Youve fallen behind on a loan payment—far behind. After a certain period of non-repayment, your debt is considered a charge-off, or a debt that your creditor assumes you wont pay. Although youre still legally liable for this debt, your original creditor may turn it over to a collection agency to recover it.

Dealing with charged off accounts can be confusing. You may be wondering if you should pay a closed charged off account and how it will impact your credit. This article will explain what a charged off account is, whether you are still liable for the debt, how paying it off affects your credit, and steps for handling these accounts properly.

What is a Charged Off Account?

A charged off account is one where the original creditor (bank, credit card company, etc.) has written the debt off as a loss, usually after 180 days of non-payment. This means they no longer expect to collect the money owed.

However, even though the creditor has charged off the account, you are still legally obligated to pay the debt. The creditor can sell or assign the debt to a collection agency to pursue payment

Once an account is charged off, it will show as a negative item on your credit report for up to 7 years. This can seriously damage your credit score.

Should You Pay a Closed Charged Off Account?

Whether you should pay a closed charged off account depends on your goals

-

If you need to rebuild your credit, paying can help since it eliminates the outstanding debt.

-

However, paying a charged off debt will not remove it from your credit report. It will simply update to show as “paid” or “settled.”

-

If the account is still with the original creditor, paying them directly can help. But if it has been assigned to collections, you would need to pay the collection agency.

-

Be cautious about making partial payments, as this can “re-age” the debt and restart the statute of limitations period in some states.

-

If the statute of limitations has expired, paying a charged off account may not be necessary, depending on your situation The debt is technically no longer legally enforceable

So weigh your options carefully and consider consulting a credit expert if you are unsure. Paying off charged off debt is not always the best move.

How Paying Off Charged Off Debt Affects Your Credit

Unfortunately, paying a charged off account does not automatically improve your credit. Here are some key points on how it impacts your credit reports and scores:

-

The negative status will remain for 7 years from the first delinquency. Paying it simply changes the status to “paid” or “settled charge off.”

-

Your payment history is not updated. The history of missed payments leading to the charge off will still show.

-

It can help your credit utilization ratio, since the balance is eliminated. This ratio compares debt to available credit.

-

** Shows creditors you are taking responsibility.** Although the charge off remains, paying shows you are accountable.

-

You’ll avoid legal risks. Paying could prevent the creditor from pursuing legal action if the debt is still within the statute of limitations.

Tips for Handling Closed Charged Off Accounts

If you decide to pay a closed charged off account, either to rebuild credit or avoid potential legal issues, here are some tips:

-

Get promises in writing. Before paying, get confirmation the payment will be marked “paid” on your credit report. Get this in writing.

-

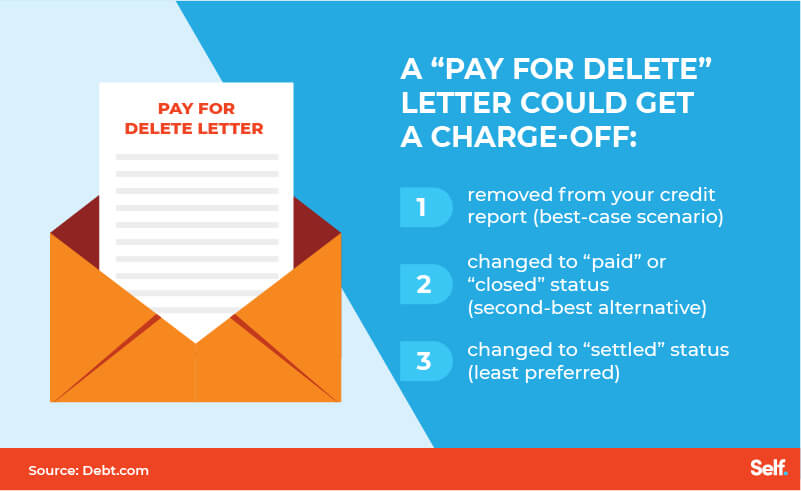

Negotiate pay-for-delete. Ask the creditor or collection agency to remove the charge off in exchange for payment. This is challenging but possible.

-

Pay in full if you can. Settling for less than the full amount rarely results in deletion. Paying the balance often has better results.

-

Dispute first if it’s inaccurate. Don’t pay inaccurate information. Dispute it first. Only pay once errors have been corrected.

-

Watch the statute of limitations. Avoid restarting the clock by making partial payments. Know the deadlines.

-

Consult a credit expert. If unsure how to approach a charged off account, talk to a credit counselor or consumer lawyer.

-

Weigh your options. Don’t just automatically pay closed accounts in collections. Make strategic decisions based on your needs and situation.

With the right approach, paying off a closed charged off account can help rebuild your credit or protect you from lawsuits over unpaid debt. Consider your specific circumstances carefully. The impact it will have depends on other factors in your credit history.

Other Steps to Rebuild Your Credit

Along with strategically handling charged off accounts, there are other ways to rebuild your credit over time:

-

Keep accounts current going forward and aim for on-time payments. Your payment history makes up a significant portion of your credit score.

-

Keep credit card balances low. High utilization hurts your credit, while low balances help.

-

Limit new credit applications. Too many hard inquiries and new accounts can worsen your scores, especially if you already have troubled credit. Wait 6-12 months between applications.

-

Mix different types of credit once your reports improve. Having installment loans, credit cards, and other types can help.

-

Consider secured cards initially to establish positive payment activity. After a year or so, you may qualify for an unsecured card.

