Buying a home comes with many new financial responsibilities, including property taxes and homeowners insurance. Escrow accounts are a way for your lender to help you manage these expenses by including them in your mortgage payment.

Note: Another type of escrow account may be used during the homebuying process to hold a buyer’s earnest money deposit. That type of escrow account is not related to the one used for taxes and insurance, which will be covered in this article.

Escrow accounts are a common part of the home buying and mortgage process. But is having one actually a good idea for you? There are several pros and cons to consider when deciding whether to set up an escrow account. This article will break down what an escrow account is, how it works, and the main benefits and drawbacks of using one for your mortgage payments.

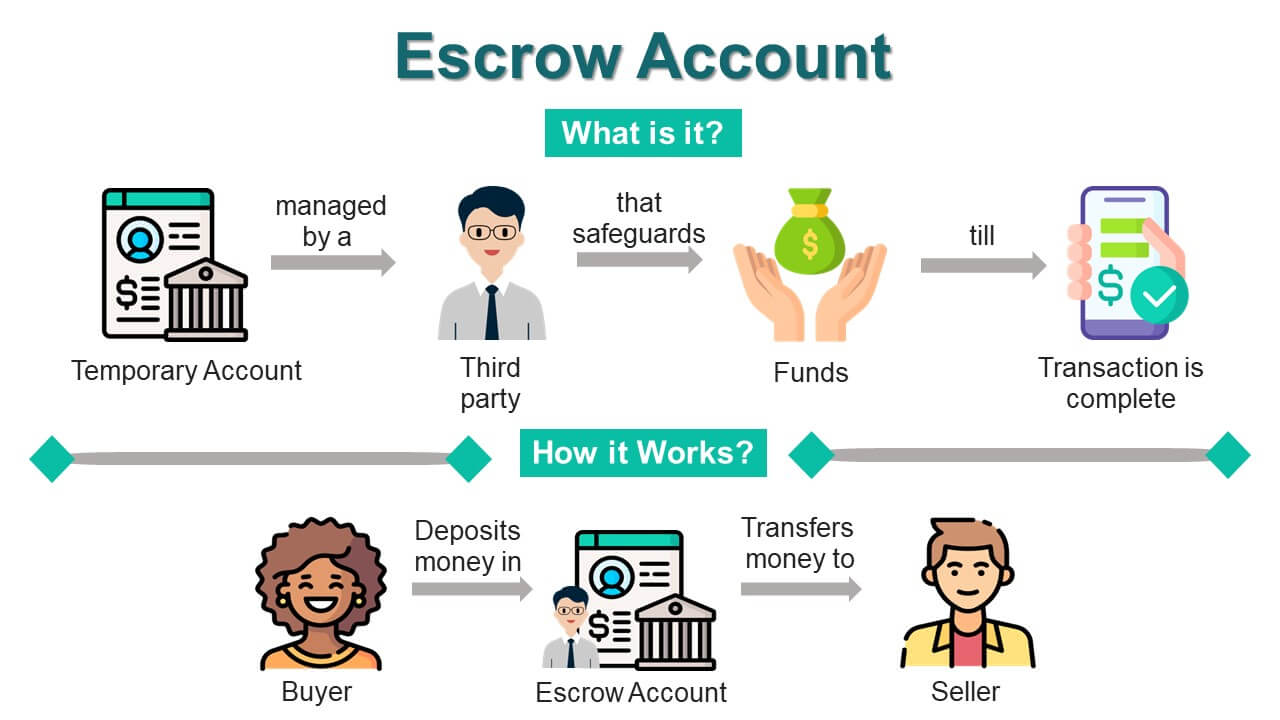

What is an Escrow Account?

An escrow account, also known as an impound account, is a special account used by lenders to pay a borrower’s property taxes, homeowner’s insurance premiums, mortgage insurance and other recurring housing expenses

Here’s how an escrow account works:

-

When you close on your mortgage loan, you will deposit a sum of money, usually equal to 2-3 months of taxes and insurance payments, into the escrow account. This is known as your escrow deposit or escrow funds.

-

Each month a portion of your total mortgage payment will go toward replenishing the escrow account. This portion is calculated to cover your yearly property taxes, insurance bills and other fees.

-

When bills come due, the lender will pay them directly from the escrow account on your behalf. This ensures these critical payments are made on time.

