Are you putting off retirement planning because you think you need thousands to get started? I’ve got some good news that might surprise you! Starting a Roth IRA is way more accessible than most folks realize, and I’m gonna break down exactly how little you need to get your retirement savings rolling.

The Surprising Minimum to Start a Roth IRA

Here’s the shocker you can technically start a Roth IRA with $0

That’s right, the IRS doesn’t say how much you have to put into a Roth IRA. They only say how much you can put in. However, things are a little more complicated in real life. The IRS does not set a minimum, but the brokerage firm that holds your Roth IRA may.

Let’s look at what different popular brokerages require:

- M1 Finance: Requires $500 minimum investment

- Vanguard: Requires $1,000 for Target Retirement Funds or STAR Fund (most other Vanguard funds need at least $3,000)

- Some online brokers: Offer $0 minimum accounts with no setup fees

So the real answer? Depending on where you open your account, you might need anywhere from $0 to $3,000 to get started.

Why Starting Small Still Makes Sense

Maybe you’re thinking, “I can only afford to put away $25 or $50 a month right now—is that even worth it?”

Yes, thanks to compound interest, small contributions can add up to a lot over time. Watch this video to see how much even small monthly donations can add up to:

| Monthly Contribution | Annual Contribution |

|---|---|

| $5 | $60 |

| $25 | $300 |

| $50 | $600 |

| $100 | $1,200 |

| $200 | $2,400 |

| $500 | $6,000 |

| $541.67 | $6,500 |

Here’s a real-world example: If you’re 30 years old and contribute just $100 per month ($1,200 per year) to your Roth IRA, by retirement at age 67, you could have over $200,000 in tax-free money! And that’s assuming a pretty modest 6% average return.

2025 Roth IRA Contribution Limits

Before you start putting money in, you should know the max amounts you can contribute. For 2025:

- Under age 50: $7,000 per year

- Age 50 or older: $8,000 per year (includes $1,000 “catch-up” contribution)

But your actual limit might be lower based on your income and tax filing status. In 2025:

- Single filers: Can contribute the full amount if making less than $150,000. Contribution amount phases out between $150,000-$165,000. No contributions allowed if making $165,000+.

- Married filing jointly: Full contribution if making less than $236,000. Phases out between $236,000-$246,000. No contributions if making $246,000+.

Who’s Eligible for a Roth IRA?

Eligibility for a Roth IRA depends on a few factors:

- You need earned income – You can’t contribute more than you earned that year.

- Income limits apply – As shown above, high-income earners may be limited or ineligible.

- No age restrictions – Unlike traditional IRAs in the past, Roth IRAs have never had age restrictions.

A Roth IRA (custodial account) can be owned by anyone, even minors with earned income. Spouses who don’t work but file jointly with a working spouse can also contribute through a spousal IRA.

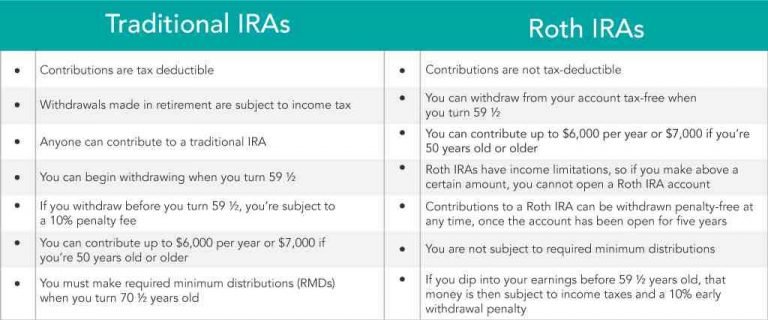

Roth vs. Traditional IRA: Quick Comparison

Still trying to decide between a Roth and Traditional IRA? Here’s a simple breakdown:

Roth IRA:

- Contributions are not tax-deductible now

- Qualified withdrawals are completely tax-free in retirement

- No required minimum distributions (RMDs) during your lifetime

- Can withdraw contributions (but not earnings) anytime without penalties

Traditional IRA:

- Contributions may be tax-deductible now (depending on income and workplace retirement plan status)

- Withdrawals are taxed as ordinary income in retirement

- Required minimum distributions starting at age 73

- 10% penalty on withdrawals before age 59½ (with some exceptions)

How to Open a Roth IRA with Limited Funds

Ready to start but don’t have much cash? Here’s a step-by-step approach:

1. Compare Online Brokerage Firms

Look for:

- Low or no minimums

- No account maintenance fees

- Low-cost investment options

- Fractional share investing (lets you invest with very small amounts)

Some of the best brokers for first-time investors with little money are M1 Finance (needs $500), Betterment, and others with $0 minimums.

2. Fund Your Account

Even if you can only start with the minimum required amount, that’s perfectly fine! Remember, starting is the hardest part.

