You can use Social Security benefits to pay for some of your Medicare premiums. You can also pay your Medicare bills online or by mail without a fee.

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken from your check before it is sent to you or deposited.

This automatic deduction generally applies to your Part B premium, but you can also set it up for many Part C and Part D plans.

If you get Social Security Disability Insurance (SSDI) or Social Security retirement benefits, your premiums may be taken out automatically at times.

But this doesn’t apply to all Medicare premiums. Each part of Medicare has its own premiums and rules for interacting with Social Security.

If you are 65 or older and one of these situations applies, you can sign up for Medicare Part A and not have to pay a premium:

You can also receive Part A without paying a premium if you qualify because of a disability. You can qualify for Medicare because of a disability at any age.

You can still get Medicare Part A if none of these situations apply, but you’ll need to pay a premium. Your premium will depend on how many work credits you have.

In 2025, if you have fewer than 30 work credits, you’ll pay $518 per month for Part A. If you have between 30 and 39 credits, you’ll pay $285 per month.

If you need to pay a Part A premium, you’ll get a bill every month. You can pay this bill online or by mail.

Medicare Part B (outpatient medical insurance) premiums are typically deducted from any Social Security or RRB benefits you receive. In this case, your Part B premiums will be automatically deducted from your total benefit check.

You must manually pay your premium if you don’t receive Social Security or RRB benefits. Medicare sends you a bill every 3 months, which you can pay online or by mail.

The standard 2025 Part B premium is $185. However, depending on your income, the premium might be higher.

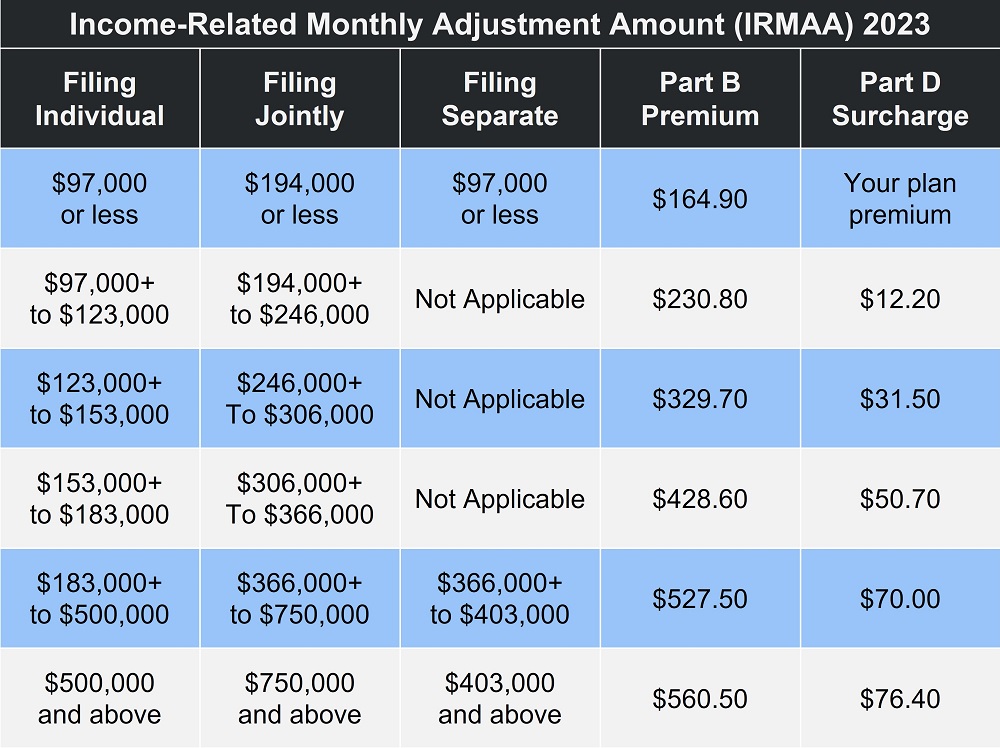

With a single income of $106,000 or more or a joint income of $212,000 or more in 2025, you’ll have to pay more for Part B. This adjusted amount is called an income-related monthly adjustment amount (IRMAA).

If you have a limited income, you might be eligible to receive Part B at a lower cost or even for free. In that case, you can apply for a Medicare savings program to help cover your expenses.

You’re not the only one who is getting close to retirement age and wondering, “How much do they take out of your Social Security check for Medicare?” I can tell you that this is one of the most common questions we hear from people who are retired.

The short answer In 2025 most people will have $185 per month deducted from their Social Security check for Medicare Part B premiums. But there’s way more to the story than just that simple number.

The Basics: Medicare Deductions from Your Social Security Benefits

When you start getting Social Security benefits and sign up for Medicare, the government takes your Medicare premiums out of your monthly benefit payment. This is the default arrangement for most beneficiaries.

