“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board is made up of financial experts whose job it is to make sure that all of our content is fair and unbiased.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo.

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most — how to save for retirement, understanding the types of accounts, how to choose investments and more — so you can feel confident when planning for your future. Bankrate logo.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo.

You’re not the only one who is thinking about retirement and wondering if a million-dollar annuity is the key to financial freedom. I’ve done a lot of research on this subject for my clients, and the answers might surprise you. Let’s look at what you can expect when you put that cool million into an annuity.

The Million-Dollar Question: What Will Your Monthly Checks Look Like?

First, there is no one answer to the question of how much a $1 million annuity pays each month. Based on what I’ve learned from a number of reliable financial sources, a 65-year-old woman who buys a $1 million immediate lifetime annuity could get around $6,297 each month. That’s a nice chunk of change!

But wait, that same million dollars might earn you about $7343 a month if you’re a 70-year-old man. And if you’re married and 65 years old and want joint coverage, you can expect to pay about $5,710 a month until both of you die.

Why the difference? Well, it all comes down to several key factors that insurance companies use to calculate your payout.

Factors That Determine Your Million-Dollar Annuity Payout

1. Age and Gender Matter – A Lot!

Your monthly payments are significantly affected by:

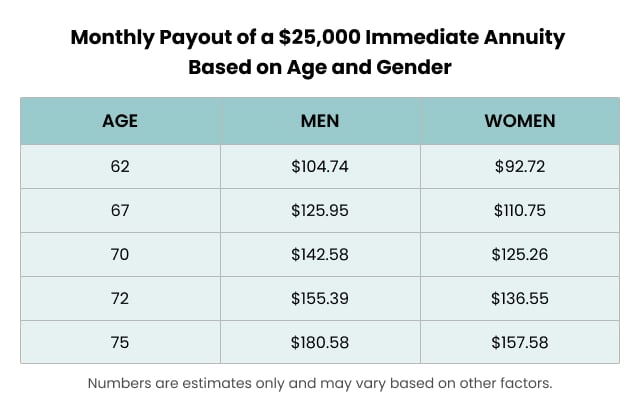

- Your age when payments begin: Older individuals receive higher monthly payments because the insurance company expects to make payments for fewer years.

- Gender: Men typically receive higher payouts than women of the same age because women statistically live longer.

For example, looking at immediate lifetime annuity payouts for a $1 million investment:

| Age | Male | Female | Joint Life (Same Age Couple) |

|---|---|---|---|

| 60 | $5,990 | $5,821 | $5,369 |

| 65 | $6,530 | $6,285 | $5,710 |

| 70 | $7,343 | $6,979 | $6,211 |

| 75 | $8,597 | $8,012 | $6,924 |

| 80 | $10,508 | $9,654 | $8,057 |

2. Type of Annuity

The annuity type you choose has enormous impact on your monthly checks:

- Immediate Annuities: Start paying right away but often provide lower returns than deferred options.

- Deferred Annuities: Allow your money to grow before payments begin, potentially resulting in larger payouts.

- Fixed Annuities: Provide guaranteed, predictable payments.

- Variable Annuities: Payments fluctuate based on investment performance.

- Indexed Annuities: Payments tied to market index performance but with some downside protection.

3. Payout Period

How long you want the payments to last dramatically affects the monthly amount:

- Life-Only Option: Highest monthly payments but stops when you die (nothing for beneficiaries).

- Period Certain: Payments for a specific number of years (10, 15, 20 years).

- Life with Period Certain: Lower monthly payments but guarantees payments for a minimum period.

- Joint and Survivor: Lower payments but continues for both spouses’ lifetimes.

4. Interest Rates

The interest rates that are in effect when you buy your annuity have a big effect on your returns. Higher rates generally mean better payouts.

Real-Life Examples of Million-Dollar Annuity Payouts

Let me share some examples to make this concrete:

Example 1: Bob’s Story

Bob is 70 years old and purchased a $1 million immediate annuity with a life-only payout. His monthly income? $7,344 for the rest of his life. He prioritized maximum monthly income over leaving money for heirs.

Example 2: Linda’s Approach

Linda, age 65, invested $1 million in a single life immediate annuity. She receives $6,297 monthly. Her payout is lower than Bob’s because she’s younger and female – both factors that increase life expectancy.

Example 3: George and Martha’s Joint Plan

This couple, both 65, invested $1 million in a joint life annuity. They receive $5,722 monthly that will continue as long as either of them is alive. The lower payment reflects the longer expected payout period covering two lives.

The Accumulation Phase Can Boost Your Payouts

Here’s a strategy that can significantly increase your monthly checks:

Imagine you’re 60, plan to retire at 65, and invest $1 million in a multi-year guaranteed annuity (MYGA) with a 5.95% annual growth rate. By age 65, your annuity would grow to approximately $1.33 million. This larger sum could then provide payments of about $4,450 per month for 25 years.

Pros and Cons of Million-Dollar Annuities

Before you sign on the dotted line, consider these benefits and drawbacks:

Pros:

- ✅ Guaranteed income stream for life

- ✅ Tax-deferred growth

- ✅ Protection against outliving your savings

- ✅ Predictable payments help with budgeting

Cons:

- ❌ High fees and expenses can eat into returns

- ❌ Limited liquidity – difficult to access funds early

- ❌ Complex terms and conditions

- ❌ May not keep pace with inflation without specific riders

Beyond the Million: What About Smaller Investments?

Not everyone has a million dollars to invest. Let’s scale things down: a $100,000 annuity might pay around $550-$1,100 monthly, depending on your age, gender, and the type of annuity you choose.

