This content may include information about products, features, and/or services that SoFi does not provide and is intended to be educational in nature.

If you’re in the market for a new (or new-to-you) set of wheels with plans to finance it, predicting your interest rate will help you figure out the total costs of the loan. According to recent Experian data, the average interest rate for a new car loan for someone with a 750 credit score is 6.87%. For a used car, the average interest rate is 9.36%.

In general, the higher the interest rate, the more expensive the loan. But what exactly does an interest rate mean for your wallet, and how can you get a lower score? We’ll look at the ins and outs of what factors can impact the interest rate on your auto loan and what you can do to get a better rate.

• The average interest rate for new car loans with a 750 credit score is 6.87%.

• Used car loans carry an average interest rate of 9.36% for those with a 750 credit score.

• Interest rates on car loans are influenced by factors like credit score, lender, loan amount, and loan term.

• Securing better car loan rates can be achieved by improving credit scores and comparing lender offers.

Hey there, folks! If you’re wondering, “Is 750 a good credit score for a car loan?” lemme put your mind at ease right off the bat—hell yeah, it is! A 750 credit score ain’t just good; it’s pretty darn great. It puts you in a sweet spot to snag some of the better interest rates and loan terms out there when you’re lookin’ to buy a car. But, I know you’re curious about the deets—how good is it really, what kinda rates can you expect, and what else matters? Don’t worry, I’ve got your back. We’re gonna dive deep into why a 750 score rocks for car loans, how it stacks up, and how you can make the most of it. So, buckle up, and let’s roll!

Why a 750 Credit Score Is a Big Win for Car Loans

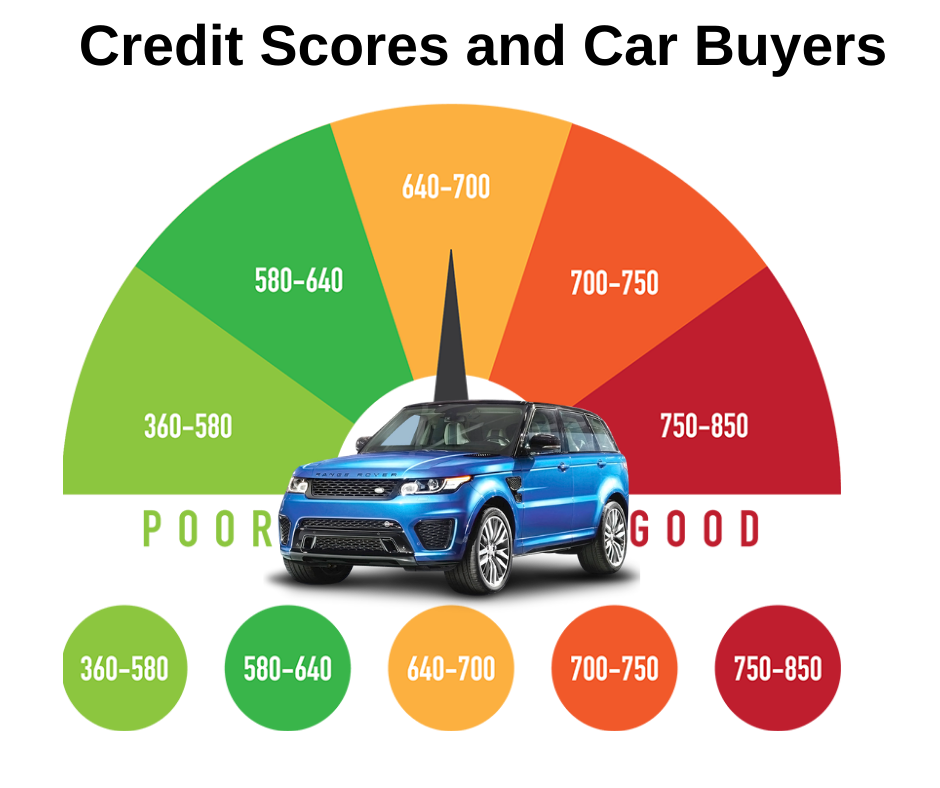

First things first, let’s chat about what a 750 credit score means. In the world of credit, scores usually range from 300 to 850 and 750 sits comfortably in the “very good” category. It’s in what lenders call the “prime” range which is typically between 661 and 780. That’s a fancy way of sayin’ you’re a low-risk borrower in their eyes. Why’s that matter? ‘Cause when you’re shopping for a car loan, lenders are more likely to offer you lower interest rates and better terms if your score screams “reliable.”