The primary deduction you’ll see is for Medicare Part B which covers

- Doctor visits

- Outpatient care

- Preventive services

- Some home health services

But depending on your situation, you might see other Medicare-related deductions too.

How Much Will Medicare Take Out in 2025?

Let’s break down the current numbers so you know exactly what to expect:

| Medicare Part | 2025 Monthly Premium | Who Pays This |

|---|---|---|

| Part A (Hospital) | $0 for most people | Free if you or spouse paid Medicare taxes for at least 10 years |

| Part A (Hospital) | $285 if worked 30-39 quarters | Those with limited work history |

| Part A (Hospital) | $518 if worked less than 30 quarters | Those with minimal work history |

| Part B (Medical) | $185 standard premium | Most beneficiaries |

| Part B (Medical) | Up to several hundred $ more | High-income earners |

| Part D (Drugs) | Varies by plan | Optional; can be deducted from SS |

As you can see from the table, most people don’t pay for Part A because they’ve worked and paid Medicare taxes long enough. But almost everyone pays for Part B.

Higher Premiums for Higher Incomes

If your income is above certain thresholds, you’ll pay more than the standard Part B premium. This is called the Income-Related Monthly Adjustment Amount (IRMAA).

For 2025, you’ll pay higher Part B premiums if your individual income exceeds $106,000 or joint income (for married couples) exceeds $212,000. These numbers are based on your tax return from two years prior.

I’ve seen clients shocked when they suddenly have to pay hundreds more per month because they had a one-time increase in income two years ago (like from selling property or taking a retirement distribution). It’s definitely something to plan for!

Other Medicare Costs That Can Be Deducted

Besides Part B premiums, you might choose to have other Medicare-related costs deducted from your Social Security:

-

Medicare Advantage (Part C) premiums – If you opt for a Medicare Advantage plan instead of Original Medicare, you can request to have these premiums deducted from your Social Security. This isn’t automatic though – you’ll need to contact your plan administrator to set this up.

-

Medicare Part D (prescription drug) premiums: If you have a separate Part D plan, you can also have those premiums taken out of your paycheck. Again, not automatic.

-

Payments for Medicare Part A—Only needed if you haven’t worked long enough to get Part A for free

One thing to note: Medigap (Medicare Supplement) premiums typically cannot be deducted from your Social Security check. These are usually paid directly to the private insurance company.

The “Hold Harmless” Provision: Your Protection

Here’s some good news! There’s a provision in Social Security law called “hold harmless” that prevents your monthly Social Security payment from decreasing year-to-year due to increases in the standard Medicare Part B premium.

This means if your Social Security cost-of-living adjustment (COLA) isn’t enough to cover an increase in the Medicare premium, your premium won’t go up by the full amount.

However, this protection doesn’t apply to:

- High-income beneficiaries

- People new to Medicare

- People who don’t have their premium deducted from Social Security

What About Medicare Taxes?

It’s important to distinguish between Medicare premiums (which are deducted from your Social Security check) and Medicare taxes (which are withheld from your wages during your working years).

The Medicare portion of FICA tax is 1.45% of all earnings for both employees and employers (2.9% total). This doesn’t directly relate to the premium deductions we’re discussing, but it’s good to understand the difference.

Can You Avoid Medicare Deductions from Social Security?

You might be wondering if there’s a way around having Medicare premiums deducted from your Social Security. The answer is yes, but with some caveats:

If you’re enrolled in Medicare but NOT yet receiving Social Security benefits, you’ll receive a bill for your Medicare premiums. You can pay these directly or sign up for Medicare Easy Pay, which automatically withdraws premiums from your bank account.

Once you start receiving Social Security benefits, the automatic deduction typically kicks in. However, you do have the option to decline Medicare Part B (and avoid those premiums) – but this is generally NOT recommended unless you have other qualifying health coverage, as you might face penalties later.

Do You Have to Pay for Medicare If You’re On Social Security?

The short answer is yes, most people on Social Security still have to pay for Medicare. The only major exception is Part A, which is premium-free if you’ve worked long enough.

However, there are a few situations where you might get help with your Medicare costs:

-

Medicare Savings Programs can help low-income beneficiaries with premiums and other costs.

-

Some Medicare Advantage plans offer “give back benefits” that may cover part or all of your Part B premium.

-

If you’re still working and covered by an employer plan, you might be able to delay enrolling in Parts B and D (and avoid those premiums).

How to Check Your Medicare Deductions

Social Security doesn’t send monthly bills for Medicare premiums, but they do send statements showing how much is being deducted from your check.

