If you get monthly Social Security benefits, your Medicare premiums may be taken out of your Social Security check automatically. The amount of the deduction depends on which Medicare plans you have and your income.

What You’ll Find in This Article

Ever opened your Social Security check and wondered where some of your money went? You’re not alone! Medicare deductions can be confusing but we’re here to break it down in simple terms. In this article we’ll explore exactly how much Medicare deducts from Social Security benefits, who pays what, and what to expect in 2025.

The Quick Answer: Standard Medicare Deductions in 2025

Most people who get Social Security benefits will have $185 taken out of their payments by Medicare automatically. 00 per month for Part B premiums in 2025. This is an increase of $10. 30 from the 2024 amount of $174. 70.

But there’s more to the story than just this standard amount – let’s dive deeper.

How Medicare Deductions Work with Social Security

When you’re enrolled in both Medicare and Social Security, the system is designed to work together. Here’s how it typically functions:

- Automatic deductions: If you receive monthly Social Security benefits, your Medicare Part B premiums are automatically deducted from your Social Security check

- No separate bills: Social Security doesn’t send monthly bills for Medicare premiums

- Notification of changes: You’ll receive a statement telling you how much is being deducted

The billing part of Medicare is almost as important as the coverage itself, says Terry from RetireGuide. “Knowing if your Medicare premiums will be deducted from your Social Security check can help your benefits fit better into your budget.”

What Medicare Parts Are Deducted from Social Security?

Not all Medicare parts are treated the same when it comes to Social Security deductions:

Medicare Part A (Hospital Insurance)

Good news! Most people don’t have to pay for Medicare Part A. You generally qualify for premium-free Part A if you or your spouse paid Medicare taxes for at least 10 years.

If you haven’t worked long enough, you might have to pay a premium:

| Time Worked Paying Medicare Taxes | Monthly Premium Amount (2025) |

|---|---|

| Less than 30 quarters (7.5 years) | $518 |

| 30-39 quarters (7.5-10 years) | $285 |

Medicare Part B (Medical Insurance)

This is the amount that is taken out of your Social Security check automatically. In 2025, the standard premium is $185. 00 monthly for most beneficiaries.

Higher income earners may pay more based on their modified adjusted gross income (MAGI). We’ll cover that in detail later.

Medicare Part C (Medicare Advantage)

Sometimes, these premiums will be taken out of your Social Security benefits, but it doesn’t always happen that way. To set this up, you’ll need to talk to the person in charge of your plan; not all plans offer this feature.

Medicare Part D (Prescription Drug Coverage)

Similar to Medicare Advantage plans, you can request to have your Part D premiums deducted from your Social Security, but you’ll need to contact your plan administrator. This isn’t automatic.

Medigap (Medicare Supplement Insurance)

You typically cannot have Medigap premiums deducted from your Social Security check. These policies are sold through private insurers who bill you directly.

How Much Will Medicare Deduct in 2025?

The standard Part B premium for 2025 is $185.00. This is what most people will see deducted from their Social Security checks.

