WASHINGTON, D. C. — Three in four retired Americans say they have enough money to live comfortably, consistent with retiree perceptions across the 23 years Gallup has tracked views on retirement in its Economic and Personal Finance surveys conducted each April.

This generally positive view of retirement is different from what people who haven’t retired yet think about it. 45% of non-retirees this year say they will have enough money to live comfortably when they retire, which is a lot less than what retirees say they have experienced.

This retirement reality versus expectations gap has persisted since Gallup began systematically collecting this information in 2002, although there has been some variation over the decades in nonretirees’ expectations. In its report from last year, Gallup said, “Nonretirees’ outlook has been consistently lower and subject to swings based on the national economic climate.” ” ###Embeddable###.

This disparity in views of retirement is underscored by an analysis of the views of retirees aged 65-80 today compared with the expectations of this same cohort 20 years ago. Just over half of those who were 45-60 in 2002-2004 projected that they would have enough money to live comfortably when they retired. But 79% of this same cohort of Americans who are retired 20 years later in fact end up saying they have enough money to live comfortably.

For this age cohort of Americans, the reality has turned out to be significantly more positive than they anticipated two decades ago. ###Embeddable###

Have you ever wondered how many retirees are living solely on their Social Security checks? The answer might shock you According to recent data, millions of American seniors are trying to make ends meet with nothing but their monthly Social Security benefits Let’s dive into the sobering reality of retirement in America today.

The Alarming Numbers

According to the latest report from The Senior Citizens League (TSCL) released in 2025, approximately 21.8 million American seniors rely exclusively on Social Security for their income. That’s not just a significant portion—it represents about 39% of all American seniors who depend entirely on these government benefits to cover all their living expenses.

To put this in perspective:

- Nearly 3 in 4 seniors (73%) depend on Social Security for more than half their income

- 19% rely on it for at least three-quarters of their income

- 15% depend on it for between half and three-quarters

- Only 9% of seniors depend on Social Security for less than a quarter of their income

These aren’t just abstract statistics—they represent real people trying to survive on what many would consider insufficient funds for a comfortable retirement.

What Does This Mean in Dollar Terms?

The average monthly Social Security payment in 2025 is around $2,000. For someone with no other income sources, that translates to just $24,000 per year. Consider all the expenses retirees face:

- Housing costs (rent/mortgage, property taxes, maintenance)

- Utilities

- Food

- Healthcare costs not covered by Medicare

- Transportation

- Personal care items

- Pet care for those with animal companions

- And occasional small luxuries or family gifts

It’s no wonder that survey data from TSCL shows that 94% of seniors felt the 2025 cost-of-living adjustment (COLA) of 2.5% was too low and that their benefits aren’t keeping pace with inflation.

Living Below the Poverty Line

For a family of one person, the federal poverty line for 2025 is $15,650 per year. The TSCL study estimates that approximately 7. Three million senior citizens in the US live on less than $1,000 a month, which is a lot less than this poverty level.

The median U.S. senior lives on between $1,000 and $2,000 per month, according to Census Bureau data. About 13% live on less than $1,000 monthly, while 44% live on between $1,000 and $2,000 monthly.

Why Are So Many Retiring With Only Social Security?

Social Security is the only source of income for a huge number of Americans for a number of reasons:

- Inadequate savings: Many workers simply haven’t been able to save enough during their working years.

- Lack of pension plans: Traditional pension plans have largely disappeared from the private sector.

- Economic downturns: Market crashes have wiped out retirement savings for many.

- Health issues: Medical emergencies or chronic conditions can deplete savings.

- Caregiving responsibilities: Many people leave the workforce to care for family members.

- Job loss in later years: Being laid off close to retirement age can make it difficult to rebuild savings.

The Generational Outlook

Interestingly, a Bankrate survey shows that 53% of non-retired U.S. adults expect they will need to use Social Security to pay for necessary expenses. Among those 60 and older—closest to retiring—69% said they will be reliant on Social Security benefits, with 47% expecting to be “very reliant.”

This is actually lower than the 77% of current retirees surveyed who said they are currently relying on their benefits to pay for necessary expenses (with 62% being “very reliant”).

The Looming Funding Crisis

The fact that the Old-Age and Survivors Insurance (OASI) Trust Fund might run out of money by 2033 if Congress doesn’t do something makes things even scarier. This would result in benefits being slashed by about 23%.

