The world of trusts is not one-size-fits-all. What kind of trust you pick should depend on how you want your assets to be managed now and in the future.

“A trust can help you navigate specific tax concerns or creditor protection, ensure your wealth supports your family, or leave a legacy for a charitable cause you believe in,” says Terry Ruhe, senior vice president and regional trust manager for U. S. Bank Wealth Management. “Whatever your wishes, there’s a trust for you. ”.

The two basic trust structures are revocable and irrevocable. The biggest difference is that revocable trusts can be changed after they are created, while irrevocable trusts typically cannot.

As stated above, a revocable trust – also referred to as a living trust – is one that can be changed after it’s created. “A revocable trust can accomplish many of the same things as a will. However, there’s one key difference,” says Ruhe. “By creating and transferring your assets to a revocable trust, you can avoid the probate process that’s required for a will. ” Probate can be both lengthy and public, and a revocable trust usually is not public.

Because you can make changes to your revocable trust at any time, for certain purposes you are still viewed as the owner of the assets – even though you have a trustee who manages the trust for you. For example, you’ll be responsible for making tax payments and reporting on the trust’s investment returns, and revocable trust assets are includable in your estate and are available to creditors.

You can set up your revocable trust to play out in several different ways, too. You can have your revocable trust end upon your death, and have all assets distributed to your beneficiaries at that time. It is also possible to set it up so that when you die, that revocable trust turns into an irrevocable trust for other people or institutions.

You typically cannot change or amend an irrevocable trust after it’s created. The assets are taken out of your estate, and the trust files its own tax return and pays its own income tax. This can give you greater protection from creditors and estate taxes.

As stated above, you can set up your will or revocable trust to automatically create irrevocable trusts at the time of your death. When you use your will to create irrevocable trusts, it’s called a testamentary trust. But you can also set up irrevocable trusts during your lifetime.

There are a variety of irrevocable trust types to choose from, depending on your unique circumstances. “Your reason for setting up an irrevocable trust is critical in helping you select one that fits your needs,” says Ruhe. Are you setting up a trust to:

The following are scenarios where these concerns can be addressed through a type of irrevocable trust.

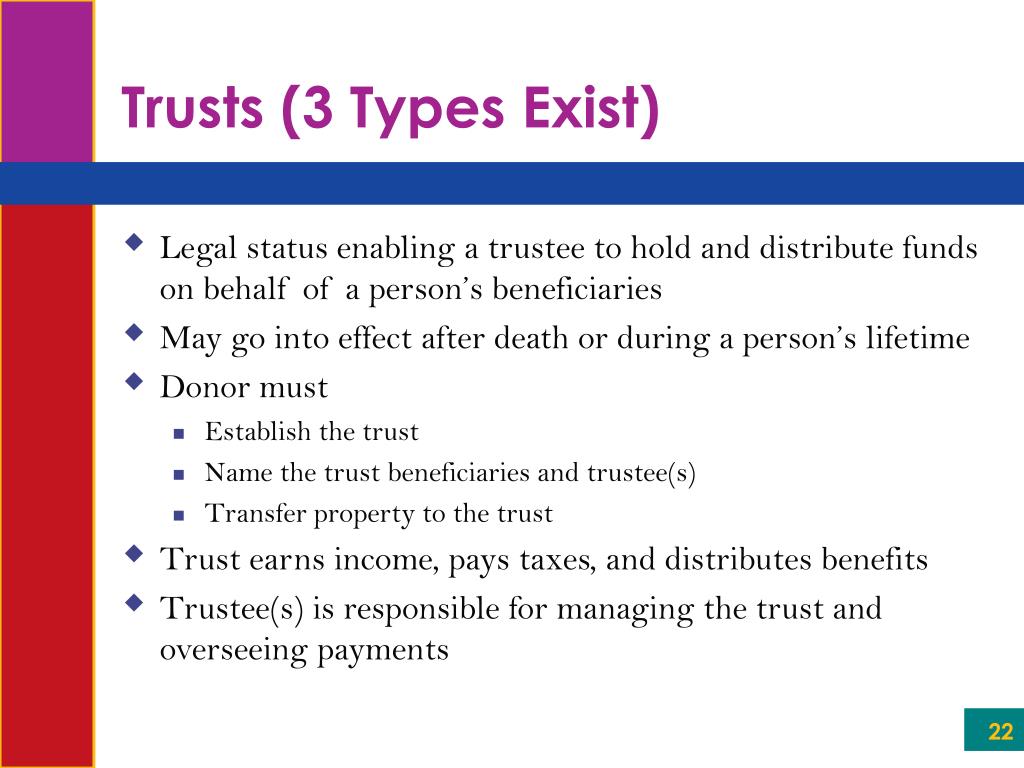

Have you ever wondered how to protect your assets while ensuring they go to the right people after you’re gone? Trusts might be the answer you’re looking for, but understanding the different types can feel overwhelming. I’ve spent countless hours researching this topic, and today I’m breaking down the three main types of trusts in simple, easy-to-understand terms.

