The future looks bright for the next generation of retirees. People are living longer and approaching retirement with a renewed sense of purpose.

With more life to look forward to and more passions to pursue, its essential to build a nest egg that lasts a lifetime. Annuities are products that can provide ongoing payments through your retirement years.

Learn about the types of annuities and how they can help ensure you wont outlive your money.

You’re not the only one who doesn’t understand annuities. When planning for retirement, it can be hard to keep track of all the different types. Don’t worry, though. I’ll explain it clearly so you can choose the best option for your future.

Annuities are powerful retirement tools that many folks overlook. They give you guaranteed streams of income that can last your whole life, which is very helpful if you want to make sure you don’t run out of money before you die!

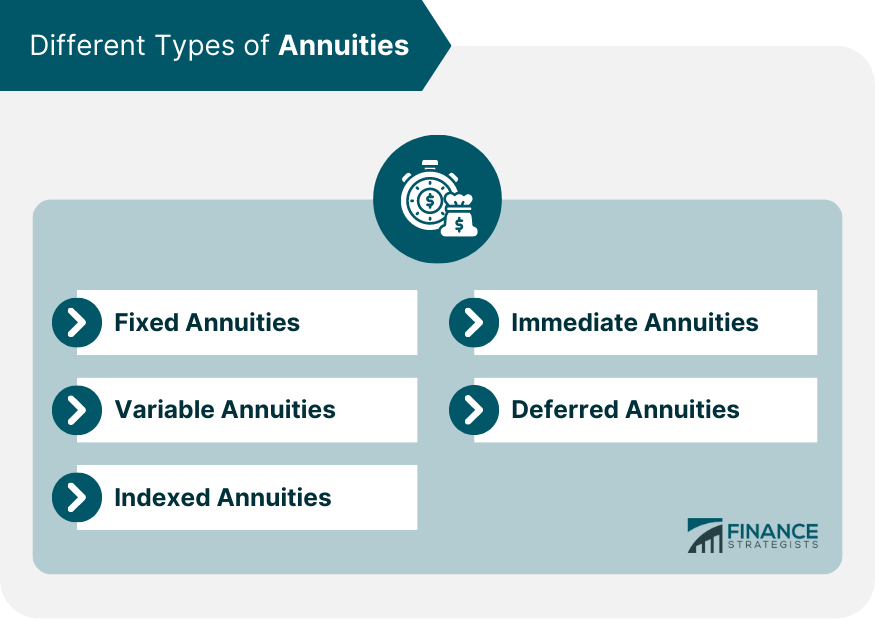

These are the 4 main types of annuities. I’ll talk about how they work and help you choose the one that might be best for you. Let’s dive in!.

What Is an Annuity Anyway?

Before we get into the types, let’s clarify what an annuity actually is:

An annuity is a contract between you and an insurance company where you make payments (either one lump sum or a series of smaller payments), and in return, the insurer promises to pay you a steady income stream in the future.

Think of it as buying yourself a paycheck for retirement. You’re essentially creating your own pension plan!.

The money in your annuity grows tax-deferred until you start taking withdrawals. This means you don’t pay taxes on the earnings until you actually receive the money.

The 4 Main Types of Annuities

There are four primary types of annuities each with unique features benefits, and drawbacks

- Fixed Annuities

- Variable Annuities

- Indexed Annuities

- Immediate Annuities

Let’s explore each one in detail

1. Fixed Annuities: Predictable and Safe

A fixed annuity is the simplest and most straightforward type. It offers a guaranteed minimum interest rate and fixed payments.

How Fixed Annuities Work:

- You make your deposit (lump sum or series of payments)

- The insurance company guarantees a specific interest rate

- Your money grows at this fixed rate during the accumulation phase

- When you’re ready for income, you receive predictable, guaranteed payments

Pros of Fixed Annuities:

- Easy to understand – straightforward terms and rates

- Guaranteed minimum return – you know exactly what you’ll get

- Predictable income – makes retirement planning simpler

- Often higher returns than savings accounts or CDs

- Protected from market losses

Cons of Fixed Annuities:

- No benefit from stock market gains

- Might not keep up with inflation

- Potential surrender charges if you withdraw early

- Possible loss if you die soon after payouts begin

Fixed annuities are great for people with low risk tolerance who prioritize stability over growth potential. If you want to know exactly how much income you’ll receive in retirement, this might be your best bet.

2. Variable Annuities: Growth Potential with Risk

Variable annuities offer potential for higher returns, but with greater risk. Your money is invested in a portfolio of mutual funds that you select.

How Variable Annuities Work:

- You contribute money to the annuity

- You choose from various investment options (mutual funds)

- Your returns depend on the performance of these investments

- The value of your annuity and future payments can go up or down

Pros of Variable Annuities:

- Potential for higher returns than fixed annuities

- Opportunity to benefit from market growth

- Tax-deferred growth until withdrawal

- No contribution limits (unlike 401(k)s and IRAs)

- Some offer minimum income guarantees through riders

Cons of Variable Annuities:

- Investment risk – your account value can decrease

- Higher fees than other annuities and traditional investments

- More complex to understand

- Surrender charges for early withdrawals

- Can make retirement budgeting more challenging due to fluctuating income

Variable annuities are better suited for experienced investors who understand the risks and have a longer time horizon before retirement. If you’re comfortable with some market exposure and want growth potential, this might work for you.

3. Indexed Annuities: The Middle Ground

Indexed annuities (sometimes called fixed indexed annuities) are a hybrid between fixed and variable annuities. They offer some market exposure with downside protection.

