Ever wished that you wouldn’t have any debt when you got old? I’m sorry to burst your bubble, but the truth may surprise you. After years of researching how to fund retirement, I’ve learned some shocking facts about how much debt the average retiree actually has. Let’s talk about the tough truth about American retirement debt right now.

The Alarming Reality of Retiree Debt

People used to say that you should “retire without debt,” but it seems like those days are over, like rotary phones and VHS tapes. The shocking results of a LendingTree study show that a staggering 2097% of adults in retirement have debt that isn’t a mortgage. This is true: almost all retirees are still paying off debt in their golden years.

The average balance? A concerning $11349 in non-mortgage debt alone.

This trend represents a dramatic shift from previous generations. In 1989, the average amount of debt for people aged 55 and up was less than $22,000. These days, the numbers are very different.

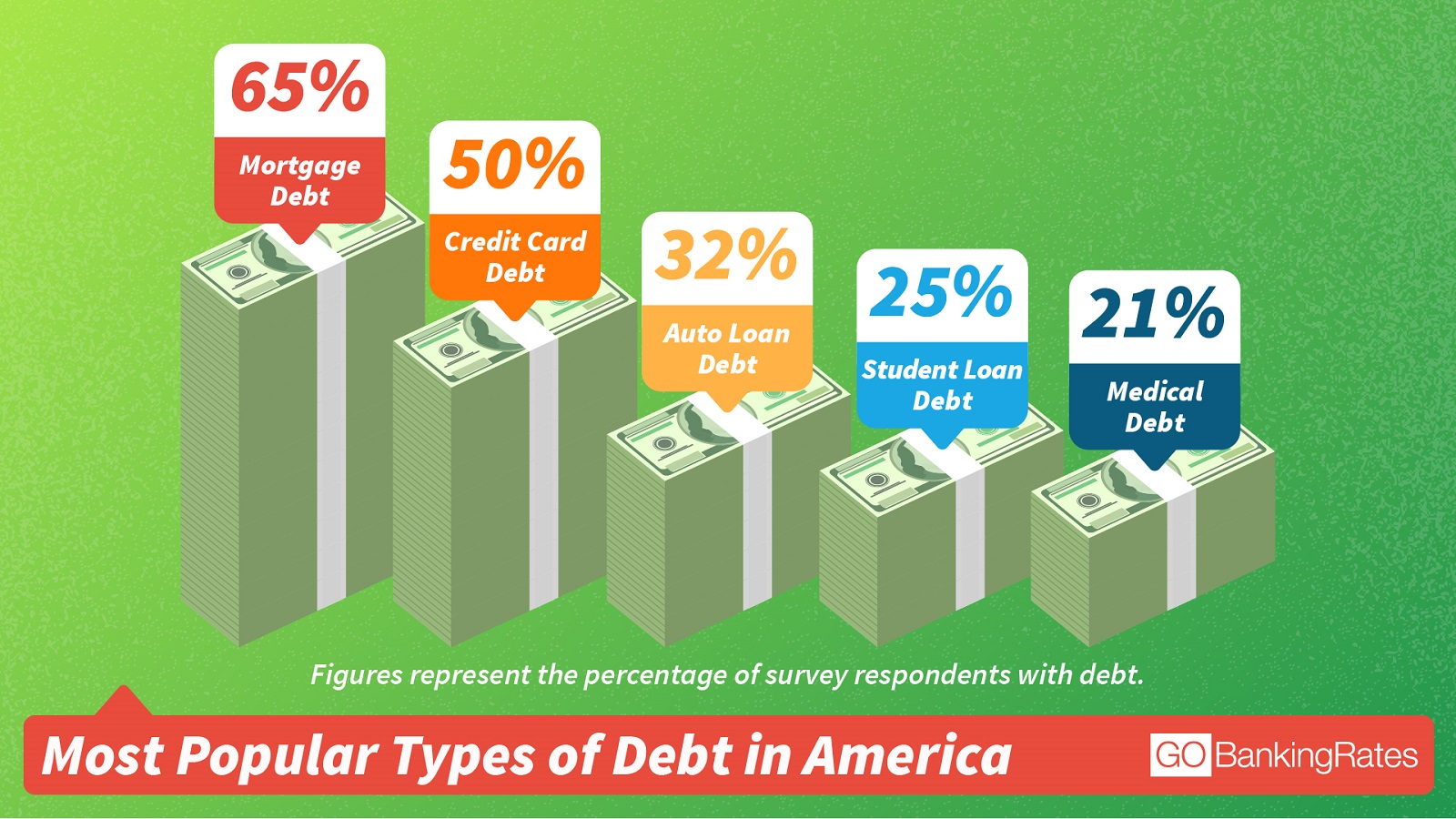

What Types of Debt Are Retirees Carrying?

The debt that seniors have doesn’t come from just one place; it comes from many places.

- Credit Card Debt: The most common type, with 93% of retirement-age Americans carrying balances

- Auto Loans: 37% of seniors have car payments

- Personal Loans: 19% are paying these off

- Student Loans: Surprisingly, 8% of seniors still have student debt

According to AARP’s 2023 report, a whopping 75% of adults aged 50-plus hold some form of debt, and 46% specifically carry credit card debt. What’s particularly concerning is that the average credit card interest rate sits at an eye-watering 21.5%!

By the Numbers: How Much Debt at Each Age?

The Federal Reserve data paints a clear picture of debt by age group:

| Age Group | Average Debt |

|---|---|

| 18-23 | $9,593 |

| 24-39 | $78,396 |

| 40-55 | $135,841 |

| 65-74 | $134,950 |

For those between 55-64 years old, the median debt in 2022 hit $90,000 – a significant increase from previous decades.

Different Types of Senior Debt

Mortgage Debt

