Turning 70 is a major milestone, and for many, it brings a clearer focus on preserving income, simplifying finances and making sure retirement savings last, especially in todays unusual economic landscape. With traditional pensions becoming less common, stock market volatility at the forefront of many retirees minds, and inflation ticking back up, the idea of locking in a guaranteed income stream becomes increasingly more appealing.

An annuity can offer that, which is why these unique insurance products have become a useful tool for creating predictable retirement income. With an annuity, retirees can get reliable monthly payments for the entirety of their lives in return for a lump sum payment. That allows retirees to supplement their Social Security income, retirement savings and returns from other investments without having to return to work or put their retirement benefits at risk.

In turn, an annuity can be a smart addition to the right retirement portfolio. But is purchasing one at age 70 really the right move? Thats what well examine below.

Turning 70 is a major milestone in your retirement journey. Traditional pensions are getting harder to find, market volatility is keeping you up at night, and inflation worries are on the horizon. You may be wondering if an annuity makes sense at this point in your life. I’ve helped a lot of seniors make this choice, and there isn’t a single right answer.

You’re in a great place for some types of annuities at age 70. The insurance company will pay you more each month than they would have at age 65, and you can make sure you have money when you need it most. But is it right for YOU? Let’s talk about it.

What Exactly Happens When You Buy an Annuity at 70?

When you purchase an annuity at age 70, you’re essentially making a deal with an insurance company you give them a lump sum of money and they promise to pay you a regular income for the rest of your life. It’s like creating your own personal pension.

When you buy an annuity, your monthly payments will be more if you are older. This is because the insurance company thinks they will have to pay out less money over a shorter period of time than with a younger person.

For instance, a man aged 70 who invests $100,000 in an immediate annuity might get between $675 and $708 a month, while a woman of the same age would get between $642 and $675 a month (women usually get a little less because they live longer).

The Pros of Buying an Annuity at Age 70

1. Guaranteed Lifetime Income

The biggest benefit is knowing you’ll receive regular payments that can’t be outlived. This eliminates what financial planners call “longevity risk” – the fear of running out of money in your later years.

2. Higher Payout Rates

At 70, you’ll get significantly higher monthly payments than someone who purchases the same annuity at 65. This is one of the key advantages of waiting until your 70s.

3. Protection From Market Volatility

With fixed or fixed indexed annuities, your principal is protected from stock market downturns. This can be particularly valuable when you have less time to recover from market losses.

4. Simplicity and Peace of Mind

Annuities automate your retirement income, creating a “retirement paycheck” that arrives regularly without you having to manage investments or worry about market fluctuations.

5. Tax-Deferred Growth

Though less beneficial than when purchased earlier, annuities still offer tax-deferred growth until you start receiving payments.

The Cons of Buying an Annuity at Age 70

1. Limited Liquidity

Once you annuitize (convert your lump sum to lifetime payments), you typically can’t access your principal beyond the regular payments. This could be problematic if you face unexpected expenses.

2. Potentially High Fees

Depending on the type, annuities can come with significant fees that eat into your returns. Variable annuities typically have the highest fees, while immediate annuities have fewer fees built into the product.

3. Inflation Concerns

Unless you purchase an annuity with inflation protection (which lowers your initial payments), your fixed payments may lose purchasing power over time.

4. Impact on Legacy Plans

Money used to purchase an annuity might reduce what you can leave to heirs, although certain riders and options can address this concern.

Real Numbers: What Payouts Can You Expect at 70?

Let’s look at some concrete examples of monthly payouts for a 70-year-old based on different annuity amounts:

For a 70-Year-Old Male:

| Annuity Value | Single Life Only | With 10-Year Certain | With Cash Refund |

|---|---|---|---|

| $100,000 | $708 | $702 | $674 |

| $250,000 | $1,775 | $1,755 | $1,685 |

| $500,000 | $3,553 | $3,510 | $3,370 |

| $1 million | $7,111 | $7,021 | $6,741 |

For a 70-Year-Old Female:

| Annuity Value | Single Life Only | With 10-Year Certain | With Cash Refund |

|---|---|---|---|

| $100,000 | $675 | $663 | $642 |

| $250,000 | $1,693 | $1,658 | $1,605 |

| $500,000 | $3,389 | $3,315 | $3,210 |

| $1 million | $6,780 | $6,631 | $6,421 |

(Note: These figures are based on March 2025 rates and can vary based on interest rates and provider)

What Types of Annuities Make Sense at Age 70?