How Indexed Annuities Work:

- Your returns are linked to a market index (like the S&P 500)

- You get partial participation in market gains

- You’re protected against market losses

- There’s usually a minimum guaranteed return

- There’s often a cap on how much you can earn

Pros of Indexed Annuities:

- Some protection against market downturns

- Potential for higher returns than fixed annuities

- Less risky than variable annuities

- Minimum guaranteed interest rate

- Tax-deferred growth

Cons of Indexed Annuities:

- Complex terms and conditions

- Caps limit your upside potential

- Participation rates may reduce your returns

- Higher fees than fixed annuities

- Surrender charges for early withdrawals

Indexed annuities appeal to those who want some market exposure but with a safety net. They’re a compromise between the security of fixed annuities and the growth potential of variable annuities.

4. Immediate Annuities: Income Now

Immediate annuities are designed for those who need income right away. They start paying out very quickly after purchase.

How Immediate Annuities Work:

- You make a lump-sum payment to the insurance company

- The insurer begins making payments to you within one year

- Payments can be for a specific period or for life

- The amount is determined by your age, gender, interest rates, and other factors

Pros of Immediate Annuities:

- Income begins almost immediately

- Simple to understand

- Guaranteed income for life (if chosen)

- Peace of mind knowing you’ll have regular payments

- Can help cover essential expenses in retirement

Cons of Immediate Annuities:

- Loss of liquidity – you can’t access the lump sum once invested

- Limited or no inflation protection (unless purchased as a rider)

- Potential loss if you die early (depending on the payout option)

- Can’t change your mind once payments begin

- May not leave money for heirs (unless you choose a period certain option)

Immediate annuities are ideal for retirees who need income now and want the security of regular payments. They’re particularly popular among those already in retirement who want to convert a portion of their savings into lifetime income.

Other Important Annuity Classifications

Besides the four main types, annuities can also be categorized based on:

Deferred vs. Immediate Annuities

- Deferred annuities delay payouts until a future date, allowing your money more time to grow

- Immediate annuities begin payments right away or within a year

Single Premium vs. Flexible Premium

- Single premium annuities require one lump-sum deposit

- Flexible premium annuities allow multiple contributions over time

Qualified vs. Non-Qualified Annuities

- Qualified annuities are purchased within tax-advantaged retirement accounts (like IRAs or 401(k)s)

- Non-qualified annuities are purchased with after-tax dollars

How to Choose the Right Annuity for You

Selecting the right annuity depends on your specific financial situation and retirement goals. Here are some factors to consider:

- Time until retirement: Younger investors might prefer deferred annuities for growth, while those near or in retirement might choose immediate annuities.

- Risk tolerance: Conservative investors may prefer fixed annuities, while those comfortable with market fluctuations might choose variable annuities.

- Income needs: Consider when you’ll need the income and how much you’ll need.

- Inflation concerns: If you’re worried about inflation eroding your purchasing power, look for annuities with inflation protection or consider indexed annuities.

- Estate planning: Some annuities offer death benefits or guaranteed periods that ensure your beneficiaries receive something if you die early.

The Annuity Decision Table

Here’s a simple table to help you compare the four types of annuities:

| Annuity Type | Risk Level | Return Potential | Income Predictability | Best For |

|---|---|---|---|---|

| Fixed | Low | Low to Moderate | High | Conservative investors seeking guaranteed returns |

| Variable | High | High | Low | Experienced investors comfortable with market risk |

| Indexed | Medium | Moderate | Medium | Those wanting some market exposure with downside protection |

| Immediate | Low | Set at purchase | High | Retirees needing income now |

Common Questions About Annuities

Are annuities a good investment?

Annuities aren’t really investments in the traditional sense – they’re insurance products designed to provide income. They can be valuable parts of a retirement strategy, especially for those worried about outliving their savings.

What happens to my annuity when I die?

It depends on the type of annuity and the options you select. Some annuities stop at death, while others continue payments to beneficiaries or offer death benefits.

Can I lose money in an annuity?

In a fixed annuity, your principal is generally protected. In variable annuities, you can lose money if your investments perform poorly. Indexed annuities typically protect your principal but may have surrender charges if you withdraw early.

What are the fees associated with annuities?

Annuities often have fees, including:

- Mortality and expense charges

- Administrative fees

- Investment management fees (for variable annuities)

- Surrender charges (for early withdrawals)

- Rider fees (for additional features)

Variable annuities typically have the highest fees, while fixed annuities have the lowest.

The Bottom Line

Annuities can be valuable tools for retirement planning, offering something many other investments can’t: guaranteed income for life. They provide peace of mind knowing you’ll have income no matter how long you live.

However, they’re not for everyone. The best approach is to thoroughly understand your options and consider working with a financial advisor who can help you determine if an annuity fits into your overall retirement strategy.

Remember, there’s no one-size-fits-all solution when it comes to retirement planning. The right choice depends on your personal situation, goals, and needs.

Have you considered including an annuity in your retirement plan? Which type seems most appealing to you? I’d love to hear your thoughts in the comments!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial professional before making investment decisions.

Should you consider a fixed annuity?

Is a fixed annuity right for you? Consider some questions first. Have you contributed enough to your 401(k) to get an employer match if its offered? Would you like to put more money away to help support yourself (and, perhaps, your spouse) in retirement? If so, a fixed annuity may be worth considering. You should consider a fixed annuity for guaranteed, predictable income over time, typically with a fixed interest rate, offering stability and security for retirement planning.

What are annuities & how do they work?

An annuity is a contract between you and an insurance company that can provide income in retirement. You buy the annuity with a lump sum or by making premium payments over time. Then, at a designated point in time, you can take withdrawals or the insurance company can start making income payments to you that last for a specific period of time or the rest of your lifetime.

Different types of annuities can meet your retirement needs in different ways. The varieties differ by:

- What time you plan to start accepting payments, usually right away or later

- How the money is put to work—usually at a fixed rate or a variable return