You may want to cancel a credit card to cut back on your spending or to stop paying the associated fees. Before you cancel, consider how ditching that credit card could impact your credit score and finances.

Hey there fam! If you’re wondering “how much does your credit score go down when you cancel a credit card,” you’ve come to the right spot. I’m here to break it down for ya, no fancy jargon, just straight-up talk. Quick answer? Yeah, canceling a card can ding your score, but how bad it gets depends on your situation. The big culprit is somethin’ called credit utilization, and we’re gonna dive deep into that right now.

So, grab a coffee (or whatever gets ya goin’), and let’s figure out if closin’ that card is gonna mess up your financial vibe or if it’s no biggie.

Why Does Canceling a Credit Card Hurt Your Score?

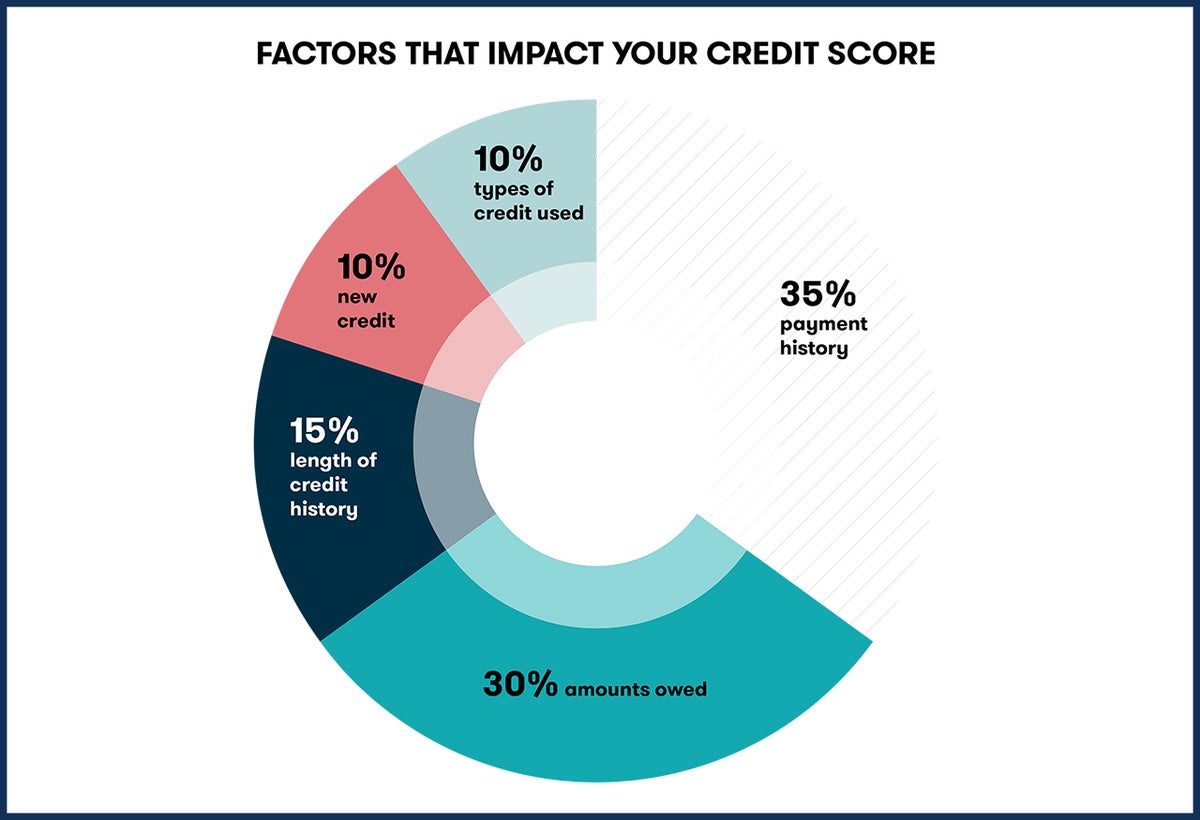

First things first, let’s talk about why canceling a credit card can knock your credit score down a peg or two. Your credit score is like a report card for how well you handle money, and it’s based on a few key things. When you close a card, you’re messin’ with some of these factors, especially:

- Credit Utilization (30% of Your Score): This is the big one, y’all. It’s how much of your available credit you’re usin’ at any time. If you’ve got a bunch of cards with big limits and you close one, your total available credit shrinks. If you’ve got balances on other cards, that makes it look like you’re usin’ a bigger chunk of what’s left, and that can hurt your score big time.

- Length of Credit History (15% of Your Score): This is how long you’ve had credit accounts open. The older, the better. Clos’n a card, especially an old one, might lower the average age of your accounts, which ain’t great for your score.

