The phrase “use it or lose it” is a good one to keep in mind when it comes to credit card habits. How frequently you use your card can impact your credit score, help you avoid fees, keep your account active—and even earn you some great rewards! By asking yourself (or us!) “How often should I use my credit card?” , youre already on the right track.

In this article, youll find the answers you need and learn how to avoid common pitfalls like account closures. Plus, well cover when it’s better to use a credit card vs a debit card.

Money matters—but so does happiness. Browse these amazing opportunities on The Muse and find the perfect fit for you »

Using a credit card responsibly is one of the best and fastest ways to build a strong credit history But a common question many people have is – how often should I use my credit card each month to build credit effectively?

The frequency of credit card usage is less important than utilizing your credit wisely when building your score, Here’s a detailed look at optimal credit card habits for credit building and tips to maximize your credit profile

Why Credit Card Usage Matters

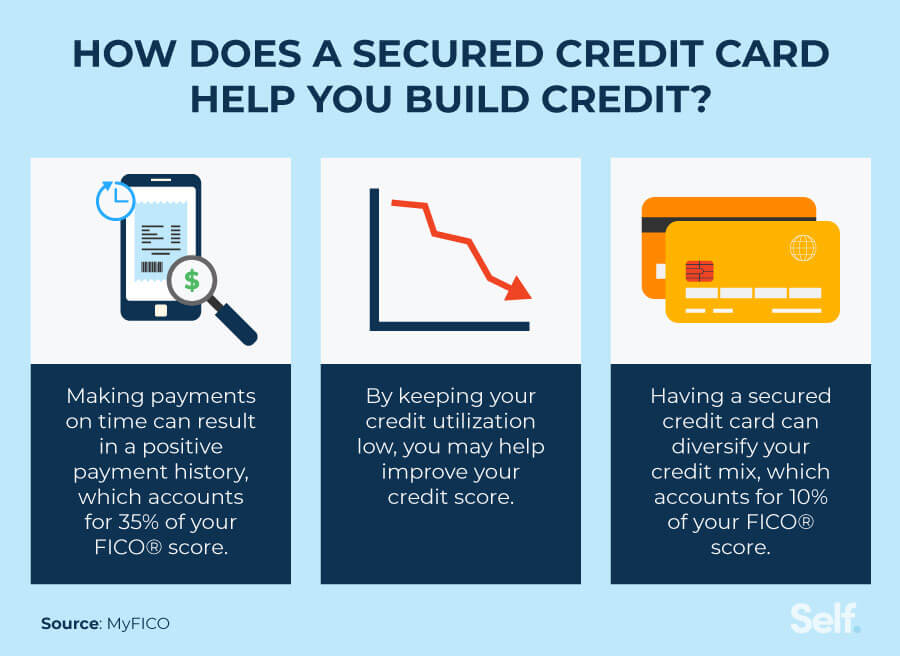

When used properly, credit cards allow you to establish a positive payment history and demonstrate responsible money management Payment history (35% weighting) and credit utilization (30% weighting) together comprise over half of your FICO credit score.

Payment history refers to your track record of paying bills on time. Using your card each month and paying by the due date builds a strong history.

Credit utilization is the percentage of your total credit limit you’re using at any given time. Ideally keep this below 30%. If your limit is $1,000, try to keep your balance under $300.

Regular, low utilization credit card usage shows lenders you can handle credit well. This helps improve your creditworthiness over time.

Usage Frequency Isn’t as Important as Utilization

When building credit, your utilization ratio matters more than how frequently you use your card.

You don’t need to use your card multiple times a month. Using it at least once a month is enough to demonstrate activity.

What matters most is keeping your balance low compared to your credit limit. Whether you make 1 purchase or 10 purchases, aim to stay under 30% utilization.

The Optimal Strategy

Here is an effective approach to build credit with your card:

-

Use it for a small, recurring expense like Netflix or groceries. This ensures regular, consistent activity.

-

Keep individual charges low to avoid getting close to your limit.

-

Pay your full statement balance every month by the due date. This builds positive payment history.

-

Check your utilization periodically and adjust spending if needed to stay under 30% of your limit.

-

Review your credit report regularly and dispute any errors.

Additional Tips

-

Become an authorized user on a family member’s card to earn a credit boost from their history.

-

Open a secured card if you’re new to credit and can’t get approved for an unsecured card yet.

-

Ask for credit limit increases over time to keep utilization low as spending needs change.

-

Leave old credit accounts open as your credit history length also impacts your scores.

How Often Should You Use Your Card?

Based on the sources provided, the recommended frequency is:

-

At least once per month – This maintains account activity and supports positive payment history.

-

Aim to keep utilization under 30% – The usage amount matters more than frequency for credit building.

-

Pay in full each month – Carrying a balance leads to interest charges without extra credit benefit.

Stay disciplined, use your card lightly but regularly, and always pay on time. This routine will help build your credit effectively over time. Monitor your profile to see your scores improve!

Frequently Asked Questions

How many times per month should I use my card to build credit?

Experts recommend using your credit card at least once per month and paying the statement balance in full. The payment history is more important than frequency. Keep any one month’s usage under 30% of your limit.

Should I use my credit card every day?

You don’t need to use your card daily. Monthly usage shows activity, and keeping your balance low avoids overutilization. Use it more if you have bills to pay, but don’t force unnecessary charges just to build credit.

Is charging small amounts better for credit?

Yes, making multiple smaller charges can keep your utilization lower than a single large purchase. But don’t go overboard as the total balance matters most. Keep monthly spending below 30% of your limit.

How many times should I swipe my credit card in a month?

Aim for at least one credit card charge per month. The number of swipes or transactions is less important than your overall utilization. Whether you make 2 or 10 purchases in a month, keep your total balance low relative to the credit limit.

Should I use my credit card only once in 6 months?

No, it’s better to use your card more often, such as monthly. At minimum, use it once every 6 months to avoid inactivity closure. But regular usage every month demonstrates responsible habits and is better for your credit profile.

Does credit card usage frequency matter?

Usage frequency matters less than your total monthly balance and payment history. Use your card minimally but consistently, and keep your utilization under 30%. Pay on time every month. This combination supports healthy credit building over time.

The Bottom Line

Check your credit card statement balance and utilization periodically, and adjust your spending as needed to stay under 30% of your limit. Using your card lightly but regularly and paying on time is the key to building credit effectively. Your scores will gradually improve as you demonstrate responsible habits month after month.

Why credit card usage matters

Effective credit card usage is crucial for building and maintaining a strong credit score. “Using a credit card every month and paying off your balance on time has a positive impact on your credit score,” says Dennis Shirshikov, a finance professor at the City University of New York.

This is because two major factors influence your score. The first is your payment history, which refers to how consistently you pay your bills on time. The second factor is your credit utilization ratio.

“Credit utilization refers to the percentage of your available credit that you are using,” Shirshikov says. “Keeping it under 30% is ideal for maintaining a healthy score.”

This means if you have a credit limit of $1,000, you should aim to keep your balance under $300 at any given time. Regularly using your credit card while keeping your balance low is an effective way to improve or keep your credit score.

In addition to credit score considerations, using your credit card responsibly can help track your expenses, manage cash flow, and create healthy financial habits. Consistent usage also lets you take advantage of the convenience, fraud protection, and rewards that credit cards offer—as long as you pay your balance in full each month.

Pay off the full balance

“Paying off the balance in full each month builds a strong payment history, which is one of the most significant factors in determining your credit score,” Shirshikov says. On the other hand, paying only the minimum can lead to higher interest costs and extend your debt repayment period, so its best to avoid it whenever possible.