-

Once a year, the lender analyzes the account and adjusts your monthly escrow payment if needed. This ensures there is enough money to cover upcoming bills.

So in short, an escrow account is a convenience account used by the lender to pay your homeownership expenses automatically. You don’t have to worry about budgeting for large quarterly or annual bills

Is an Escrow Account Required?

Whether an escrow account is mandatory depends on your mortgage program and down payment amount:

-

Conventional loans often require escrow for down payments under 20%. Once you reach 20% equity, it may become optional.

-

FHA and USDA loans require escrow accounts regardless of down payment size.

-

VA loans do not require escrow accounts. They are optional.

If you’re applying for a government-backed or conventional loan with less than a 20% down payment, you can expect to have a mandatory escrow account. You usually only have a choice if you make a large down payment or qualify for a VA loan.

Now let’s look at the biggest pros and cons of opening an escrow account.

The Pros of Escrow Accounts

1. Your Bills Are Paid on Time

The #1 benefit of an escrow account is that your lender will handle paying your property taxes, insurance, and other bills on time. This protects you from penalties, late fees, and other headaches that come with missing payments.

As a new homeowner, keeping track of annual and semi-annual bills can be confusing. It’s easy to lose track and let something slip through the cracks. With an escrow account, the lender does all the work for you. They collect enough money from your monthly payment to cover your bills and pay them when due.

2. Your Monthly Payments Stay Consistent

Another nice perk is payment consistency. Instead of your mortgage jumping up and down each tax season, the fluctuating amounts are bundled into your escrow portion. This allows the overall payment to remain relatively stable.

Of course, your escrow payment can still change year to year as insurance and taxes shift. But having these variable expenses rolled in helps smooth out some of the bumps compared to paying them separately.

3. Account Shortfalls are Covered

If there is a shortfall in your escrow account, perhaps due to an unexpected tax hike, the lender will spot the difference. You don’t have to stress if the balance can’t cover an upcoming bill. The lender will make the payment anyway and adjust your monthly escrow contribution moving forward to make up for it.

This cushion provided by the lender is another way escrow accounts buy you some peace of mind. Temporary shortfalls won’t result in lapsed payments or angry tax collectors. The lender has your back.

4. May Get Better Mortgage Rates or Terms

Some lenders offer better mortgage interest rates or discounts on closing costs if you agree to open an escrow account. The account benefits them by ensuring timely payment of insurance and taxes on their collateral. In exchange, they pass on some savings to you.

So if you don’t mind having an escrow account, be sure to ask your lender if they offer any rate discounts in exchange! It could potentially save you money on your loan.

5. Integrated with Your Mortgage

Finally, integrating your escrow account with your mortgage payment can greatly simplify homeownership. You only have one payment to worry about each month instead of coordinating multiple bills and dates. It becomes a helpful “one stop shop” for your housing expenses.

The Cons of Escrow Accounts

Of course, escrow accounts also come with a few drawbacks to consider:

1. Large Upfront Deposit

When opening an escrow account, you’ll need to fund it with a lump sum deposit upfront. This deposit is usually equal to 2-3 months worth of taxes and insurance. It ensures the account has enough money from day one to start making payments on your behalf.

Coming up with this large deposit can be a challenge, especially for buyers short on cash. It adds one more big expense at closing. Just be prepared for this requirement.

2. Higher Monthly Payments

With an escrow account, your total monthly mortgage payment will be higher than just principal and interest. Now you’re also paying 1/12 of your yearly taxes, insurance, and mortgage insurance each month.

While this does help smooth out costs over the year, it does raise your base payment. Make sure you budget appropriately for the increased cash flow needed to cover a mortgage with escrow.

3. Loss of Interest

One downside is that money sitting in your escrow account isn’t earning interest like it would in your personal savings or checking account. The lender gets to hold and use those funds interest-free while they sit waiting to pay bills.

That said, today’s interest rates are very low, so you aren’t missing out on much potential earnings. But it’s something to keep in mind.

4. No Control Over Payments

Some borrowers don’t like the idea of the lender taking over payment responsibilities. You lose the ability to control when and how your insurance and taxes are paid. Some may also dislike not being able to access or invest the funds themselves.

Of course, you can still choose to make additional principal payments on your mortgage if you want to pay it down faster. But your escrowed expenses are on auto-pilot.

