How Much Income Do You Need to Qualify for a $200,000 Mortgage?

Getting approved for a $200,000 mortgage is a major financial move that requires careful planning and preparation As a mortgage lender, I often get asked “How much income do I need to qualify for a $200,000 mortgage?” There’s no one-size-fits-all answer, but this article will walk you through the key factors lenders consider when underwriting loans of this size

The Primary Factors That Impact Mortgage Qualification

When determining your eligibility for a mortgage, lenders mainly look at two key factors – your debt-to-income ratio (DTI) and credit score.

Debt-To-Income Ratio

Your DTI compares your total monthly debts with your gross monthly income. Most conventional mortgages require your DTI to be below 50%. So if your total monthly debts are $2,500 and your gross monthly income is $5,000, your DTI would be 50% ($2,500/$5,000). The lower your DTI, the better positioned you are to qualify.

Credit Score

Lenders also look at your credit report and score, which reflects your history of repaying debts. Most aim to see scores of at least 620, but many prefer 680 or higher for conventional mortgages. The higher your score, the better your chances of approval. FICO and VantageScore are the two main scoring models.

Other Key Criteria

Along with DTI and credit score, lenders determine if you have enough cash reserves, stable employment history, and income sources. Providing tax returns, bank statements, and other financial paperwork helps demonstrate qualification. First-time homebuyers also need 3.5% for a downpayment in most cases.

How Much Income You Need for a $200,000 Mortgage

As a general guideline, you may need around $60,000 in annual gross income to qualify for a $200,000 mortgage, assuming you have no other major debts. However, the actual amount can vary significantly depending on your:

-

Downpayment amount – The more you put down, the less you need to borrow. Putting 20% down reduces your required mortgage.

-

Loan program – FHA loans allow higher DTIs and lower scores but require mortgage insurance. VA and USDA loans have flexible qualification guidelines for eligible borrowers.

-

Monthly debts – Less existing monthly debt results in a lower DTI and increases eligibility.

-

Credit score – A higher score within lending guidelines provides better mortgage rates and terms.

-

Location – Required income levels vary by real estate markets across the country. High-cost areas have higher incomes.

I always recommend connecting with an experienced loan officer when starting the mortgage process. They can review your specific scenario and provide a more accurate estimate of the income needed for the mortgage amount, downpayment, and home price you have in mind. Pre-qualification early on also allows you to make any necessary adjustments to debt, credit, and savings to put yourself in a stronger position before applying.

The Bottom Line

While a rough guideline suggests around $60,000 in yearly income may be enough for a $200,000 mortgage, many factors impact your actual qualification requirements. Working with a lender to analyze your unique financial situation is the best way to determine if you have the right income for the mortgage amount that matches your home buying goals.

Loan type and interest rate

The type of loan program you choose affects the mortgage rate you’re offered — and therefore the sum you can borrow. The differences tend not to be huge, but every bit helps when you’re paying interest on a large sum over a long time.

Let’s take a single month, as an example that shows those differences.

Here were the average interest rates across three major loan types:

- Conventional loans: %

- FHA loans: %

- VA loans: %

The differences can be even greater if you choose a shorter-term loan (usually, a 10-, 15- or 20-year mortgage) rather than a 30-year mortgage term, or if you opt for an adjustable-rate mortgage (ARM).

Income isn’t the only factor for mortgage qualifying

Of course, mortgage lenders take your income into account when deciding how much they are prepared to lend you. But income is only one factor in a long list that lenders look at to approve your home loan amount. Other important factors for mortgage qualifying include:

- Credit history: The better your credit score, the more loan options you have. Plus, you could get a lower interest rate, which will help increase your home buying budget

- Debt-to-income ratio (DTI): By keeping your other debts low (like credit cards and car loans), you can free up your monthly budget and get approved for a larger mortgage loan

- Employment history: Lenders typically want to see a steady two-year employment history prior to getting a home loan

- Savings and assets: You don’t need a huge amount of savings to get a home loan these days. But if your income is on the lower end, having “cash reserves” in your bank account could help you get a home loan more easily

- Additional housing expense: Homeownership costs like property taxes, homeowners insurance, and HOA dues (if living in a condo or townhome with a homeowners association) will also affect your home buying power. The more expensive your total mortgage payment, the smaller your maximum loan amount

You don’t need to be perfect in all these areas to get a home loan. But improving one area of your finances (like your credit report or down payment) can often help make up for a weaker area (like a lower income).

