Americans have lofty goals for their retirement, with the typical worker believing they need $1. 46 million to retire comfortably — a jump of 53% from their savings target in 2020, according to a new survey from Northwestern Mutual.

The study found that the average amount held in a retirement account today is only $88,400, which means that most people are still a long way from reaching that goal. That means that the typical worker has a $1. 37 million gap between their actual savings and their retirement aspirations.

Due to the impact of inflation and other financial pressures, Americans today believe they need to sock away more for their golden years compared with 2020, when the typical worker pegged a comfy retirement as requiring $951,000 in savings, Aditi Javeri Gokhale, chief strategy officer at Northwestern Mutual, told CBS MoneyWatch.

But, she added, many workers are also expecting to live longer and spend more time in retirement, which may also explain why people believe they need bigger nest eggs than in prior years. Indeed, Gen Z workers, who are currently in their early 20s, want to retire at 60, and almost 1 in 3 think theyll live to 100, meaning that theyll need to fund a 40-year retirement, the study found.

“The magic number is at an all-time high — its 50% higher than what it was before the pandemic,” Gokhale said. “The general cost of living seems to be higher now than it was before, whether this is true or not.” “.

Social Security is also causing more worry because its trust fund reserves will run out in 2033, which will mean less money for benefits if the program isn’t fixed before then.

“Were all seeing stories about Social Security, and youll see more of that since its election year,” she noted. “So if my benefit will be cut, I have to shoulder more of the burden.”

The Reality Check That Might Keep You Up at Night

Some people worry that they aren’t saving enough for their golden years. Millions of Americans worry every night about whether their retirement savings will be enough when they finally quit their jobs for good.

Here’s the cold, hard truth: the median retirement savings for American households is just $87,000, according to the Federal Reserve Survey of Consumer Finances. That’s… not a lot. Especially when you consider that retirement could last 20-30 years.

But don’t panic yet! Let’s dive deeper into what Americans actually have saved for retirement, broken down by age, and figure out if you’re on track or need to kick your savings into high gear.

The Average vs. Median Retirement Savings: A Tale of Two Numbers

Before we jump into the nitty-gritty let’s clarify something important

- Average (mean) retirement savings: $333,940 for all American families

- Median retirement savings: $87,000 for all American families

Why such a huge gap? Because averages can be heavily skewed by outliers (those ultra-wealthy folks with millions saved). The median gives us a more realistic picture of what typical Americans have saved.

Retirement Savings by Age: How Do You Stack Up?

Let’s break it down by age group to see where most people stand:

| Age Range | Average Retirement Savings | Median Retirement Savings |

|---|---|---|

| Under 35 | $49,130 | $18,880 |

| 35-44 | $141,520 | $45,000 |

| 45-54 | $313,220 | $115,000 |

| 55-64 | $537,560 | $185,000 |

| 65-74 | $609,230 | $200,000 |

| 75+ | $462,410 | $130,000 |

Looking at 401(k) balances specifically (from Fidelity Investments, Q4 2024), here’s what people have saved:

| Age | Average 401(k) Balance |

|---|---|

| 20-24 | $7,300 |

| 25-29 | $24,000 |

| 30-34 | $45,700 |

| 35-39 | $73,200 |

| 40-44 | $109,100 |

| 45-49 | $152,100 |

| 50-54 | $199,900 |

| 55-59 | $244,900 |

| 60-64 | $246,500 |

| 65-69 | $251,400 |

| 70 | $250,000 |

Yikes! If you’re approaching retirement age (55-64) with only the median amount of $185,000, you might be in for a rude awakening.