5. Possible Payment Issues

In rare cases, an escrow account runs into problems that could potentially lead to late fees. For example, if the lender makes a serious accounting mistake or goes bankrupt, payments could get missed or delayed. Most lenders are very reliable, but glitches can happen.

To maximize accountability, pick a reputable lender with a long history and reviews showing strong escrow servicing. This minimizes any risk of payment issues down the road.

6. Could Be a Scam Target

Unfortunately, fraudsters often target escrow accounts because they hold large sums of money. Be very cautious of any calls or emails claiming to be from your lender asking about your escrow funds or account details. Never send money without verifying the request through normal channels first.

Stick with a well-known lender and watch for warning signs of escrow scams. This will help protect your funds against theft or misuse.

Is an Escrow Account Right for You?

As you can see, escrow accounts offer some nice benefits but also come with responsibilities. Here are some final tips for deciding if one fits your situation:

-

If your lender requires an escrow account, you don’t have a choice. It will be mandatory.

-

If you struggle to save or budget for large periodic bills, an escrow can help you pay them seamlessly.

-

If you want full control over your payments, dislike lump-sum deposits, or can earn more interest on your own, try to waive escrow.

-

See if your lender offers discounted rates for opening an escrow account. That may sway your decision.

-

Make sure you have strong defenses against escrow scams and fraud.

The bottom line? Escrow accounts provide valuable convenience and payment protection services for many homeowners. But they aren’t for everyone. Look at your own finances, preferences, and risk factors to decide if the benefits outweigh the drawbacks in your unique situation.

What are the advantages of having an escrow account?

Using an escrow account to manage your taxes and insurance payments can offer important benefits.

- One mortgage payment covers multiple expenses. You don’t have to save or pay for your taxes or insurance separately because your lender does it on your behalf, which means fewer bills you need to track.

- Large expenses get broken down into smaller monthly payments. Instead of getting hit with large insurance and tax bills that may come to thousands of dollars each year, the cost is spread evenly across your monthly mortgage payments.

- Your payments stay up to date so you stay protected. Falling behind on taxes or insurance can lead to financial and legal consequences that no homeowner wants to deal with. Having an escrow account can help ensure you stay on top of these expenses with the help of your lender.

Video: The basics of escrow

JavaScript is required to play this video. Please enable JavaScript, or download the video in MP4 format.

Escrow, a small word thats a big part of buying a home. Whether youre a future homebuyer curious about escrow accounts or a homeowner managing finances, this Mortgage Tip can help.

Welcome to Mortgage Tips with Wells Fargo.

The basics of escrow.

Owning a home brings added expenses like property taxes and insurance. Thats where your escrow account comes in. Every month, you contribute to this account, and we use those funds to cover your home-related expenses when theyre due.

First, we use records from your loan closing, local property tax office, and insurance company to estimate your annual expenses. Then, we use this information to estimate your monthly escrow payment.

For example, if yearly property taxes are an estimated $3,000 and your homeowners insurance is $1,200, thats a total of $4,200. We divide that number by 12 to give a monthly escrow amount of $350, and add that to your mortgage, so you have one combined payment.

Property taxes and insurance premiums can change over time, changing your escrow accordingly. These changes can impact your monthly payment amount. We determine a minimum balance for your escrow account to provide a cushion for these fluctuations. Whatever the changes, we help keep you in the know.

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A.

© 2016-2024 Wells Fargo Bank, N.A. NMLSR ID 399801

Why You Should NEVER Use a Mortgage Escrow Account

FAQ

Is it better to have an escrow account or not?

What are the disadvantages of escrow?

Lost interest.

Most escrow accounts do not bear interest, though some states do require escrow accounts to pay at least a small interest rate. Some consumer advocates bemoan the loss of potential interest homeowners could be earning on their tax and insurance monies.

Who benefits from an escrow account?

Escrow is generally considered good because it protects the buyer and seller in a transaction. In addition, escrow as part of mortgage payments is generally good for the lender and helps the buyer by ensuring property taxes and homeowners insurance are paid on time.

Is it better to opt out of escrow?

Overall, borrowers often opt for escrow waivers to exercise more control over their personal finances. Lower closing costs: When you close on your mortgage, part of your closing costs go toward your escrow account. In the absence of an escrow account, you may lower your closing costs.