Understanding Trusts: The Basics

Before diving into the specific types, let’s clarify what a trust actually is. A trust is essentially a legal arrangement that allows you to separate who owns an asset from who controls it and who uses it. Think of it as a container where you can place your valuable possessions and dictate exactly how they should be managed and distributed.

As Terry Ruhe senior vice president and regional trust manager for U.S. Trust, puts it “a trust can help you navigate specific tax concerns or creditor protection ensure your wealth supports your family, or leave a legacy for a charitable cause you believe in.”

The 3 Main Types of Trust

When it comes to estate planning there are three primary categories of trusts that form the foundation of most trust arrangements

1. Revocable Trusts

Also known as “living trusts” or “inter vivos trusts,” these are created during your lifetime. The key feature here is flexibility – you can change or cancel them whenever you want!

Key features:

- You can modify or terminate the trust at any time

- You typically name yourself as the initial trustee

- Assets avoid the probate process when you die

- Provides for management of assets if you become incapacitated

- Your information stays private (unlike wills which become public record)

Drawbacks:

- Doesn’t protect assets from creditors

- Doesn’t reduce estate taxes

- Can be expensive to set up and administer

- Requires re-titling of assets

I helped my parents set up a revocable trust not long ago, and the peace of mind it gave them was well worth the money it cost to set up. They love knowing that they can make changes as their lives change.

2. Irrevocable Trusts

As the name suggests, it’s hard to change or cancel these trusts once they’re set up. This may seem like a restriction, but the trade-off has big benefits.

Key features:

- Cannot be easily modified once established

- Assets are better protected from creditors

- Can reduce or eliminate estate taxes

- Assets are no longer considered part of your personal estate

Drawbacks:

- You give up control over the assets

- You cannot serve as trustee

- Very difficult to make changes once established

- Subject to strict IRS regulations

My friend Mike established an irrevocable trust for his vacation property. While he can’t change the terms now, he’s relieved knowing that the property is protected from potential future creditors and will pass to his children without excessive taxation.

3. Testamentary Trusts

A testamentary trust is set up through your will and only goes into effect after you die, unlike the first two types that are set up while you are still alive.

Key features:

- Created through your will after your death

- Assets must go through probate first

- Terms can be changed any time before death (by modifying your will)

- Great for managing inheritance for minor children or individuals who can’t manage money

Drawbacks:

- Does not avoid the probate process

- Can be time-consuming to implement

- Terms become public record

- May be expensive due to probate costs

My neighbor used a testamentary trust to provide for her grandson who struggles with addiction. She knew he wasn’t ready to manage a large inheritance, so the trust provides structured payouts while protecting the principal.

How These Trusts Compare

To make it easier to understand the differences, here’s a quick comparison table:

| Feature | Revocable Trust | Irrevocable Trust | Testamentary Trust |

|---|---|---|---|

| Created when? | During your lifetime | During your lifetime | After your death |

| Can be changed? | Yes, anytime | Very difficult | Yes, before death |

| Avoids probate? | Yes | Yes | No |

| Protects from creditors? | No | Yes | Yes, after probate |

| Reduces estate taxes? | No | Yes | Possibly |

| Privacy | Private | Private | Public record |

Specialized Trust Types

Besides the three main types, there are also a number of specialized trusts that are made for specific situations. These usually fit into one of the three main groups, but they have different features for different uses:

- Special Needs Trusts: For disabled loved ones who receive government benefits

- Charitable Trusts: To support causes you care about while gaining tax advantages

- Asset Protection Trusts: Specifically designed to protect assets from creditors

- Spendthrift Trusts: For beneficiaries who might not manage money responsibly

- Pet Trusts: To ensure your pets are cared for after you’re gone

Which Trust Is Right for You?

Choosing the right trust depends entirely on your specific goals. Here are some guidelines:

-

Choose a revocable trust if: You want flexibility, privacy, and to avoid probate while maintaining control of your assets.

-

Choose an irrevocable trust if: Asset protection from creditors or estate tax reduction is your primary concern, and you’re comfortable giving up control.

-

Choose a testamentary trust if: You’re primarily concerned about providing structured inheritance for heirs who may not be able to manage money well.

Common Questions About Trusts

Do I need to be wealthy to benefit from a trust?

Not at all! While trusts are often associated with wealth, they can benefit people with modest estates too. If you own real estate, have minor children, or want to avoid probate, a trust might make sense regardless of your net worth.

How expensive is it to set up a trust?