- Credit Mix (10% of Your Score): This is about havin’ different types of credit—cards, loans, mortgages, etc. If you close a card and it’s one of your only credit lines, you’re makin’ your mix less diverse, which can nudge your score down a bit.

But let’s be real—the utilization thing is where most of the damage happens. So, how much does your score actually drop? Well it ain’t a set number. It depends on how much credit you’re losin’ and what you’ve got goin’ on with your other accounts. Let me paint ya a picture.

How Much Could Your Score Drop? Let’s Break It Down

Say you’ve got three credit cards, each with a $5,000 limit. That’s $15,000 total credit available. Now, let’s play with some scenarios to see how canceling one card could hit ya.

Scenario 1: No Balance, Chillin’ Like a Villain

- Total Credit Limit: $15,000

- Total Balance: $0

- Credit Utilization: 0% (you’re golden!)

If you cancel one card, your limit drops to $10,000, but since you ain’t got no balance, your utilization stays at 0%. In this case, the drop in your score might be super small or even nothin’ at all. Maybe a couple points if the card was old and messes with your credit history age. No sweat, right?

Scenario 2: Some Balance, Startin’ to Feel It

- Total Credit Limit: $15,000

- Total Balance: $3,000

- Credit Utilization: 20% (still decent)

Now cancel one card and your limit drops to $10,000. That $3,000 balance now means your utilization jumps to 30%. That’s the magic number where credit folks start frownin’. Your score might drop a noticeable amount—could be 10-20 points or more, dependin’ on other stuff in your credit file. It’s not a disaster, but it stings.

Scenario 3: High Balance, Ouch Time

- Total Credit Limit: $15,000

- Total Balance: $6,000

- Credit Utilization: 40% (already high)

Close a card, limit drops to $10,000, and now your utilization shoots to 60%. Yikes! That’s gonna hurt. Your score could tank by 30-50 points or worse, especially if you’ve got a thin credit file (meanin’ not many accounts or a short history). This is where ya feel the pain.

Here’s a quick table to show how utilization changes can hit ya:

| Total Credit Limit | Balance | Utilization Before | Utilization After Closing 1 Card | Likely Score Impact |

|---|---|---|---|---|

| $15,000 | $0 | 0% | 0% (Limit now $10,000) | Minimal (0-5 points) |

| $15,000 | $3,000 | 20% | 30% (Limit now $10,000) | Moderate (10-20 points) |

| $15,000 | $6,000 | 40% | 60% (Limit now $10,000) | Severe (30-50+ points) |

See how it works? The more you’re usin’ of your credit, the worse it gets when you shrink that limit by closin’ a card. And if the card you’re ditchin’ has a high limit compared to your others, it’s gonna hurt even more. I’ve seen peeps get screwed up bad by closin’ a card with a $10,000 limit while keepin’ smaller ones with balances.

What Else Plays a Role in the Drop?

Utilization ain’t the only thing, though it’s the heavyweight champ. Here’s a couple other factors that can sneak in and mess with your score when you cancel a card:

- How Old the Card Is: If it’s one of your oldest cards, closin’ it might lower the average age of your accounts. Now, here’s a lil’ myth-buster—some folks think closin’ an old card wipes out its history. Nah, fam! If you close it in good standin’ (no balance, paid on time), it stays on your credit report for up to 10 years and keeps helpin’ your score. Still, if it’s super old, the average age drop can nick ya a few points.

- How Many Cards You Got Left: If you only got a couple cards and you close one, your credit mix looks weaker, and the utilization hit is bigger. If you’ve got a bunch of other accounts, the impact might be less. Peeps with a “thin file” (just a few accounts) get hit harder.

- What You Owe Elsewhere: If your other cards or loans got high balances, closin’ a card makes your overall debt-to-credit ratio look worse. Keep them balances low, and the damage ain’t so bad.

So, the drop ain’t just one number for everyone. It could be a tiny blip of 5 points or a gut-punch of 50 or more. It all depends on your personal setup. I remember thinkin’ about ditchin’ an old card once ‘cause I wasn’t usin’ it, but when I crunched the numbers, I saw my utilization woulda jumped from 15% to 35%. I was like, “Heck naw, I’m keepin’ this puppy!”

When Should You Even Think About Canceling a Card?

Now, just ‘cause it can hurt your score don’t mean you should never close a card. Sometimes, it’s the right move. Here’s when it might make sense, even with a potential score drop:

- High Annual Fees Suckin’ You Dry: If a card’s got a fat annual fee and you ain’t gettin’ the perks to match, it might be worth sayin’ goodbye. Like, if you’re payin’ $100 a year for a card you don’t even swipe, that’s just dumb.