-

Let negative items fall off your reports. Most negative marks stay on your credit report for 7 years max. As this information disappears, your scores will gradually improve.

-

Monitor your credit reports and dispute any errors with the bureaus. Mistakes on your reports could unfairly lower your scores.

It takes persistence and patience, but with a strategic approach, you can rebuild your credit over time even after experiencing issues like charge offs.

Summary: Key Points on Closed Charged Off Accounts

-

A charged off account means the creditor has written off the debt as a loss but you still owe it.

-

Whether to pay a closed charged off account depends on your credit goals and if the statute of limitations has expired.

-

Paying a charged off debt won’t remove it from your credit report, but can show you are taking responsibility.

-

Negotiating pay-for-delete or getting the creditor to mark it “paid” are better options than just paying a collection agency.

-

Along with handling charge offs properly, focus on improving payment history, lowering credit utilization, and letting old mistakes fade from your reports.

-

With a strategic approach, you can take control of your credit situation even after experiencing setbacks like charged off accounts.

Managing charge offs and credit disputes can be complex. If unsure, seek assistance from a credit counseling agency or consumer law attorney to understand your options. But with perseverance and smart strategies, you can recover from credit stumbles over time.

What Happens With Charged-Off Debt?

The statute of limitations is the amount of time that a debt can be collected through the legal court system. Once the statute of limitations has passed, the debt is deemed too old to be collected. In this case, the borrower cannot be brought to court for the unpaid debt.

In fact, the debtor can countersue the collections agency that took them to court over a time-barred debt. A debtor can also sue if an agency attempting to collect on an old debt is asked not to contact the consumer again and does so anyway. Such actions are in violation of the Fair Debt Collection Practices Act (FDCPA).

On the other hand, the removal of a charge-off status from a consumer’s credit report doesnt mean the statute of limitations has passed. If, after seven years, the charge-off is deleted from the report, the statute of limitations may still be in effect. In this case, the consumer can still be taken to court for a judgment on their unpaid debt. Each state has its own statute of limitations on debt, which, depending on the type of debt, could be as low as three years or as high as 15 years.

Note that just because a debt has passed the statute of limitations on its payment doesnt mean that the consumer no longer owes. It just means that the creditor or debt collector will not be able to get a judgment in court for the payment of the old debt.

Creditors refer to uncollectible debt as bad debt. When a firm incurs a bad debt, it writes off the uncollectible amount as an expense on the income statement. For a debt to qualify as a business bad debt, it must be incurred as part of normal business operations. The debt can be associated with another business or an individual. Bad debt charge-offs are more likely to occur when associated with unsecured forms of credit, such as credit card debts or signature loans.

How Do I Remove Charge-Offs From My Credit Report?

You can try to remove a charge-off from your credit report by paying off the debt, negotiating a pay-for-delete agreement with the lender, or hiring a credit repair company. However, in most cases when you pay off a charge-off debt, the status of the debt will be changed to “charge-off paid.” A charge-off on your credit report can be a negative sign to other lenders, which can hinder your ability to get future loans.

What does Charge Off mean on my Credit Report? Does Charged Off mean I don’t have to pay?

FAQ

Is it worth paying off closed accounts?

Ultimately if it’s the only way to stop you from spending so much, then in the long term it’s probably your best option. But in the short term it’s gonna hurt your credit score. Especially closing so many at once and reducing your chase line of credit.

Should I pay off a charged off account?

Should you pay off a credit card that has been closed?

Regardless of why your account was closed, you’ll need to pay any balance you owe. Understanding the proper steps to pay off a closed credit card account is crucial for maintaining your financial health and credit score. Here’s our guide to how to pay a closed credit card account.

Should I pay a debt that has been written off?

When creditors write off debt, they generally sell it to collection agencies that will then pursue payment. By paying the debt — either in full or through negotiation — you can eliminate further collection calls, letters and potential legal action.

Should you pay off a closed or charged off account?

Paying off closed or charged off accounts can have some potential benefits, despite the fact that they may not be removed from your credit report immediately. Here are a few reasons why it can still be advantageous: Improved credit utilization ratio: When you pay off a debt, your overall credit utilization ratio decreases.

Will paying a closed or charged off account improve my credit score?

Paying a closed or charged off account will not typically result in immediate improvement to your credit scores, but can help improve your scores over time. If the creditor has not sold or transferred the debt to a collection agency, the charged off account still will report the balance owed.

What happens if a credit card account is charged off?

When an account is charged off, the creditor writes it off as a financial loss. The account is closed and the debt may be sold to a debt buyer or transferred to a collection agency. Having a charge-off on a credit report doesn’t erase the debt, though. If you have an account charged off as bad debt, you’re still legally responsible for paying it.

Should I pay or settle a charged-off account?

It depends on your financial goals. If you want to improve your credit score or plan to apply for a loan soon, paying or settling a charged-off account may help. But you must be strategic: Request a pay-for-delete agreement, where the creditor or collection agency removes the account from your credit report in exchange for payment.

When should I pay a charge-off on my credit report?

The charge-off date should be the date of your first delinquent payment on the original account. If after investigating you find that the charge-off on your reports is legitimate, it’s important to take action and pay it off. It may be tempting to not pay a charge-off, since your lender has likely stopped trying to collect on the account.

Should you pay off a credit card charge-off?

The charge-off date should be the same as the date of your first delinquent payment on the original one. If you find the charge-off is inaccurate, don’t pay it. You can file a dispute or work with a credit repair company to solve this issue. If, however, the charge-off is legitimate, consider paying it off. Debt settlement is a viable option.