The cost varies depending on complexity and location. A basic revocable trust might cost $1,000-$3,000 to establish, while more complex trusts can cost significantly more. However, these costs should be weighed against the potential savings in probate costs and taxes.

Can I set up a trust myself?

While DIY trust kits exist, I strongly recommend working with an experienced estate planning attorney. The potential for costly mistakes is high, and what you save upfront might cost your heirs significantly more later.

Bottom Line

Understanding the three main types of trusts—revocable, irrevocable, and testamentary—provides a solid foundation for your estate planning. Each offers distinct advantages depending on your goals, whether that’s avoiding probate, protecting assets, or ensuring proper management of your estate.

I’ve seen firsthand how the right trust can provide peace of mind and protect family legacies. The key is to work with qualified professionals who can tailor a solution to your specific situation. Don’t wait until it’s too late to protect what you’ve worked so hard to build!

Remember, while trusts can be powerful tools, they’re just one component of a comprehensive estate plan. Wills, power of attorney documents, and healthcare directives should also be part of your overall strategy.

Have you considered which type of trust might work best for your situation? The sooner you start planning, the more options you’ll have available.

Estás ingresando al sitio de U.S. Bank en español Algunos materiales y servicios podrían estar disponibles solamente en inglés. Los enlaces incluidos en esta comunicación podrían dirigirte a sitios web en inglés.

Financial guidance and support, tailored for you.

Explore the benefits of personalized wealth services.

Share:

- The two basic trust structures are revocable and irrevocable.

- You can change a revocable trust after you set it up. Moving your assets to a revocable trust can help you avoid probate.

- Once an irrevocable trust is set up, it usually can’t be changed or amended. You can choose from different types of irrevocable trusts based on why you want to set one up.

The world of trusts is not one-size-fits-all. The type of trust you choose should reflect your unique wishes for how your assets are handled now and in the future.

Terry Ruhe, senior vice president and regional trust manager for U.S. Trust, says, “A trust can help you deal with specific tax issues or protect you from creditors. It can also help you make sure your wealth supports your family or leave a legacy for a charity you believe in.” S. Bank Wealth Management. “Whatever your wishes, there’s a trust for you. ”.

The two basic trust structures are revocable and irrevocable. The biggest difference is that revocable trusts can be changed after they are created, while irrevocable trusts typically cannot.

(There are a few exceptions, though, as state laws can vary considerably.1)

“Both revocable and irrevocable trusts can provide specific benefits depending on your intent,” Ruhe continues.

As we already said, a revocable trust, which is also called a living trust, can be changed after it has been set up. “A revocable trust can accomplish many of the same things as a will. However, there’s one key difference,” says Ruhe. “By creating and transferring your assets to a revocable trust, you can avoid the probate process that’s required for a will. ” Probate can be both lengthy and public, and a revocable trust usually is not public.

You are still seen as the owner of the assets for some purposes even though a trustee manages the trust for you because you can change your revocable trust at any time. For example, you’ll be responsible for making tax payments and reporting on the trust’s investment returns, and revocable trust assets are includable in your estate and are available to creditors.

You can set up your revocable trust to play out in several different ways, too. You can have your revocable trust end upon your death, and have all assets distributed to your beneficiaries at that time. You can also set it up so that when you pass away, that revocable trust automatically creates irrevocable trusts that continue for different people or institutions.

You typically cannot change or amend an irrevocable trust after it’s created. The assets move out of your estate, and the trust pays its own income tax and files a separate return. This can give you greater protection from creditors and estate taxes.

As stated above, you can set up your will or revocable trust to automatically create irrevocable trusts at the time of your death. When you use your will to create irrevocable trusts, it’s called a testamentary trust. But you can also set up irrevocable trusts during your lifetime.

There are a variety of irrevocable trust types to choose from, depending on your unique circumstances. “Your reason for setting up an irrevocable trust is critical in helping you select one that fits your needs,” says Ruhe. Are you setting up a trust to:

- Transfer wealth to the next generation?

- Keep a family business in the family?

- Leave a legacy with a charity you support?

- Minimize estate taxes for you or your beneficiaries?

- Shield your assets from creditors?

The following are scenarios where these concerns can be addressed through a type of irrevocable trust.

Irrevocable life insurance trust

This type of trust (also called an ILIT) is often used to set aside funds for estate taxes. An ILIT might be particularly useful if you own a family business that’s set to remain in your estate when you pass away. You can create an ILIT ahead of time to ensure the business stays in your family, despite estate bills, by gifting the premium on your life insurance into the ILIT each year.

Your trustee will own the policy, and when you pass away, the trustee collects the policy proceeds. Those proceeds can be distributed to the trust’s beneficiaries, who can use them to pay estate taxes, ensuring they won’t have to sell the family business. They may also use it to fund a buy/sell agreement where they buy out the remaining owners once you pass away so they can control the company.