- You Ain’t Usin’ It and the Limit’s Low: If it’s a card with a tiny limit—like $500 or somethin’—and you don’t use it, closin’ it might not do much damage. Your utilization won’t budge much if the limit was small to start with.

- Life Changes, Like Divorce: If you’re splittin’ up with a spouse, you might need to close joint cards to protect yourself from their spendin’. That’s more important than a few credit points.

- You’ve Moved On to Better Cards: Maybe you started with a secured card (them trainin’ wheels of credit) and now you’ve graduated to somethin’ better. If the old one ain’t doin’ nothin’ for ya, closin’ it might be fine.

- Store Cards You Don’t Shop At No More: Them retailer cards often got low limits, and if you ain’t shoppin’ there, why keep it? Just watch the utilization if you got a balance elsewhere.

But real talk—most times, keepin’ a card open is better for your score, especially if it’s got no fee and a decent limit. I got a card I ain’t touched in years, but it’s got a $7,000 limit, so I let it sit there helpin’ my utilization look pretty.

How to Minimize the Damage If You Gotta Close It

If you’re dead set on cancelin’ a card, there’s ways to soften the blow on your credit score. We ain’t just gonna leave ya hangin’ with bad news. Try these tricks:

- Pay Off All Balances First: Before you close it, make sure the card’s balance is zero. Most issuers won’t even let ya close it with a balance, but even if they do, you’re still on the hook for payin’ it. Clear it out to avoid extra hits to your score from high utilization.

- Check Your Other Cards’ Limits: See how closin’ this card will change your total credit limit. If it’s gonna push your utilization over 30%, maybe hold off or pay down other balances first.

- Redeem Them Rewards, Yo: Don’t leave money on the table! If the card’s got points or cashback, use ‘em before you cancel. Once it’s closed, them goodies usually disappear.

- Get a New Card Before Closing: If you’re worried about losin’ too much credit limit, apply for a new card with no annual fee first. Once you’re approved, close the old one. That way, your total credit don’t shrink as much. Just don’t go crazy applyin’ for too many cards at once—that can ding your score too.

- Ask for a Product Switch Instead: Some card companies let ya switch to a different card with better terms (like no fee) without closin’ the account. You keep the credit history and limit, but get a card that fits ya better. Worth a call to ask!

- Keep an Eye on Your Credit Report: After closin’ it, check your credit report to make sure it’s reported right. If it shows as “closed by creditor” instead of “closed by consumer,” or if there’s errors, dispute that junk. It should stay on your report for 10 years if it’s in good standin’.

I’ve done this dance before—called up a card company to ditch a card with a fee, but they offered me a no-fee version instead. Saved my credit limit and didn’t take no hit. Felt like I dodged a bullet!

Alternatives to Cancelin’—Keep That Score Safe

If you’re on the fence, why not just keep the card without closin’ it? Here’s some ideas to avoid the hassle altogether:

- Stick a Small Recurrin’ Charge on It: Put somethin’ tiny on the card, like a Netflix subscription, and set it to autopay. Keeps the card active so the issuer don’t close it for inactivity, and it don’t mess with your score.

- Hide It, Don’t Close It: If you don’t wanna use it, just toss it in a drawer or safe. Don’t cut it up ‘cause you might need the number later, but keep it outta sight so you ain’t tempted to spend. That available credit still helps your utilization.

- Negotiate with the Issuer: If the fee’s the problem, call ‘em up and see if they’ll waive it for a year or switch ya to a better card. Sometimes they’ll bend if they think you’re walkin’ away.

I got a card I don’t use much, but I throw a small charge on it every few months just to keep it alive. Ain’t no harm, and my score stays happy.

Common Myths About Cancelin’ Cards—Don’t Fall for ‘Em

There’s a lotta nonsense floatin’ around about closin’ credit cards. Let me set the record straight on a couple things I hear all the time:

- Myth: Clos’n a Card Wipes Out Its History. Wrong! If you close it with no balance and a good payment record, it sticks on your credit report for up to 10 years, still helpin’ your score. Only bad stuff (like late payments) falls off after 7 years.

- Myth: Cancelin’ Always Boosts Your Score. Heck no! Most times, it hurts ‘cause of that utilization spike. Don’t close a card thinkin’ it’ll magically fix your credit—it won’t.

- Myth: Unused Cards Hurt Your Score. Nah, fam. An unused card with no fee can actually help by keepin’ your available credit high. Just don’t let it sit so long the issuer closes it on ya.

I used to think closin’ old cards would clean up my credit report, but turns out, keepin’ ‘em open was the smarter play. Learn from my dumb mistakes, peeps!