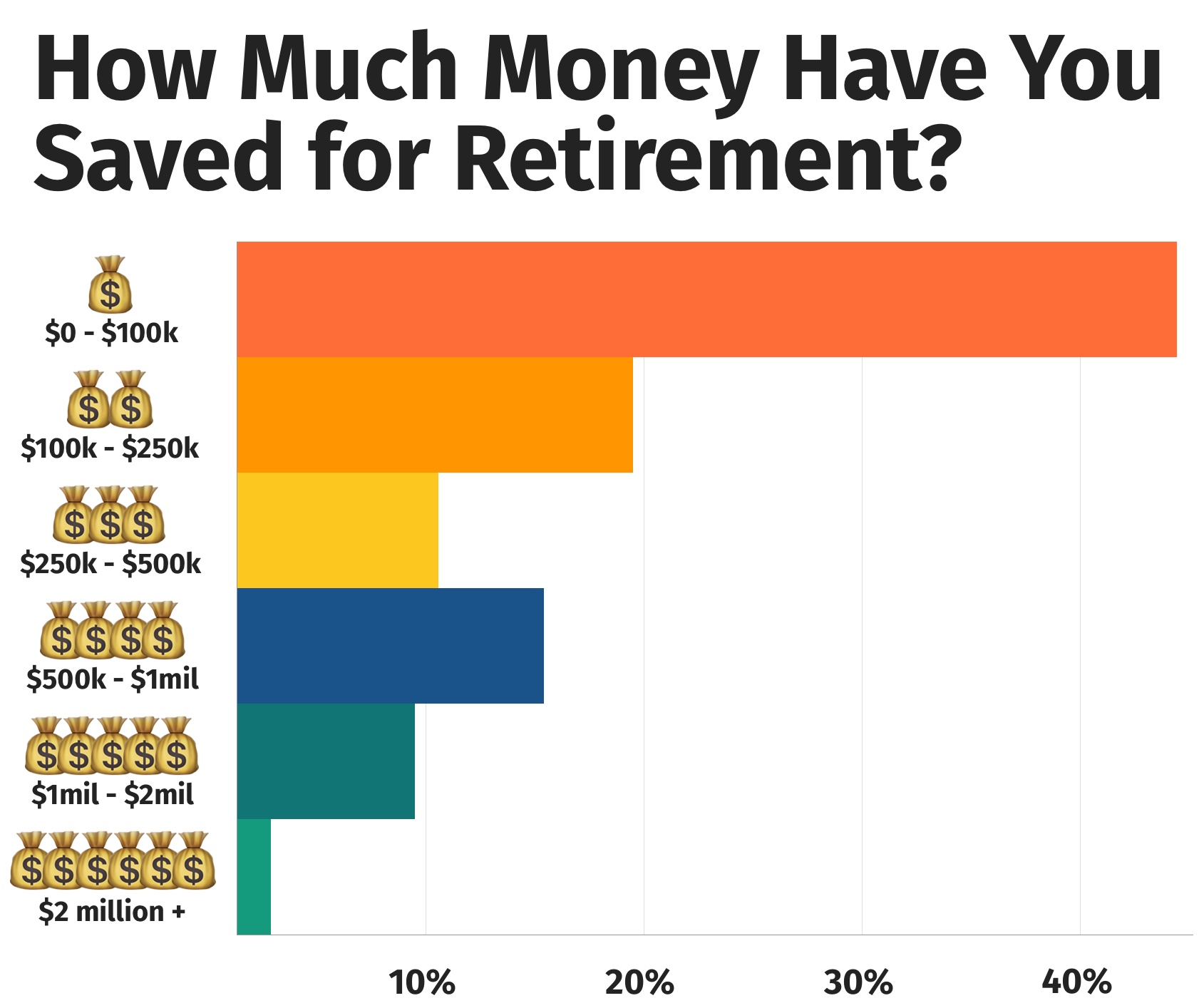

The Millionaire’s Club: How Many Actually Retire Rich?

Everyone wants to retire with a million dollars. But how many Americans actually achieve this milestone?.

A recent CNBC Your Money survey on retirement found that only 1% of retirees say they have more than $1 million saved. And if we look at retirement accounts more closely, only about 5% of individuals S. households have $1 million or more in retirement savings.

Even more exclusive is the $2 million club – just 3.2% of retirees have over $1 million in their retirement accounts, with even fewer having $2 million or more.

What’s the Income Picture in Retirement?

It’s not just about how much you’ve saved – it’s about the income those savings generate. The average household retirement income in the United States is $27,617, according to Wisevoter’s analysis of Census Bureau data.

But this varies widely depending on where you live – some states have much higher or lower averages.

What the Experts Say You SHOULD Have Saved

Now for the part that might make you sweat a little. Financial experts have some pretty clear guidelines on how much you should have saved at different ages:

According to Fidelity Investments:

- By age 30: 1x your annual salary

- By age 40: 3x your annual salary

- By age 50: 6x your annual salary

- By age 60: 8x your annual salary

- By age 67: 10x your annual salary

Other financial experts have slightly different recommendations:

- By age 35: 1x your annual salary

- By age 50: 5x your annual salary

- By age 70: 7x your annual salary

Using these benchmarks, if you earn $80,000 when you retire at 67, your savings goal should be around $800,000.