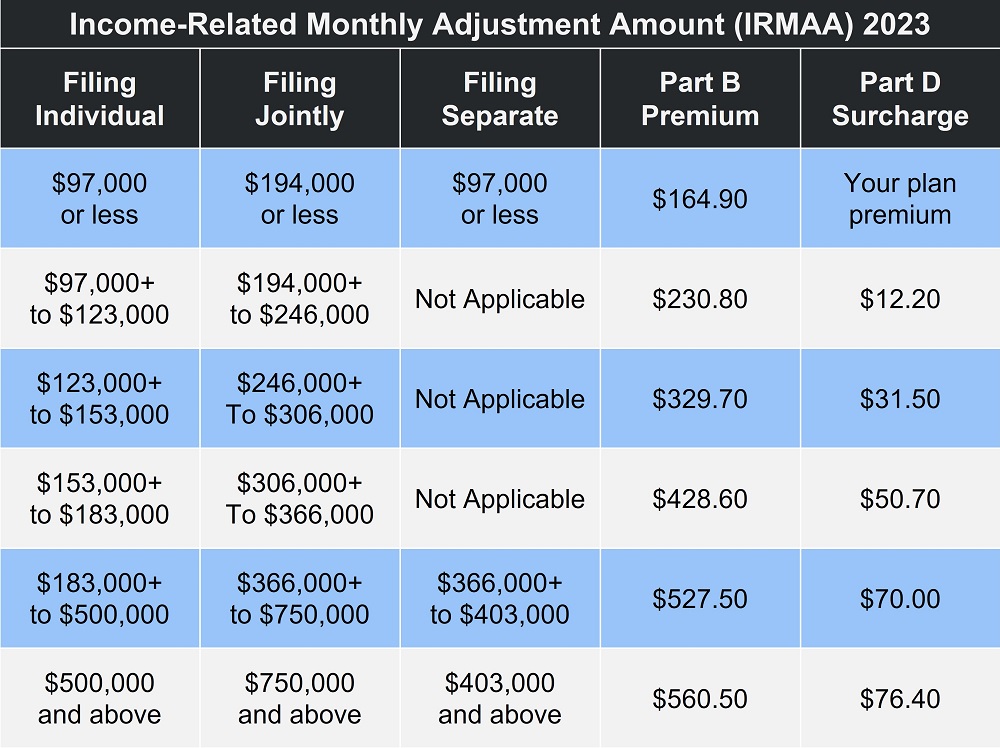

However, if you have a higher income, you’ll pay an additional amount known as the “income-related monthly adjustment amount” (IRMAA).

Here’s what higher-income beneficiaries will pay in 2025:

| Modified Adjusted Gross Income (MAGI) | Part B Monthly Premium |

|---|---|

| Individuals ≤ $106,000 or Married couples ≤ $212,000 | Standard premium = $185.00 |

| Individuals > $106,000 to $133,000 or Married couples > $212,000 to $266,000 | Standard premium + $74.00 = $259.00 |

| Individuals > $133,000 to $167,000 or Married couples > $266,000 to $334,000 | Standard premium + $185.00 = $370.00 |

| Individuals > $167,000 to $200,000 or Married couples > $334,000 to $400,000 | Standard premium + $295.90 = $480.90 |

| Individuals > $200,000 to < $500,000 or Married couples > $400,000 to < $750,000 | Standard premium + $406.90 = $591.90 |

| Individuals ≥ $500,000 or Married couples ≥ $750,000 | Standard premium + $443.90 = $628.90 |

For married folks who lived together during the tax year but filed separately, there’s a different chart:

| Modified Adjusted Gross Income (MAGI) | Part B Monthly Premium |

|---|---|

| Individuals ≤ $106,000 | Standard premium = $185.00 |

| Individuals > $106,000 and < $394,000 | Standard premium + $406.90 = $591.90 |

| Individuals ≥ $394,000 | Standard premium + $443.90 = $628.90 |

Do All Social Security Recipients Pay for Medicare?

No, not everyone on Social Security pays for Medicare in the same way:

- Medicare Part A: Most people don’t pay any premium if they qualify for Social Security benefits

- Medicare Part B: Everyone with Part B must pay premiums, which are typically deducted from Social Security benefits

- Income considerations: Some low-income individuals may qualify for assistance programs that help cover Part B premiums

As the InsuredAndMore website explains, “Medicare Part A (hospital insurance) is free for almost everyone. You have to pay a monthly premium for Medicare Part B (medical insurance).”

Can I Refuse Medicare Part B to Avoid the Deduction?

Yes, you can refuse Medicare Part B, but this decision comes with significant risks:

- You might face late enrollment penalties if you decide to enroll later

- You could have gaps in your healthcare coverage

- This is generally not recommended by healthcare professionals

As InsuredAndMore notes, “Stopping Medicare Part B coverage is generally not recommended.”

What If My Social Security Benefit Is Less Than My Medicare Premium?

If your Social Security benefit isn’t enough to cover your Medicare premium:

- Medicare will bill you directly for the remainder

- You’ll need to pay the difference directly to Medicare

- You can set up Medicare Easy Pay for automatic withdrawals from your bank account

What If My Income Changes?