A reduction of approximately 20% would mean a monthly payment of only $1,540 for someone receiving the average $2000 benefit; this would be a devastating blow to those who depend on every dollar.

What Can Be Done?

Policy Solutions

The TSCL survey found that 95% of seniors believe reforming Social Security and Medicare should be a top priority for the government. Some potential reforms include:

-

Changing how COLAs are calculated: 68% of seniors support switching from the current Consumer Price Index for Urban Wage Earners (CPI-W) to the Consumer Price Index for the Elderly (CPI-E), which better reflects seniors’ spending patterns.

-

Removing the cap on taxable income: Currently, in 2025, only the first $176,100 of income is subject to Social Security tax. Half of survey respondents support eliminating this cap, which would make all income subject to Social Security tax.

-

Increasing the payroll tax rate: About 31% support raising the current rate (6.2% for employees, with employers matching for a total of 12.4%).

Personal Strategies for Those Retiring Soon

If you’re approaching retirement and worried about depending too heavily on Social Security, consider these steps:

-

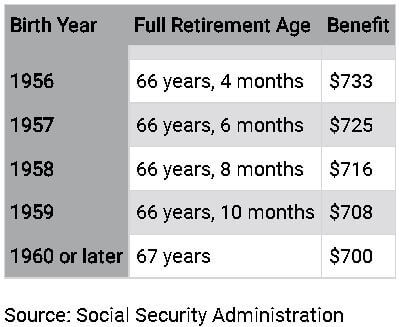

Delay claiming benefits if possible: For each year you delay claiming Social Security beyond your full retirement age (up to age 70), your benefit increases by about 8%.

-

Consider part-time work: Even a modest income can significantly reduce your dependence on Social Security.

-

Maximize available benefits: Make sure you’re getting all the benefits you’re entitled to, including spousal benefits if applicable.

-

Create a realistic budget: Carefully track your expenses for several months to identify where your money is going and where you might be able to cut back.

-

Prioritize expenses: Rank your expenses from most important to least important and focus on covering the essentials first.

-

Review your Medicare plan annually: You may be able to find a lower-priced option for the Medicare services you need.

-

Take advantage of preventative services: Use all the preventative health services offered by Medicare to avoid costly treatments later.

-

Utilize resources for seniors: Contact utility providers about assistance programs, and check with local senior centers for information about meal services, health clinics, and transportation assistance.

The Bottom Line

The fact that 21.8 million American seniors—nearly 40% of our retired population—depend entirely on Social Security is a wake-up call. Social Security was never designed to be a retiree’s sole source of income, yet for millions, it’s exactly that.

As a society, we need to address both the immediate needs of current retirees and the long-term sustainability of the Social Security program. On a personal level, if you’re still in the workforce, this data underscores the importance of saving for retirement through multiple channels.

What are your thoughts on this issue? Are you surprised by how many people retire with only Social Security? I’d love to hear your comments below!

Note: The information in this article is based on data from The Motley Fool, 401(k) Specialist, and CNN Business, with studies conducted by The Senior Citizens League (TSCL) and Bankrate in 2024-2025.

A Big Factor in Lowered Expectations Is Doubts About Social Security

The disconnect between the retirement expectations of nonretirees and the more positive outcomes among those who are now retired has several possible explanations. Retirees may take advantage of the chance to downsize and move to cheaper parts of the country. They may also find that their daily costs are lower than they thought they would be without having to work or take care of children. Medicare may help pay for health care costs in ways they didn’t expect, even if they need more care in retirement than they did before. And, importantly, the disconnect is explained by the unanticipated value of Social Security in retirement.

An analysis of aggregated data from 2019-2024 (involving interviews with 2,087 retirees and 3,935 nonretirees) shows that an average of 58% of retired Americans say Social Security is a “major source” of their retirement income, making it the important bedrock of their financial security. This is much higher than those who say pension plans (34%) and 401(k) and retirement plans (29%) are major sources of their retirement incomes. ###Embeddable###.

