How much do you need to save for retirement? Its one of the most common questions people have. And no wonder. That’s why there are so many unknowns: when will you retire? how much will you spend? and for how long?

Thats why we did extensive analysis to come up with age-based retirement savings factors that can help you plan—in spite of those uncertainties. These milestones are aspirational. You likely wont meet all of them. But they can serve as goalposts to help you make a plan to save enough to maintain your lifestyle in retirement.

A lot of research shows that you should try to save at least 15% of your annual income, which includes any contributions from your employer.

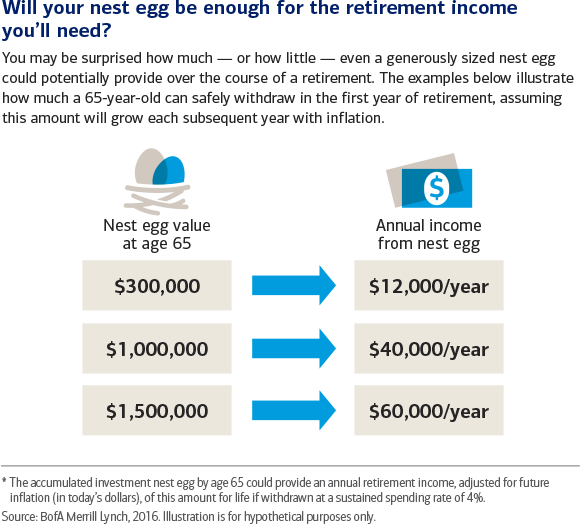

A sustainable withdrawal rate is estimated to be no more than 4% to 5% yearly, with adjustments for inflation.

Our savings factors are based on the assumption that a person saves 15% of their annual income starting at age 25 (which includes any employer match), invests more than 20% of their savings over the course of their lifetime in stocks, retires at age 67, and plans to keep living the way they did before retirement (see footnote 1% for more details).

Based on those assumptions, we estimate that saving 10x (times) your preretirement income by age 67, together with other steps, should help ensure that you have enough income to maintain your current lifestyle in retirement. That 10x goal may seem ambitious. But you have many years to get there. To help you stay on track, we suggest these age-based milestones: Aim to save at least 1x your income by age 30, 3x by 40, 6x by 50, and 8x by 60. Your personal savings goal may be different based on various factors including 2 key ones described below. But these guidelines can provide a starting point to help your build your savings plan, and assess your progress.2,3

I completely understand why you want to retire early at age 58. It sounds like you’ll have more time for family, hobbies, and finally taking that cross-country road trip you’ve been dreaming about. But here’s the million-dollar question: how much money do you really need to retire at age 58?

Because I really want to retire early, I’ve spent a lot of time researching this subject. Would you believe what I found? It’s not just about having a lot of money saved up to retire at 58. You need to carefully plan, think strategically, and have realistic expectations about how much it will cost you in the future.

So grab a cup of coffee and let’s dive into everything you need to know about retiring at age 58. Trust me, by the end of this article, you’ll have a much clearer picture of your retirement number

Why Retiring at 58 Is Different (And More Expensive)

Before we jump into specific dollar amounts, we need to understand why retiring at 58 presents unique challenges:

- Longer retirement period – If you retire at 58 and live to 100 (which is increasingly common), that’s a 42-year retirement you need to fund!

- No Social Security yet – You can’t claim Social Security until 62 at the earliest (with reduced benefits), meaning you need to cover 4+ years completely on your own.

- No Medicare until 65 – This is a big one! You’ll need private health insurance for 7 years, which can be extremely expensive.

- Early withdrawal considerations – Taking money from your retirement accounts before 59½ may trigger penalties (though there are exceptions).

These factors mean your retirement savings need to stretch further than someone retiring at the traditional age of 65 or older.

The Magic Number: How Much You Need to Save

At this point, we have information from several sources that says if you want to retire comfortably at 58 years old,

You’ll need approximately $134 million in savings by age 58

This calculation assumes:

- You’ll withdraw about $50,000 in your first year of retirement

- Your withdrawal amount will increase by 2.5% annually to keep pace with inflation

- Your investments will continue growing at a modest 5% average annual return

- You’ll live to approximately age 100

Of course, this is just a baseline. Your actual number could be higher or lower depending on several factors.

Factors That Impact Your Retirement Number

1. Your Desired Lifestyle

Be honest with yourself: do you want a simple, cheap retirement or do you want to travel a lot and live a fancy life? Your expected annual costs will make a big difference.

Some questions to ask yourself:

- Will your mortgage be paid off?

- How much travel do you plan to do?

- Do you have expensive hobbies or interests?

- Will you be supporting adult children or aging parents?

2. Where You’ll Live

According to a recent CNBC analysis, the cost of a comfortable retirement varies dramatically by state:

- Mississippi is the most affordable state, requiring about $55,074 annually

- Hawaii is the most expensive, requiring a whopping $121,228 annually

- Most states fall somewhere between $58,000 and $75,000 per year

Your location choice can literally make a $66,000 difference in your annual expenses! States with lower housing costs and taxes (like Mississippi, Alabama, and Oklahoma) require significantly less savings than states with high costs of living (Hawaii, California, and Washington D.C.).

