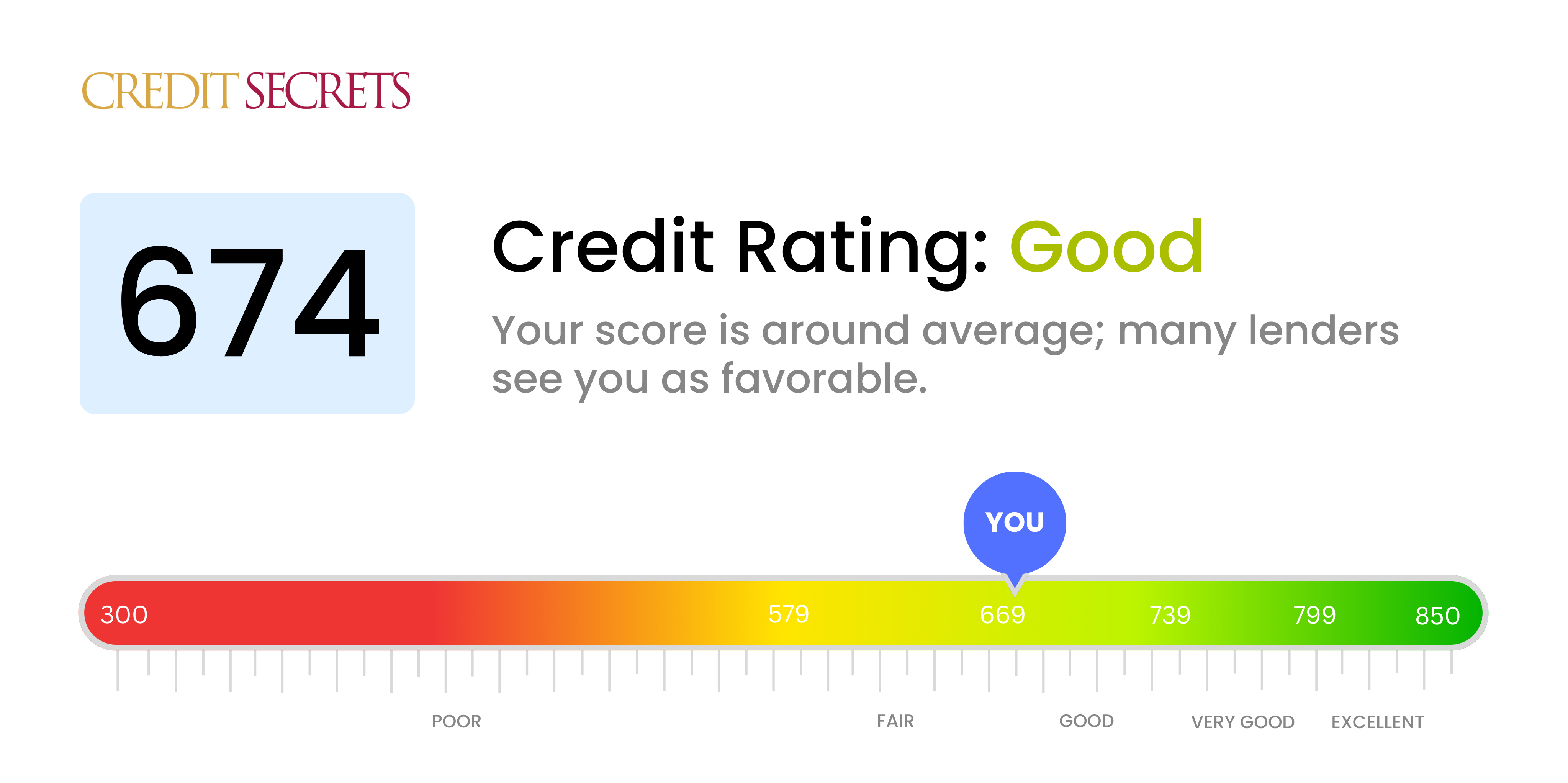

A credit score of 674 is an average, or fair, score and may indicate to lenders that you are a lower-risk borrower. According to FICO, a score that falls in the 670 to 739 range is classified as “good.” FICO scores are based on information typically provided by the three major credit bureaus: Experian, TransUnion, and Equifax.

Although FICO® scores are used by 90% of the top lenders, some creditors base their decisions on a credit score provided by VantageScore. VantageScore’s “good” credit score range is 661 to 780. So even with a 674 credit score, you’re still considered lower risk.

Many lenders in the U.S. consider people with a “good” credit score to be acceptable borrowers. This means they may see you as eligible for an array of credit products, though you may not get the most choice product offers, lowest interest rates, or best loan terms.

