Providing consumers with financing for new and used vehicles, helping them on the road to car ownership and financial well-being.

At Drive®, a Santander product, you can get pre-qualified for cars in two minutes with no impact to your credit score. Get tips, calculators and resources at every step so you can go to the dealership with confidence. Find a car that fits your budget and let’s drive.

Getting approved for an auto loan can be an exciting yet stressful process. You likely have your eye on the perfect new or used car and are eager to drive it home. However, before you can do that, you need financing in place.

Many people applying for a car loan want to know how long does it take Santander to approve a car loan? Santander Consumer USA is one of the largest specialized auto lenders in the nation. The company works with over 14000 dealers nationwide to provide financing solutions to consumers.

In this article, we’ll walk through the Santander auto loan approval process and timeline. We’ll also provide tips to help expedite your auto loan approval.

Overview of Santander Auto Loans

Santander Consumer USA is based in Dallas, Texas and has over 50 years of experience in auto financing. The company provides loans for both new and used vehicles.

Santander services auto loans for many major automotive brands including Chrysler, Dodge, Fiat, Jeep, Ram, and Alfa Romeo. They work directly with dealerships to offer consumers competitive rates and financing terms.

Some key things to know about Santander auto loans:

- Loan amounts from $5,000 to $75,000

- Terms up to 75 months

- Interest rates from 3.99% to over 20% based on creditworthiness

- Online application and account management

- Variety of end-of-term options including trade-in, buyout and refinancing

Santander offers standard auto loans as well as special financing programs for those with limited credit histories. They also have loans tailored specifically for military members under the Military Auto Loan Program.

Santander’s Auto Loan Approval Process

When you apply for auto financing through Santander, you’ll go through the following general process:

Step 1: Submit an Application

The auto loan process begins when you submit an application. This is usually done at the dealership when you’ve selected your new or used car. The dealer will collect information on the vehicle and your personal/financial details.

The application asks for basic information like your name, address, date of birth, Social Security number, employer details, income, and expenses. You’ll also provide details on the vehicle you wish to purchase.

Step 2: Review of Application and Documents

Once Santander receives the application, an underwriter will review all the details and documentation provided. This helps them verify the information and determine your creditworthiness.

Documents commonly requested include pay stubs, W-2s, tax returns, driver’s license, references, and possibly bank statements. Providing complete, accurate documentation helps speed up the review process.

Step 3: Credit Check and Background Check

As part of the review process, Santander will conduct credit and background checks. This gives them a comprehensive financial profile and verifies your identity and employment.

Your credit report provides details on your borrowing and repayment history. Santander checks your credit with the three main reporting bureaus (Equifax, Experian, TransUnion). Your credit score is a major factor in loan eligibility and terms.

Step 4: Underwriting Review and Decision

Next, an underwriter will carefully evaluate your application and all documentation based on Santander’s loan policies and criteria. They analyze factors like your income, expenses, credit score, down payment, loan amount, and the vehicle value.

Based on this risk assessment, the underwriter will decide whether to approve or deny the auto loan application. If approved, they determine the exact loan terms including APR, length of loan, and down payment requirements.

Step 5: Notification of Loan Decision

Finally, once the underwriter makes a definitive decision, Santander will notify you and the dealer of the outcome.

If approved, you’ll receive specifics on the approved loan amount, interest rate, monthly payments, etc. You can then finalize the loan agreement and sale documents to purchase your vehicle.

If your application is denied, the notice will explain why and outline steps you can take to potentially improve chances for future approval.

How Long Does It Take Santander to Approve a Car Loan?

Now that you understand the general auto loan approval process, let’s discuss timing. So how long does it actually take Santander to approve a car loan application?

The exact timeline can vary from person to person based on your specific circumstances. However, here are some general timeframes to expect:

-

Same day approval: For applicants with exceptional credit history and qualifying factors, Santander may be able to approve your loan within the same business day. This is the fastest possible scenario.

