Can you save for the future and get a tax break? TFSAs and RRSPs both offer tax advantages that can help you achieve your saving and investing goals. Which one is best for you? It’s not always clear-cut how to protect your income, but you can use both a TFSA and an RRSP as part of your savings plan. But – if you must choose one over the other, its important to understand how they differ. Here are some important considerations to help you decide which option is right for you.

What’s the Big Deal: TFSA vs. RRSP?

Let me guess – you’re trying to figure out whether to put your hard-earned cash into a TFSA or RRSP? Join the club! As a Canadian navigating the financial landscape, I’ve struggled with this exact question. The truth is, there’s no one-size-fits-all answer, but I’m gonna break it down for you in plain language so you can make the best choice for YOUR situation.

Both TFSAs and RRSPs offer fantastic tax advantages for Canadians, but they work differently and might be better suited to different financial goals and income levels. Let’s dive in!

The Basics: What Are These Account Thingies Anyway?

TFSA (Tax-Free Savings Account)

Despite the name (which is honestly misleading), a TFSA isn’t just a savings account—it’s an investment basket where you can hold various investments like stocks, ETFs, bonds, and yes, actual savings.

- Contribution Limit: $7,000 for 2025

- Tax Benefits: Contributions are made with after-tax money, but all growth and withdrawals are completely TAX-FREE!

- Flexibility: Withdraw anytime without penalty, and you get that contribution room back the following year

- No Age Limit: Use it as long as you live, no forced withdrawals

RRSP (Registered Retirement Savings Plan)

RRSPs are designed with retirement in mind, and they offer big tax breaks that don’t work the same way as TFSAs.

- Contribution Limit: 18% of your previous year’s earned income or $32,490 for 2025 (whichever is lower)

- Tax Benefits: Contributions are tax-deductible NOW, but withdrawals are taxed as income in the future

- Restrictions: Withdrawals are generally taxable unless used for specific programs like the Home Buyers’ Plan

- Age Limit: Must be converted to a RRIF by the end of the year you turn 71

So, Is TFSA Better Than RRSP? It Depends On…

Your Income Level

This is HUGE! The account that gives you the best tax break will depend on your current income and expected future income.

For Lower Incomes (Under $50000) A TFSA often makes more sense because

- Your tax rate is already low, so the RRSP tax deduction isn’t as valuable

- You might actually pay MORE tax in retirement if you use an RRSP (if your retirement income puts you in a higher tax bracket than you’re in now)

- TFSA contribution room isn’t tied to income—everyone gets the same amount

For Higher Incomes (Over $50,000):

An RRSP might be more advantageous because:

- You’re likely in a higher tax bracket, making the immediate tax deduction more valuable

- You’ll probably be in a lower tax bracket in retirement, so you’ll pay less tax when withdrawing

- The tax refund you get can be reinvested in a TFSA for even more tax benefits!

Your Short vs. Long-Term Goals

Choose TFSA if

- You need flexibility to access your money

- You’re saving for medium-term goals (house down payment, wedding, etc.)

- You don’t want to be forced to withdraw at a certain age

Choose RRSP if:

- You’re specifically saving for retirement

- You want to lower your current taxable income

- You’re disciplined enough not to touch the money (since there are tax penalties for early withdrawals)

Real-Life Scenarios: Who Should Choose What?

Scenario 1: Young Professional with Growing Career

Meet Samantha, a 28-year-old marketing associate making $55,000 with expectations of earning more in the future.

What works for her? A mix of both, but with emphasis on RRSP contributions. Here’s why:

- She’s already in a decent tax bracket where RRSP contributions provide good tax savings

- Her career trajectory suggests she’ll have even higher income later, so locking in tax deductions now makes sense

- She can use the Home Buyers’ Plan to withdraw up to $60,000 from her RRSP for her first home purchase

Scenario 2: Gig Worker with Variable Income

Meet John, a 35-year-old freelancer making between $30,000-$45,000 annually with unpredictable income patterns.

What works for him? Prioritizing TFSA contributions. Here’s why:

- His income fluctuates, making the flexibility of TFSA withdrawals valuable during lean months

- He’s not consistently in a high tax bracket, so RRSP benefits are less significant

- He might need access to his savings on short notice for business expenses

Scenario 3: High-Income Professional with Pension

Meet Albert, a 45-year-old engineer earning $120,000 annually who also has a company pension.