With a 750 score you’re likely to qualify for rates that are way below what folks with lower scores get stuck with. For instance, based on the latest numbers floatin’ around in 2025, if you’re buyin’ a new car you might be lookin’ at an average interest rate between 6.70% and 6.87%. If it’s a used car you’re after, expect somethin’ around 9.06% to 9.36%. Compare that to someone with a score below 500, who could be slammed with rates as high as 15.81% for new cars or a whopping 21.58% for used ones. See the difference? Your 750 score could save you hundreds, if not thousands, over the life of your loan.

I remember when I was helpin’ a buddy shop for his first ride. He had a score around 750, and man, the deals he got were night and day compared to another pal with a score in the 500s. Same dealership, same car model, but my buddy with the higher score walked away with a monthly payment that didn’t make him wanna cry. That’s the power of a solid credit score, y’all!

How Credit Scores Affect Car Loan Interest Rates

Now, let’s break this down a bit more so you really get why 750 is such a big deal Credit scores are like a report card for your financial responsibility The higher your score, the more lenders trust you to pay back what you borrow. And trust me, they reward that trust with lower interest rates. Here’s a quick peek at how rates generally look based on different score ranges for car loans in early 2025

| Credit Score Range | Category | New Car APR | Used Car APR |

|---|---|---|---|

| 781 and above | Super Prime | 5.18% | 6.82% |

| 661 – 780 | Prime | 6.70% | 9.06% |

| 601 – 660 | Near Prime | 9.83% | 13.74% |

| 501 – 600 | Subprime | 13.22% | 18.99% |

| 300 – 500 | Deep Subprime | 15.81% | 21.58% |

As you can see, with a 750 score, you’re sittin’ pretty in the prime range, which means your rates for a new car are hoverin’ around that 6.70% mark, maybe a tad higher dependin’ on the lender. For a used car, you’re closer to 9.06%. That’s a far cry from the double-digit rates folks with lower scores gotta deal with. Ain’t gonna lie, just lookin’ at those numbers makes me wanna high-five anyone with a 750!

But here’s the kicker—those rates aren’t just numbers on a page. They directly impact how much you’re shellin’ out every month and over the whole loan term. Let’s say you’re borrowin’ $30,000 for a new car over 60 months (that’s 5 years). At 6.70%, your monthly payment might be around $590, and you’d pay about $5,388 in total interest. Compare that to someone with a score in the 500s payin’ 15.81%—their monthly payment jumps to $727, and they’re coughin’ up over $13,591 in interest. That’s more than double the interest cost! So yeah, your 750 score is savin’ you some serious dough.

What Else Affects Your Car Loan Besides Credit Score?

Alright, before you go thinkin’ a 750 score is your golden ticket to the cheapest loan ever, lemme throw in a reality check. Your credit score is a huge piece of the puzzle, but it ain’t the only one. Lenders look at a bunch of other stuff when decidin’ what rate and terms to offer you. Here’s what else can mess with your car loan deal:

- Loan Amount: If you’re borrowin’ a big chunk of change, lenders might see it as riskier and bump up your rate a bit. Borrow less, and you might score a better deal.

- Loan Term: Shorter terms (like 36 months) often come with lower rates ‘cause there’s less time for somethin’ to go wrong. Longer terms (like 72 months) might mean higher rates but smaller monthly payments. Gotta weigh what works for ya.

