Many Americans are rethinking how to make sure they have a steady income in their later years because of rising prices and unstable markets. As a result, annuities have surged in popularity, especially among those nearing retirement. With an annuity, you take a lump sum of money and convert it into a predictable stream of monthly income, either for life or for a set number of years. The idea of locking in income from a large investment can be incredibly appealing, after all, especially during periods of economic volatility.

Right now, this type of retirement tool might be a good addition to your portfolio. But before you put any money into it, you should know how much you can expect to get back every month. This is especially important if you plan to invest a lot of money. That answer isnt always straightforward, though, as annuity payouts are shaped by factors like your age, the type of contract you choose and how long you want the payments to last. And, the interest rate landscape can impact both investment yields and insurer payouts, too.

So, what could your payments look like if youre investing $500,000 in an annuity, and why does that number vary so widely? Thats what well outline below.

Do you ever worry about whether or not your retirement savings will last? I know I do! An annuity is something that many of us think about, but the big question is always: how much monthly income will it really bring in?

If you’ve got $500,000 to invest in an annuity, you’re probably curious about exactly what kind of monthly paycheck that could create for your golden years. The good news? I’ve done the research so you don’t have to!

In this article, I’ll break down exactly how much a $500,000 annuity might pay monthly, what factors affect your payout, and whether this retirement strategy makes sense for your situation.

The Short Answer: What Will a $500k Annuity Pay Monthly?

To get right to the point, a $500000 annuity could pay anywhere from $2693 to $5,284 a month, depending on a number of important factors.

- Your age when payments begin

- Your gender (women typically receive lower payments)

- The type of annuity you choose

- Whether you want lifetime payments or a fixed period

- If you include a beneficiary option

For example a 65-year-old woman purchasing an immediate lifetime annuity might receive around $3,151 per month while a 75-year-old man could get approximately $4,304 monthly with the same investment.

Factors That Determine Your Monthly Annuity Payment

Before we dive into specific numbers, it’s important to understand what actually affects how much you’ll receive each month from your $500k annuity

1. Your Age When Payments Start

This is probably the biggest factor. To put it simply, your monthly checks will be bigger if you are older when you start getting them. This is because the insurance company thinks it will have to pay out less money over your lifetime.

As of June 2025, new information from Cannex shows that age affects the monthly payments on a $500,000 immediate life annuity in the following ways:

| Age | Male | Female | Joint Life |

|---|---|---|---|

| 60 | $3,002 | $2,919 | $2,693 |

| 65 | $3,269 | $3,151 | $2,863 |

| 70 | $3,671 | $3,498 | $3,113 |

| 75 | $4,304 | $4,014 | $3,470 |

| 80 | $5,284 | $4,853 | $4,048 |

2. Gender Matters (For Better or Worse)

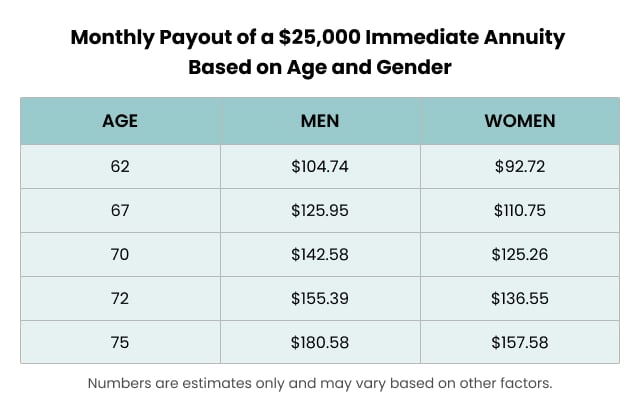

You might have noticed in the table above that women typically receive lower monthly payments than men of the same age. This isn’t some weird gender bias – it’s simply because women generally live longer than men, so the insurance company expects to make more payments over time.

3. Single Life vs. Joint Life Annuities

If you want your annuity to cover both you and your spouse (joint life), your monthly payments will be lower than if you chose a single life annuity. This makes sense since the insurance company is potentially covering two lifetimes instead of one.

A joint life option for 65-year-olds might pay around $2,863 monthly compared to $3,269 for a single male or $3,151 for a single female.

