Wondering if you can still use that sneaky backdoor to get money into a Roth IRA even when you make too much? Good news – the backdoor is wide open in 2025!

There have been rumors for years that the Backdoor Roth IRA would be shut down, but it is still a legal way for high-income earners to save for retirement and get tax-free growth. Lawmakers have threatened to shut it down, but no law has actually been passed to do so.

Having helped clients plan their retirement for years, I can say that this is still one of the best ways for successful professionals to save for retirement without paying taxes on the money they earn. In 2025, let’s talk about everything you need to know about the Backdoor Roth IRA.

What Exactly Is a Backdoor Roth IRA?

First, let’s clear something up – a Backdoor Roth IRA isn’t an official account type. It’s a strategy, a workaround, a perfectly legal two-step dance that lets high earners contribute to Roth IRAs despite income restrictions.

Here’s the basic process:

- Make a non-deductible contribution to a Traditional IRA

- Convert that Traditional IRA to a Roth IRA shortly after

That’s it! Two simple steps that allow your money to end up in a Roth IRA regardless of your income level

The reason this works is because while the IRS restricts direct Roth IRA contributions based on income, there are no income limits on:

- Making non-deductible contributions to Traditional IRAs

- Converting Traditional IRAs to Roth IRAs

This opens a “backdoor” for people with a lot of money to put money into a Roth IRA.

Why Would You Want to Use a Backdoor Roth IRA?

Roth IRAs offer some amazing benefits that make them worth pursuing:

- Tax-free growth – Once money is in your Roth IRA, all future earnings grow 100% tax-free

- Tax-free withdrawals in retirement – Qualified withdrawals pay zero taxes

- No Required Minimum Distributions (RMDs) – Unlike Traditional IRAs, you’re never forced to withdraw money

- Estate planning advantages – Your heirs can inherit your Roth IRA with potential tax-free growth

What’s wrong? If you make too much money, you can’t put money directly into a Roth IRA. In 2025, the income phase-out ranges are:

| Filing Status | Phase-Out Range |

|---|---|

| Single/Head of Household | $150,000 – $165,000 |

| Married Filing Jointly | $236,000 – $246,000 |

| Married Filing Separately | $0 – $10,000 |

If your income exceeds these thresholds, you can’t contribute directly to a Roth IRA – that’s where the backdoor strategy comes in!

Backdoor Roth IRA Contribution Limits for 2025

The contribution limits for a Backdoor Roth IRA are the same as standard IRA limits:

- $7,000 for people under age 50

- $8,000 for people age 50 and older (includes $1,000 catch-up contribution)

Remember that these limits apply to the total of all your IRA contributions for the year, whether Traditional or Roth.

Step-by-Step Guide to Executing a Backdoor Roth IRA in 2025

Let’s break down exactly how to do this properly:

Step 1: Make a Non-Deductible Contribution to a Traditional IRA

- Open a Traditional IRA if you don’t already have one

- Contribute up to $7,000 (or $8,000 if 50+) of after-tax money

- Do NOT take a tax deduction for this contribution

Step 2: Convert to a Roth IRA

- Wait for the funds to settle (typically a few days)

- Request a conversion of your Traditional IRA to a Roth IRA

- This can usually be done online through your account provider

Step 3: Tax Reporting

- When you file your taxes, complete Form 8606 to report the non-deductible contribution

- This form tracks your “basis” (after-tax money) in your IRAs

- Failing to file this form could result in double taxation later!

Step 4: Invest the Funds

- Once the money is in your Roth IRA, invest it according to your retirement strategy

- Remember these funds are now growing completely tax-free

Pro tip: I usually recommend converting very quickly after contributing to minimize any potential earnings between the contribution and conversion. Why? Because any earnings that occur before conversion would be taxable.

The Pro-Rata Rule: The Backdoor Roth IRA’s Biggest Complication

Here’s where things get tricky. If you have existing pre-tax money in any Traditional, SEP, or SIMPLE IRAs, the IRS applies something called the “pro-rata rule.”

This rule means you can’t just convert your new non-deductible contribution – you have to convert a proportional mix of pre-tax and after-tax money across all your IRAs.

Let me give you an example:

Imagine you have $93,000 in a pre-existing Traditional IRA with pre-tax funds. You then make a $7,000 non-deductible contribution to a Traditional IRA. Your total IRA balance is now $100,000 with just 7% being after-tax money.

If you convert $7,000 to a Roth IRA, the pro-rata rule says that 93% of that conversion ($6,510) is taxable as ordinary income. Only 7% ($490) would be tax-free.

This can make the backdoor Roth much less attractive if you have large pre-tax IRA balances.

