For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent.

For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good. A score in the high 700s or 800s is considered excellent. About a third of consumers have FICO® ScoresÎ that fall between 600 and 750âand an additional 48% have a higher score. In 2023, the average FICO® Score in the U.S. was 715.

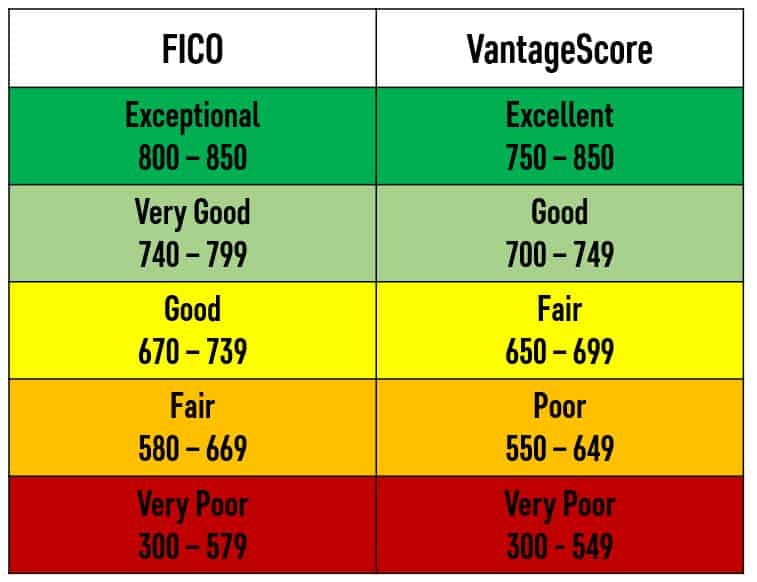

Lenders use their own criteria for deciding whom to lend to and at what rates. But a higher credit score can generally help you qualify for a credit card or loan with a lower interest rate and better terms. The two main types of credit scores, the FICO® Score and VantageScore® credit scores, vary slightly in their ranges but have similar scoring factors.

Your credit score is one of the most important numbers in your financial life. It plays a role in whether you can get approved for credit cards, loans, mortgages, and more. It also influences the interest rates and terms you’ll be offered. So where does a 772 credit score land you? Is 772 a good credit score?

The short answer is yes 772 is an excellent credit score that will qualify you for the best rates and terms on loans and credit cards. But let’s take a closer look at what makes it so great.

What is a Good Credit Score?

Credit scores typically range from 300 to 850. The higher the number, the better your credit. Anything over 700 is generally considered good, while 800 and above is excellent.

Here’s how the main credit score ranges break down

- 300-629: Bad credit

- 630-689: Fair credit

- 690-719: Good credit

- 720-850: Excellent credit

So with a score of 772, you’re safely in the excellent range.

What Does a 772 Credit Score Mean?

A 772 credit score means you have exceptional credit health. It signals to lenders that you are an ultra low-risk borrower who always pays bills on time and keeps credit card balances low.

Specifically, a score of 772 tells lenders:

- You have a long history of responsible credit use.

- You have never missed a payment or defaulted on a loan.

- You keep credit card balances well under 30% of the limits.

- You have a healthy mix of credit types, like mortgages, auto loans, and credit cards.

- You only open new credit accounts sparingly.

Essentially, 772 means you’re a VIP borrower who lenders want to do business with. You’ve earned access to the lowest interest rates, biggest loan amounts, and best rewards programs.

What Percentage of People Have a 772 Credit Score?

772 is well above the average credit score of 714. Only a small percentage of people can claim scores this high.

According to FICO data, 772 falls in the “very good” credit score range, which includes 25% of consumers. It’s even better than that: FICO says only 1% of people with “very good” scores are likely to become seriously delinquent.

So you’re in an elite group if your score is 772. Statistically, about 1 in 4 people have credit as good as yours, and only 1 in 100 are likely to stop paying bills in the future. That makes you a prize customer in lenders’ eyes.

Advantages of a 772 Credit Score

What can you get with a 772 credit score that people with lower scores can’t? Here are some of the biggest perks:

Low interest rates – Excellent credit means you’ll qualify for the lowest rates on mortgages, auto loans, personal loans and credit cards. This saves you money as you pay less interest over time.

High credit limits – Issuers will trust you with higher credit limits and loan amounts because your 772 score proves you can handle it responsibly. This gives you more purchasing power.

Ideal terms – From 0% intro APR offers to sign-up bonuses, you’ll have access to the most rewarding credit card and loan terms lenders offer.