Many retirees are still paying off their homes. The Federal Reserve’s Survey of Consumer Finances shows mortgage debt (including home equity loans) ranges from $138,700 to $188,400 on average for adults 55 and up.

Credit Card Debt

The median credit card debt for people between 55 and 74 years old is $3,500, compared to $2,700 for all households.

Medical Debt

This is becoming a huge problem for seniors. In 2020:

- 7% of adults 65+ (3.9 million people) had unpaid medical bills

- The average unpaid medical bill was a whopping $13,800

- Total medical debt among older adults reached $53.8 billion

Geographic Hotspots for Retiree Debt

Where you live seems to impact how much debt you’re likely to carry in retirement. According to the LendingTree study, these are the 10 cities where retirement-age adults carry the most debt:

- San Antonio: $18,107 average debt

- Jacksonville, Florida: $17,811

- Dallas: $16,985

- Houston: $16,101

- Orlando, Florida: $15,945

- Riverside, California: $15,727

- New Orleans: $15,108

- Austin, Texas: $15,046

- Miami: $14,397

- Memphis, Tennessee: $14,204

Florida and Texas account for SEVEN of the top ten debt-heavy cities for retirees. Yikes!

On the flip side, the cities with the least senior debt include Salt Lake City ($6,717), San Jose ($6,731), and Portland, Oregon ($6,782).

How Did We Get Here? The Rise in Senior Debt

The percentage of older Americans with debt has been rising steadily over the decades. Among people 75 and older, 53% of households reported debt in 2022, compared to just 21% in 1989.

Several factors contribute to this trend:

- Generational shift: Younger baby boomers came of age during the credit card era

- Housing costs: Many seniors refinanced homes during the low-interest period ending in 2022

- Rising healthcare costs: Medical expenses continue to outpace inflation

- Economic challenges: Inflation and high interest rates create a double whammy

- Fixed incomes: Unlike younger workers, retirees can’t easily increase their income

The Emotional Toll of Retirement Debt

Being in debt doesn’t just hurt your wallet – it hurts your wellbeing too. According to AARP’s research, 61% of debt-holding adults 50 or older feel their debt is a problem, with 16% describing it as a “major problem.”

