Congratulations, you’ve saved $15 million for retirement. Most Americans don’t even come close to that much. But the big question is: Is it enough? Will you be drinking margaritas on the beach or watching your spending at the store? Let’s answer this question that keeps a lot of people who are planning to retire up at night.

The Reality Check: Average Retirement Savings in America

Before we get too deep let’s put your $1.5 million into perspective. According to the most recent data the median retirement nest egg in America is under $400,000. Yep, you read that right. Most Americans retire with nowhere near $1.5 million in savings.

Based on the 2022 Survey of Consumer Finances, the average senior household (ages 65 to 74) has around $200,000 saved. Actually, that’s just for the roughly 2050% of households that even have retirement accounts!

So if you’re sitting on $1.5 million, you’re already way ahead of the average American. But that doesn’t automatically mean you’re set for life.

The Magic Number Debate

People who work with money have been talking a lot about the “magic number” needed to retire. Recent surveys show different targets:

- Charles Schwab estimates $1.8 million based on retirement plan participants

- Schroders survey suggests $1.2 million

- Northwestern Mutual lands right in the middle at $1.5 million

So your $1.5 million nest egg puts you right at what many experts consider the sweet spot. But the real answer isn’t quite so simple.

How Long Will $1.5 Million Actually Last?

This is where things get interesting. According to a recent GOBankingRates analysis from March 2025, how long your money lasts varies dramatically depending on where you live.

If we follow the classic 4% withdrawal rule (taking out 4% of your savings annually), $1.5 million would provide about $60,000 per year. But depending on your state, this could stretch for wildly different timeframes:

- West Virginia: 54 years (most affordable)

- Kansas: 52 years

- Mississippi: 51 years

- Florida: 39 years (popular retirement state)

- Massachusetts: 23 years

- California: 24 years

- Hawaii: Just 17 years! (least affordable)

Mind blown? Mine too. Living in Hawaii might be paradise, but your $1.5 million will run out three times faster than in West Virginia!

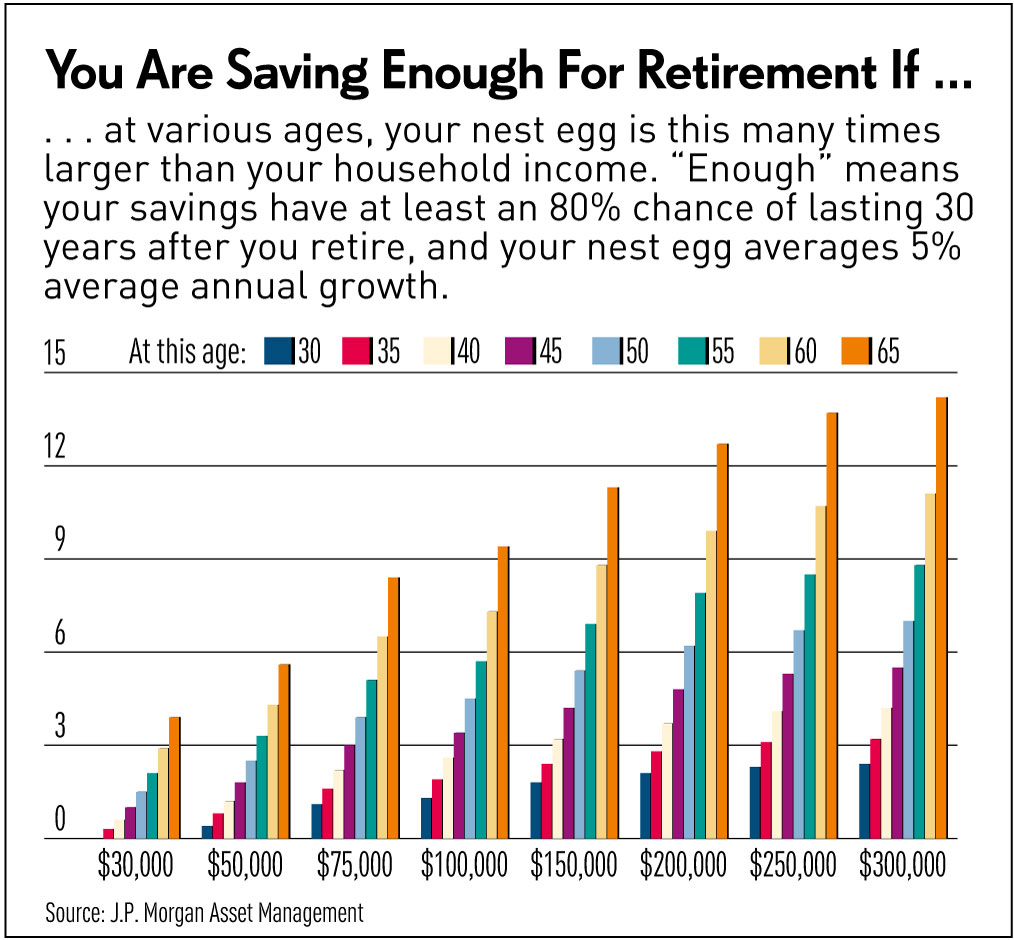

Breaking It Down By Age: When Can You Retire?