Hey there! If you’re sittin’ there wonderin’, “Is 674 a good credit score to buy a car?” then you’ve come to the right place. I’ve been down this road myself, stressin’ over numbers and car dreams, so let’s cut through the confusion together. Quick answer: Yeah, 674 is a pretty decent score—it’s considered “good” and can likely get you a car loan, but it ain’t the golden ticket for the best rates or terms. Stick with me, and we’ll dive into what this number really means for your car-buying journey, how it impacts your wallet, and what you can do to roll outta the dealership with a sweet ride.

What Does a 674 Credit Score Even Mean?

First off, let’s get a grip on where 674 stands in the big ol’ world of credit scores. Credit scores are like your financial report card—they tell lenders how likely you are to pay back what you borrow. The higher the score, the more trustworthy you look. Now, there’s a couple of main models out there that rate your score: FICO and VantageScore. Here’s how 674 stacks up in both:

-

FICO Score Ranges

- Exceptional: 800 and above

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 579 and below

-

VantageScore Ranges:

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very Poor: 300-499

See that? With a 674, you’re sittin’ in the “Good” range for both That’s solid ground! It means you’ve probably been payin’ your bills mostly on time and managin’ your debts decently But, let’s be real—it’s on the lower end of “good,” so you’re not quite in the VIP club for the lowest interest rates or the fanciest loan offers. Still, it’s a far cry from “poor” or “fair,” where gettin’ approved for anything can be a real headache.

How Does 674 Affect Buying a Car?

Alright, now let’s talk about the rubber meetin’ the road—buyin’ a car with a 674 credit score. The good news? You’re in a spot where most lenders will at least consider you for an auto loan. In fact, stats show that around two-thirds of financed cars go to folks with scores of 661 or higher, so you’re in that majority. But here’s the catch: your score influences the interest rate you’ll get slapped with, and that can make a huge diff in how much you pay over time.

Interest Rates by Credit Score

Here’s a lil’ breakdown of average annual percentage rates (APRs) for car loans based on credit score ranges. This’ll give ya a sense of what to expect with a 674:

| Credit Score Range | Average APR (New Car) | Average APR (Used Car) |

|---|---|---|

| Superprime: 781-850 | 5.18% | 6.82% |

| Prime: 661-780 | 6.70% | 9.06% |

| Nonprime: 601-660 | 9.83% | 13.74% |

| Subprime: 501-600 | 13.22% | 18.99% |

| Deep Subprime: 300-500 | 15.81% | 21.58% |

With a 674 you’re in the “Prime” bucket (661-780) so you’re lookin’ at around 6.7% APR for a new car and about 9.06% for a used one. Not terrible, right? But compare that to someone with a score in the 800s—they’re payin’ way less in interest. For a $20,000 used car loan over five years, your monthly payment might be around $415, while someone with a top-tier score pays closer to $400 or less. That extra interest adds up, y’all—could be thousands over the loan’s life.

Approval Odds with 674

Can ya get approved with a 674? Most likely, yeah. Lenders see this score as a sign you’re a decent bet, though they might not roll out the red carpet. Some might ask for a bigger down payment to lower their risk, or they could hit ya with stricter terms. Also, keep in mind that some dealers use a special score called the FICO Auto Score, which focuses more on your history with car loans. If you’ve had issues with auto payments in the past, that could ding ya even if your regular score is 674.

Real Talk: What 674 Means for Your Car Budget

Let’s put this in real-life terms. Say you wanna buy a used car for $20,000, and you’ve got no down payment (we’ve all been there). With a 674 score and a five-year loan at 9.06% APR, you’re payin’ about $415 a month, and you’ll shell out close to $5,000 in interest by the end. Now, if your score was just a bit higher, say in the 740s, you might snag a rate closer to 6.8%, droppin’ your monthly payment and savin’ you hundreds in interest. That’s money you coulda spent on gas or a dope sound system, ya know?

Plus, here’s a sneaky lil’ thing—bad credit can jack up your car insurance rates in most states. So, even with a “good” score like 674, you might not be gettin’ the cheapest deal on that front either. It’s like the system’s rigged to keep nickelin’ and dimin’ ya!

Tips to Buy a Car with a 674 Credit Score

Don’t sweat it too much, though. A 674 ain’t perfect, but it’s workable. We’ve got some tricks up our sleeve to help you drive off the lot without breakin’ the bank. Here’s what to do:

- Bring a Fat Down Payment: If ya can scrape together a bigger chunk of cash upfront, it lowers the loan amount and might even get ya a better rate. Lenders see it as less risk on their end. Even 10-20% down can make a big diff.