What works for him? Maxing out RRSP first, then TFSA. Here’s why:

- His high income means substantial tax savings from RRSP contributions

- He expects lower retirement income, so withdrawing from RRSP in retirement will likely be at a lower tax rate

- With a pension plus RRSP, he might face OAS clawbacks in retirement, making TFSA withdrawals (which don’t count as income) valuable

The Impact of Withdrawals – This Is Important!

Here’s where things get real interesting and why your long-term plan matters:

TFSA Withdrawals:

- 100% tax-free (no impact on your taxable income)

- Don’t affect government benefits like OAS or GIS

- Contribution room is restored the following year

- No penalty for taking money out whenever you want

RRSP Withdrawals:

- Taxed as regular income (could push you into a higher tax bracket)

- May reduce government benefits like OAS or GIS if your income is too high

- Contribution room is PERMANENTLY LOST (except for HBP and LLP programs)

- Withholding tax applied on withdrawal (10-30% depending on amount)

Smart Strategies for Using Both

In an ideal world, you’d contribute to both accounts. Here’s how to be strategic:

-

Don’t waste your RRSP tax refund. If you put money into an RRSP and then get a tax refund, put that money into your TFSA. This is like double-dipping on tax benefits!.

-

Consider your age – Younger investors might prioritize TFSAs because they have more time for tax-free growth and might need flexibility. As your income grows, shift more toward RRSPs.

-

Think about your foreign investments – For U.S. stocks, an RRSP might be better because the U.S. doesn’t recognize TFSAs as retirement accounts, and you may face withholding taxes on dividends in a TFSA.

-

If you and your partner make very different amounts of money, the person with the higher income can put money into a spousal RRSP to help even out your retirement income and maybe even lower your overall tax burden.

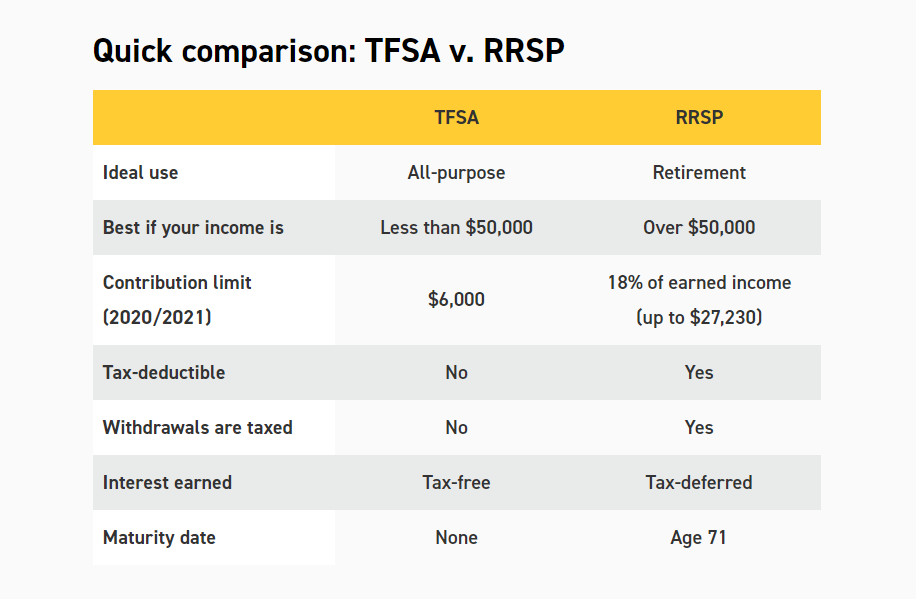

A Handy Comparison Table

| Feature | TFSA | RRSP |

|---|---|---|

| 2025 Contribution Limit | $7,000 flat | 18% of 2024 income or $32,490 (whichever is less) |

| Tax on Contributions | After-tax dollars (no deduction) | Tax-deductible (immediate tax break) |

| Tax on Withdrawals | Tax-free | Taxed as regular income |

| Flexibility | Withdraw anytime, no penalty | Withdrawals taxed except for HBP and LLP |

| Effect on Gov’t Benefits | No impact | Can reduce benefits like OAS/GIS |

| Best for | Lower income earners, flexible goals | Higher income earners, retirement focus |

| Age Limits | None | Must convert to RRIF by end of year you turn 71 |

My Personal Take

Honestly? I use both, but I lean toward maxing out my TFSA first because I love the flexibility. Nothing beats knowing I can pull money out tax-free if I need it, and I won’t lose that contribution room forever. But I’m not you – your situation is unique!