Why Most Americans Fall Short

So why are most Americans not hitting these targets? Several factors come into play:

- Starting too late: Many don’t begin serious retirement saving until their 40s or 50s, missing out on decades of compound growth

- Inadequate contribution rates: Contributing only 3-5% when experts recommend 10-15%

- High debt loads: Student loans, mortgages, and credit card debt eating into potential savings

- Lack of access to employer plans: Not all workers have access to 401(k) plans

- Financial emergencies: Using retirement funds to cover unexpected expenses

- Economic downturns: Market crashes wiping out significant portions of retirement savings

Will You Outlive Your Money?

One thing that retirees worry about the most is not having enough money. And it’s a legitimate concern. An AARP survey from April 202024 found that 31% of adults saving for retirement aren’t sure they’ll have enough saved, and 33% think they won’t have enough saved.

The traditional “4% rule” suggests that if you have retirement savings of $1 million, you can safely withdraw $40,000 per year (adjusted for inflation) without running out of money for about 30 years.

So that median retirement savings of $200,000 for those aged 65-74? That translates to just $8,000 per year using the 4% rule. Add in the average Social Security benefit of approximately $1,976 per month ($23,712 annually), and many retirees are looking at a total annual income of around $31,712 – hardly luxurious.

Can You Retire on $500K? What About $1 Million?

Let’s address some common questions:

Can you retire with $500,000?

Yes, it’s possible to retire with $500,000, but you’ll need to be careful with your withdrawals. At a conservative withdrawal rate of 4%, $500,000 would provide about $20,000 per year. Combined with Social Security, this might be enough if:

- Your home is paid off

- You live in a low-cost area

- You have modest lifestyle expectations

- You have good health insurance coverage

How long will $1 million last in retirement?

A $1 million nest egg can cover an average of 18.9 years of living expenses, according to GoBankingRates. But this varies dramatically by location – from as little as 10 years in Hawaii to more than 20 years in many states with lower costs of living.

Boosting Your Retirement Savings: It’s Never Too Late

If you’re looking at these numbers and feeling behind, don’t despair! There are ways to catch up:

1. Max Out Tax-Advantaged Accounts

- 401(k) contribution limits for 2025: $23,500, with an additional $7,500 catch-up if you’re 50+

- IRA contribution limits for 2025: $7,000, with an additional $1,000 if you’re 50+

2. Consider Working Longer

Working a few extra years can dramatically improve your retirement outlook by:

- Allowing more time for savings to grow

- Increasing your Social Security benefits

- Shortening the period your savings need to last

3. Develop Multiple Income Streams

- Rental properties

- Part-time work

- Dividend-paying investments

- Side businesses

4. Reduce Expenses

Use a 50/30/20 budgeting system:

- 50% for essentials

- 30% for discretionary spending

- 20% for savings

5. Catch-Up Strategies for Late Starters

- Take advantage of catch-up contributions

- Consider a more aggressive investment strategy (with professional guidance)

- Look into health savings accounts (HSAs) as additional tax-advantaged savings

The Bottom Line: Reality vs. Dreams

The gap between what most Americans have saved and what they need for a comfortable retirement is substantial. While the average retirement savings for those aged 65-74 is $609,230, the median is just $200,000 – and that’s for households nearing or in retirement!

Remember that these figures represent all savings, not just what’s in retirement accounts. When looking specifically at 401(k) balances, the numbers are even more sobering, with the average 65-69 year old having $251,400.

I always tell my clients that the best time to start saving was 20 years ago, but the second-best time is today. No matter where you are on your journey, taking action now can dramatically improve your retirement outlook.

Final Thoughts

Retirement planning isn’t one-size-fits-all. While these averages and medians give us a general picture, your personal retirement needs may be higher or lower depending on:

- Your desired lifestyle in retirement

- Where you plan to live

- Your health expectations

- Whether you’ll have a mortgage or other debt

- Additional income sources

The most important thing is to have a plan and to start saving consistently. Meet with a financial advisor to create a personalized retirement strategy that aligns with your goals and circumstances.

Remember, it’s never too late to improve your retirement outlook – but the sooner you start, the easier it will be!

Have you checked your retirement savings lately? Are you on track to meet your goals? Share your thoughts and experiences in the comments below!

How far does $46 million get you?

Many of the 4,588 adults who responded to the financial service companys survey likely answered with a guesstimate, given that the study also found that only about half of boomers — many of whom are already retired — say they actually know how much they need to retire, Gokhale said.