You can also check your deductions by:

- Creating or logging into your my Social Security account online

- Reviewing your annual Social Security benefit statement

- Calling Social Security at 1-800-772-1213

What If Your Deduction Seems Wrong?

If you notice an unexpected change in your Medicare deduction, there could be several reasons:

- Your income from two years ago increased, pushing you into a higher premium bracket

- You’re newly enrolled in Medicare

- You’ve requested additional deductions for Medicare Advantage or Part D

- There’s been an error in your records

If you believe there’s a mistake, contact Social Security immediately to resolve the issue.

Final Thoughts

Understanding Medicare deductions from your Social Security check is crucial for planning your retirement budget. While most people will pay the standard $185 per month for Part B in 2025, your actual deductions could be higher depending on your income and which Medicare plans you choose.

I’ve seen too many new retirees get surprised when their first Social Security check is smaller than expected because they didn’t account for Medicare premiums. Don’t let that be you!

Remember, Medicare helps cover your healthcare costs but doesn’t pay for everything. Planning for these expenses—including the premiums that will be deducted from your Social Security—is an important part of a secure retirement plan.

Have you checked what your estimated Social Security benefit will be? It’s a good idea to subtract at least $185 (or more, depending on your income) to get a more realistic picture of what will actually hit your bank account each month.

And remember, these numbers change annually, so it’s always good to stay informed about the latest Medicare premium amounts. Your financial health in retirement depends on it!

Medicare Part C and Part D

Medicare Advantage (Part C) and Medicare Part D prescription drug plans are administered by private insurance companies that contract with Medicare.

Medicare Advantage plans must cover everything that Original Medicare (parts A and B) covers. They often include coverage for extra services and coverage from Part D prescription drug plans.

Stand-alone Medicare Part D plans work alongside Original Medicare and cover take-home prescription medications.

Medicare Advantage and Part D plans are optional. If you want either, you’ll have multiple options with varying costs, some starting at $0 per month. The Medicare website has a tool that you can use to shop for both plan types in your area.

You can deduct your Medicare Advantage or Part D plan premiums from Social Security. To set it up, you’ll need to contact the company that administers your plan.

But it can take some time for automatic payments to begin. This means your first payment could be very large, since it may cover multiple months at once. Your insurer will walk you through the details and let you know roughly how long it should take.

If it looks like it’s going to take a few months, consider putting some money aside for the premiums. This way, you’ll have a buffer if the first payment is larger than usual.

Your premiums will be deducted once per month after everything is set up.

Medicare premiums are tax-deductible. However, you can deduct premiums only once your out-of-pocket medical expenses reach a certain limit.

The IRS has set that limit at 7.5% of your adjusted gross income (AGI), which is the amount you make after taxes are deducted from each paycheck.

If your AGI is $50,000, you could deduct $3,750 in medical costs. Depending on your premiums and other healthcare spending, you might not reach this number.

If your spending is less than 7.5% of your AGI, you can’t deduct any healthcare expenses, including premiums.

Keep careful records of your out-of-pocket medical costs throughout the year so that you can make the right tax deductions when the time comes.

If your Medicare bills aren’t automatically deducted, you can pay them online or by mail. You won’t pay an added fee for parts A, B, or D, depending on your payment method.

You have several ways to pay:

- You can use your MyMedicare account to pay online with a credit or debit card.

- Your premiums will be taken out of your checking account automatically through Medicare Easy Pay.

- your bank’s automatic bill pay feature, which means Medicare will get your payments right away.

- a money order or check that you can mail to Medicare with the part of your Medicare bill that you torn off

- write your information on the tear-off part of your bill and mail it back to Medicare to be paid with a credit or debit card.

Are Medicare Premiums Deducted From Social Security?

FAQ

Does everyone pay $170 for Medicare?

Do you have to pay for Medicare? Yes, most people pay $185 per month for Medicare Part B and may pay more if they choose extra coverage options. Part A is free if you worked for 10 years or more.

How much is deducted from Social Security for Medicare per month?

Medicare takes the Part B premium out of your Social Security check. For most people in 2025, it was $185 a month. The exact amount can change based on your income, any other Medicare plans you have (like Part D or Advantage), and sometimes a federal rule called “hold harmless” that limits premium increases.

How much does Medicare hold out of your Social Security check?

Deductions from Social Security for Medicare primarily consist of the Medicare Part B premium, which was $185. 00 in 2025 for most people, though high-income earners pay more due to income-related monthly adjustment amounts (IRMAA).

How much do Social Security and Medicare take out of your check?

| FICA Component | Employer Pays | Employee Pays |

|---|---|---|

| Social Security tax | 6.2% | 6.2% |

| Medicare tax rate | 1.45% | 1.45% |

| Additional Medicare tax withheld | 0% | 0.9% |