If you’re earning good money right now and expect to have a lower income in retirement, the RRSP probably gives you more bang for your buck. If you’re just starting out or value flexibility, the TFSA might be your best friend.

Common Questions People Ask Me

“Can I have both a TFSA and RRSP?”

Absolutely! And if you can afford it, contributing to both is often the ideal strategy.

“What if I withdraw from my RRSP early?”

You’ll pay tax on the withdrawal at your current income tax rate, plus the financial institution will withhold some tax immediately (10-30% depending on the amount).

“I’m young – which should I start with?”

If you’re early in your career with a lower income, a TFSA often makes more sense to start. As your income grows, you can shift more toward RRSP contributions.

“Can I transfer money between TFSA and RRSP?”

You can’t directly transfer between accounts, but you can withdraw from your TFSA (tax-free) and then contribute that money to your RRSP (getting a tax deduction).

Bottom Line: Is TFSA Better Than RRSP?

The TFSA isn’t inherently “better” than the RRSP – they’re just different tools for different jobs. The right choice depends on:

- Your current income level

- Your expected future income

- When you need access to your money

- Your short and long-term financial goals

For most Canadians, a smart strategy involves using both accounts strategically throughout your life, adjusting contributions based on your changing income and goals.

Remember, the worst thing you can do is let analysis paralysis stop you from saving altogether! Even if you’re not sure which is optimal, starting with either account is WAY better than not saving at all.

What’s your situation? Are you team TFSA, team RRSP, or trying to juggle both? I’d love to hear your thoughts!

What about the Lifelong Learning Plan (LLP)?

The Lifelong Learning Plan (LLP) allows you to withdraw amounts from your RRSP to finance eligible training or education for you, your spouse or your common-law partner2. You dont have to include the withdrawn amounts in your income, and there is no withholding tax on these amounts. Withdrawals made must be repaid to the RRSP over a period of no more than 10 years, and unpaid amounts must be included in your income for the year they were due. A TFSA can also help you to save for your education, but, withdrawals are treated differently; whereas LLP withdrawals must be paid back, there is no obligation to pay back TFSA withdrawals.

Saving for a home down payment

Under the Home Buyers Plan (HBP), first-time home buyers can take up to $60,000 out of their RRSP to use toward the purchase of their first home2. You can use the money from your RRSP to help pay for your down payment if you’re saving for a new home. The amount withdrawn can be paid back into the RRSP through instalments over a 15-year period. Look at the different scenarios below. Both Samantha and John are saving for a down payment on a home, but they have different strategies.

Samantha – 28 years old, marketing associate Samantha isn’t the best when it comes to her savings strategy and tends to pull money out to fund her everyday life. She wants to save enough for a down payment on her own home, but she’s not sure if she can do it while also putting money away for retirement. Why an RRSP? An RRSP would benefit Samantha because it will allow for the withdrawal of up to $60,000 for the purchase of her first home through the Home Buyers Plan without paying tax2. She could also pay less tax while saving for a house by putting money into an RRSP. This is because the money would lower her taxable income now, when her tax rate is higher than it might be in retirement. An RRSP might also help Samantha stay committed to her goal because she wouldn’t be able to make RRSP withdrawals for other expenses without tax implications.

John – 28 years old, marketing associate John is dedicated to his savings strategy but lacks a rainy-day fund to access if he needs to. His goal is to save for a down payment on a home and, ultimately, he wants to save for retirement. Why a TFSA? John is saving for a home and retirement but also wants access to his funds, so he could benefit from having a TFSA. A TFSA allows him to make a withdrawal at any time1, for any reason, tax-free. Any amount withdrawn from a TFSA would be added back to his contribution room in future years, so he wouldn’t lose room in his TFSA.