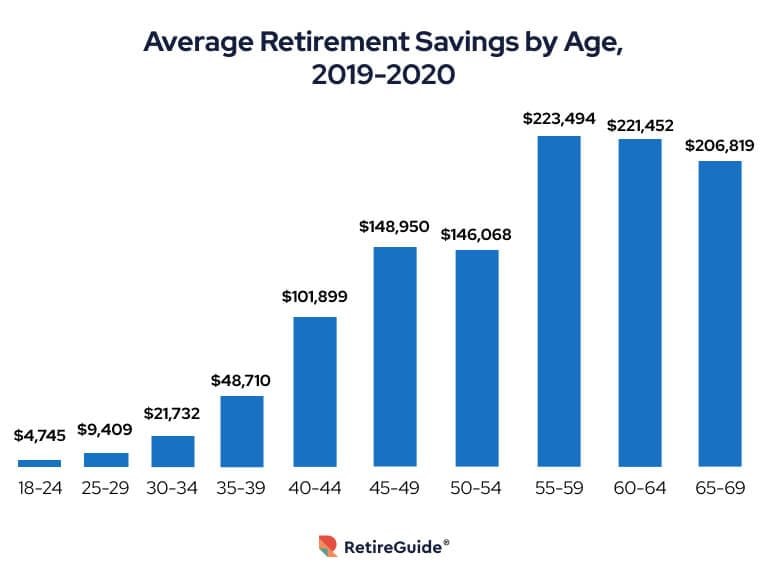

The average retirement savings is $333,940. Balances vary by age, with those 55-plus having the most in their accounts.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not provide advisory or brokerage services, and it does not tell investors whether to buy or sell certain stocks, bonds, or other investments.

Let’s be honest – we’re all wondering if we’ve saved enough for our golden years As a financial advisor who’s worked with hundreds of pre-retirees, I constantly get asked this question “How much should I have saved by now?” It’s especially common among folks in their early 60s who can see retirement on the horizon

Today, I’m diving into exactly how much the average 62-year-old American has saved for retirement. I’ll share the numbers that might surprise you (or confirm your fears), and more importantly, what you can do if you’re behind.

The Hard Numbers: Average Retirement Savings at Age 62

The most recent data from Fidelity Investments (Q4 2024) shows that the average 401(k) balance for Americans aged 60 to 64 is $246,500. Based on their IRA balances, people born between 1946 and 1964, or “baby boomers,” have saved an average of $257,002.

Edward Jones provides even more specific data, showing that 62-year-olds with a $100,000 salary should have between $925,000 and $1,065,000 saved for retirement. For those earning $50,000, the target range is $460,000 to $530,000.

But here’s the shocking part – most Americans aren’t meeting these targets The Federal Reserve data indicates that even by age 60, less than half (45%) of non-retirees with retirement accounts believe their savings are on track

Comparing Average Savings by Generation

To put this in perspective let’s look at how different generations are doing with their retirement savings

| Generation | Average 401(k) Balance | Average IRA Balance |

|---|---|---|

| Baby Boomers | $249,300 | $257,002 |

| Gen X | $192,300 | $103,952 |

| Millennials | $67,300 | $25,109 |

| Gen Z | $13,500 | $6,672 |

We can see that baby boomers (which includes 62-year-olds) have accumulated the most, but the question remains: is it enough?

How Much Should a 62-Year-Old Actually Have Saved?

Financial experts suggest different benchmarks for adequate retirement savings. According to Fidelity’s retirement savings guidelines, by age 60, you should have about 8 times your annual income saved. By age 67, this increases to 10 times your annual income.

For example:

- If you earn $75,000 at age 62, you should ideally have about $600,000-$675,000 saved

- If you earn $100,000, your target would be around $800,000-$900,000

Edward Jones suggests slightly higher targets – for a 62-year-old earning $100,000, they recommend having $925,000 to $1,065,000 saved to maintain your current lifestyle in retirement.

Why Most People Fall Short

I’ve worked with clients in their 60s for more than ten years, and I’ve seen a few common reasons why they don’t reach these goals:

- Late start to saving: Many didn’t begin serious retirement savings until their 40s or 50s

- Financial setbacks: Divorces, medical issues, or helping adult children can deplete savings

- Market downturns: Recessions like 2008 and the pandemic created significant setbacks

- Education costs: Paying for children’s college education often came at the expense of retirement saving

- Income limitations: Not everyone earns enough to save the recommended percentages

What If You’re Behind? (Real Talk)

If your savings don’t match these benchmarks, don’t panic! There’s still time to improve your situation:

1. Take advantage of catch-up contributions

At 62, you’re eligible for catch-up contributions to retirement accounts:

- 401(k): $7,500 additional (on top of the $23,500 limit) for 2025

- IRA: $1,000 additional (on top of the $7,000 limit) for 2025

2. Delay Social Security benefits if possible

You can get about 8% more in Social Security benefits for every year you wait to claim them between your full retirement age and 2070. This is a strong way to make more money in retirement.