In contrast to the 58% of retirees for whom Social Security is a major source of income, barely a third (35%) of nonretirees, on average, say they expect Social Security to be a major source of retirement income. This makes Social Security significantly behind the 2050% of nonretirees who think that their 401(k) and retirement accounts will be their main source of income when they retire—the nonretired Americans who answered “No.” 1 projected retirement source. But in an oppositive pattern to the increased importance of Social Security in reality, investments are much less important in retired reality than is anticipated by Americans before they retire.

- Non-retirees are much more likely than retirees to think that part-time work will be their main source of income (2020 vs. 3%).

- People who aren’t retired are much less likely than retirees to say that a pension plan will be a major source of income. This is likely because fewer companies offer defined pension plans to their employees these days.

Among nonretirees, there has been a modest uptick in projections about the importance of Social Security as a major source of retirement income compared with 20 years ago — from less than 30% to the mid-30% range. But the significant perceptions versus reality gap has persisted as far back as Gallup has data. A consistently higher percentage of retirees have rated Social Security as a major source of their income than is the projection among nonretirees in every year since 2002. ###Embeddable###

The yawning gap between expectations about Social Security and reality is made evident by an analysis of shifts in the attitudes of those who were aged 45-60 two decades ago. Only 35% of this group of nonretirees in 2002-2004 projected Social Security to be a major source when they retired. Twenty years later, a significantly higher 61% of retirees in the same cohort (now 65-80 years old) report that in fact Social Security has turned out to be a major source of income. ###Embeddable###

Other Gallup research underscores the lack of confidence in the long-term viability of Social Security among nonretirees.

- Gallup polled people who are not retired in June and July of last year, and only about half said they thought Social Security would pay them a benefit when they retired.

- Gallup and West Health did a study from November 202023 to January 202024 that found that 80% of Americans aged 26 and under are worried that Social Security will not be available when they are eligible to receive it. This is up from 27% two years ago.

Who Says You Can’t Retire on Social Security Alone???

FAQ

Can you retire with only Social Security?

It’s not ideal, but it is possible to retire on Social Security alone. To do so, you will need to carefully plan your finances, live a very cheap life, and usually own a home in a low-cost area with no debt. Although Social Security was meant to supplement other retirement income, it wasn’t meant to cover all costs. Typically, it only replaced about 40% of pre-retirement earnings.

How many retirees rely solely on Social Security?

While estimates vary by study and year, a 2025 The Senior Citizens League (TSCL) report indicated nearly 22 million seniors rely solely on Social Security for their income.

What percentage of Americans have no retirement?

Estimates vary, but studies show between 40% and 46% of Americans have no retirement savings, with some surveys indicating that a significant portion of older adults (over 50) also lack any savings at all.

How many live on just Social Security?

Approximately 21. The Senior Citizens League (TSCL) reports that between 8 and 22 million seniors depend on Social Security as their only source of income.

How many retirees rely on social security?

While many retirees have multiple income sources, a significant number depend primarily on Social Security benefits. According to a 2021 study by the Center on Budget and Policy Priorities, 40.2% of older Americans rely solely on Social Security income in retirement. This translates to approximately 24.8 million individuals.

Is Social Security enough for a secure retirement?

Retirees with these three sources of income are far less likely to face poverty and economic hardship. A new report also finds that a large portion (40 percent) of older Americans rely only on Social Security income in retirement. Social Security alone is not considered sufficient for a secure retirement, and it was not intended to stand alone.

What percent of retirees live on social security alone?

The Social Security Administration (SSA) estimates that of the over 46 million Americans receiving Social Security retirement benefits… 21% of married couples and 45% of single persons rely on Social Security for 90% or more of their income.

How many seniors rely on social security?

New survey data from The Senior Citizens League indicates nearly three in four seniors depend on Social Security for at least half their income. A startling number of seniors get by on Social Security alone, even though the program was never intended to be recipients’ sole source of income.

Do older Americans only receive Social Security in retirement?

Americans are concerned and even afraid for their retirement security. And the news headlines often don’t make them feel better. The latest is a claim from the National institute for Retirement Security that “A plurality of older Americans, 40.2 percent, only receive income from Social Security in retirement.” If true that’s very worrying.

What percentage of older Americans rely solely on social security?

According to a 2021 study by the Center on Budget and Policy Priorities, 40.2% of older Americans rely solely on Social Security income in retirement. This translates to approximately 24.8 million individuals. The reliance on Social Security as the sole source of retirement income is particularly prevalent among certain demographic groups.