Let’s get personal. When exactly can you retire with $1. 5 million? That depends on a lot of things, but here’s a quick breakdown by age:

Can You Retire at 65 with $1.5 Million?

Absolutely yes. This is the traditional retirement age, and $1.5 million should last you 20-40 years depending on your location and lifestyle. With Social Security kicking in and Medicare covering much of your healthcare, this is very doable in most states.

Can You Retire at 60 with $1.5 Million?

Yes, but with some planning. If you withdraw $60,000 annually (4% rule), your money should last decades. The main challenge here is healthcare – you’ll need to budget for 5 years until Medicare eligibility at 65.

Can You Retire at 55 with $1.5 Million?

Yes, with careful planning. Early retirement is definitely possible with $1.5 million. According to Bankrate’s savings withdrawal calculator, if you earn just 4% on your nest egg and withdraw $60,000 annually, after 50 years you’d still have $1.29 million left! The key challenges are healthcare costs and potential early withdrawal penalties from retirement accounts.

Can You Retire at 45 with $1.5 Million?

Pushing it, but possible. Super early retirement with $1.5 million requires answering some tough questions:

- Do you have debt?

- Are there still children at home?

- Do you live in an expensive area?

- Can you cover medical costs for potentially 40+ years?

- Do you have a plan to make the money last 45+ years?

If you can live on $40,000-$50,000 annually and maybe have a small side hustle, it could work!

The Monthly Income Question

Most folks planning retirement think in terms of monthly income. So what kind of monthly retirement income can $1.5 million generate?

If you retire at 60 and live until 90 (30 years), your $1.5 million would give you approximately $4,167 per month before taxes – assuming no investment growth.

Here’s a breakdown by retirement age (assuming you live to 90):

| Retirement Age | Monthly Income |

|---|---|

| 60 | $4,167 |

| 55 | $3,571 |

| 50 | $3,125 |

| 45 | $2,778 |

| 40 | $2,500 |

Keep in mind this doesn’t account for:

- Social Security benefits (average check: $1,543/month)

- Investment growth (which could significantly increase these numbers)

- Inflation (which could decrease purchasing power)

- Taxes (which vary by state and income level)

How to Make Your $1.5 Million Last Longer

Want to stretch that nest egg even further? Here are some practical tips:

1. Pay Off All Debt Before Retiring

Nothing eats into retirement funds faster than debt payments. Focus on eliminating:

- Credit card debt (highest interest first!)

- Personal loans

- Student loans

- Mortgage (if possible)

2. Consider Geographic Arbitrage

As we saw earlier, location makes a HUGE difference. The most affordable states for retirees are:

- West Virginia

- Kansas

- Mississippi

- Oklahoma

- Alabama

Or if you’re feeling adventurous, consider these international options:

- Costa Rica

- Panama

- Portugal

- Greece

3. Stay Busy (Without Spending)

Boredom often leads to spending. Find fulfilling activities that don’t drain your wallet:

- Volunteering

- Gardening

- Part-time work doing something you enjoy

- Hobbies that don’t require constant spending

4. Continue Investing

Don’t just let your money sit! Keep a portion invested to generate growth:

- Dividend stocks

- Bond ladders

- Real estate income

- Low-cost index funds

5. Create Multiple Income Streams

Social Security shouldn’t be your only income source besides withdrawals:

- Rental properties

- Part-time consulting

- Online business

- Royalties

The Reality Check: Do You Really Need $1.5 Million?

I’m gonna be honest with ya – many Americans retire with way less than $1.5 million and are perfectly happy. As I mentioned earlier, many retirees live primarily on Social Security and seem to be doing fine.

The magic-number concept comes from the idea that you should save roughly 10x your annual salary to supplement Social Security, which was never designed to be your sole retirement income.

But the truth is that what you need depends entirely on the lifestyle you want. If you’ve paid off your home, don’t have expensive hobbies, and live in an affordable area, you might need much less than $1.5 million.

Final Thoughts: So Is $1.5 Million Enough?

The answer is a resounding YES for most people, with some caveats:

✅ If you retire at traditional age (65+)

✅ If you live in a low to medium cost area

✅ If you don’t have excessive debts or expenses

✅ If you maintain reasonable spending habits

But it might be challenging if:

❌ You want to retire extremely early (before 50)

❌ You live in Hawaii, California, New York, or other high-cost areas

❌ You want a luxurious lifestyle with extensive travel and high spending

❌ You have significant health issues that might require expensive care

At the end of the day, retirement isn’t just about hitting some magical number. It’s about creating a sustainable lifestyle that brings you joy and security.

So if you’ve got $1.5 million saved up, take a moment to celebrate – you’re in better shape than most Americans! With some smart planning and location flexibility, you can enjoy a comfortable retirement for decades to come.