- Down Payment: The more cash you put down upfront, the less you gotta borrow, and lenders love that. A hefty down payment can sometimes snag you a lower rate. Aim for at least 10-20% if you can swing it.

- Your Income and Debt: Lenders wanna know if you got the cash flow to handle payments. They’ll peek at your income and your debt-to-income ratio (how much of your income goes to debt). If you’re stretched thin, they might not cut you as much slack, even with a 750 score.

- The Car Itself: New cars usually get lower rates ‘cause they’re less likely to break down and lose value quick. Used cars, especially older ones, often come with higher rates. Some lenders won’t even touch a car over 10 years old or with crazy high mileage.

- Where You Get the Loan: Banks, credit unions, online lenders, and dealerships all got their own rules. One might offer you a sweet rate while another ain’t so generous. Shoppin’ around can make a big diff.

- Economic Vibes: Bigger stuff like inflation and Federal Reserve moves can nudge rates up or down for everyone. Right now, in 2025, rates are kinda high compared to a few years back, but there’s talk of them maybe droppin’ a bit soon.

So, while your 750 score gives you a super-duper head start, these other factors can tweak the final deal. I’ve seen folks with great scores still pay more ‘cause they didn’t put much down or picked a long loan term. Don’t just bank on your score—play the whole game smart.

Why 750 Is Awesome, But You Can Still Push for Better

Here’s the deal—havin’ a 750 credit score is fantastic, no doubt. It’s above average, and it shows lenders you’re good with money. Most Americans don’t even get close to this level—lots are stuck in the 600s or lower. So, pat yourself on the back! But, and this is a big but, you can still aim for better rates or terms by takin’ some extra steps. Plus, if you’re just shy of 750, I got tips to get you there.

If you’ve got a 750 score, here’s how to milk it for all it’s worth:

- Shop Around Like Crazy: Don’t settle for the first lender you talk to. Hit up banks, credit unions, and online spots. Get preapproved with a few so you can compare rates side by side. Sometimes you can even use one offer to haggle with another lender.

- Put Down More Cash: If you can scrape together a bigger down payment, do it. It cuts the loan amount and might lower your rate. Plus, it shows the lender you’re serious.

- Pick a Shorter Term: If your budget allows, go for a shorter loan term. Yeah, monthly payments might sting a bit more, but you’ll save on interest in the long run.

- Team Up with a Cosigner: If you think you can get an even better rate, ask a friend or family member with an awesome score (like 800+) to cosign. Just make sure they know they’re on the hook if you miss payments.

Now, if your score ain’t quite at 750 yet, don’t sweat it. Boostin’ your credit ain’t rocket science, though it does take some patience. Here’s how to inch closer to that magic number:

- Pay Bills on Time, Every Time: Late payments are a killer. Set reminders or auto-pay to stay on track.

- Lower Your Credit Card Balances: Keep your credit usage low—under 30% of your limit if possible. Pay down debt to free up some room.

- Don’t Apply for Too Much Credit: Every new application can ding your score a bit. Only apply when you really need to.

- Check Your Report for Goofs: Sometimes errors sneak into your credit report. Pull yours for free and dispute any weird stuff you spot.

I’ve been there myself, hoverin’ just below a killer score, and lemme tell ya, takin’ these steps made a difference. It’s like givin’ your financial rep a lil’ polish before you walk into the lender’s office.

What If Your Score Is Lower Than 750?

Okay, let’s say your score ain’t 750—it’s more like 650 or even 550. Is all hope lost for a decent car loan? Nah, not at all! You might not get the rock-bottom rates, but you can still make it work. If you’re in the 601-660 range, you’re lookin’ at new car rates around 9.83% and used car rates near 13.74%. Lower than that, say 501-600, and it’s more like 13.22% for new and 18.99% for used. Still doable, just pricier.

Here’s my advice if your score’s takin’ a hit:

- Focus on What You Can Control: Make a big down payment and pick a cheaper car to keep the loan small.