Social Security uses tax information from the IRS to determine your premium. Generally, they use your tax return from two years ago (so 2023 tax data for 2025 premiums).

If your income has decreased significantly due to certain life-changing events, you can request that Social Security reconsider your premium amount. Qualifying events include:

- Marriage, divorce, or death of a spouse

- You or your spouse stopped working or reduced work hours

- Loss of income-producing property due to disaster

- Changes to pension income

- Employer settlements due to bankruptcy or reorganization

To request a reduction, you’ll need to file Form SSA-44 “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” and provide documentation of your change in circumstances.

Common Questions About Medicare Deductions

Is Medicare Part B automatically deducted from Social Security?

Yes, if you receive Social Security benefits, your Part B premium will be automatically deducted unless you specifically opt out of Part B coverage.

Is Medicare free at age 65?

Medicare Part A is usually free if you’ve worked and paid Medicare taxes for at least 10 years. Medicare Part B always requires a premium payment (usually $185.00 per month in 2025 for most people).

Why is my first Medicare bill so high?

Your first bill might include premiums for multiple months if there was a delay in processing your enrollment. Also, if you have a higher income, you may be paying income-related surcharges.

Why did Social Security stop deducting my Medicare premium?

This could happen for several reasons, including a change in your eligibility status or an error in your records. Contact Social Security immediately if you notice this change.

The Medicare Giveback Benefit: A Possible Reduction

Some Medicare Advantage plans offer what’s called a “giveback benefit” or “Part B premium reduction.” With these plans, the private insurance company may pay some or all of your Part B premium, effectively reducing what comes out of your Social Security check.

To qualify for this benefit, you need to:

- Be enrolled in Original Medicare (Parts A and B)

- Pay your own Part B premium (not have Medicaid paying it)

- Live in the service area of a plan that offers this benefit

This could be worth looking into if you want to reduce your Medicare costs!

Conclusion: Understanding Your Medicare Deductions

For most folks on Social Security, Medicare will deduct the standard Part B premium of $185.00 monthly from their Social Security checks in 2025. This amount might be higher if you have a higher income.

It’s worth reviewing your Social Security statement each year to understand exactly what’s being deducted and why. If you see unexpected changes in your deduction amounts, contact the Social Security Administration right away.

We know navigating Medicare and Social Security can be complicated. If you need personalized help understanding your deductions, consider speaking with a Medicare counselor through your State Health Insurance Assistance Program (SHIP) or calling the Social Security Administration directly.

Remember, staying informed about these deductions helps you better manage your retirement budget and avoid any surprises when it comes to your healthcare coverage costs!

Can Medicare Premiums Be Deducted Automatically From Social Security Checks?

While Medicare premiums can be deducted automatically, the amount withheld from your Social Security check each month depends on what Medicare plans you are enrolled in, whether you have to pay Medicare Part A premiums and your annual income.

Most people don’t have to pay Medicare Part A premiums. You will have to pay Part A premiums, though, if you haven’t paid Medicare taxes through your job in at least 10 years.

If you have to pay monthly Medicare Part A premiums, you can’t qualify for Social Security benefits. But you can still buy Medicare Part A if you don’t qualify for Social Security.

| Time Worked Paying Medicare Taxes | Monthly Premium Amount |

|---|---|

| Less than 30 quarters (7.5 years) | $518 |

| 30 to 39 quarters (7.5 to 10 years) | $285 |

If you have Medicare Part B health insurance, your monthly premiums are based on how much money you make and are taken out of your Social Security check automatically. Most Part B enrollees will have $185 deducted from their Social Security each month in 2025.

The amount increases if you have a high income. The amount of the premium, and the income level at which it increases, change each year.

Medigap (Medicare Supplement Insurance)

You typically cannot have your Medigap premiums deducted from your Social Security check.

Medigap — also called Medicare Supplement insurance — helps cover out-of-pocket Medicare costs such as copays, coinsurance and Medicare deductibles. These policies are sold through private insurers who bill you directly.