Paying off a credit card is very likely to help your score, especially if you were using more than 30% of your credit limit.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

Paying off credit card debt is smart, whether you zero out your balance every month or are finally done paying down debt after months or years. And as you might expect, it will affect your credit score.

Whether you are chipping away at a balance or eliminating it with one big payment, your score will likely go up.

Paying off credit card balances can give your credit score a nice boost. But how much will your credit score go up after you pay off credit cards? The increase depends on your credit profile and how you manage accounts after paying them off.

I’ve paid off credit cards completely in the past, both by steadily chipping away at balances over months and by wiping balances out in one large payment. In my experience, eliminating credit card debt improves credit scores noticeably when you do it right

In this article, I’ll explain how paying off credit card debt affects your credit score and how much of an increase you can expect. I’ll also provide tips to keep your score up after paying off cards.

How Paying Off Credit Cards Affects Your Credit Score

When you pay off credit card balances, it positively affects your credit utilization ratio and payment history:

Credit Utilization

This measures how much of your total credit limits you are using. Lower credit utilization is better for your credit score. Paying off credit cards lowers your credit card balances, so your credit utilization ratio improves.

Payment History

Paying your credit card bill on time adds a positive payment to your credit history. Paying in full is ideal, but even minimum payments on time help.

So by paying off card balances, you directly improve two major factors that make up your FICO and VantageScore credit scores. This is why paying off credit card debt tends to increase your credit score

How Much Your Credit Score Can Increase

It’s hard to give an exact number for how much paying off credit cards will raise your credit score. The increase depends on your situation:

If you had high credit utilization – Paying off cards can increase your credit score a lot if you were using most or all of your credit limits before. This significantly lowers your credit utilization ratio.

If you had low balances – You may only see a small score bump if you already used 30% or less of your credit limits before paying off cards. Your credit utilization was already good.

If you had late payments – Eliminating your balance helps your score if you missed payments before. But one on-time payment after months of mistakes won’t erase your history of missed payments.

If you close accounts – Your credit score might drop slightly if you close credit cards after paying them off. This lowers your total credit limits available.

As a general guideline, you can expect your credit score to increase by 10 to 50 points after paying off credit card debt completely if you keep accounts open. The higher your utilization was before, the more your score can improve. Just don’t expect a single payoff to negate a history of late or missed payments.

How Long It Takes For Your Credit Score To Increase

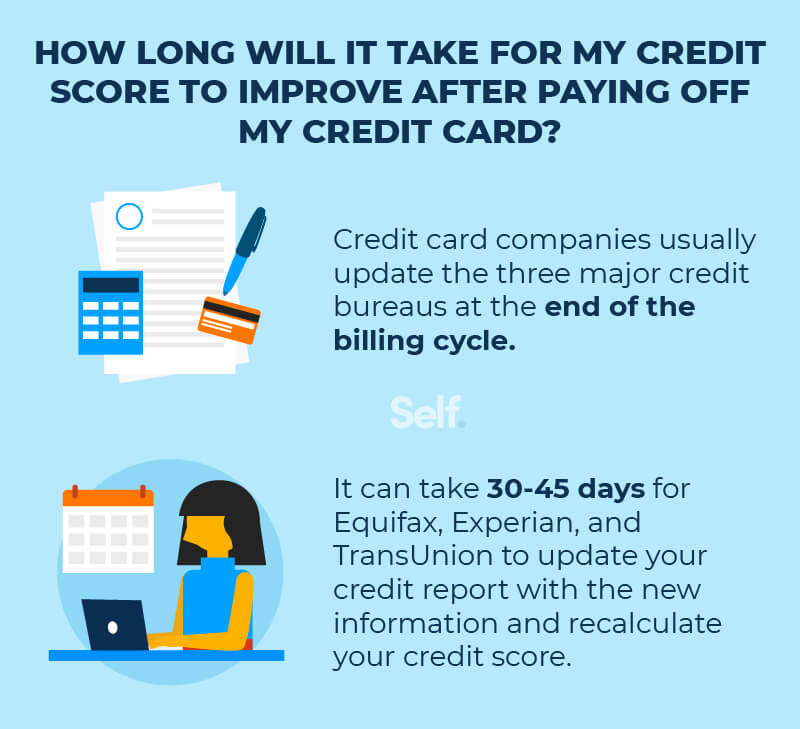

You should see your credit score change within a statement cycle or two after paying off credit cards. Credit card companies report your new lower balance to the credit bureaus after your statement period closes. The updated balance will then be reflected in credit scoring calculations within 30-45 days in most cases.

