Once you hit a certain age, you may start thinking about having enough savings for retirement. You may think more about it when you hit milestone decades, such as when you turn 40.

For many, this decade is marked by growing families (and the accompanying college funds) and a mortgage. Dont forget the regular bills that arrive every month like clockwork.

Even if you get promotions and pay increases at work to help offset living expenses, you’ve still got a retirement plan to tend to. These savings priorities tug at your wallet from all directions. Not everyone has thought, “Am I saving enough?” or “How much should I have saved for retirement by age 40?”

Everybody’s savings situation is unique and depends on their finances, lifestyle, and long-term goals. But knowing the basics of benchmarks and ranges can help you figure out if you’re on the right track and if you need to speed up your savings.

With that in mind, here’s a guide to help take some of the guesswork out of where you should be financially in your forties. Take a look at how much you should have saved by age 40, taking into account both the average amount saved for retirement and the costs of saving. Well also look at some tips to help you increase your retirement savings.

A lot of feelings can come to the surface when you turn 40. You might be wondering if your job is where it should be, if you’ve done enough, or if your money is in order. Perhaps this question keeps you awake at night: “How much money should I have saved by now?”

We’ll talk about how much savings the average 40-year-old has, whether you should worry if you’re behind, and how you can get caught up quickly if you need to.

The Hard Truth About Average Savings at 40

According to the Federal Reserve data, Americans between the ages of 35-44 (which includes our 40-year-old focus) have a median of $7,500 in transaction accounts. This includes checking accounts, savings accounts, money market accounts, and similar liquid assets.

But that number doesn’t tell the whole story. Looking at mean financial assets (which includes investment portfolios and bank accounts), Americans in the 35-44 age bracket have about $170,740 saved up.

Why such a big difference between median and mean? The mean gets pulled up by the small percentage of people with very large savings, while the median gives us a more realistic picture of what the typical 40-year-old has saved.

Retirement Savings vs. Regular Savings

When we talk about savings at 40, we need to distinguish between two types

- Liquid savings – Money in checking, savings, and money market accounts that you can access easily

- Retirement savings – Money in 401(k)s, IRAs, and other retirement accounts

According to Fidelity, by age 40, you should aim to have approximately three times your annual salary saved for retirement. So if you make $60,000 a year, you should ideally have around $180,000 saved in retirement accounts.

The Economic Policy Institute found the mean retirement savings for families headed by someone 38-43 years old was about $121,000, while the median was significantly lower at $37,000.

Savings by Demographics: The Gap Is Real

It’s important to acknowledge that averages don’t tell the whole story. There are significant disparities in savings across different demographic groups:

- According to Federal Reserve data, White non-Hispanic Americans had an average of $481,430 in financial assets

- Black non-Hispanic Americans had an average of $68,800

- Hispanic Americans had an average of $50,390

These numbers highlight the ongoing wealth gap that affects saving potential for many Americans.

Why Are So Many 40-Year-Olds Behind on Savings?

You’re not the only one who feels a little scared when you look at these numbers. There are many reasons why it’s hard for 40-somethings to save money these days:

- Student loan debt that lingers well into adulthood

- Housing costs that have grown faster than wages

- The 2008 recession that hit early in their careers

- Rising healthcare costs eating into potential savings

- Supporting both children and aging parents (the “sandwich generation”)

How Much Should You REALLY Have Saved at 40?

While the benchmarks and averages are helpful, they don’t account for your unique situation. Here’s a more personalized approach to determining if you’re on track:

Emergency Fund

You should have 3-6 months of expenses saved in an easily accessible account. At 40, with potentially greater responsibilities like a mortgage or kids, leaning toward the 6-month mark is wise.

Retirement Savings

The 3x salary rule from Fidelity is a good starting point. But consider:

- Do you want to retire early?

- Do you live in a high-cost area?

- Will you have a pension or other income sources in retirement?

Debt Considerations

It’s good to have savings, but if you have a lot of high-interest debt, paying it off might be better for your finances than saving a lot of money.

I’m Behind on Savings at 40. Now What?

First, take a deep breath. You still have 20-25 years before typical retirement age, which is plenty of time to make meaningful progress. Here’s what to do if you’re playing catch-up:

1. Maximize Retirement Contributions

- Max out your 401(k) – In 2025, you can contribute up to $23,000 (plus employer match)

- Open an IRA if you don’t already have one – You can contribute an additional $7,000

2. Cut Expenses and Boost Income

- Review your budget for potential savings

- Consider a side hustle to increase your income

- Funnel any raises or bonuses directly to savings before lifestyle inflation kicks in

3. Reconsider Major Expenses

- Could downsizing your home free up cash for savings?