For comparison, if we apply the same calculations used for our million-dollar examples but divide by 10:

| Age | Male ($100k) | Female ($100k) |

|---|---|---|

| 65 | $653 | $629 |

| 70 | $734 | $698 |

How to Calculate Your Own Annuity Payout

If you’re math-inclined, here’s the formula used to calculate annuity payments:

P = (d[1-(1 + r/k)-nk])/(r/k)

Where:

- P: Initial investment amount

- d: Regular withdrawal amount

- r: Annual interest rate (decimal)

- k: Number of compounding periods per year

- n: Number of years for withdrawals

Don’t worry if that looks intimidating – most financial advisors or annuity providers can run these calculations for you!

Making the Best Decision for Your Retirement

When deciding if a million-dollar annuity is right for you, I recommend:

- Evaluate your retirement needs: How much monthly income do you need?

- Consider your longevity: Family history often provides clues about life expectancy.

- Assess your risk tolerance: How important is payment certainty versus growth potential?

- Compare multiple quotes: Payouts vary significantly between providers.

- Consult a financial advisor: They can help determine if annuities fit within your overall retirement strategy.

My Final Thoughts

A million-dollar annuity can definitely provide substantial monthly income for retirement – anywhere from about $5,000 to over $10,000 per month depending on your circumstances. But remember, this is just one piece of your retirement puzzle.

The best approach combines various income sources – Social Security, pensions, investments, and perhaps annuities – to create a secure retirement plan that works for your unique situation.

Have you considered how a million-dollar annuity might fit into your retirement plans? I’d love to hear your thoughts in the comments below!

Note: The figures provided in this article are based on rates available as of early 2025. Annuity rates change frequently, so always get current quotes before making decisions.

Scenario No. 2: 50-year-old male – deferred income annuity

If a man in his 50s bought a deferred income annuity that starts paying out at age 65 and has a death benefit that can be used before payments start, he would get:

- $14,248 per month (Integrity Companies, A+ rating from AM Best)

- $12,217 per month (Symetra, A rating from AM Best)

(Only two out of the five insurers on Income Solutions offered a deferred income annuity).

Now, let’s tweak some of those metrics.

What if the same man waits until age 55 to purchase the annuity, and payments start when he’s 70? Even though the annuity is deferred for the same amount of time (15 years), by delaying payouts until age 70 (instead of 65), his monthly amount goes up, with a low offer of $14,118 per month and a high offer of $16,208 per month.

Scenario No. 1: 65-year-old woman – immediate income annuity

A 65-year-old woman purchasing an immediate income annuity for her life only can expect between $5,617 and $6,438 per month.

If the same woman waits five years to buy the same annuity (when she’s 70 years old), her monthly payments increase to as much as $7,271 a month.

The 65-year-old woman wants to make sure that her family gets some of the money she put into the annuity if she dies. We added a 10-year period certain to the contract, which means that if the woman dies within the first 10 years of her contract, her beneficiary will receive payments for the rest of the 10-year term. This slightly decreased her monthly payouts, with the highest quote coming in at $6,281 per month vs. $6,438.

What Does A $1 Million Annuity Pay Per Month?

FAQ

What is the monthly income on a $1,000,000 annuity?

The exact payout depends on multiple factors, including your age, gender, type of annuity and additional features like survivor benefits or death benefits. The quotes show that an annuity for $1 million can pay anywhere from $4,736 to over $14,000 a month, depending on how the contract is set up.

What is the biggest disadvantage of an annuity?

The biggest problems with annuities are that they are hard to get money out of because they have high fees and penalties for taking money out early, and they are also hard to understand, which can lower long-term returns by a lot.

How much annual income can $1 million generate?

Depending on the investments made, the level of risk taken, and interest rates at the time, a $1 million portfolio can bring in anywhere from $40,000 to $100,000 or more per year.

How much do you need in an annuity to get $1000 a month?

We’ll also assume you’re going to live approximately 18 more years to the average male life expectancy of 83 years. In order to withdraw $1,000 each month you would need roughly $192,000. If you exceeed your life expectancy and make it to the ripe old age of 90 you would need approximately $240,000.

How much does a 1 million annuity pay a month?

As of August 2025, with a $1,000,000 annuity, you’ll get an immediate payment of $6,000 monthly starting at age 60, $6,608 monthly at age 65, or $7,125 monthly at age 70. How much does a $1.5 million annuity pay?

How much does a $10,000 annuity pay per month?

As of August 2025, with a $10,000 annuity, you’ll get an immediate payment of $60 monthly starting at age 60, $66 monthly at age 65, or $72 monthly at age 70. How much does a $20,000 annuity pay per month?

What factors affect the monthly payout of a 1 million annuity?

The monthly payout of a $1 million annuity depends on several factors, including when payments start, the length of distribution, and the annuitant’s age and gender. If you’re considering a $1 million annuity, it’s important to understand how that lump sum translates into reliable monthly income.

How much does a $400,000 annuity pay per month?

As of August 2025, with a $400,000 annuity, you’ll get an immediate payment of $2,400 monthly starting at age 60, $2,643 monthly at age 65, or $2,850 per month at age 70. How much does a $500,000 annuity pay per month?

How much do annuities cost?

By the time you reach age 65, the annuity would have a value of just over $1.33 million, allowing you to begin taking payments of $4,450 per month. Several different types of annuities vary based on when you pay for the annuity, when you receive payments or even who is making the payments on the annuity.

How much does a 5 million annuity cost?

As of August 2025, with a $5,000,000 annuity, you’ll get an immediate payment of $30,000 monthly starting at age 60, $33,041 monthly at age 65, or $35,625 monthly at age 70. Are annuities subject to RMD?