4. Payout Period: Lifetime vs. Fixed Term

You can choose between:

- Lifetime payout – Guaranteed income until you die (highest risk for you if you die early)

- Fixed period – Payments for a specific number of years (10, 15, 20 years, etc.)

- Life with period certain – Payments for life, but with a minimum guaranteed period

Using the Annuity Payout Calculator on Calculator.net, a $500,000 annuity with a 10-year fixed payout and 5.8% interest rate would pay approximately $5,511.20 monthly. Over those 10 years, you’d receive total payments of $661,344.16 (including $161,344.16 in interest).

5. Type of Annuity You Choose

There are several types of annuities that affect your monthly payout:

- Fixed annuities – Stable, predictable income with a permanent interest rate

- Variable annuities – Payments fluctuate based on investment performance

- Indexed annuities – Tied to market index performance with less risk than variable

- Immediate annuities – Start paying right away

- Deferred annuities – Payments begin at a future date

Real-World Examples: What Different People Get From a $500k Annuity

Let’s look at some hypothetical examples based on recent data to make this more concrete:

Example 1: Ted (75-Year-Old Male)

Ted invests $500,000 in an immediate lifetime annuity. His estimated monthly payout is $4,269 (approximately $51,228 per year) for the rest of his life.

Ted chose a single life annuity, which offers the highest monthly payout but doesn’t provide anything to beneficiaries after he passes away. This works great for Ted because he wants to maximize his retirement income and doesn’t need to leave money behind.

Example 2: Ella (65-Year-Old Female)

Ella also invests $500,000 in an immediate lifetime annuity. Her monthly payout is $3,103 (about $37,236 annually) – more than $1,000 less per month than Ted even though they invested the same amount!

Why the difference? Ella is 10 years younger than Ted, so the insurance company expects to make payments to her for many more years. Plus, women typically live longer than men, further reducing her monthly amount.

Example 3: Irene (65-Year-Old Female with Beneficiary Protection)

Irene invests $500,000 in an immediate lifetime annuity with a 20-year period certain. This means payments will continue for at least 20 years, even if she passes away earlier.

Her monthly payout is $2,827 (approximately $33,456 annually) – less than Ella’s, even though they’re the same age and gender. The difference is that Irene’s annuity includes protection for her beneficiaries, which reduces her monthly amount.

Is a $500,000 Annuity Right for You?

Honestly, this is where things get personal. There’s no one-size-fits-all answer. But I can share some pros and cons to help you decide:

Pros of a $500k Annuity:

- Guaranteed income for life (no matter how the market performs)

- Tax-deferred growth (you don’t pay taxes until you receive payments)

- Protection against outliving your savings

- Predictable, steady income for budgeting

- No investment management required on your part

Cons of a $500k Annuity:

- Often come with high fees (sometimes hidden in complex contracts)

- Usually requires a large upfront investment

- Limited liquidity (hard to access your money if needed)

- Potential loss if you die early (unless you add riders/protections)

- Typically lower returns than other investments

Common Annuity Questions

What happens to my annuity if I die early?

This depends entirely on the type of annuity you choose:

- With a straight life annuity, payments stop when you die, even if that’s shortly after purchasing it

- With a life with period certain or refund annuity, your beneficiaries receive something after your death

- A joint and survivor annuity continues payments to your spouse after you die

Are annuity payments taxable?

Generally, yes – but it depends on how you purchased the annuity:

- For qualified annuities (purchased with pre-tax money like a 401k rollover), payments are fully taxable as ordinary income

- For non-qualified annuities (purchased with after-tax dollars), only the earnings portion is taxable

Can I get my money back if I change my mind?

Most annuities have a “free look” period (usually 10-30 days) where you can cancel without penalty. After that, withdrawing your money typically involves surrender charges that can be quite steep (sometimes 7-10% of your investment).

The Bottom Line: Is a $500,000 Annuity Worth It?

Whether a $500,000 annuity makes sense really depends on your personal situation and goals. If having guaranteed monthly income for life is your priority, then an annuity could be a great addition to your retirement strategy.

Based on current rates, a $500,000 annuity could provide roughly $2,700 to $5,300 per month depending on your age, gender, and the specific options you choose.