- Show Off Your Stability: Got a steady job? Been livin’ at the same spot for a while? Bring pay stubs, proof of address, or whatever ya got to show you’re not a flight risk. It can sway a lender to give ya a shot.

- Shop Around for Financing: Don’t just take the dealership’s word for it. Check with your bank, credit union, or even online lenders for rates. Sometimes you can walk in pre-approved with a better deal than what the dealer offers. Compare, compare, compare!

- Consider a Co-Signer: If you’ve got a buddy or family member with killer credit, ask if they’d co-sign the loan. It can boost your chances of approval and maybe snag a lower rate. Just don’t mess ‘em over by missin’ payments, alright?

- Be Ready to Negotiate: Dealers and lenders know you want that car. Use that 674 as leverage to say, “Hey, I’m a good bet, let’s work somethin’ out.” Haggle on the price, the rate, whatever ya can.

One last thing—if ya end up with a higher rate than you hoped, keep makin’ those payments on time. After 6-12 months, you might be able to refinance at a lower rate if your score’s gone up. Keep an eye on that!

How to Boost Your 674 Score for a Better Deal

Now, if you’re thinkin’, “Man, I want those lower rates,” or if ya just wanna be in a stronger spot before signin’ for a car loan, let’s talk about pumpin’ up that 674 to somethin’ even better. Movin’ into the “Very Good” range (740-799) can save ya big bucks. Here’s how to get there:

- Pay Every Bill on Time, No Excuses: Late payments can tank your score faster than a lead balloon. Set reminders, automate payments, do whatever it takes to pay at least the minimum by the due date. Payment history is like 35% of your FICO score, so it’s huge.

- Keep Credit Card Balances Low: Don’t max out your cards. Aim to use less than 30% of your available credit. So, if ya got a $10,000 limit, keep the balance under $3,000. This “credit utilization” thing is a big deal, makin’ up about 30% of your score.

- Don’t Apply for New Credit Right Now: Every time ya apply for a card or loan, it’s a “hard inquiry” that dings your score a bit. Avoid new apps for at least 6 months before goin’ for a car loan.

- Check Your Credit Report for Goofs: Errors happen. Maybe a paid-off debt’s still showin’ as owed. Grab your free credit report and dispute anything funky. Fixin’ mistakes can give ya a quick boost.

- Keep Old Accounts Open: Don’t close old credit cards, even if ya don’t use ‘em. The length of your credit history matters, and closin’ accounts can shrink your available credit, hurtin’ your score.

I remember when I was hoverin’ around a 670-ish score, and I made it a game to get over 700. Paid off a couple small balances, set up auto-pay, and bam—within a few months, I was seein’ progress. It takes patience, but it’s worth it when ya see them lower rates.

What If You’ve Got a 674 and Still Get Denied?

Hey, it happens. Not every lender’s gonna say yes, even with a “good” score like 674. Different places got different rules, and maybe they’re lookin’ at other stuff like your debt-to-income ratio or past car loan hiccups. If ya get turned down, don’t throw in the towel. Try these:

- Ask Why: Lenders gotta tell ya why they said no. Maybe it’s somethin’ fixable, like a high credit card balance you can pay down quick.

- Look for Bad Credit Lenders: Some specialize in folks with less-than-perfect scores. Rates might be higher, but it gets ya in a car. Just read the fine print—don’t get stuck with crazy terms.

- Save Up and Wait: If ya can hold off, build that score a bit more and save for a bigger down payment. Sometimes waitin’ a few months makes all the diff.

- Consider a Cheaper Ride: Maybe aim for a less pricey car to lower the loan amount. Less risk for the lender might mean a yes.

I had a pal who got denied with a score close to 674, and he just kept shoppin’ around till he found a credit union that worked with him. Took a bit of hustle, but he’s cruisin’ now.

Why Your Credit Score Matters Beyond Just Cars

While we’re on the topic, let’s zoom out a sec. A 674 score ain’t just about buyin’ a car—it’s a snapshot of your financial health. It can affect everything from rentin’ an apartment to gettin’ a credit card with sweet rewards. And yeah, buyin’ a car can actually help your score if ya make payments on time. It adds to your “credit mix”—havin’ both loans and credit cards—which lenders like to see. Plus, consistent payments boost your payment history, the biggest factor in your score.

But mess up those payments? Oof, that’s gonna hurt. Missin’ a car loan payment by 30 days or more can drop your score hard, so stay on top of it. Set up alerts or auto-pay if ya gotta. We’re all human, and life gets messy, but don’t let a slip-up cost ya.