Quick approvals – A 772 credit score makes for a quick, smooth approval process. Lenders know instantly they want your business.

Valuable rewards – Premium travel and cash back credit cards with the best rewards programs will now be within your reach.

Lower insurance rates – Insurers use credit scores to set premiums. Excellent credit can mean big savings on auto and home insurance.

No need for big deposits – Landlords and utilities will often waive hefty deposits for renters with high 700s credit scores.

Job opportunities – Some employers check credit reports as part of pre-employment screening. Excellent credit makes you a more attractive applicant.

How to Maintain a 772 Credit Score

Once you’ve reached the upper echelon of 772, you’ll want to keep it there. Here are some tips for maintaining your excellent credit:

-

Always pay bills on time – Payment history is the biggest factor in your scores. Even one 30-day late can drop your scores by up to 110 points. Set up autopay so you never miss a due date.

-

Keep balances low – High utilization hurts your scores. Try to keep balances under 10% of your credit limits. Pay in full each month if possible.

-

Limit hard inquiries – Each application for new credit results in a hard inquiry, which can lower your scores slightly. Only apply for what you need.

-

Watch your credit mix – Lenders like to see a variety of credit types. Having open and active accounts like mortgages, credit cards and installment loans can help your mix.

-

Let aging accounts age – The longer you have credit, the better. Keep old accounts open as they help build your history.

-

Dispute errors – Stay on top of your credit reports and dispute any mistakes with the bureaus. Errors can drag down your scores.

Stick to these habits, and your 772 score will stand strong for years to come.

How to Reach a 772 Credit Score

If you don’t have a 772 credit score yet, take heart. With some time and smart credit moves, you can get there. Here are some tips:

-

Pay all bills on time, every time – Set up autopay or reminders so you never miss a payment. This builds a strong payment history.

-

Lower credit utilization – Get balances on credit cards and other revolving credit below 30%, or even lower. Ask for credit limit increases.

-

Build credit history – Apply for new credit just periodically. Letting accounts age builds history over time.

-

Check credit reports – Review reports from all three bureaus. Dispute any mistakes that could be dragging down your scores.

-

Limit hard inquiries – Each new credit application results in an inquiry, so only apply for what you need. Too many dings your scores.

-

Mix up credit types – Use different credit products – like cards, retail accounts, installment loans – to show you can manage diverse accounts.

-

Practice good habits – Making on-time payments, keeping low balances, and using credit responsibly over time will boost your scores.

It takes diligence and patience, but with responsible credit use, a 772 score is certainly within reach.

Is 772 a Good Credit Score?

A FICO credit score of 772 is undoubtedly excellent. It signals to lenders that you are an ultra-low-risk borrower with exceptional credit who always pays on time and uses credit responsibly.

With a 772 score, you can qualify for the best credit card rewards, lowest loan rates, biggest credit limits, and more. Less than 25% of people have credit scores this high. It’s an accomplishment to be proud of.

Just be sure to maintain your excellent 772 score by continuing to practice good credit habits – like making on-time payments, keeping balances low, limiting inquiries, and letting accounts age. Handle credit with care, and your score will continue opening doors for you.

Get your FICO® ScoreΠfor free

Sign up and get instant online access to your FICO® Score for free.

Checking your own credit wonât lower your credit scores.

View specific factors that are affecting your score and how to improve it.

ÎCredit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

Heres more on what qualifies as a good credit score, what impacts your credit and how to improve your credit scores.

VantageScore Credit Score Factors

VantageScore lists the factors by how influential they generally are in determining a credit score, but this will also depend on your unique credit report. VantageScore considers factors in the following order:

| VantageScore Credit Scoring Factor | Importance |

|---|---|

| Payment history | Extremely influential |

| Total credit usage | Highly influential |

| Credit mix and experience | Highly influential |

| New accounts opened | Moderately influential |

| Balances and available credit | Less influential |

Is 772 A Good Credit Score? – CreditGuide360.com

FAQ

Can I buy a house with a 772 credit score?

What credit score do you need to buy a house? You generally need a credit score of at least 620 to qualify for a loan to buy a home.Nov 27, 2024

What can you do with a 772 credit score?

3. A lower rate of interest– a CIBIL score of 772 will also help you get good deals on both short-term and long term loans. You will be able to get lower rates of interest on loans like home loans, vehicle loans, etc.

Is a 900 credit score possible?

What is considered an excellent credit score?