Are You Behind or Ahead in Your Financial Journey?

Let’s be honest – turning 40 hits different. You’re likely juggling career demands, family responsibilities, and maybe even caring for aging parents. With all that going on, it’s no wonder if retirement savings has taken a backseat.

But here’s the uncomfortable truth your 40s are critical for building wealth You’ve still got time to course-correct, but the runway is getting shorter

So how much should someone who is 40 years old have saved? The short answer is that most financial experts say you should have saved about three times your yearly salary by that age. But the real answer is much more nuanced.

In 2025, what does the data really say about savers in their 40s? More importantly, what should you do if you’re not quite there yet?

The Expert Recommendations vs. Reality

According to Fidelity, one of the largest retirement plan providers, you should aim to have 3 times your annual salary saved by age 40. If you’re earning the median salary for 40-year-olds (about $70000) that means you should ideally have around $210,000 saved.

But the Motley Fool suggests a slightly lower but still substantial target of $185,000 if you’re earning the average salary of $65,676 for full-time employees between 35-44.

Reality Check: What Americans Actually Have Saved

Here’s where it gets interesting. According to Fidelity’s latest report from 2025, Americans in their early 40s (ages 40-44) have an average of $105,900 in their 401(k) accounts. Those between 45-49 have about $146,700.

That’s significantly less than the recommended 3x salary benchmark.

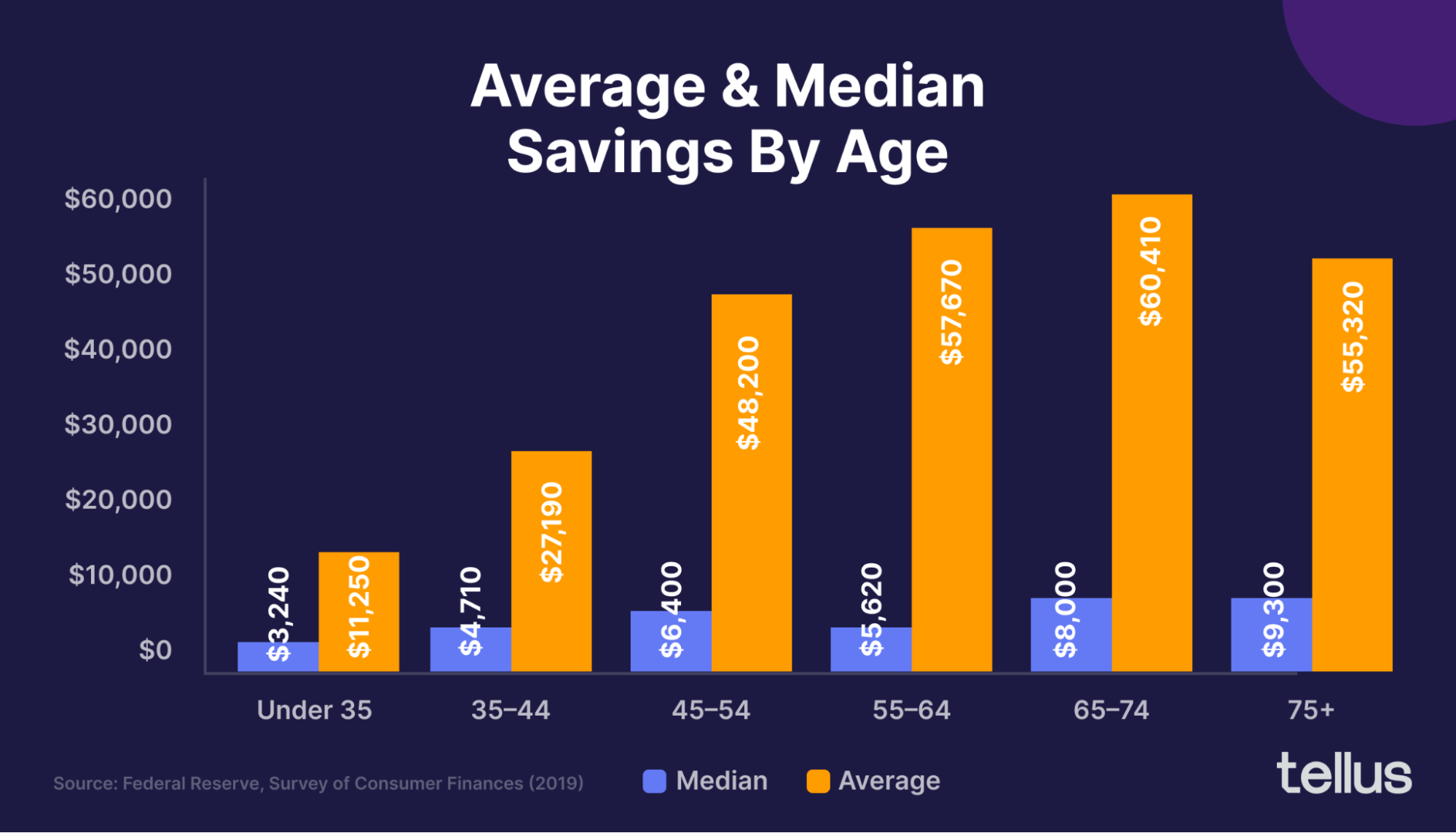

The Federal Reserve data paints an even more sobering picture:

- Only about 55% of people between 35-44 even have a retirement account

- The median balance for those who do? Just $60,000

- The median net worth for this age group is $91,110

Why You’re Probably Behind (And Why It’s Not Entirely Your Fault)

If you’re feeling a bit panicky looking at these numbers, take a deep breath. There are legitimate reasons why many 40-somethings are behind:

- You survived multiple economic crises – From the 2008 recession to the pandemic, your prime earning years have been disrupted by major economic upheavals

- Education costs exploded – Many of us are still paying off student loans

- Housing costs increased dramatically – Especially if you live in a major metropolitan area

- You’ve been prioritizing your kids – College savings accounts, braces, summer camps… raising kids is expensive!

- Life happened – Divorce, medical issues, career changes – all can derail even the best financial plans

Catching Up: It’s Not Too Late (I Promise)

The good news? At 40, you likely have 20+ years before retirement. That’s plenty of time for compound interest to work its magic – IF you start now.

Here’s my step-by-step plan to catch up:

1. Max Out Your Retirement Accounts

First things first: if your employer offers a 401(k) match, grab every penny of it. That’s free money!

For 2025, you can contribute:

- Up to $23,000 to your 401(k)

- An additional $6,500 to an IRA

If you’re married and your spouse works, double these opportunities.

2. Prioritize Roth Accounts When Possible

This is a key strategy the Motley Fool recommends for 40-somethings. While traditional retirement accounts give you a tax break now, Roth accounts offer tax-free withdrawals in retirement.

A tax-free source of income in your golden years is very helpful, especially if you’re trying to catch up on your savings and may not have a lot of money saved up.

3. Boost Your Income (Even Temporarily)

According to financial experts, adding just $100 per week in side income (after taxes) and investing it could add nearly $300,000 to your retirement savings over 20 years (assuming 10% annual returns).

Consider:

- Negotiating a raise (at 40, you likely have valuable skills)

- Changing jobs (often the fastest way to increase salary)

- Starting a side hustle

- Monetizing a hobby

4. Build That Emergency Fund

This might seem counterintuitive when you’re trying to catch up on retirement, but hear me out. At 40, an emergency is one of the biggest threats to your retirement plans.

You might have to take money out of your retirement account at the worst possible time if you lose your job or have a medical emergency when the market is down. You will have to pay taxes, penalties, and sell your assets at a loss.

Aim for 6 months of expenses in a high-yield savings account.

5. Be Strategic About Family Financial Support

Many 40-somethings find themselves in the “sandwich generation” – supporting both kids and aging parents simultaneously.

Set clear boundaries on how much financial support you can provide while still meeting your own savings goals. Remember: your kids can get loans for college, but no one will loan you money for retirement!

What Your Savings Should Look Like at Different Ages

For context, here’s what financial experts recommend at different age milestones:

| Age | Recommended Savings (Multiple of Salary) |

|---|---|

| 30 | 1x annual salary |

| 35 | 2x annual salary |

| 40 | 3x annual salary |

| 45 | 4x annual salary |

| 50 | 6x annual salary |

| 55 | 7x annual salary |

| 60 | 8x annual salary |

| 67 | 10x annual salary |

The Uncomfortable Truth About Racial Wealth Gaps

We can’t discuss average savings without acknowledging significant disparities across demographic groups. According to Federal Reserve data:

- White non-Hispanic Americans have average financial assets of $481,430

- Black non-Hispanic Americans have average financial assets of $68,800

- Hispanic Americans have average financial assets of $50,390

These disparities reflect systemic issues including discriminatory lending practices, income inequality, and unequal access to financial education.

My Final Thoughts: Focus on Progress, Not Perfection

I’ve worked with hundreds of clients in their 40s who felt hopelessly behind on retirement savings. Five years later, many were back on track.

The key was focusing on progress rather than perfection. Instead of beating yourself up about past financial mistakes, concentrate on what you can control right now.

Remember:

- Small increases matter – Boosting your savings rate by just 1-2% annually can dramatically change your retirement outlook

- Consistency beats timing – Regular contributions over time will outperform trying to time the market

- It’s never too late – Even if you’re starting from zero at 40, you can still build substantial wealth before retirement

Here’s my challenge to you: Increase your retirement contributions by at least 1% this month. Then set a calendar reminder to increase it another 1% in six months. These small changes compound dramatically over time.