Wrappin’ It Up: You’ve Got This!

So, is 674 a good credit score to buy a car? Yup, it’s good enough to get ya in the game. You’re likely to get approved for a loan, though you might not score the rock-bottom rates that folks with 800s get. With an APR around 6.7% for new cars or 9% for used, you’re payin’ a bit more in interest, but it’s doable. Use tricks like a big down payment, shoppin’ around for financing, or even gettin’ a co-signer to sweeten the deal. And if ya wanna level up, focus on boostin’ that score by payin’ on time and keepin’ credit use low.

Here at [Your Blog/Company Name], we’re all about keepin’ it real and helpin’ ya navigate these financial mazes. I’ve been there, stressin’ over whether my score was “good enough,” and I know it feels like a mountain to climb. But take it step by step—check your score, plan your budget, and don’t be afraid to ask lenders questions. You’re closer to that new ride than ya think! Drop a comment if you’ve got a story about buyin’ a car with a score like this, or if ya need a lil’ more advice. Let’s keep the convo goin’!

Can I Get a Credit Card with a 674 Credit Score?

With a 674 credit score, you should be able to qualify for a standard, or unsecured, credit card. This type of credit card allows the cardholder to use their credit card when they want to, up to the credit limit. There’s no end date for an unsecured credit card, and you can use it continuously.

One thing to keep in mind about your credit card options with a “good” credit score: You most likely won’t qualify for the best credit card perks out there, such as balance transfer offers, 0% APR offers, or those credit cards with peak cash-back rewards. You may also not get the best rates or terms.

Can I Get an Auto Loan with a 674 Credit Score?

While there’s no credit rate minimum etched in stone for an auto loan, a good number of borrowers have a credit score of 660 or higher, according to Lending Tree. Meanwhile, Wallethub.com reports individuals with credit scores below 700 receive more than 40% of all auto loans.

Your interest rate on a car loan does depend on your credit score, along with some other factors, such as your debt-to-income ratio, how much of a down payment you put down, the length of your loan term, and whether you’re buying a new or used car. The latest average auto loan interest rates for a credit score of 674 is 6.40% for a new car and 8.75% for a used car, according to Experian.

To determine the odds of your defaulting, they will consider your credit score and history, as well as your loan term, down payment, income and debt, and their own criteria as well.

What Credit Score Do Car Dealerships Use? (Which Credit Bureau Is Most Used for Auto Loans?)

FAQ

Can you get a car loan with a credit score of 674?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.

What can you do with a 674 credit score?

With a 674 credit score, you should be able to qualify for a standard, or unsecured, credit card. This type of credit card allows the cardholder to use their credit card when they want to, up to the credit limit. There’s no end date for an unsecured credit card, and you can use it continuously.

What credit score is needed for a $30,000 car loan?

Is a 670 credit score good enough to buy a car?

A good credit score to obtain a car loan typically falls within the range of 660-720 or higher, so with a Transunion score of 678 and an Experian score of 693, you may be eligible for a car loan.

Can you get a student loan with a 674 credit score?

Student loans are some of the easiest loans to get with a 674 credit score, seeing as more than 60% of them are given to applicants with a credit score below 700. A new degree may also make it easier to repay the loan if it leads to more income.

Can a 674 credit score be used for a car loan?

Most auto lenders will lend to someone with a 674 score. However, if you want to ensure you qualify for a car loan at the best interest rates, you will want to continue improving your credit score. There are also several other factors that lenders consider when deciding whether to lend to you and at what interest rate.

Is a 674 FICO score good?

A 674 FICO ® Score Score is Good, but by earning a score in the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to check your credit score to find out the specific factors that impact your score the most and get your free credit report from Experian.

What is the best credit card for a 674 credit score?

This content is not provided, commissioned or endorsed by any issuer. The best type of credit card for a 674 credit score is a card with low fees and either rewards or a low APR promotion. You should compare credit cards with rewards if you plan to use your card for everyday purchases that you can pay off by the end of the month.

What credit score do you need to buy a car?

The report also found that on average, the credit score for a used-car loan was 684, while the average score for a new-car loan was 756. What minimum credit score is needed to buy a car? There isn’t one specific score that’s required to buy a car because lenders have different standards.

What is a good credit score for a car loan?

Usually, higher scores mean lower interest rates on loans. According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.70% or better, or a used-car loan around 9.06% or lower. Superprime: 781-850. 5.18%. 6.82%. Prime: 661-780. 6.70%. 9.06%. Nonprime: 601-660. 9.83%. 13.74%.