- Look for Bad Credit Lenders: Some lenders specialize in helpin’ folks with lower scores. Rates won’t be amazing, but they might be better than you expect.

- Get That Score Up Before Applyin’: If you got a few months, work on your credit first. Even jumpin’ from 600 to 650 can shave off some interest.

I’ve seen family members struggle with so-so scores, and trust me, a little effort goes a long way. One of my cousins bumped his score up 50 points in six months just by payin’ stuff on time and cuttin’ back on card swipes. By the time he applied for his car loan, he saved a bundle on interest.

Real Talk: What a 750 Score Means for Your Wallet

Let’s get down to brass tacks—how does a 750 score hit your wallet when you’re buyin’ a car? It’s all about the monthly payment and total cost. With a score in the prime range, your payments are gonna be more manageable compared to someone with a lower score. For a $25,000 new car loan over 60 months at around 6.70%, you’re payin’ roughly $492 a month. Someone with a score under 500, at 15.81%, is shellin’ out closer to $606 for the same loan. That’s over $100 more every month just ‘cause of the rate!

Over the life of the loan, the savings are even crazier. You might pay about $4,520 in interest total with your 750 score. The other guy? They’re lookin’ at over $11,360 in interest. That’s money you coulda spent on a sweet road trip or pimpin’ out your ride!

I ain’t gonna sugarcoat it—car loans are a big commitment, even with a great score. But startin’ with a 750 gives you a leg up to keep costs down. Pair that with smart moves like shoppin’ for the best lender and keepin’ your loan term short, and you’re golden.

Other Perks of a 750 Credit Score

Oh, and one more thing—havin’ a 750 score don’t just help with car loans. It opens doors for other stuff too. You’re more likely to qualify for better credit cards, personal loans, or even a mortgage with favorable terms. It’s like havin’ a VIP pass in the financial world. Lenders see you as a safe bet, so they’re more willin’ to work with ya on bigger purchases or flexible repayment plans.

I’ve noticed with my own score in that range, I get preapproval offers poppin’ up left and right. It’s nice knowin’ I got options if I need ‘em, whether it’s for a car, a house, or just some extra cash in a pinch.

Wrappin’ It Up: Make That 750 Work for You!

So, is 750 a good credit score for a car loan? You bet your boots it is! It lands you in the prime category, settin’ you up for interest rates that are way better than average—think around 6.70% for a new car and 9.06% for a used one. That translates to lower monthly payments and huge savings over time compared to folks with lower scores. But remember, it ain’t the whole story. Stuff like your down payment, loan term, and the lender you choose can tweak the deal.

If you’ve got a 750, celebrate it, then hustle to maximize it—shop around, put down as much as you can, and keep that loan term tight if possible. If you’re not quite there yet, no worries. A few smart moves can get you closer to that magic number. We’ve all been on this financial journey, and I’m rootin’ for ya to get the best damn car loan out there. Drop a comment if you got questions or wanna share your own car-buyin’ story—I’m all ears! Let’s keep this convo rollin’!

.png)

How many people have a 900 credit score?

Nobody has a 900 credit score. That’s because standard credit scores range from 300 to 850. That said, FICO created industry-specific FICO® Score models that range between 250 and 900, but these models have very limited use.

How to Get a Better Auto Loan Interest Rate

There are a number of measures you can take to improve your chances of getting a better auto loan insurance rate.

A good place to start is to focus on building your credit. This means staying on top of bill payments, keeping your credit usage low, and only applying for credit when necessary, among other things.

You can also spend some time improving your credit score. Regular credit score monitoring can help you find ways to boost your score.

Finally, shop around for a lender to see which one can offer you the lowest interest rate.

Why You NEED a 750 Credit Score

FAQ

Is a 750 credit score good enough to buy a car?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.Mar 31, 2025

How big of a loan can I get with a 750 credit score?

How much would a $70,000 car payment be?

For a $70,000 vehicle, assuming a $10,000 down payment, 5% interest, and 72 months, your payment would be approximately $967 per month.

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)