In other words, while some people have talked with a financial adviser or worked out a detailed plan themselves for their retirement, many Americans are heading toward retirement without really sitting down and figuring out what they need.

“There is no major calculation; its a feeling,” Gokhale noted. “Some of them probably have done some math, in terms of saving and in terms of average burn to operate [in retirement], but it generally comes [down] to feeling. “.

Obviously, everyone’s retirement needs are very different and depend on how well they lived while they were working, how much it costs to live where they live, their taxes, and other financial factors. Using the rule of thumb to withdraw 4% of ones retirement savings annually, a nest egg of $1. 46 million would result in about $58,400 in annual income.

After adding in Social Security benefits, which is about $23,000 annually, that results in retirement income of about $81,000 each year — or above the median household income of $74,580.

Of course, most Americans are far from reaching $1. 46 million in savings — and many head into retirement with no savings at all.

The study underscores the do-it-yourself mentality of the current retirement system, which some experts have said has evolved from the shift to 401(k) programs from pensions, with the latter managed by companies to provide workers with a steady stream of income in retirement.

But with 401(k) programs, workers typically pick their own investments and decide how much of their income to save.

Teresa Girarducci, an economist and professor at the New School for Social Research in New York, is one of the critics of the system. She recently told CBS News that the current approach has left behind 90% of workers. For starters, only half of American workers even have access to a retirement plan, leaving the rest to cobble together a savings strategy.

A lot of Americans don’t think they have enough money to talk to a financial adviser, but Gokhale, whose company offers that service, says more people should take that step. “I dont believe you have to be on your own and Google search, What do I need for retirement,” she added.

But other research indicates there are plenty of hurdles to overcome. For one, about 6 in 10 people over 50 have never talked with a financial professional, and the reasons range from their fears that they dont have enough in savings to justify it and that its too expensive, according to a study published earlier this year from AARP.

“If you are trying to do this on your own, it becomes very very overwhelming and disheartening,” Gokhale said.

For most Americans, going it alone is the standard way to plan for retirement.

More from CBS News

Aimee Picchi is the associate managing editor for CBS MoneyWatch, where she covers business and personal finance. She previously worked at Bloomberg News and has written for national news outlets including USA Today and Consumer Reports.

HOW MUCH Money Do Most Americans RETIRE With?

FAQ

How many people have $1,000,000 in retirement savings?

Even though there isn’t a real-time number, estimates based on the most recent data from the Federal Reserve in 2022 point to around 3 2% to 4. 7% of Americans have $1 million or more in retirement accounts.

How much money do most people retire with comfortably?

The average amount needed to retire comfortably can be considered $1. 26 million according to a 2025 study, though this varies significantly based on individual circumstances like lifestyle, location, and existing income.

What is the average 401k balance for a 65 year old?

The average 401(k) balance for a 65-year-old varies by the source, but recent data shows figures around $272,588 to $299,442 for those aged 65 and older, with the median balance being significantly lower, often under $100,000.

What percentage of Americans have $500,000 in retirement?

About the same

How much money does the average American get in retirement?

In 2022, the average (median) retirement savings for American households was $87,000. What is the average retirement income for a person in the United States? According to a study by Wisevoter of data from the U.S. S. Census Bureau’s American Community Survey.

What is the average retirement savings?

The average retirement savings in the U.S. is $87,000, but the average retirement savings by age, income, level of education, and race varies. The median retirement savings for American households is $87,000. Median retirement savings for Americans younger than 35 is $18,800.

How much money do Americans save for retirement?

According to Empower Personal Dashboard TM, the typical American has $491,022 saved for retirement. Here’s how average retirement savings break down by age.

How much money does a 70 year old make in retirement?

Americans in their 70s have an average retirement savings balance of $994,140; the median is $432,043, putting some 70-year-olds in the retirement millionaire bracket. Most Americans retire in their mid-60s and may start to see healthcare costs eating up a portion of their retirement nest egg.

What is the average retirement age?

Data source: Federal Reserve (2024). Data shows that, in 2019, 51% of Americans retired at 61 or earlier, and 23% retired between 62 and 64, before Medicare coverage kicks in at 65. And, despite white Americans having higher retirement savings on average, their average retirement age tends to be higher than Black and Hispanic Americans.

How much should you save for retirement?

By age 35, aim to save one to one-and-a-half times your current salary for retirement. By age 50, that goal is three-and-a-half to six times your salary. By age 60, your retirement savings goal may be six to 11-times your salary. Ranges increase with age to account for a wide variety of incomes and situations.