Paying off credit cards is one of the fastest ways to improve your credit score since the effects are reported and calculated quickly. Just make sure you continue practicing good credit habits after paying off cards to maintain your credit score over time.

Tips to Keep Your Credit Score Up After Paying Off Cards

Here are some tips to make sure your credit score keeps increasing after you pay off credit card balances:

-

Keep accounts open – Don’t close credit cards just because you paid them off. This can shorten your credit history and lower your total credit limits.

-

Use cards lightly – Use paid-off cards occasionally to avoid inactivity closure. Even small charges help.

-

Pay on time always – Your payment history is key. Pay at least the minimum on time every month.

-

Maintain low utilization – Try to keep balances under 30% of credit limits on all cards going forward.

-

Check credit reports – Review your credit reports regularly for errors you should dispute.

-

Limit new accounts – Only open new credit cards sparingly when you need them to avoid red flags.

The most important thing is continuing responsible credit habits over time. Just paying off a credit card balance once won’t give you perfect credit forever. But it can start your credit score moving upward as long as you maintain good financial habits.

Common Questions About Credit Score Increase After Paying Off Cards

Here are answers to some frequently asked questions about how paying off credit cards affects your credit score:

How much does paying off all credit cards increase your credit score?

It depends on your situation, but expect a 10 to 50 point increase if you had high balances before paying off cards. The higher your credit utilization was before, the more room for improvement.

Will my credit score go up if I pay off a credit card?

Yes, your credit score should increase after paying off a credit card balance completely. Just don’t close the account after paying it off.

Does paying off credit cards early help your credit?

Paying off cards early in your statement cycle can help. It lowers the balance reported to the credit bureaus. But you boost your score simply paying off balances anytime.

If I pay off all my credit cards will my credit score go up?

Paying off all your credit card balances will likely increase your credit score as it reduces your overall credit utilization significantly. Again, just keep those accounts open after paying them off.

How long does it take for credit score to go up after paying off credit card?

You should see your credit score start to increase within a billing cycle or two, in 30-45 days, once the credit bureaus have your new lower balance reported.

Can you pay off a credit card before statement date?

Yes, you can pay off balances before your statement closing date. This makes the balance reported lower than if you wait until after the statement date.

What happens if you pay off credit cards and close accounts?

While paying off cards helps your credit score, closing accounts after can slightly hurt it. Your credit history shortens and total available credit decreases.

The Bottom Line

Paying off credit cards in full is one of the fastest ways to give your credit score an uplift. Just don’t close accounts after paying them off. If you had high balances before, your credit score can increase significantly as your credit utilization ratio improves.

But you do need to practice ongoing good credit habits after paying off cards to maintain a higher credit score over time. The bump from a one-time payoff won’t last if you go back to missing payments and maxing out cards. Use your credit wisely and keep balances low going forward.

How much will paying off my credit card benefit my score?

The effect that paying off a card will have on your score depends on your credit utilization. The closer you were to your credit limit(s), the more a paid-off card is likely to lift your score, all other things being equal. The way you pay off the balance also makes a difference.

- Paying off the full balance: If your credit utilization drops significantly because you wiped out your credit card debt, you’ll likely see improvement once the lower balance is reported to the three major credit bureaus.

- Paying it off slowly and methodically: Most credit scoring models will also reflect your progress incrementally. You won’t see a huge increase when you finally get that balance to zero.

- Paying off one card, but having balances on the others: Your credit utilization is calculated both per-card and overall. While it’s best to pay off all cards every month, you’re headed in the right direction if you eliminate one balance.

Should I carry a balance or pay my card in full?

Carrying a balance does not help your credit score. There is a persistent myth that paying off your entire balance is a mistake when you are trying to build credit. That’s not true.

It’s best for your wallet and for your score to pay balances in full and on time. Second-best? Pay at least the minimum payment, on time.

If you carry a balance, try to keep it below 30% of your credit limit — and much less is better — because having a high credit utilization will harm your scores. (You can check to see how much of your credit limits you are using by viewing your free credit score from NerdWallet.)

On the flip side, not using a card at all can lead to the card being canceled for inactivity.