Can you retire at 65 with $5 Million

Recent surveys indicate that Americans believe they’ll need around $1.27 million for a comfortable retirement, with those in their 60s aiming for about $968,000. Working with this benchmark, it is feasible to live off 1.5 million. For a 65-year-old with an average life expectancy of 17 years, that’s roughly $85,000 yearly for expenses.

Of course, certain factors come into play here.

- Social Security Benefits: Social Security is a big source of income, and the best time to file your claim is very important. If you file early, you may get smaller payments, but if you wait, you may get bigger checks.

- Lifestyle in Retirement: Today’s retirees often stay active, travel, or work part-time. Budgeting for these activities is essential. Some downsize or explore different living arrangements.

- Healthcare Costs: Again, budgeting for healthcare is vital. Medicare starts when you turn 65, but until then, you may need private insurance. Long-term care insurance is one way to cover possible medical costs.

- Inflation: Inflation reduces your purchasing power over time. To deal with rising costs, you might want to use an inflation-adjusted withdrawal strategy, such as the 4% rule.

- Part-Time Jobs: A lot of older people work part-time to make extra money and keep busy. A phased retirement plan can help you get used to retirement while also making you more money.

How Much Money Is Enough to Retire?

$1. 5 million net worth—how far does it go in retirement? To figure out this and determine whether it is sufficient for retirement, consider these key factors:

- Lifestyle: Think about your plans. If you like to travel, dress well, or have a lot of parties, the costs of clothes and entertainment can add up quickly. As an example, clothes for people 65 and older cost about $1,357, while entertainment costs about $3,182. You might find it hard to learn how to live off of investments while still enjoying a good life, so you might want to make some changes.

- Location: Where you live matters. Some states have higher taxes and costs of living, while others offer benefits for retirees and ways to make more money. Compare state-specific advantages to make informed financial choices for retirement.

- Healthcare: Rising healthcare expenses are a crucial consideration. The cost of health care can be high in retirement, making up about 12 2% of total future expenses, according to2022 BLS data.

- Housing: Transportation costs make up a big part of retirement costs, making up 34 7% of expenses for older adults. To deal with these costs, you might want to downsize or move to a cheaper area.

- Food Costs: The amount you spend on food depends on your lifestyle and the foods you like. People aged 65 to 74 usually set aside about $8,198 a year to pay for their food supplies. If your annual income isn’t enough to cover your expenses, you might want to change the way you eat by going out to eat less often and buying in bulk to make your money go further.

By understanding and accounting for these factors, you can better gauge how much money you’ll need to live comfortably after working.

Why Retirees With $1M Actually End Up With $5M

FAQ

Can you retire comfortably with 1.5 million dollars?

Retiring comfortably on $1. 5 million is possible, but it depends on your lifestyle, how much you spend, where you live, and any other income you have, like Social Security or a pension. While $1. 5 million dollars is a lot of money that can support a modest, comfortable retirement for many. However, it might not be enough for a fancy lifestyle, living in a high-cost area, or having high medical costs before you can get Medicare.

How long does 1.5 mm last in retirement?

A $1. The duration of a $5 million retirement fund depends a lot on where you live and how you live your life, but in general, it can last 20 years or more if you follow a 4% withdrawal rule, according to NerdWallet. A study by GOBankingRates found that it could last over 20 years in low-cost states like West Virginia and under 20 years in expensive states like Hawaii.

Is 1.25 million enough to retire on?

Is $1.5 million enough to retire?

To figure out if $1.5 million is enough to retire, you’ll need to factor in Social Security, pension and other income, as well as fixed and variable costs.

Can you retire with $1.5 million in savings?

Yes, you can retire with $1.5 million in savings. If a couple withdraws $60,000 per year (between $4,000 and $5,000 per month), this will be enough to live comfortably in retirement. And yes—if you retire at age 62, the 4% withdrawal rule ensures $1.5 million will last 25 years with your $60,000 annual income.

Can you retire early with 1.5 million dollars?

The only thing that you’ll need to remember is that healthcare won’t be covered for a few years. But, if you can make it work for 5 years, then it’s entirely possible to retire early with 1.5 million dollars at 60 years old. Can you retire at 55 with 1.5 million dollars?

Can you retire on 1 million dollars?

Saving a million dollars is doable if you start early, and it could last you decades in retirement. Can You Retire on $1 Million? Factors such as housing and health care will also impact your budget and determine whether $1 million is the right savings goal for your needs. Many people think $1 million is sufficient savings for retirement.

How much money do you need to retire comfortably?

For now, $1.5 million should allow most people to retire comfortably. To know for sure, you’ll have to estimate your retirement expenses and subtract the monthly spend from your monthly expected income. Here are two things to consider when calculating your spending:

How much money do you need to retire at 50?

Retiring at 50: The Basics Retiring 15 years before the typical retirement age requires thorough planning. To retire at 50 with $1.5 million, your savings must produce sufficient income to cover your living expenses for several decades. As a result, it’s essential to consider your lifestyle, expenses and investment income.