3. Healthcare Costs

This is probably the biggest wild card. Healthcare costs before Medicare eligibility can be substantial, and even after Medicare kicks in at 65, you’ll still have expenses.

According to Fidelity’s annual Retiree Health Care Cost Estimate, a 65-year-old who retired in 2024 can expect to spend approximately $165,000 on healthcare during retirement. Since you’re retiring at 58, you’ll need to add the cost of seven years of private insurance before Medicare.

A rough estimate? Plan for at least $200,000-$250,000 in healthcare costs throughout your retirement if you’re relatively healthy.

Creating Your Retirement Income Strategy

When retiring at 58, you need to carefully plan how you’ll generate income during different phases of retirement:

Phase 1: Age 58-62 (Pre-Social Security)

During these years, you’ll rely entirely on:

- Your personal savings and investments

- Any pension benefits if you’re lucky enough to have them

Phase 2: Age 62-65 (Early Social Security Option + Pre-Medicare)

You can start taking Social Security, but with reduced benefits:

- At age 62, your benefit is reduced to about 70% of what you’d get at full retirement age

- In 2025, the maximum monthly benefit at age 62 is $2,831

- You’ll still need private health insurance

Phase 3: Age 65+ (Medicare Eligibility)

Your healthcare costs will likely decrease once Medicare kicks in, but you’ll still have:

- Medicare premiums (Part B and possibly Part D)

- Supplemental insurance costs

- Out-of-pocket expenses

Phase 4: Age 67+ (Full Retirement Age for Social Security)

If you waited until now to claim Social Security, you’d get your full benefit:

- Maximum monthly benefit at full retirement age is $4,018 in 2025

- Waiting until age 70 could increase your benefit to as much as $5,108 monthly

Accessing Your Retirement Accounts at 58

Here’s where it gets a little tricky. Most retirement accounts have age restrictions:

401(k) Plans:

Good news! The “Rule of 55” allows you to withdraw from your current employer’s 401(k) without the 10% early withdrawal penalty if you leave your job in or after the year you turn 55.

IRAs and Roth IRAs:

These typically require you to be 59½ to avoid penalties, but there are exceptions:

- Substantially Equal Periodic Payments (SEPP) or Rule 72(t) distributions

- Roth IRA contributions (not earnings) can be withdrawn anytime tax-free

Taxable Investment Accounts:

These have no age restrictions, making them valuable for early retirees.

Sample Retirement Budget at 58

Let’s look at what a realistic annual budget might look like for someone retiring at 58:

| Expense Category | Monthly Cost | Annual Cost |

|---|---|---|

| Housing (mortgage/rent, taxes, insurance, maintenance) | $1,500 | $18,000 |

| Healthcare (insurance premiums + out-of-pocket) | $1,200 | $14,400 |

| Utilities | $400 | $4,800 |

| Food & groceries | $600 | $7,200 |

| Transportation | $400 | $4,800 |

| Travel/entertainment | $800 | $9,600 |

| Miscellaneous | $500 | $6,000 |

| TOTAL | $5,400 | $64,800 |

This budget would require approximately $1.6-$1.7 million in retirement savings, assuming the 4% withdrawal rule. That’s slightly higher than our baseline estimate because I’ve included a more generous travel budget.

Steps to Determine Your Personal Retirement Number

- Track your current expenses – Look at what you’re spending now and how it might change in retirement

- Factor in healthcare costs – Add premiums for private insurance until Medicare eligibility

- Consider inflation – Most experts suggest planning for 2.5%-3% annual inflation

- Account for taxes – Remember that withdrawals from traditional retirement accounts are taxed

- Use a retirement calculator – The Merrill Personal Retirement Calculator can help with projections

- Build in a safety margin – Add 15-20% to your number for unexpected expenses

My Thoughts on Early Retirement Planning

I think one of the biggest mistakes people make is underestimating how long their money needs to last. Nearly a third of today’s retirees live into their 90s, and with improving healthcare, that number will likely increase.

We also tend to underestimate inflation’s impact. Even a modest 2.5% inflation rate means prices will double about every 28 years. That $5 coffee you enjoy today might cost $10 when you’re in your 80s!

From my experience talking to friends who’ve retired early, the biggest surprise is usually healthcare costs. Many didn’t realize just how expensive private insurance would be before Medicare eligibility. Don’t make that mistake!

Bottom Line: Is Retiring at 58 Realistic for You?

Retiring at 58 is absolutely possible, but it requires serious planning and disciplined saving. Here’s my honest take:

- If you have at least $1.3-$1.5 million saved, no debt, and moderate spending habits, you’re probably in good shape.

- If you have less saved but have guaranteed income sources like a pension, you might still be okay.

- If you’re planning to rely solely on Social Security eventually and have less than $1 million saved, you might want to reconsider your timeline or location.

The most important thing is to be realistic about your expenses and create a detailed plan. Working with a financial advisor can help you fine-tune your strategy and identify potential pitfalls.