Not all annuities are created equal, especially for someone in their 70s. Here are the most appropriate options:

1. Immediate Annuities

These begin paying out right away and are perfect if you need income now. At 70, this is often the most sensible choice because you can immediately start receiving higher payments based on your age.

2. Fixed Indexed Annuities

These offer protection from market losses while providing growth potential linked to market indexes. They can be a good option if you want some growth but can’t risk losses.

3. Qualified Longevity Annuity Contracts (QLACs)

A QLAC allows you to defer Required Minimum Distributions (RMDs) on up to $200,000 of retirement funds until age 85. This can be valuable for tax planning.

4. Long-Term Care Annuities

These specialized annuities provide enhanced benefits if you need long-term care but still function as regular income annuities if you don’t. It’s a way to address care concerns without “use it or lose it” worries.

Should You Wait Until 75 to Buy an Annuity?

There’s a common question about whether waiting until 75 would yield better results. While it’s true that monthly payments increase with age, waiting means:

- You miss out on five years of guaranteed payments

- You have five more years of market risk

- You might face health issues that could affect qualification

The “sweet spot” for immediate annuities is generally considered to be between 70-75. If you’re healthy and have adequate income from other sources, waiting could yield higher payments. But if you need the income now or worry about market volatility, buying at 70 makes more sense.

Who Should Definitely Consider an Annuity at 70?

An annuity at age 70 might be perfect for you if:

- You don’t have a traditional pension

- You’re concerned about outliving your savings

- Longevity runs in your family

- You want to simplify your finances

- You’re seeking protection from market volatility

- Current CD and savings rates don’t provide enough income

- You want a portion of your retirement funds to generate guaranteed income

Who Should Probably Skip the Annuity at 70?

An annuity might not be right for you if:

- You have serious health issues or a short life expectancy

- You already have sufficient guaranteed income from pensions and Social Security

- You need full access to your funds for potential emergencies

- You’re primarily focused on maximizing inheritance for heirs

- You’re comfortable managing investments and can tolerate market fluctuations

A Balanced Approach: The Partial Annuity Strategy

Many financial advisors recommend a balanced approach where only a portion of your retirement savings goes into an annuity. This creates a financial foundation of guaranteed income while maintaining liquidity and growth potential with your remaining assets.

For example, you might:

- Calculate your essential expenses (housing, food, healthcare, utilities)

- Determine how much of these are covered by Social Security and any pensions

- Use an annuity to cover the remaining essential expenses

- Keep other assets invested for growth, discretionary spending, and legacy planning

Alternative Options to Consider

Before committing to an annuity, consider these alternatives:

- Certificates of Deposit (CDs): Currently offering competitive rates with more liquidity

- Bond Ladders: Creating your own stream of income with individual bonds

- Treasury Securities: Government-backed securities with various term lengths

- Dividend-Focused Portfolios: Stocks or funds that generate regular income

Final Thoughts: Getting the Best Deal

If you do decide an annuity makes sense at 70, here are some tips:

- Shop around: Rates can vary significantly between providers

- Consider splitting your purchase: Buy annuities from multiple insurance companies to reduce risk

- Look for companies with high financial strength ratings: A.M. Best, Moody’s, and Standard & Poor’s ratings matter

- Understand all fees and terms: Ask detailed questions about any costs or restrictions

- Consider working with a fiduciary advisor: They’re legally obligated to put your interests first

The decision to buy an annuity at 70 is significant and personal. It depends on your health, other income sources, legacy goals, and comfort with financial complexity. While annuities can provide valuable peace of mind through guaranteed income, they’re not the right solution for everyone.

I always tell my clients that retirement security usually comes from diversification – not just among investments, but among income sources too. An annuity might be one piece of your retirement puzzle, but it’s rarely the complete picture.

What’s your biggest concern about retirement income? Have you considered other strategies to create reliable income streams? The right approach is the one that helps you sleep well at night knowing your financial future is secure.

Should a 70-year-old buy an annuity?

At age 70, the decision to purchase an annuity comes down to a range of factors, including your goals and your financial situation. It may seem like too late to buy an annuity at this point in time, but there are some good reasons to do so and some bad reasons to too.

