Want to know how Uncle Sam keeps track of your retirement savings? If you’ve been putting money into a Roth IRA and wondering, “Does the IRS really know about this?” you’re not the only one. A lot of people ask this question because Roth contributions don’t show up on your tax return like traditional IRA contributions do.

Let me explain how the IRS keeps track of your Roth IRA contributions, what forms they use, and what you need to know to stay in line with tax laws.

The Primary Tracking Method: Form 5498

The main way the IRS knows about your Roth IRA contributions is through Form 5498, which is officially called “IRA Contribution Information.” Here’s what you need to know about this form

- Not filed by you: Your IRA trustee or issuer (the financial institution where you have your Roth IRA) files this form with the IRS by May 31 each year

- Contains all contribution details: The form shows total contributions made during the tax year

- Covers all types: It includes your direct contributions, rollovers, and transfers

- Sent to both parties: A copy goes to the IRS and another copy comes to you

This form is the primary reporting mechanism that enables the IRS to know exactly how much you’ve contributed to your Roth IRA during the year.

Why Roth Contributions Don’t Appear on Your Tax Return

Roth IRA contributions are made with money that has already been taxed, while traditional IRA contributions are reported directly on your tax return because they are tax-deductible. This means:

- You don’t get a tax deduction for Roth contributions

- There’s no dedicated line on Form 1040 to report them

- Qualified distributions aren’t taxable income

This is why a lot of people are curious about how the IRS keeps track of these donations. It seems like they might “slip through the cracks” since you don’t report them, but they don’t!

When You DO Need to Report Roth-Related Activities

While regular Roth contributions aren’t reported on your tax return, there are specific situations where you’ll need to file Form 8606:

- When taking nonqualified distributions from your Roth IRA

- When doing Roth conversions from traditional IRAs

- When making nondeductible contributions to traditional IRAs (often part of backdoor Roth strategies)

Form 8606 helps the IRS keep track of the basis (the amount you’ve already paid taxes on) in your IRAs.

How the IRS Catches Excess Contributions

One of the biggest concerns people have is accidentally contributing too much to their Roth IRA. The IRS has a system to catch this:

- They receive Form 5498 from your financial institution showing your contributions

- They compare this against income information from your tax return

- If your income exceeds the limits or if your contributions exceed the annual maximum, they can identify the discrepancy

The penalties for excess contributions can be steep – 6% of the excess amount for each year it remains in the account. For example, if you contributed $1,000 over the limit, you’d owe $60 each year until you correct the mistake.

Verifying the Accuracy of Your Roth IRA Contribution Reporting

To ensure your Roth IRA contributions are correctly reported to the IRS:

- Review your Form 5498 when you receive it (usually in May)

- Compare it with your records of contributions

- Contact your financial institution if you find any discrepancies

- Keep your own detailed records of all contributions

Common Questions About Roth IRA Reporting

Does the IRS actively monitor Roth IRA contributions?

Not in real-time. The IRS receives information after the tax year ends through Form 5498. This means they’re not “watching” your contributions as they happen, but they do eventually get a complete picture.

Can the IRS seize my Roth IRA?

Yes, the IRS can levy against your Roth IRA to satisfy outstanding federal tax obligations. While retirement accounts have some protections, they’re not immune to IRS collection actions if you have unpaid taxes.

What happens if I contribute to a Roth IRA when my income is too high?

If your income exceeds the limits for Roth IRA contributions, you have a few options:

- Remove the excess contribution before the tax filing deadline (including extensions)

- Apply the excess contribution to a future year (if eligible)

- Pay the 6% excise tax on the excess amount

Do I need to keep track of my Roth IRA contributions myself?

While there’s no legal requirement to track your own contributions, it’s highly recommended. Your financial institution reports to the IRS, but keeping your own records helps you:

- Verify the accuracy of Form 5498

- Know how much you can withdraw tax-free (your basis)

- Plan future contributions effectively

- Avoid potential penalties for excess contributions

Tips for Managing Your Roth IRA Contributions

Here are some practical tips to ensure you’re handling your Roth IRA contributions correctly:

-

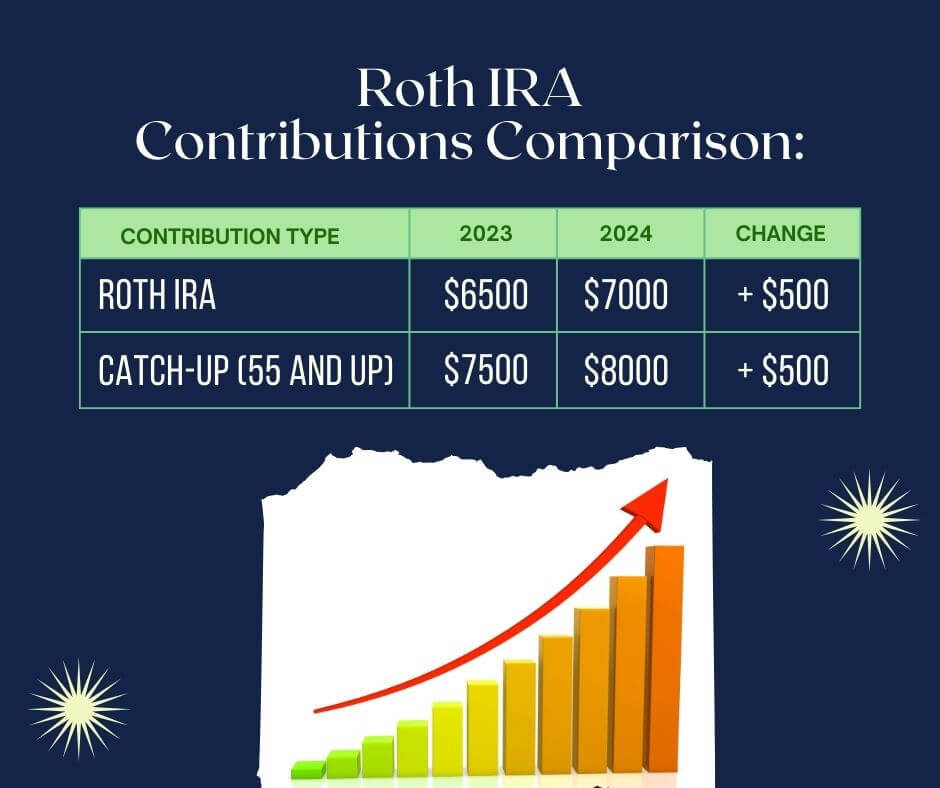

Understand contribution limits: For 2023, the contribution limit is $6,500 ($7,500 if you’re 50 or older)

-

Know the income phase-out ranges: Contribution eligibility phases out at higher income levels

-

Keep detailed records of all contributions: Date, amount, and tax year designation

-

Review your Form 5498 carefully: Make sure it matches your records

-

Consider working with a tax professional: If you’re unsure about any aspect of Roth IRA reporting

What About the Backdoor Roth IRA Strategy?

The backdoor Roth IRA strategy (making nondeductible traditional IRA contributions and then converting to a Roth) is still currently allowed, though there have been proposals to eliminate it. If you use this strategy:

- You must report the nondeductible traditional IRA contribution on Form 8606

- The conversion to a Roth IRA will be reported by your financial institution on Form 1099-R

- You’ll need to report the conversion on your tax return

The Bottom Line

The IRS primarily knows about your Roth IRA contributions through Form 5498, which is filed by your financial institution. While you don’t report these contributions directly on your tax return, they’re still tracked and monitored.

Staying informed about how this reporting works can help you avoid potential issues and maximize the benefits of your Roth IRA. The tax-free growth and distributions offered by Roth IRAs make them an excellent retirement savings vehicle, but like all tax-advantaged accounts, they come with rules and reporting requirements that you need to understand.

Frequently Asked Questions

Do Roth IRA contributions get reported to the IRS?

Yes, they do. While you don’t report them on your tax return, your financial institution reports them to the IRS via Form 5498.

How are Roth IRA contributions monitored?

They’re monitored through Form 5498 filed by your financial institution and through monthly account statements. The IRS receives the form directly.

How does the IRS know if you over-contribute to a Roth IRA?

The IRS compares the contributions reported on Form 5498 with your income and other tax information to identify excess contributions.

How does the IRS know if you contribute to an IRA?

Through Form 5498, which reports your IRA contributions to the IRS. Your IRA custodian is required to file this form with the IRS, usually by May 31.

Can the IRS touch your Roth IRA?

Yes, the IRS can levy against your Roth IRA to satisfy outstanding federal tax obligations if necessary.

What is a Roth IRA & how does it work?

A Roth IRA is a retirement account funded with after-tax dollars. Qualified distributions are tax-free, and you can make contributions after age 70½, unlike traditional IRAs.

By staying informed about how the IRS tracks your Roth IRA contributions and following the rules, you can enjoy the tax benefits of this popular retirement savings vehicle without worrying about unexpected penalties or issues down the road.

Are retirement plan contributions excluded from my taxable income?

See “Income, Employee Compensation, Retirement Plan Contributions,” Publication 17, Your Federal Income TaxUse

Form 8606 to report:

- Nondeductible contributions to traditional IRAs

- Distributions from traditional, SEP, or SIMPLE IRAs, if you have ever put money into a traditional IRA that wasn’t tax-deductible.

- Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs

- Distributions from Roth IRAs

Use Form 5329 to report additional taxes on IRAs and retirement plans, including:

- tax on an early distribution

- exceptions to the tax on early distributions

- taxes on excess contributions

- taxes you had to pay because you didn’t get the required minimum distribution

How can I tell from Form 1099-R if my IRA distribution is taxable?

See “Are Distributions Taxable, Reporting and Withholding Requirements,” Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs)