Deciding when to start collecting your Canada Pension Plan (CPP) is one of the biggest financial decisions you’ll make for your retirement. As someone approaching retirement age, I’ve spent countless hours researching this topic to figure out what’s best for my own situation.

The standard age to take CPP is 65, but you can start as early as 60 or delay until 70. Taking it early at 60 means a permanent 36% reduction in your monthly benefits, while waiting until 70 gives you a 42% increase. But the decision isn’t as straightforward as just looking at the monthly amount.

What Happens When You Take CPP Early at Age 60?

If you decide to take CPP at age 60, here’s what you need to know:

- Your benefits will be reduced by 0.6% for each month before age 65 (7.2% per year)

- This equals a permanent 36% reduction compared to waiting until 65

- In 2025, the maximum monthly CPP benefit at age 65 is $1,433 ($17,196 annually)

- At age 60, the maximum would be reduced to $917.12 per month ($11,005.44 annually)

- The average CPP payment in 2025 is actually much lower at $808.14 per month

Let’s look at the key factors that might influence your decision.

3 Good Reasons to Take CPP at Age 60

1. You Need the Money Now

You might need extra money to pay your bills and debts because you lost your job or had to retire early because of health problems. If you don’t have enough savings to get you through your 60s, you may need to start taking CPP early.

As Robb Engen from Boomer & Echo points out: “Simply put, without sufficient income or personal savings to carry you through your 60s you may have no choice but to take CPP as early as possible.”

That $11,005 annual income starting at 60 could be the difference between meeting your basic needs or struggling financially.

2. You Have a Shorter Life Expectancy

If you have reason to believe you won’t live into your 80s or beyond, taking CPP early often makes financial sense. The “breakeven point” for taking CPP at 60 versus 65 is around age 74.

In other words, if you live past 74, you would’ve been better off waiting until 65 to start your pension. But if you don’t live that long, you’ll collect more total benefits by starting at 60

Health conditions, family history, or lifestyle factors might give you some insight into your potential longevity. If you’re concerned about a shortened life expectancy, it can be wise to get those benefits earlier.

3. You Have Years of Zero Contributions

If you stopped working before 60 (maybe you retired at 55 or became self-employed and paid yourself dividends instead of salary), those years of zero contributions can impact your CPP calculation.

When you turn 60, your CPP benefits are based on your best 35 years of work, but when you turn 65, they are based on your best 39 years of work.

If you stopped working at 55, for example, waiting until 65 would mean including 10 years of zero contributions in your calculation, which could significantly reduce your benefit amount.

The Downsides of Taking CPP at Age 60

1. Permanently Reduced Benefits

The %2036% percentage decrease in benefits is permanent and will last your whole life. That decrease in income can add up to a lot of money over time if you live into your 80s or 90s.

Let’s look at a simple comparison:

| Age at Start | Monthly Payment | Annual Payment | Total by Age 85 |

|---|---|---|---|

| Age 60 | $917.12 | $11,005.44 | $275,136.00 |

| Age 65 | $1,433.00 | $17,196.00 | $343,920.00 |

| Age 70 | $2,034.86 | $24,418.32 | $366,274.80 |

If you live to 85, waiting until 65 would give you nearly $68,800 more in total benefits!

2. Longevity Risk

People tend to underestimate how long they’ll live. Most Canadians who are 60 years old today can expect to live another 25 years. Women typically live even longer.

If you’re healthy at 60, there’s a decent chance you could live well into your 80s or even 90s. Taking CPP early leaves you with less guaranteed income in those later years, when you might face increasing healthcare costs.

3. Giving Up a Guaranteed Return

By waiting until 65 instead of taking CPP at 60, you effectively earn a guaranteed 7.2% annual return (adjusted for inflation). This is hard to beat consistently in the investment world, especially with a guarantee.

Some folks argue they could take CPP early and invest it for better returns, but this strategy:

- Requires you to actually invest the money (not spend it)

- Involves investment risk

- Requires consistent returns above 7.2% after fees and taxes

- Doesn’t provide the same lifetime guarantee

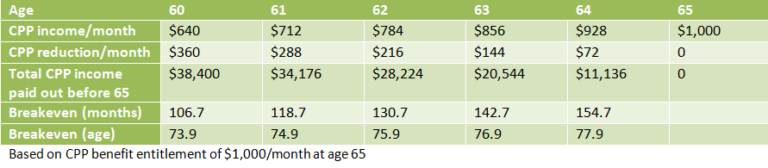

CPP Breakeven Analysis

The breakeven point when taking CPP at age 60 versus age 65 is around 74 years old:

- If you take CPP at 60, you’ll receive about $11,005 per year for 5 extra years = $55,027 by age 65

- After 65, you’ll continue receiving the reduced amount ($11,005) while someone who waited gets $17,196

- The difference is about $6,191 per year

- It would take about 9 years of this difference ($55,027 ÷ $6,191 ≈ 8.9 years) to make up for the early payments

- 65 + 9 = 74 years old

So if you expect to live beyond 74, waiting until 65 would likely give you more money overall. If you think you might not reach 74, taking it early at 60 could be better financially.

Special Situations to Consider

Working While Taking CPP

You can continue working while collecting CPP. Between ages 60-65, you must continue contributing to CPP, and these contributions will increase your benefit through post-retirement benefits (PRB). After 65, contributions become optional.

GIS Eligibility

If you expect to qualify for the Guaranteed Income Supplement (GIS) at age 65, taking CPP early might make sense. Delaying CPP could result in a higher income that triggers GIS clawbacks. Since GIS is non-taxable and CPP is taxable, this calculation gets complex.

CPP Disability

If you’re considering taking CPP early due to health issues, look into CPP disability benefits first. These benefits are always higher than early retirement benefits and will convert to a full retirement pension at 65.

CPP Survivor Benefits

If you’re receiving a survivor’s benefit from a deceased spouse, the combined amount with your own CPP can’t exceed the maximum. This might affect your decision about when to start your own CPP.

My Personal Take

I believe there’s no one-size-fits-all answer to when you should take CPP. While financial advisors often recommend delaying CPP to maximize lifetime benefits, they sometimes overlook the emotional and practical aspects of the decision.

Here’s what I think:

-

If you need the money to make ends meet at 60, take it. Financial stress can harm your health and wellbeing.

-

Consider your health realistically. As one commenter on Boomer & Echo put it: “I’ve seen so many people die right after they retire. Healthy people, friends who jogged daily and ate well.”

-

Balance mathematical optimization with life enjoyment. As another commenter said: “For the few extra dollars you get later in life, you could be enjoying money right now.”

-

Remember retirement is often divided into the “go-go years” (early retirement), “slow-go years” (mid-retirement), and “no-go years” (late retirement). Having more money in those active early years might enhance your quality of life.

How to Apply for CPP at Age 60

If you decide taking CPP at 60 is right for you:

- Apply online through your My Service Canada Account (MSCA) for fastest processing (7-14 days)

- Or complete a paper application and mail it to Service Canada (can take up to 120 days)

- You can apply up to 12 months before you want your pension to start

Final Thoughts

The decision about when to take CPP shouldn’t be made in isolation. It should be part of your overall retirement income strategy, considering all your income sources, tax situation, health, and lifestyle goals.

Working with a fee-only financial planner who doesn’t earn commissions from selling products can help you analyze your specific situation.

Remember that CPP is just one piece of your retirement puzzle. OAS, personal savings, workplace pensions, TFSAs, and RRSPs all play important roles in creating a comfortable retirement.

Ultimately, I believe the “best” decision is one that gives you peace of mind and aligns with your personal values and priorities. For some, that’ll mean taking CPP at 60, while others will benefit from waiting.

What’s your take? Are you leaning toward taking CPP early, or do you plan to wait? I’d love to hear about your situation in the comments below!

What the math says

Waiting until age 70 to receive CPP produces a larger monthly benefit than applying at 65 or earlier. But putting things off only makes sense if you think you’ll collect long enough to make up for what could turn out to be years of foregone payments. Here’s where longevity and the concept of a “break-even” age come in.

The break-even age if you begin benefits at age 60 instead of 65 is approximately 74. That means if your family history, health, and lifestyle suggest you’ll live past age 74, you’re better off waiting until 65 to collect. What about if you’re 65 and want to put off retirement until 70? That move will only pay off if you live past 82.

Start sooner or wait longer?

Deciding when to take CPP shouldn’t happen without careful consideration. There’s a lot at stake. Your decision could impact your Old Age Security (OAS), tax rate, investments, estate planning and more. A wrong choice could cost you dearly in lost benefits. Don’t forget, once you begin receiving payments you can’t change your mind. Plan wisely!.

If you’re like most people who have diligently contributed to the Canada Pension Plan (CPP) throughout their working years, chances are you’ll reach for those benefits as soon as you can, at age 60. Government records show only 7% of new CPP recipients in 2017 waited until after 65 to start collecting.

But there are pros and cons to starting as soon as you are eligible. Should you start sooner or later? Here’s what you need to know and consider.

7 Reasons To Take CPP At 60

FAQ

Is it better to take CPP at 60 and invest it?

Deciding when you take your cpp is a huge decision and is different for each person. Depends on your other sources of income. Most people are better off between 65 and 70 but unique to each situation. Remember that there is a huge reduction applied if you take at 60 and 42% increase from 65 value if you take at 70.

What is the best age to collect CPP?

When you turn 70, you can start getting the most out of your CPP retirement pension. After that age, there’s no reason to wait. If you need money sooner, you can start collecting your pension as early as age 60, but with a permanent reduction.

How much will I get if I take my CPP at 60?

The amount of Canada Pension Plan (CPP) you receive at age 60 depends on how long and how much you contributed to the plan throughout your career, as well as the specific month you start receiving benefits.

What are the two mistakes people make when calculating CPP?

Two common mistakes are measuring life expectancy from birth and using the wrong mortality table.

Should I take CPP at 60?

Depending on your health, financial situation, and retirement plan, taking CPP at 60 may make the most sense. Or, you may be better off waiting until later to maximize your lifetime benefits. This article covers the pros and cons of taking CPP at age 60, how much you can expect, and how to apply. Should You Take CPP at Age 60, 65, or 70?.

What happens if you take CPP earlier than 74 years?

If you start getting CPP benefits before age 60, you may not get them if you live past 74. A retiree who starts getting CPP at age 60 will have earned $38,400 by age 65 and $76,800 by age 70. If a senior starts taking CPP at age 70 instead of age 60, they will get an extra $110,400 if they live to age 90.

What is the breakeven point if you take CPP at 60?

Summary: The breakeven point when you take CPP at age 60 is between age 73 and 74. If you live past 74 years, you may lose out on benefits if you take CPP earlier at age 60. A retiree who collects CPP at 60 will have already received $38,400 by age 65 and $76,800 by age 70.

What happens if I start my CPP pension before age 65?

If you start your CPP pension before age 65 Payments decrease by 0.6% each month (7.2% per year), up to a maximum reduction of 36% if you start at age 60. If you start your CPP pension after age 65 Payments increase by 0.7% each month (8.4% per year), up to 42% at age 70.

What happens if you take CPP at 65?

Doing so means a 36% permanent reduction in your monthly benefit, but that’s still money in your pocket today. The maximum payment amount for taking CPP at age 65 is $17,196 per year (2025). That amount would be reduced to $11,005.44 per year if you elect to take CPP at 60.

What are the pros and cons of claiming CPP at 60?

Here’s a breakdown of the pros and cons of claiming CPP at age 60. Starting CPP at 60 provides you with immediate income, which can be beneficial if you retire early or need extra funds. This can help cover living expenses or allow you to enjoy your retirement earlier.