Remember, retiring early isn’t just about having enough money – it’s about having enough purpose and activities to fill those extra years. Make sure you’re retiring TO something, not just FROM something!

Have you started planning for early retirement? What challenges are you facing? I’d love to hear your thoughts in the comments below!

How you want to live in retirement

In other words, do you expect your expenses to go down when you retire? We call that a below average lifestyle. Or will you spend as much as you do now? Thats average. If you expect your expenses will be more than they are now, thats above average.

Lets look at some hypothetical investors who are planning to retire at 67. Joe is planning to downsize and live frugally in retirement, so he expects his expenses to be lower. His savings factor might be closer to 8x than 10x. Elizabeth is planning to retire at age 67 and her goal is to maintain her lifestyle in retirement, so her savings factor is 10x. Sean sees retirement as an opportunity to travel extensively, so it may make sense for him to save more and plan for a higher level of retirement spending. His savings factor is 12x at age 67.

Sign up for Fidelity Viewpoints weekly email for our latest insights.

Our simple widget lets you see the impact of these 2 variables—when you plan to retire and what kind of lifestyle you want to live in retirement—on how much you need to have saved when you do retire, and on all the intermediate milestones.

What if youre behind? If youre under age 40, the simple answer is to save more and invest for growth through a diversified investment mix. Of course, stocks come with more ups and downs than bonds or cash, so you need to be comfortable with those risks. If youre over 40, the answer may be a combination of increased savings, reduced spending, and working longer, if possible.

No matter what your age, focus on the goals ahead. If you aren’t at your next milestone yet, don’t give up. You can catch up to future milestones by planning and saving. The key is to take action, and the earlier the better.

When you plan to retire

The age you plan to retire can have a big impact on the amount you need to save, and your milestones along the way. The longer you can postpone retirement, the lower your savings factor can be. That’s because waiting longer gives your savings more time to grow, you’ll live longer in retirement, and your Social Security benefit will be bigger.

Consider some hypothetical examples (see graphic). Max plans to delay retirement until age 70, so he will need to have saved 8x his final income to sustain his preretirement lifestyle. Amy wants to retire at age 67, so she will need to have saved 10x her preretirement income. John plans to retire at age 65, so he would need to have saved at least 12x his preretirement income.

Of course, you cant always choose when you retire—health and job availability may be out of your control. But one thing is clear: Working longer will make it easier to reach your savings goals.

See footnote 1 at the end of the article for more information.

Can You Retire with $500k at 58?

FAQ

How much should you have saved to retire at 58?

If you want an annual retirement income of $50,500 per year (or $4,208. 33 a month), you should aim to save approximately $1. 11 million ($50,000 x 22 = $1. 11 million) before you turn 58.

Can I retire at 58 with $600000?

If you manage to stay healthy and never need long-term care then $600,000 could be enough to sustain you in retirement. If you need long-term care in a nursing home, on the other hand, that could really eat away at your savings.

Can I retire at 58 with $2 million dollars?

Your ability to retire on $2 million depends on your expenses in retirement. Because lifestyle drives monthly expenses, your activities and hobbies may run up against your $80,000 annual income. This amount equates to $6,666 per month.

Is $3 million enough to retire at 58?

Yes, retiring early with $3 million is possible. If you plan to retire at 55, you will have to account for 11 additional years of expenses and 11 fewer years of income compared to retiring at 66. However, with careful planning, $3 million can provide a comfortable retirement starting at 55. 4.

What happens if you retire at 58?

Make provision for healthcare: If you go into retirement at 58, you won’t become eligible for Medicare for another seven years when you turn 65. If your employer doesn’t pay for your health insurance after you retire, look into private health insurance or make sure you have other ways to budget for medical costs.

How to save for retirement at 58?

Here are some more tips on how to save money to retire at age 58: Estimate your retirement costs: As we already said, think about how much money you will need in retirement. These depend on your personal needs, lifestyle, where you live, and other factors that influence the cost of living.

How much money should a 58 year old save?

If you want an annual retirement income of $50,500 per year (or $4,208.33 a month), you should aim to save approximately $1.11 million ($50,000 x 22 = $1.11 million) before you turn 58. Remember to factor in Social Security benefits and any other benefits or income you might receive during retirement. What are the average retirement savings at 58?

How much should you have saved for retirement?

A common rule of thumb for retirement saving is to have 10 times your income in the bank by age 67. So if you plan to retire at 58, you’d want to have saved approximately the same amount as someone retiring at 67 making the same income. For instance, if you make $75,000 a year, you’d want to have $750,000 saved for retirement. Average Retirement Savings By Age 55. How much should you have saved?

Can I retire at 58 with 500K saved?

If you want to retire at 58, you need to consider the rules surrounding tax-advantaged retirement accounts. With a 401 (k), you ordinarily cannot withdraw money penalty-free before age 59.5. However, there is an exception to this rule called the Rule of 55. Can I retire at 60 with 500k? Yes, you can!

How much money can you make a year after retirement?

For example, if a person made roughly $100,000 a year on average during his working life, this person can have a similar standard of living with $70,000 – $80,000 a year of income after retirement. This 70% – 80% figure can vary greatly depending on how people envision their retirements.