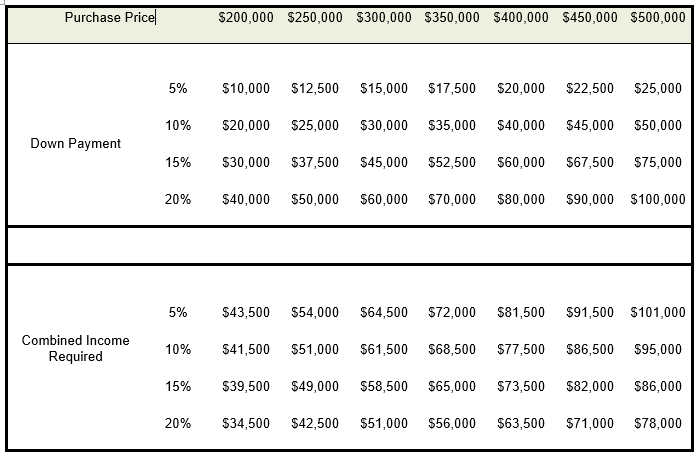

The size of your down payment is an important consideration in your home buying budget. The more money you put down, the smaller your loan amount will be. That can help you qualify if your income is relatively low.

For instance, say you want to buy a $250,000 home. With a 3% down payment, your loan amount is $242,500 and your monthly mortgage payments are about $1,573 (assuming a 6.75% interest rate). But if you can put 10% down, your loan amount drops to $225,000. Your monthly mortgage payments are over a $100 cheaper. This can make it easier to qualify for the loan payment on your mortgage.

Additionally, those who are financing a home purchase with a conventional loan will pay private mortgage insurance (PMI) when they put less than 20% down. You can get rid of your PMI when there is at least 20% equity in the home. However, for the first several years, you’ll pay these insurance premiums along with your mortgage payment. So again, home buyers with larger down payments can pay less per month on a $200,000 house.

Your debt-to-income ratio (DTI) is the percentage of your gross monthly income, or pre-tax income, that goes toward your monthly debt payments. Those include things like minimum credit card payments, child support, alimony, and installments on auto loans, student loans, and personal loans.

Mortgage lenders use your DTI ratio as a benchmark for affordability. The higher your existing debts are, the less monthly income you have to spare. That will affect how large of a mortgage payment you can afford.

- In the example above, a borrower with no existing debts, might qualify for a $200K mortgage loan with an annual income around $70,000

- If that same borrower has a $1,000 of debt payments (let’s say students loans or car payment), they will need to make an annual income of around $88,000 to qualify for that same $200K loan

Your DTI is made up of two parts: front-end ratio and back-end ratio. As a rule of thumb, back-end ratio is the more important of the two. And lenders prefer it to be no greater than 36% for most mortgage programs but some may go up to 43%. By paying down your total debt before you buy a home — and avoiding taking on new debts — you can lower your DTI. This could substantially increase your home buying budget.

How much Income do I need to buy a $200k house? #200k #realestate #realestateinvesting

FAQ

What income is needed for a 200K mortgage?

How much do I need to make to get a $200,000 loan?

Key Takeaways. The salary needed to buy a $200,000 home ranges from about $55,000 to $97,000 at current mortgage rates, depending on the down payment, insurance and other variables. The common rule used by mortgage lenders dictates that your monthly mortgage payment can’t exceed 28% of your gross household income.

Can I afford a 200K house on 50k a year?

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $258,000. That’s because your annual salary isn’t the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

How much do I need down for a 200K house?

To purchase a $200,000 house, you need a down payment of at least $40,000 (20% of the home price) to avoid PMI on a conventional mortgage.Apr 24, 2025