-

1-3 days: For well-qualified applicants who provide complete documentation, approval often takes 1-3 business days. This allows time for review of application details, credit check, and underwriting decision.

-

3-7 days: Applications that require extra verification or review will generally get a decision within 3-7 business days. Additional documents or clarification often adds time to the process.

-

1-2 weeks: For applicants with credit challenges, limited history, or complex applications, the process may take 1-2 weeks or longer. More scrutiny is required in these situations.

-

30 days: Federal law requires lenders to either approve or deny an application within 30 days. So this is the maximum timeline you can expect. If Santander requires the full 30 days, they’ll notify you of the delay.

As you can see, a typical auto loan approval through Santander takes anywhere from same-day to one month. Simple applications with strong applicant credentials tend to be approved more quickly.

Factors outside of your control like company underwriting backlogs can also impact timing. The best advice is to proceed with realistic expectations. Most applicants receive a loan decision within 1-2 weeks.

Tips for Faster Auto Loan Approval

While Santander’s loan decision timeline is outside of your control, there are things you can do to potentially expedite the process:

-

Have excellent credit: Your credit score plays a huge role in loan approval speed. Those with scores above 740 will have the fastest turnaround time. Review your credit reports and resolve any errors beforehand.

-

Lower your debt-to-income ratio: Your DTI compares your monthly debt payments to gross income. The lower your DTI, the better in terms of qualifying for fast approval. Pay down balances on credit cards and other debts.

-

Make a larger down payment: Putting down 20% or more shows you are financially committed to the purchase. A larger down payment can mean faster loan approval.

-

Provide all requested documents upfront: Being responsive and submitting complete documentation enables smoother underwriting. Missing items can cause delays.

-

Go through a Santander preferred dealer: Dealer expertise with the lender’s processes can streamline the application and approval. Check Santander’s dealer locator for options.

-

Apply during a sales promotion: Special financing offers sometimes have expedited approval terms. Look for deals that advertise faster turnaround.

-

Avoid unnecessary hard credit pulls: Each application triggers a hard inquiry. Minimize these by only formally applying when ready to buy. Check your pre-qualification options first.

While you may be eager to drive away in your new vehicle as soon as possible, it’s important to be realistic about the approval timeline. Submit a complete application with Santander’s required documents, then allow their underwriting team the necessary time to conduct their full review and make a responsible credit decision. With sound preparation and patience, you’ll soon be hitting the road with approved financing in place.

Frequently Asked Questions

What credit score is needed for Santander auto loan approval?

Santander generally requires a minimum credit score of 620 for standard auto loan approval. Applicants with scores of 640 or higher will qualify for the best rates and terms. Those with lower scores may still be approved but will pay higher interest rates.

How long is a Santander auto loan approval good for?

A Santander approval is valid for 30 days. If you do not finalize the loan agreement and complete the purchase within 30 days, the approval expires and you must reapply.

Can I get approved for a car loan without a down payment?

Santander does approve $0 down payment auto loans in some cases. However, a down payment of 10-20% of the vehicle purchase price improves your chances for quick approval and better rates.

What documents do I need for Santander auto loan approval?

Typical documents needed are a valid driver’s license, recent paystubs, bank statements, W-2s, proof of auto insurance, references, and possibly tax returns. Providing all required paperwork upfront avoids delays.

Can I get pre-approved for a Santander car loan?

Yes, Santander allows you to get pre-qualified or pre-approved before visiting dealers. The pre-approval letter states loan terms pending verification of application details. Pre-approval can speed up the final approval process.

Getting an auto loan approved through Santander typically takes anywhere from one day to a couple weeks depending on your financial qualifications. Strong credit, low debt, and providing complete documentation helps ensure the fastest approval decision. With a Santander auto loan, you can soon drive away in the vehicle you’ve been dreaming of.