Why buying an annuity at age 70 could make sense

If youre seeking guaranteed income you cant outlive, an annuity offers just that. The older you are when you buy an immediate or deferred income annuity, the larger your monthly payments tend to be. Thats because annuities are essentially bets against the insurance company. If you live longer than their actuarial tables predict, you come out ahead. And, since insurers are factoring in fewer years of life expectancy when you buy at age 70, they pay more over a shorter period.

It’s possible for someone 70 years old who invests $100,000 in an immediate annuity today to get much higher monthly payments than someone 65 years old who did the same thing today. A healthy 70-year-old woman could expect to live into her late 80s or even later. This means that not only would their payments be higher, but she could also get annuity payments for 15 to 20 years.

So, you might be an ideal candidate at age 70 if youre in excellent health and longevity runs in your family. And, this could be an ideal time to purchase one since interest rates are still relatively high right now. That means fixed annuities, in particular, are offering stronger returns than they were just a few years ago. These market conditions can make it a more attractive time to lock in a payout rate.

Planning for Retirement: Can You Buy an Annuity at Any Age?

FAQ

At what age should you not buy an annuity?

Annuities come with various costs, including administrative fees and surrender charges. These costs are worse for adults over 80 because they don’t have as much time for their guaranteed income to cover them. Experts say annuities may not make sense in these scenarios: You have your basic needs covered.

Should you buy an annuity at age 70?

People aged 60 to 75 are often told to get immediate annuities, like single premium immediate annuities (SPIAs), because they pay out the most during August 12, 2025.

How much will a $100,000 annuity pay monthly if bought at age 70?

According to an analysis of Cannex data by Annuity. org, a 70-year-old man who buys a $100,000 immediate fixed annuity could get about $729 a month for the rest of his life. A 70-year-old woman, meanwhile, might receive around $689 per month.

What is the best annuity rate for a 70-year-old?

Improving rates with age

However, annuity rates tend to increase with age, meaning those who choose to buy an annuity later in retirement are likely to benefit from better rates. As of May 2025, rates for a healthy 60-year-old were 7.01% compared to 8.54% for a healthy 70-year-old.

Should I buy an annuity at 70?

The decision to buy an annuity at 70 is complex and hinges on an individual’s unique financial situation and retirement goals. Consider talking with a financial advisor when making any major decisions about your retirement, like buying an annuity. The key advantage of purchasing an annuity at 70 is the guarantee of a steady income stream.

What is the best age to buy an annuity?

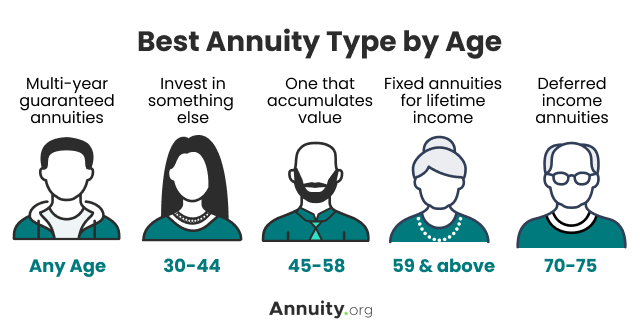

Annuities can provide people with a guaranteed stream of income when they need it most. While some financial advisors suggest that the best age to begin taking payments from an annuity is between 70 and 75, you don’t have to wait until then to buy it. You can purchase one from age 18 on up to your retirement years. 1

When is the best time to buy an annuity?

While some start at 60 years old, the choice depends on the annuity type and when you want payments to begin. The best time to buy an annuity ultimately depends on your financial goals. The type of annuity you’re interested in and how soon you want your payments to start are also important factors to consider based on your age.

Is a 75 year old annuity worth it?

The age 75 rule is a general observation that annuities often offer higher monthly payouts when purchased at age 75. Since a 75-year-old has a shorter life expectancy than a 70-year-old, the monthly payments are higher. Someone considering an annuity at 70 might wonder if waiting five more years is worth the potential increase.

How old do you have to be to get an annuity?

You typically can wait until you’re 95 years old before you must annuitize your contract. Plus, the IRS sets its own age restriction by levying a 10% penalty on people who withdraw from an annuity before age 59 ½. At what age does an annuity make sense?

Should you buy an annuity before retirement?

Annuities can be part of the retirement income plan you develop before retirement. With a deferred annuity, the earlier you buy and the younger you are, the more time your premiums can benefit from tax-deferred growth.