Possible solutions to the pro-rata problem:

- Roll your pre-tax IRA funds into an employer 401(k) if the plan allows it

- Convert all your Traditional IRA funds to Roth (but be prepared for the tax bill)

- Consider whether the tax consequences still make the strategy worthwhile

Common Backdoor Roth IRA Mistakes to Avoid

I’ve seen many people mess up this strategy over the years. Here are the mistakes to avoid:

- Forgetting to file Form 8606 – This tracks your non-deductible contributions and prevents double taxation

- Waiting too long between contribution and conversion – This can create taxable earnings

- Ignoring the pro-rata rule – This can result in unexpected taxes

- Making direct Roth contributions and backdoor contributions in the same year – This can complicate your tax situation

- Failing to consider state tax implications – Some states treat Roth conversions differently

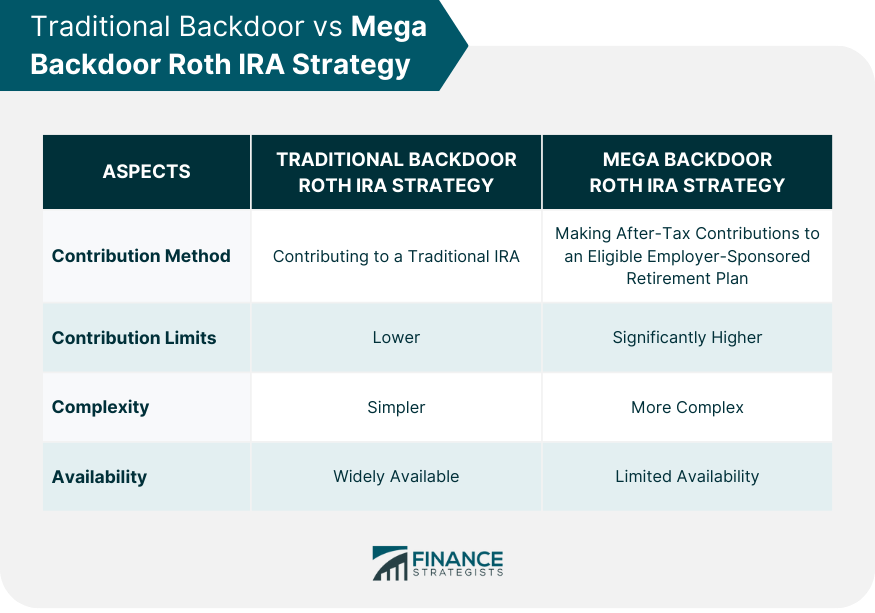

The Mega Backdoor Roth: Taking It to the Next Level

If you’re really ambitious about maximizing your Roth savings, there’s also something called the “Mega Backdoor Roth.” This strategy uses a 401(k) plan that allows:

- After-tax contributions above the standard employee deferral limit

- In-plan Roth conversions or in-service distributions

With this approach, you could potentially contribute up to $70,000 (or more if you’re over 50) to Roth accounts in 2025, depending on your plan’s specific provisions and your total compensation.

Not all 401(k) plans allow this, so check with your plan administrator to see if yours does.

Is the Backdoor Roth IRA Right for You?

The backdoor Roth IRA strategy makes the most sense if:

- Your income exceeds the direct Roth IRA contribution limits

- You don’t have significant pre-tax IRA balances (or can roll them into a 401(k))

- You expect to be in the same or higher tax bracket in retirement

- You want tax diversification in your retirement accounts

- You want to avoid RMDs during your lifetime

It might NOT be ideal if:

- You have large pre-tax IRA balances that would trigger significant taxes under the pro-rata rule

- You expect to be in a much lower tax bracket in retirement

- You need the money soon and can’t meet the Roth withdrawal requirements

Legislative Outlook: Will Backdoor Roth IRAs Be Eliminated?

People have been predicting the end of the backdoor Roth IRA for years. Various legislative proposals have suggested eliminating or restricting this strategy, particularly for very high-income individuals.

However, as of October 2025, the backdoor Roth IRA remains fully legal and available. There’s always the possibility of future changes, but for now, this strategy continues to be a valuable planning tool.

Final Thoughts

The backdoor Roth IRA remains one of the most powerful tax planning strategies available to high-income earners in 2025. While it requires some careful execution and tax reporting, the long-term benefits of tax-free growth and withdrawals make it worth considering.

I always recommend working with a qualified tax professional when implementing this strategy for the first time. The pro-rata rule in particular can create unexpected tax consequences if you don’t plan carefully.

Have you used the backdoor Roth IRA strategy? I’d love to hear your experiences in the comments below!

FAQs About Backdoor Roth IRAs

Q: Is the backdoor Roth IRA legal?

A: Yes, it’s completely legal as of 2025. While it’s technically a workaround to income limits, the IRS has recognized it as a legitimate strategy.

Q: Do I need a new Traditional IRA for the backdoor conversion?

A: Not necessarily, but having a separate “clean” Traditional IRA with no pre-tax funds makes the process simpler and helps avoid pro-rata complications.

Q: How soon after contributing should I convert to a Roth IRA?

A: As soon as the funds settle, which is typically a few days. This minimizes any earnings that would be taxable upon conversion.

Q: What if I already have money in a Traditional IRA?

A: The pro-rata rule will apply, potentially making much of your conversion taxable. Consider rolling those funds into an employer plan if possible.

Q: Can I recharacterize a Roth conversion if I change my mind?

A: No. Since 2018, Roth conversions can no longer be recharacterized or undone.

Q: How do I report a backdoor Roth IRA on my taxes?

A: You’ll need to file IRS Form 8606 to report the non-deductible contribution to your Traditional IRA and the subsequent conversion to a Roth IRA.

Q: Can I do a backdoor Roth IRA if I’m retired?

A: You need earned income to make an IRA contribution. However, if you have a working spouse, you may be able to make a spousal IRA contribution.

So no more backdoor Roth Conversion starting in 2026?

whats your source on this. Someone on YouTube talked about this, but they mixed it up with something from 2021 called Build Back Better, which didn’t pass.

Do you have an Intuit account?

Youll need to sign in or create an account to connect with an expert. 3 Replies