What If You’ve Already Closed a Card?

If you’ve already pulled the trigger and closed a card, don’t panic just yet. The damage might not be as bad as you think, and there’s stuff you can do to bounce back:

- Check Your Utilization Now: Figure out where you stand after closin’ it. If it’s over 30%, focus on payin’ down balances on other cards ASAP to bring it back down.

- Monitor Your Score: Keep tabs on your credit score through free tools or apps. See how much it actually dropped and if it’s recoverin’ over time.

- Build Credit Elsewhere: Keep makin’ on-time payments on your remainin’ cards or loans. That’s the best way to rebuild. Maybe even become an authorized user on someone else’s card to boost your file.

- Don’t Close More Cards Right Away: Give it some time before makin’ more changes. Multiple closures in a short span can look bad to lenders.

I closed a card a few years back without thinkin’, and my score took a lil’ hit—dropped about 15 points. But I paid down some other debt quick, and it climbed back up in a couple months. No permanent damage, just a lil’ scare.

Final Thoughts—Think Before You Cancel

So, how much does your credit score go down when you cancel a credit card? It’s a tricky question with no one answer. It could be a tiny dip of 5 points or a rough fall of 50 or more, dependin’ on your credit utilization, how many cards you got, and the card’s limit and age. The biggest factor is that utilization ratio—keep it under 30% if ya can, or you’re askin’ for trouble.

Before you cancel, ask yourself: Do I really need to close this card? Is there a fee I can’t handle, or am I just tidyin’ up? Most times, keepin’ it open (even unused) is the safer bet for your score. If you gotta close it, follow them steps I laid out to keep the damage low.

At the end of the day, your credit score is a tool, not your whole life. But it’s worth protectin’ ‘cause it affects stuff like gettin’ loans or rentin’ a place. So, take a minute, crunch them numbers, and make the call that’s best for your wallet. And hey, if you’ve got questions or wanna share your own credit card drama, drop a comment below. I’m all ears!

Now, go check your credit report (it’s free, ya know) and see where you stand before makin’ any big moves. Let’s keep that score lookin’ sharp, alright? Catch ya later!

Steps to Safely Cancel a Credit Card

If youve decided that canceling a credit card is the right move, you can take a few different actions to minimize any negative impact.

- Redeem your rewards: Dont forget to take advantage of any credit card rewards before canceling a card. You may have points that can be used to make purchases or converted to cash. Some cards have airline miles rewards programs and discounts for certain purchases. You may even be able to transfer rewards.

- Pay off your balance: If you decide to cancel a card, you are still responsible for any balance on the account. You could cancel the card before paying what you owe, but you will still need to make payments with interest until it is paid in full.

- Contact the card issuer: When you are ready to cancel, you will need to contact the company that issued the credit card. Check your cardholder agreement to see if there any additional steps you need to take to move forward with cancellation.

- Send a certified letter: Sending a certified written letter is a good follow-up measure to ensure the card issuer receives your request and follows through. You can also request the card issuer send you written confirmation of the cancellation.

- Monitor your credit reports. Keep an eye on your credit reports following cancellation to ensure it is accurately reported. Your credit report should reflect the closure of the account and the fact that you requested the cancellation. If there is an error, you have the right to dispute it with the credit reporting agencies.

Reasons to Consider Canceling Credit Card

While getting rid of a credit card may have an impact on your credit score, there are plenty of possible reasons that cancellation may be the right choice for you.

- Substantial fees: Some credit cards charge an annual fee. This may be the case with premium travel cards or cards offered to people with poor credit. You may find that paying the fee on a credit card is not worth the perks you receive.

- Spending control: Credit cards can be a useful tool, but they can also lead to a high debt load if not used responsibly. If you are working on building a budget and looking for ways to control your spending, canceling a credit card may be helpful.

- Divorce: If you are going through a separation or a divorce, canceling joint credit cards is a common part of untangling your finances. You will need to decide together to cancel a shared card and how to pay off any outstanding balance.

What CLOSING a Credit Card Did to My Credit Score…

FAQ

How do I raise my credit score 100 points in 30 days?

For most people, increasing a credit score by 100 points in a month isn’t going to happen. But if you pay your bills on time, eliminate your consumer debt, don’t run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Will my credit score go down if I stop using my credit card?

Is it better to cancel a credit card or keep it?

Keeping an unused credit card open can benefit your credit score – as long as you follow good financial habits. If an unused credit card tempts you to unnecessarily spend or has an annual fee, you may be better off canceling the account.

Can you cancel credit cards without hurting your credit score?

No, cancelling your cards won’t hurt your credit. It will just be slightly less positive.