- Are you spending too much on vehicles or other depreciating assets?

- Can you reduce education costs for children while still providing quality options?

4. Adjust Your Timeline

- Could you work a few years longer than planned?

- Would a partial retirement phase work for your situation?

- Can you develop passive income streams to supplement retirement?

Where Should a 40-Year-Old Keep Their Savings?

Not all savings vehicles are created equal, especially at 40 when you’re balancing short-term access with long-term growth.

For Emergency Funds and Short-Term Goals

- High-yield savings accounts – Currently offering around 3.40%-3.90% interest

- Money market accounts – Similar rates with some check-writing privileges

- Certificates of deposit (CDs) – Higher rates if you can lock up money for a set period

For Retirement Savings

- 401(k) or 403(b) – Especially if there’s an employer match

- Traditional or Roth IRA – Depending on your tax situation

- Health Savings Account (HSA) – Triple tax advantage if you have a high-deductible health plan

Real Talk: Success Stories from 40-Year-Olds Who Caught Up

I recently spoke with Maria, who at 40 had only $20,000 saved for retirement. “I panicked at first,” she told me. “But then I made some radical changes – I took on consulting work on weekends, slashed my expenses, and maxed out my 401(k) for the first time ever.”

Five years later, Maria has over $150,000 saved and is on track to retire comfortably at 65.

Then there’s John, who at 42 realized he had prioritized paying for his kids’ activities over his own retirement. “I didn’t want to shortchange my children, but I realized that becoming a financial burden to them later would be much worse.” John and his wife found more affordable alternatives for extracurriculars and redirected $1,000 monthly to their retirement accounts.

The Bottom Line: It’s Not Just About the Numbers

While having a healthy savings account at 40 is important, remember that financial success isn’t just about hitting arbitrary benchmarks. It’s about creating financial security that allows you to live the life you want.

If you’re behind, don’t waste energy beating yourself up. Instead, channel that energy into making positive changes starting TODAY.

And if you’re ahead of the curve? Congrats! But remember that life can throw curveballs at any time, so continue to build your financial resilience.

Savings Milestones to Aim for Through Your 40s

| Age | Emergency Fund | Retirement Savings | General Savings Goals |

|---|---|---|---|

| 40 | 6 months of expenses | 3x annual salary | Home equity, education funds |

| 45 | 6-8 months of expenses | 4x annual salary | Reducing high-interest debt |

| 50 | 6-8 months of expenses | 6x annual salary | College funding (if applicable) |

Common Questions About Savings at 40

Is it too late to start saving at 40?

Absolutely not! While starting earlier is always better due to compound interest, 40 is NOT too late. You still have decades for your money to grow before traditional retirement age.

Should I prioritize retirement savings or my kids’ college fund?

Remember: your kids can borrow for college, but you can’t borrow for retirement. Secure your financial future first, then help with education if possible.

What if I can only save a small amount each month?

Start where you are! Even $100 a month adds up over time and builds the habit of saving. As your income increases or expenses decrease, you can save more.

Should I pay off my mortgage or save more?

This depends on your mortgage interest rate, investment returns, and personal comfort with debt. If your mortgage rate is low (under 4%), you might earn more by investing extra cash than by paying down your mortgage early.

Take Action Now

No matter where you stand with your savings at 40, the most important thing is to take action:

- Today: Calculate your current savings rate and set a new target

- This week: Review and adjust your budget to increase savings

- This month: Meet with a financial advisor to create a personalized plan

- This year: Aim to increase your savings rate by at least 1-2% of your income

Your 40s can be your power years for building wealth – don’t waste them worrying about past mistakes. Instead, harness your peak earning potential to secure your financial future.

Remember, the best time to start saving was 20 years ago. The second best time is right now.

Health care expense savings

If youve ever gotten a bill from your doctor, you already know that health care is expensive.

The average retired couple age 65 in 2022 may need approximately $315,000 in after tax savings to cover health care expenses in retirement. However, that also depends on a few factors, including:

- Where you retire

- How healthy you are

- How long you live

Its worth considering now how you plan to pay for your health care expenses later on. For example, do you plan to use your 401(k), HSA or IRA to pay for health care expenses?.

Consider enrolling and contributing to a health savings account (HSA), which can give you tax benefits. You save money before taxes and maybe even get money from your employer. These can grow and be withdrawn tax-free at the federal and state levels as long as they are used for medical reasons.