3. Consider working a bit longer

Even working part-time for a few extra years can make a huge difference by:

- Allowing your investments more time to grow

- Reducing the number of years you’ll need to fund in retirement

- Possibly maintaining health insurance coverage

4. Rethink your retirement lifestyle

Be realistic about your retirement expectations. You might be able to save more if you downsize or move to a cheaper area.

5. Look at tax-efficient withdrawal strategies

How you withdraw your money matters almost as much as how much you’ve saved. A good financial planner can help minimize taxes on your retirement income.

Beyond the Averages: What Really Matters

While knowing the average savings is helpful, what’s more important is understanding YOUR specific retirement needs. I’ve seen clients comfortably retire with less than the “recommended” amounts, while others struggle despite having more saved.

Your retirement readiness depends on:

- Your expected lifestyle costs

- Whether you’ll have a mortgage or rent payment

- Healthcare needs and insurance coverage

- Other income sources (pensions, Social Security, part-time work)

- Where you plan to live (cost of living varies dramatically)

- Potential inheritance or assets you could liquidate if needed

Case Study: My Client John (Not His Real Name)

One of my clients, let’s call him John, came to me at 62 with only $350,000 saved – well below the recommended amount for his $90,000 salary. He was panicking.

After we analyzed his situation, we realized:

- He had paid off his home

- His expected Social Security benefit was substantial

- His expenses were modest

- He had a small pension from a previous employer

- He was willing to work part-time for 5 more years

With some adjustments to his investment strategy and a solid withdrawal plan, John was able to retire comfortably at 67 despite having less than the “recommended” amount.

Expert Advice for Those Approaching Retirement

Laurie Rowley, CEO of Icon Savings Plan, emphasizes starting to save as early as possible. But what if you’re already 62? Financial advisors recommend:

- Maximize retirement contributions: Contribute the maximum allowed to your 401(k), including catch-up contributions.

- Consider Roth conversions: If appropriate for your tax situation, converting some traditional IRA money to Roth can reduce future tax burdens.

- Reduce expenses now: Cutting current expenses allows you to save more and practice living on less.

- Review your investment allocation: Make sure your investments align with your time horizon and risk tolerance.

- Consider working with a financial advisor: Professional guidance can help optimize your remaining working years.

The Bottom Line

The average 62-year-old has around $250,000 saved for retirement, which falls short of most expert recommendations. But averages don’t tell the full story of YOUR retirement readiness.

If you’re behind, don’t despair. You still have options to improve your situation. The most important step is to honestly assess where you stand now and make the most of your remaining working years.

Remember, retirement planning isn’t just about hitting a magic number – it’s about creating a sustainable lifestyle that allows you to enjoy your golden years with dignity and peace of mind.

What’s your biggest retirement planning concern? Drop a comment below, and I’ll try to address it in my next post!

Frequently Asked Questions

Q: Can I retire at 62 with $500,000 saved?

A: It depends on your expenses, other income sources, and expected lifestyle. For some people with modest needs and other income sources like Social Security, $500,000 might be sufficient. For others with higher expenses or healthcare needs, it may not be enough.

Q: How much income can $250,000 in retirement savings generate?

A: Using the common 4% withdrawal rule, $250,000 would generate about $10,000 per year in retirement income. Combined with Social Security benefits (the average is approximately $1,976 monthly or $23,712 annually as of 2025), this might provide a modest retirement income.

Q: I’m 62 with little saved. Is it too late?

A: It’s never too late to improve your situation. Focus on maximizing savings, delaying Social Security if possible, considering part-time work, and potentially adjusting your retirement lifestyle expectations.

Q: Should I pay off my mortgage before retiring?

A: This depends on your interest rate, tax situation, and other factors. Generally, entering retirement without debt provides more financial flexibility, but sometimes it makes more sense to invest extra funds rather than pay off a low-interest mortgage.

Q: How do medical costs impact retirement savings needs?

A: Healthcare can be one of the largest expenses in retirement. Even with Medicare, you’ll likely need to budget for supplemental insurance, copays, and potential long-term care needs, which could significantly impact how much you need to save.

Remember, retirement planning is personal. While averages and benchmarks provide useful context, your retirement plan should be tailored to your unique circumstances, goals, and resources. If you’re feeling overwhelmed, consider consulting with a financial advisor who can help create a personalized strategy for your situation.

Ages 55 to 64

- Average household retirement savings: $537,560.

- Median household retirement savings: $185,000.

This age range is close to Social Security’s definition of full retirement age, ranging from 65 to 67, depending on your year of birth. About 57% of households headed by a baby boomer have retirement holdings.

Average retirement savings by age group

- Average household retirement savings: $49,130.

- Median household retirement savings: $18,880.

In the Survey of Consumer Finances, nearly 50% of families headed by someone under age 35 had retirement accounts. These could include IRAs, Keoghs and certain employer-sponsored accounts, such as 401(k)s, 403(b)s and thrift savings accounts.