3. Choose Simple Investments

When you’re starting small:

- Target-date retirement funds require as little as $1,000 at some brokers

- ETFs often have no minimums beyond the cost of one share (and some brokers offer fractional shares)

- Index funds offer instant diversification with relatively low entry points

4. Set Up Automatic Contributions

This is super important! Even if it’s just $25 a week or $100 a month, automatic contributions help you:

- Stay consistent

- Take advantage of dollar-cost averaging

- Gradually increase as your income grows

Real Talk: Why I Wish I Started Earlier

I gotta be honest – when I first started looking into retirement accounts, I put it off because I thought I needed thousands of dollars to start. BIG mistake! I could’ve had years more growth if I’d known you could start with so little.

Don’t make my mistake. The power of a Roth IRA isn’t just in how much you contribute, but in how long your money has to grow. Starting with just $500 or $1,000 today is WAY better than waiting until you have $5,000 five years from now.

The Magic of Tax-Free Growth

Let’s talk about why Roth IRAs are so powerful, especially if you’re starting small. With a Roth IRA:

- You pay taxes on money now (when your contributions are relatively small)

- All growth—potentially decades of compound returns—is 100% tax-free

- Withdrawals in retirement are tax-free (when your account might be worth hundreds of thousands)

This is especially beneficial if:

- You’re currently in a lower tax bracket than you expect to be in retirement

- You’re young and have decades for tax-free growth

- You want flexibility (Roth contributions can be withdrawn anytime)

Where to Open Your Roth IRA

When you’re starting with limited funds, choosing the right brokerage matters. Here are some popular options:

- M1 Finance: $500 minimum, no hidden fees, fractional shares available

- Betterment: Robo-advisor that creates a portfolio based on your goals and risk tolerance

- Vanguard: Traditional brokerage with excellent low-cost funds, higher minimums ($1,000-$3,000)

Summary: Just Get Started!

The most important takeaway? You don’t need much to start a Roth IRA!

- Technically, the IRS minimum is $0

- Practical minimums range from $0-$1,000 depending on the broker

- Even small monthly contributions add up significantly over time

- The sooner you start, the more powerful compound interest works for you

Don’t let a small starting amount discourage you. I’ve seen too many people delay retirement savings because they’re waiting until they have “enough” to start. The truth is, the best time to start your Roth IRA was yesterday—the second best time is today, even if you’re starting small!

Have you started your Roth IRA yet? What’s holding you back? Drop a comment below—I’d love to help you get started on your retirement journey!

Remember: While this article provides general information about Roth IRAs, everyone’s financial situation is different. It’s always a good idea to consult with a financial advisor about your specific retirement planning needs.

What’s the deadline for making contributions in a given year?

ROTH IRA The Roth IRA contribution deadline is typically April 15 of the following year.

TRADITIONAL IRA The deadline is typically April 15 of the following year.

Self-employed or own a small business?

You may be able to save even more with a SEP-IRA, SIMPLE IRA, or Individual 401(k).

Roth IRA Explained Simply for Beginners

FAQ

What disqualifies you from opening a Roth IRA?

You usually can’t put money into a Roth IRA if your Modified Adjusted Gross Income (MAGI) is higher than the IRS’s income limits. For 2025, those limits are $165,000 for single filers and $246,000 for married couples filing jointly. Additionally, you must have earned income to contribute; .

How much money does it cost to start a Roth IRA?

It typically costs nothing to open a Roth IRA account itself, though you’ll need to fund it with an initial investment and potentially pay ongoing fees for investments or account maintenance, depending on your chosen broker.

Can I start a Roth IRA with no money?

Yes, you can open a Roth IRA with no money to start, as many brokers have a $0 account minimum, but you must have earned income to contribute to it. To contribute, you generally need wages, salaries, tips, or other self-employment income, or be the spouse of someone with earned income (a spousal IRA).

How do I open a Roth IRA for a beginner?

Opening your Roth IRA It’s easy. You can go through your current discount brokerage, like ETrade or Datek. You can also go through an independent service like Vanguard. Call them up, tell them you want to open a Roth IRA, and they’ll walk you through it.

How much money can I contribute to a Roth IRA?

Contributions to your retirement savings can be made as pre-tax or post-tax Roth contributions. The IRS sets an annual limit for Roth IRA contributions. We recommend that your total annual contributions, including both employer and personal contributions, equal at least 18% of your total annual compensation.

Is there a fee to open a Roth IRA?

While there generally isn’t a fee for opening a Roth IRA, there may be other costs and requirements depending on your provider and selected investments. Some brokers and robo-advisors — but not all — may require a minimum amount to open an account with them, or charge trading commissions when investments are bought and sold.

Can a single person open a Roth IRA?

Anyone can open a traditional IRA and contribute funds. If you’re single and make less than $161,000 a year, or $240,000 a year if you’re married and file taxes jointly, you can put money into a Roth IRA. These income limits are subject to change each year.