The general rule of thumb for how much retirement savings you should have by age 40 is three times your household income.

The median salary in the U. S. in the fourth quarter of 2022 was $1,084 per week or $56,368 per year. By that measure, someone in their late thirties to early forties should have around $169,104 saved for retirement.

What if youre married? If you and your spouse have an annual household income of $95,000, you should aim to have $285,000 set aside by 40. A single 40-year-old who earns a $60,000 salary per year should strive to have $180,000 saved.

When looking at these numbers, it’s important to remember that every person and situation is different.

Ask yourself:

- How much is my annual salary?

- What’s my ideal retirement age?

- What do I want to do when I retire?

It’s likely that you’ll need even more than the three times your household income rule if you want to live in style while traveling the world. But if you plan on downsizing your home and spending your time and money on the same hobbies you always have, perhaps you might not require quite as much.

Either way, don’t endure sleepless nights if your current retirement nest egg falls short of the recommended amount. You still have time to put money into your retirement account, even though it may seem like you’ll be retiring soon.

Those who begin putting money toward their retirement plan earlier are better off than those who don’t, thanks to compound interest, which is interest earned on your initial principal and your accrued interest. If you are just joining the retirement savings party — or stepping on the dance floor later than others — you have options as you get closer to retirement.

Employees who contribute to a 401(k), 403(b), or 457 can contribute up to $22,500 in 2023. Once you reach 50 years of age, you’re eligible to set aside an additional $7,500 annually in catch-up contributions.

Once you feel comfortable that your emergency fund, retirement nest egg, and savings habits are on par with (or above) target amounts and aligned with your financial goals, it’s time to think about other things you might want to save for.Maybe your family has grown out of its home and it’s time to upgrade.

You dont want to miss any family expenses you need to save for, such as saving for college and even weddings. Lets take a look at some of the ways you can save for each.

If you want to ensure your children don’t face student loan debt, you can consider a 529 College Saving Plan or a savings account that offers a competitive rate of return, such as a certificate of deposit (CD) or a money market account.

- 529 plans: A 529 college savings account lets your money grow tax-free and has high contribution limits. You can take out your money whenever you want without having to pay taxes on it, as long as you use it for school. Pay for school, room and board, fees, books, and other things with it. You can also deduct some of your contributions from your state income taxes, which is an added bonus. Some states offer a tax credit. Keep in mind that you can buy a different state plan if you don’t like the one you have.

- College Savings Account (ESA) from Coverdell: An ESA is a plan that lets you save money after taxes and let it grow tax-free. Like 529s, you can withdraw them tax-free for qualifying expenses. ESAs are capped at $2,000 per year. You can choose from many different investments, and they give you a little more freedom than 529 plans. However, your income cannot go over a certain amount. You can only contribute until your child turns 18.

- The Uniform Transfer to Minors Act (UTMA) and the Uniform Gift to Minors Act (UGMA) are examples of custodial accounts. With these accounts, you are in charge of your child’s savings account until they reach the age of majority in their state. The good thing about a custodial account is that you can use the money for anything. The bad thing is that this is also its drawback. The student doesn’t have to use the money for college. They can use it for anything, like a fancy vacation or to buy a car. Lack of money may also make it harder for your child to get financial aid.

- With a deposit account, like an online savings account, money market account, or a certificate of deposit (CD), you can save money.

The average cost of a wedding in America in 2022 was $30,000 ($36,000 including the engagement ring). If your child will get married relatively soon, and you’d like to help with wedding expenses, you may want to park some money in short-term investment vehicles that will remain intact, like high-interest savings accounts, which have a higher interest rate than regular savings accounts, or other cash equivalents like short-term Treasuries, which are short-term U.S. government debt obligations.

On the other hand, if you have a longer timeframe, you may want to consider longer-term investments like mutual funds, which are bundles of stocks and bonds grouped together.

