One of the most popular ways to help someone get onto the property ladder is a gifted deposit.

Getting your foot on that all-important first rung is hard, so many first-time buyers turn to the Bank of Mum and Dad for help. The thing is, gifting a deposit isn’t a straightforward process. One would think you simply need to transfer the money across to the giftee’s account, but that isn’t the case.

There’s a lot more to gifted deposits, and we’re going to explore all the frequently asked questions in today’s post.

Putting together a down payment for a home can be challenging, especially for first-time homebuyers. To help with the costs, many rely on monetary gifts from family or friends. But the IRS has rules about gifting money, so it’s important to understand if there are limits on gifted deposits when using them for a home down payment.

What is a Gifted Deposit?

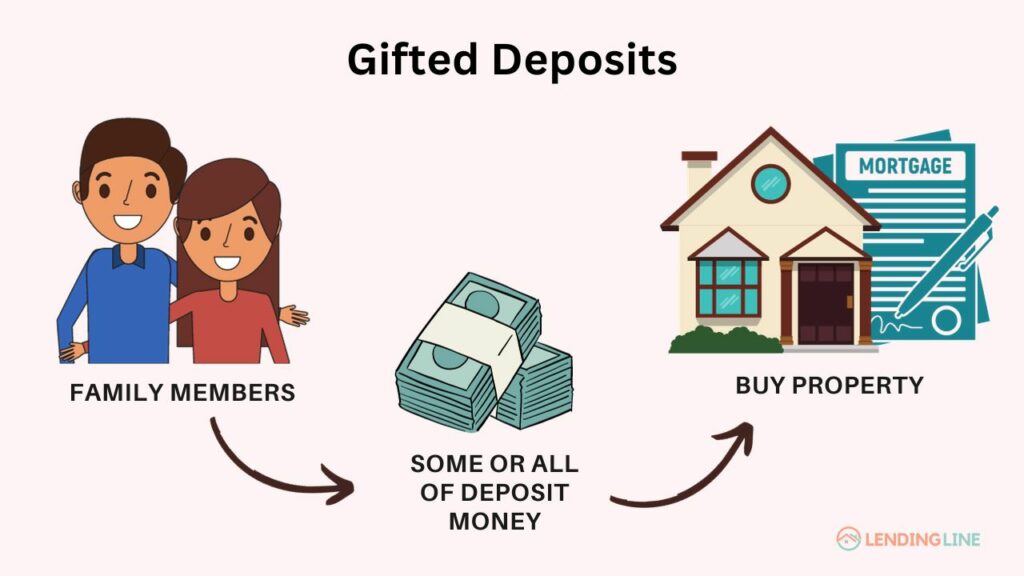

A gifted deposit refers to money given by a friend or relative to use specifically as part or all of a down payment on a home This can be an extremely helpful way for first-time homebuyers to come up with enough cash to qualify for a mortgage

Gifted deposits can come from parents, grandparents siblings aunts/uncles, or even close friends. The money belongs to the gift giver, but they provide it as an outright gift to the homebuyer to put towards the down payment on their new home.

IRS Gift Tax Rules and Exclusions

The IRS considers any gift over a certain amount to be taxable income However, most gifted deposits for home down payments fall under the annual federal gift tax exclusion

Here are some key gift tax rules to understand:

-

The annual federal gift tax exclusion for 2025 is $19,000 per individual giver. This means each person can gift up to $19,000 without being subject to the gift tax.

-

Gifts under the annual exclusion amount are not subject to the gift tax or required to be reported to the IRS.

-

The annual exclusion applies on a per-person basis. An individual can make multiple tax-free gifts up to $19,000 each. For example, giving $19,000 each to four children would be $76,000 total gifted tax-free.

-

Spouses can combine their annual exclusions to give $38,000 tax-free per recipient. For example, a married couple could gift their married child $38,000 using each spouse’s exclusion.

-

In addition to the annual exclusion, there is a lifetime gift and estate tax exemption that is over $12 million per individual in 2025. Very few exceed this limit over their lifetime.

-

Gift amounts over the annual exclusion count towards the lifetime exemption but no tax is due until the exemption is exceeded.

Are There Limits on Gifted Deposits for Down Payments?

When used specifically as a down payment gift, there are no special IRS limits or rules on gifted deposits beyond the standard gift tax exclusions. As long as the gifted amounts fall under the $19,000 annual exclusion thresholds, they can be used freely as part or all of a home buyer’s down payment.

Because down payments on a home are typically under $100,000, gifted deposits for this purpose usually do not have any tax implications. For example, parents could gift a married couple $76,000 tax-free by using each parent’s $19,000 annual exclusion. This would cover a 20% down payment on a $380,000 home.

Even larger down payments can be covered tax-free by combining gifts from both sets of parents, grandparents, siblings, etc. Technically, there is no limit as long as each individual giver keeps their gift under $19,000 annually per recipient.

Mortgage Rules on Gifted Deposits

While the IRS does not limit gifted down payments, mortgage lenders often have their own rules about these funds. Key mortgage requirements to understand include:

-

Documentation of gift funds – Lenders require a paper trail like a withdrawal receipt, cancelled check, or gift letter.

-

Minimum borrower contribution – Many lenders want the borrower to contribute a minimum of 3-5% from their own funds, even if receiving a gift.

-

Gift funds only – Cash gifts must be used for the down payment or closing costs, not for financial reserves after closing.

-

No repayment expected – A letter will confirm the funds are an outright gift with no expectation of being repaid.

As long as you have proper documentation, gifted deposits can be an excellent source of down payment funds for hopeful homebuyers. Just be sure to comply with IRS rules so they are tax-free to the recipient.

Key Takeaways on Gifted Deposits

-

Gifted deposits from family or friends are a popular way to fund part or all of a home down payment.

-

Individual cash gifts up to $19,000 annually are exempt from federal gift taxes.

-

There is no limit on total gifted deposits as long as each person keeps their gift under the annual exclusion amount.

-

Mortgage lenders have additional rules, but will accept properly documented gift funds.

-

Talk to family and friends, a lender, and tax advisor to ensure you understand all the requirements when using gifted deposits.

Is there a limit on how much deposit can be gifted?

Unless your lender has stipulated otherwise, there is no upper limit to how much a gifted deposit can be.

With homes throughout Central & East London, you’ll find your perfect property with Petty’s

- Home

- ›

- About

- ›

- Our Blog

- ›

- What Counts As A Gifted Deposit? Gifting Money Rules

One of the most popular ways to help someone get onto the property ladder is a gifted deposit.

Getting your foot on that all-important first rung is hard, so many first-time buyers turn to the Bank of Mum and Dad for help. The thing is, gifting a deposit isn’t a straightforward process. One would think you simply need to transfer the money across to the giftee’s account, but that isn’t the case.

There’s a lot more to gifted deposits, and we’re going to explore all the frequently asked questions in today’s post.

Gifted Deposit Mortgage | How Does A Gifted Deposit Work?

FAQ

How much can you gift someone for a deposit?

Is there a limit on how much deposit can be gifted? Unless your lender has stipulated otherwise, there is no upper limit to how much a gifted deposit can be.

How much money can be gifted for a down payment?

What are the problems with gifted deposits?

The first being, as mentioned above, the capital could be subject to inheritance tax if the donor dies within 7 years of them gifting the money. The next is that if the donor falls into financial difficulty, they may want you to pay them back, which could lead to a falling out.

How much cash can you deposit as a gift?

It’s important to know the IRS requirements regarding cash gifts and income. Key Takeaways: Cash gifts and income are subject to IRS reporting rules. Gifts of up to $19,000 in cash are exempt from reporting in 2025.