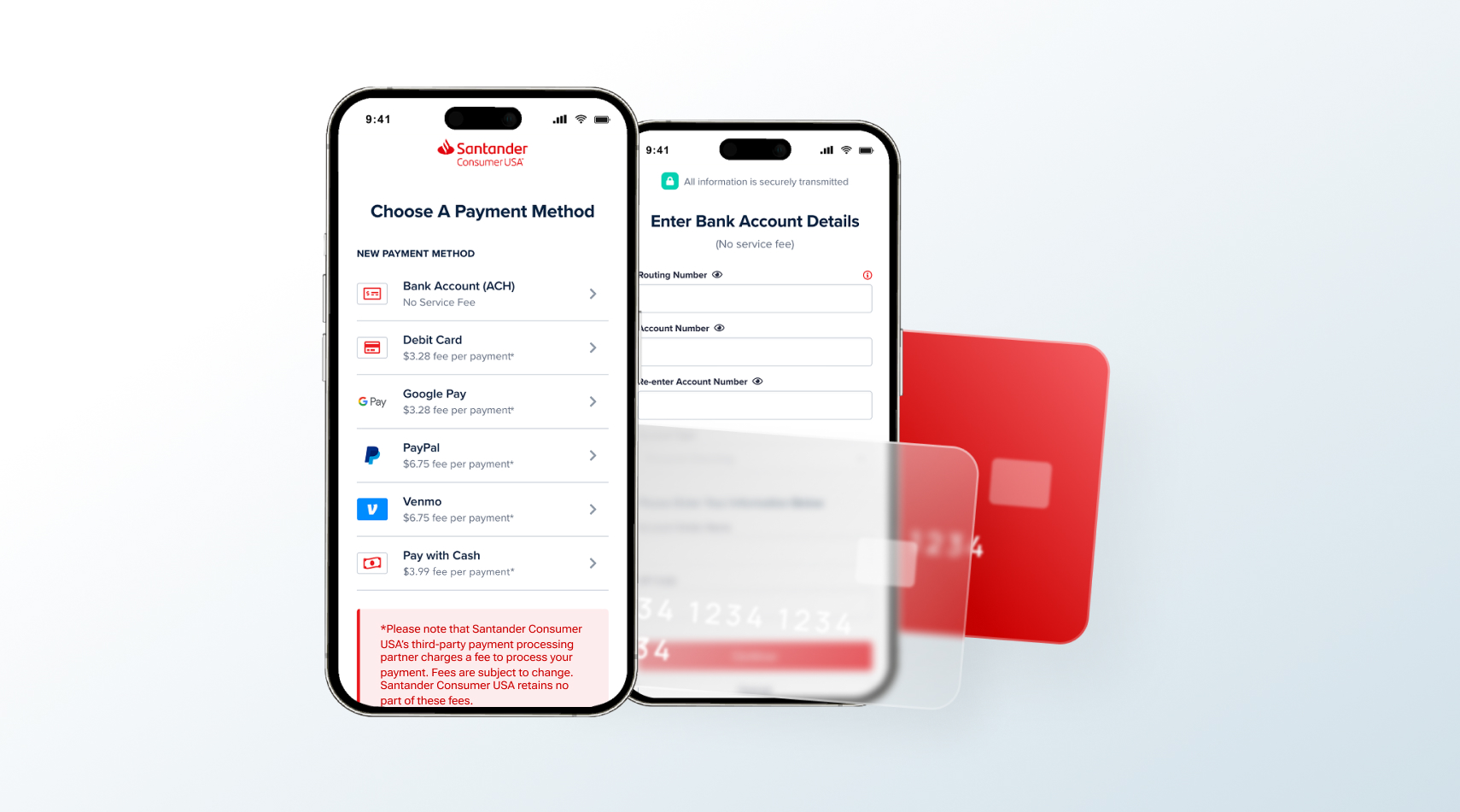

Easy ways to pay

Choose from quick and convenient payment options, including Apple Pay, Google Pay, PayPal and Venmo.

Proud to be a preferred lender for major brands and vehicle manufacturers.