The best time to start saving was 20 years ago. The second best time is today.

Quick Action Steps for 40-Something Savers

- Calculate your personal target – Multiply your current salary by 3 to see your ideal savings benchmark

- Check your current savings – Add up all retirement accounts and other investments

- Determine your gap – Subtract your current savings from your target

- Create a catch-up plan – Divide your gap by the years until retirement to see your annual savings need

- Automate your savings – Set up automatic transfers so you don’t have to think about it

Remember, financial health isn’t just about hitting arbitrary benchmarks. It’s about creating security and options for your future self. Every dollar you save today is a gift to that person.

What’s your biggest challenge in saving for retirement? Comment below and I’ll try to address it in a future post!

Advice that meets you where you are

Not sure what your goals are yet? That’s okay. Explore advice tailored to your needs — and discover what matters most to you along the way.

T. Rowe Price was named one of the best financial advisory firms of 2025*

Retirement planning can be intimidating at any age—even more so early in your career. When retirement seems so far in the future, it’s hard to plan for it with so many competing priorities in the present. For example, in addition to your regular bills, you may have student loans to repay. Or maybe you’re trying to save money to buy a house or pay for your children to go to college.

Still, it’s important to make steady progress toward saving, no matter what your age. Moreover, taking stock of where you stand can help you plan with more intention based on your situation.

What should I have saved by age 35, 50, and 60?

There is a lot of research showing that people tend to rely on approximations or rules of thumb when it comes to financial decisions.

Because of this, a lot of financial companies put out savings benchmarks that show how much a person should save based on their age and income. A savings goal isn’t a replacement for thorough planning, but it is a quick way to see if you’re on the right track. It’s much better than the alternative that some people use—blindly guessing! More importantly, it can act as a catalyst to take action and start saving more.

However, for the benchmark to be useful, it needs to be realistic. Setting the target too low can lead to a false sense of confidence; setting it too high can discourage people from doing anything. Articles on retirement savings goals have generated spirited discussion about the reasonableness of the targets.

How Much You Should Save In Your 401K By Age

FAQ

How much does the average 40 year old have in savings?

| Age Range | Account Balance |

|---|---|

| Ages 35-44 | $41,540 |

| Ages 45-54 | $71,130 |

| Ages 55-64 | $72,520 |

| Ages 65-74 | $100,250 |

Is 100k saved by 40 good?

Having $100000 in your 401(k) by your late 30s to early 40s is considered a strong position, especially if you are contributing consistently and taking advantage of employer matches. Starting early and maximizing contributions can significantly impact your retirement savings over time due to compound growth.

Can you retire at 40 with $500,000?

It is possible to retire at age 40 with $500,000, but you will probably need to live cheaply, plan your finances carefully, and maybe find other ways to make money, since $500,000 usually only gives you a small income. You’ll need to significantly reduce your living expenses, possibly by relocating to a lower-cost area or owning a home outright.

How much money should you be worth at 40?

The median net worth at age 40 is around $135,300. This is according to the Federal Reserve’s most recent Survey of Consumer Finances (SCF). However, what your net worth should be depends entirely on your personal situation.

How much should a 40 year old save for retirement?

You may be starting to think about your retirement goals more seriously. By age 40, you should have saved a little over $185,000 if you’re earning an average salary and follow the general guideline that you should have saved about three times your salary by that time.

How much money should I have saved for retirement?

The following savings guidelines can be a starting point for evaluating your progress toward a fully funded retirement. These rules of thumb say you should have saved 2 to 3 times your income by age 40. 3 to 4 times your income by age 45. These income-based targets assume you can live on a similar or slightly lower income during retirement.

How much money should a 50 year old have saved?

At the same age, but making $90,000, the person should have saved $90,000. An individual at age 50 making $300,000, should have saved 1,955,000. Here are the tables from JP Morgan’s report: Retirement Savings Checkpoints with income ranging from $100k to $300k.

How much money should you save at age 60?

Based on Federal Reserve data, Americans aged 55 to 64 had an average of $570,250 in financial assets. Fidelity recommends that you have eight times your annual salary saved at age 60. Right now, the average household income is just over $80610. So, those numbers don’t quite add up, but they’re close.

How much money should a 30 year old have saved for retirement?

For example, it found that someone age 30 making $50,000 a year should have already saved $20,000 for retirement. At the same age, but making $90,000, the person should have saved $90,000. An individual at age 50 making $300,000, should have saved 1,955,000. Here are the tables from JP Morgan’s report:

How much money can a 35-year-old save?

The Federal Reserve found that people aged 35 to 44 had an average of $170,740 saved. A 35-year-old might not have quite that much saved up. But you’ll likely have some bigger savings goals on the horizon. Maybe you are starting to think about retirement. Maybe you are working to build your career for long-term financial earnings.