The emotional impacts reported by seniors with debt include:

- Feeling stressed (34%)

- Uncertainty about future financial security (28%)

- Depression (19%)

Catherine Collinson, CEO of the nonprofit Transamerica Institute for Retirement Studies, notes: “High interest-rate credit card debt is the most worrisome, because it can easily spiral out of control.”

How Much Debt Should You Have When You Retire?

The industry standard suggests that no more than 28% of your pretax household income should go to servicing home debt (principal, interest, taxes, and insurance).

While some experts still recommend being completely debt-free by retirement, the reality is that many Americans are carrying debt well into their golden years. The key question isn’t necessarily whether you have debt, but whether you can manage it on your retirement income.

Tips for Seniors to Manage and Reduce Debt

If you’re approaching retirement with debt or already retired with outstanding balances, here are some strategies to consider:

1. Prioritize by Interest Rate

Focus on paying down high-interest debt first. There’s a big difference between a 20% credit card and a 5% car loan. Consider:

- Applying for a zero-interest credit card to transfer balances

- Calling creditors to negotiate lower rates (yes, this actually works sometimes!)

2. Cut Unnecessary Costs

Retirement is the perfect time to reassess your spending:

- Do you really need two vehicles?

- Could you downsize to a smaller home?

- Are you paying for subscriptions you rarely use?

3. Consider Consolidation

A debt consolidation loan might help simplify payments and potentially lower your interest rate.

4. Get Professional Help

AARP’s research found that only 15% of older adults with credit card debt have a formal plan for paying it off. Consider:

- Meeting with a financial advisor who specializes in retirement planning

- Using free resources like the National Council on Aging’s Budget Checkup tool

- Creating a detailed budget that accounts for all income and expenses

5. Develop a Payoff Strategy

Choose between methods like:

- Debt snowball: Pay off smallest debts first for quick wins

- Debt avalanche: Focus on highest interest debts first to save more money

The Bottom Line on Retiree Debt

The dream of a debt-free retirement is becoming increasingly rare for Americans. With 97% of retirement-age adults carrying non-mortgage debt and 60% of households headed by adults 65+ having some form of debt (up from 41.5% in 1992), it’s clear that retiree debt is a growing concern.

But don’t despair! Being aware of the problem is the first step toward addressing it. By creating a solid plan to manage and gradually reduce your debt, you can still enjoy a financially stable retirement.

Remember, retirement is supposed to be about freedom and enjoyment, not stress over debt payments. The earlier you start planning for a lower-debt retirement, the better your golden years will be.

Have you started planning your debt-free (or at least reduced-debt) retirement? I’d love to hear your strategies in the comments below!

FAQs About Retiree Debt

Q: What percentage of retirees have debt?

A: According to 2025 data from LendingTree, 97% of retirement-age adults have non-mortgage debt. Other studies show about 60% of households headed by adults 65+ carry some form of debt.

Q: What is considered a wealthy retiree?

A: “Affluent” retirees are typically defined as those with at least $100,000 in yearly income and assets of $320,000 or more.

Q: How much does the average 70-year-old have in savings?

A: According to Federal Reserve data, the average amount of retirement savings for 65-74 year-olds is just north of $426,000, though the median is significantly lower.

Q: Is it OK to retire with debt?

A: While high-interest debt like credit cards should ideally be eliminated before retirement, some forms of lower-interest debt can be manageable. The key is ensuring your retirement income can comfortably cover your debt payments.

Q: What is a good monthly retirement income?

A: Median retirement income for seniors is around $47,357 per year, with seniors typically earning between $2,000 and $6,000 per month. Financial experts recommend saving enough to replace about 70% of your pre-retirement monthly income.