Average retirement savings by age 40

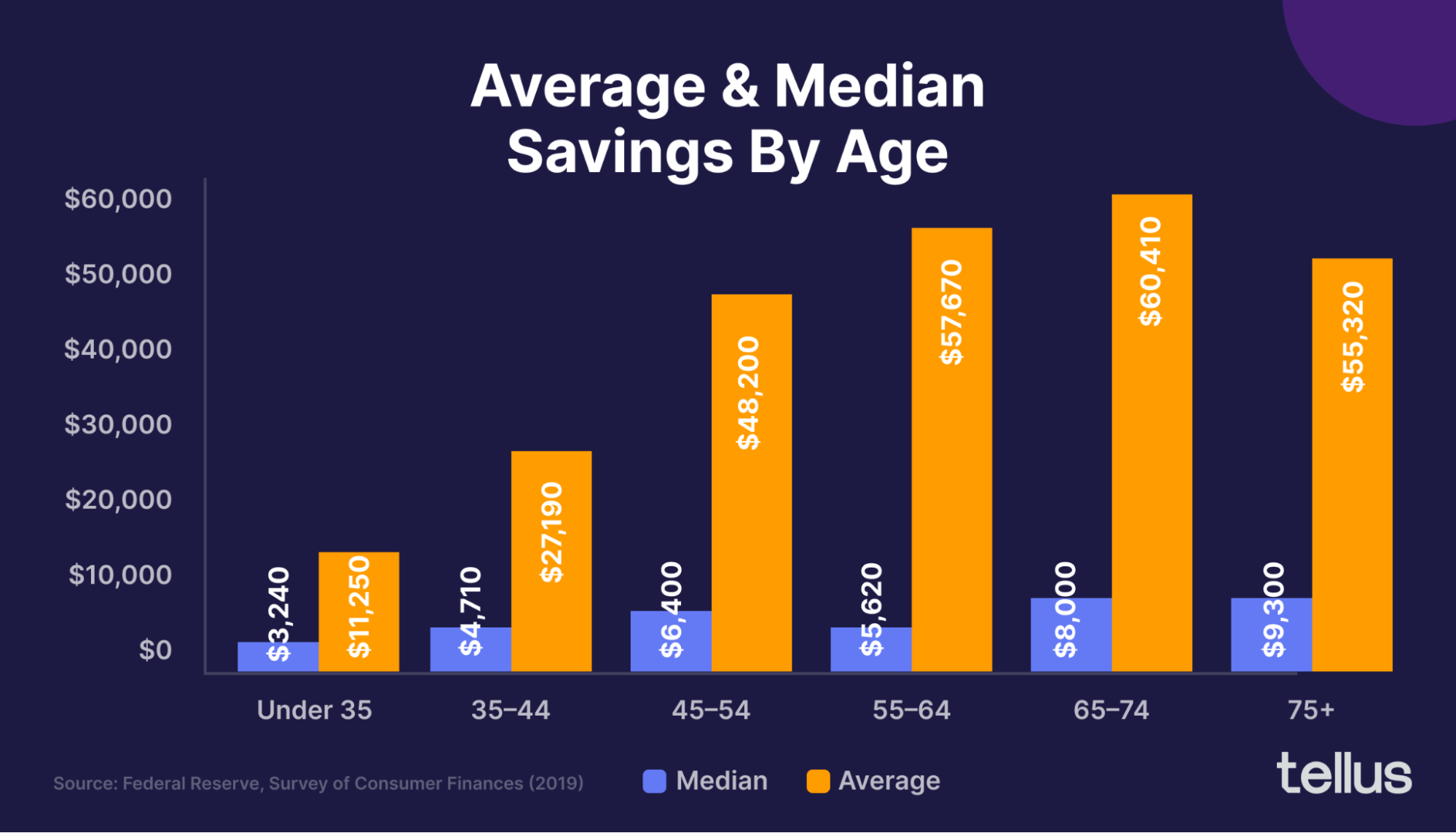

Check out the average retirement savings by age, according to research by the Federal Reserve in 2019 to 2020:

- Age 25 to 29: $9,408.51

- Ages 30 to 34: $21,731.92

- Ages 35 to 39: $48,710.27

- Ages 40 to 44: $101,899.22

- Ages 45 to 49: $148,950.14

- Ages 50 to 54: $146,068.38

- Ages 55 to 59: $223,493.56

- Ages 60 to 64: $221,451.67

As you can see, the average savings by 40 is higher than $48,000 but likely lower than $148,000. However, its worth noting that just because thats the average, that amount may not be what you might want to consider having saved. Keep reading for more information.

What savings expense categories come to mind in this stage of life? Many 40-somethings cite emergency savings, health care, retirement planning, home costs and family expenses.

No matter where you are in life or how old you are, the one thing you can always count on is the unexpected. That’s why it’s so important to have an emergency fund, which is cash you set aside in a savings account or online savings account for unforeseen expenses, like a sudden change in employment, a broken furnace, or the family pet suffering a major sickness or injury.

Ideally, your emergency fund should contain at least three to six months’ worth of living expenses — so if worse comes to worst, you can cover all your essentials without worry for a couple of months, from your mortgage to groceries to prescriptions.