who can help you understand your specific situation and explore alternatives.

Have you ever taken a nonqualified distribution from your Roth IRA? What was your experience like? I’d love to hear your thoughts in the comments!

Disclaimer: While we’ve made every effort to ensure this information is accurate, tax laws change frequently. This article is for informational purposes only and should not be considered tax or financial advice. Always consult with a qualified tax professional regarding your specific situation.

Roth IRA distribution rules

A qualified Roth IRA distribution is a withdrawal of investment earnings without taxes or penalties. The Roth IRA must be at least five years old and one of the following must be true in order to make a qualified distribution:

- You are age 59 ½ or older.

- The withdrawal is due to a disability.

- After you die, the money is sent to a beneficiary or your estate.

- You can use the money to buy, build, or rebuild your first home, up to a $10,000 lifetime limit.

» See our picks for the best Roth IRA accounts

What is the Roth IRA early withdrawal penalty?

There is a 10% penalty if you withdraw earnings early from your Roth IRA. In addition to the penalty, you may also pay taxes on the withdrawal at your ordinary income tax rate.

There are some exceptions to the 10% penalty. In certain scenarios, individuals can tap into their Roth IRA earnings early without incurring penalties (more on this below). Advertisement.

Charles Schwab |

Interactive Brokers IBKR Lite |

Coinbase |

|---|---|---|

| NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.8 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

5.0 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.6 /5 |

|

Fees $0 per online equity trade |

Fees $0 per trade |

Fees 0% – 4% varies by type of transaction; other fees may apply |

|

Account minimum $0 |

Account minimum $0 |

Account minimum $0 |

|

Promotion None no promotion available at this time |

Promotion None no promotion available at this time |

Promotion Get $200 in crypto when you sign up. Terms Apply. |

| Learn More | Learn More | Learn More |