I personally think annuities work best as part of a diversified retirement plan, not your entire strategy. Maybe use a portion of your savings for an annuity to cover your essential expenses, while keeping other investments more accessible for flexibility.

Before making any decisions, I’d recommend talking to a financial advisor who can help you understand all the options and how they fit with your specific retirement goals. Annuities can be complex, and the right choice really varies from person to person.

Have you considered an annuity for your retirement? What questions do you still have about how they work? I’d love to hear your thoughts in the comments!

Note: The monthly payment figures in this article are based on rates available as of June 2025 and are subject to change. Always get current quotes before making any financial decisions.

How to find the right annuity for your retirement portfolio

Finding the right annuity for your $500,000 investment requires careful consideration of your unique retirement needs and goals. Heres how to navigate the process effectively:

Consider your risk tolerance. If market volatility is a concern, a fixed annuity providing guaranteed payments might be preferable. But if you’re okay with some investment risk and want the chance of higher returns, you might want to look into a variable annuity.

Compare different annuity types. Immediate annuities start paying right away, but lock in your capital. Deferred annuities allow your money to potentially grow before payments begin. A single premium immediate annuity typically offers the highest monthly payments, while fixed-indexed annuities provide growth potential with downside protection.

Check the provider’s financial strength. Before giving an insurance company $500,000, use independent rating agencies to make sure they are financially stable. A company with an “A” rating or higher offers greater security that itll honor decades of future payments.

Read the fine print on fees: Annuities, especially the variable and indexed varieties, can carry substantial fees that reduce your effective returns. Ask for a full breakdown of all fees, such as death and expense fees, administrative fees, surrender fees, and rider costs.

A $500,000 annuity can be a powerful way to guarantee income for retirement, but the exact amount youll receive each month depends on when you buy it, your profile and the contract terms you select. As a rough guide, you can expect somewhere between $2,600 and $5,200 per month currently. Before committing to an annuity, though, you should carefully consider your overall financial picture, including other income sources, health status and financial goals for your heirs. After all, the highest-paying option wont be the best choice if it doesnt align with your broader needs.

Angelica Leicht is the senior editor for the Managing Your Money section for CBSNews.com, where she writes and edits articles on a range of personal finance topics. Angelica previously held editing roles at The Simple Dollar, Interest, HousingWire and other financial publications.

How much will a $500,000 annuity pay monthly?

If youre investing $500,000 into an annuity, your payments could range anywhere from about $2,600 to over $5,200 per month, according to an analysis of Cannex data by Annuity.org. However, the exact amount of your monthly payment depends on a range of factors, including:

Your age when payments begin: One of the biggest influences on your monthly payout is your age when the annuity starts paying out. The older you are, the higher your payments typically are. For example, the average 70-year-old male with a $500,000 annuity can expect a monthly payment of $3,655 right now, while the average 60-year-old male can expect a monthly payment of $2,953.

Your gender: Men and women typically receive different payment amounts, as women tend to live longer than men, statistically. That means insurers expect to make payments over a longer period for women, which lowers the monthly amount. For instance, a 65-year-old man would currently receive about $3,237 a month on a $500,000 annuity, while a woman the same age would receive a monthly payment of $3,103.

The annuity type you choose: There are many kinds of annuities, and your choice affects both your initial payment amount and long-term growth. Some common options include:

- Fixe annuities: With a fixed annuity, you get a set amount every month.

- Variable annuities: The payments on these will change based on how well the investments do.

- Instant annuities: As soon as you put money into an instant annuity, it starts giving you a monthly income.

- For deferred annuities, payments are put off, as the name suggests, so your money has time to grow.

Guarantees and extra features: Adding guarantees to protect your heirs can lower your monthly income. For example, if you choose lifetime-only payments, your monthly check will be higher, but the payments stop when you die. If you add a 20-year guarantee, the annuity will keep paying your beneficiaries if you die earlier than expected, but your monthly income might be lower. Similarly, inflation protection riders can help your payments keep up with rising costs, but reduce your starting income.

The interest rate environment: When interest rates are high, insurers can offer more generous monthly payments. When rates are low, the opposite happens. That means timing your purchase can make a noticeable difference in your monthly income.