Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Have you ever wondered how some investors seem to get paid just for owning stocks? That magical money-making method is called dividends, and I’m gonna show you exactly how to get your hands on them. As someone who’s been investing for years, I can tell you that dividend investing has been one of the smartest financial decisions I’ve made.

Dividends are basically like getting a “thank you” payment from companies for being a loyal shareholder. And who doesn’t love extra cash showing up in their account without having to do any additional work? Let’s dive into the world of dividends and how you can start collecting them.

What Are Dividends, Anyway?

Before we jump into how to get dividends, let’s make sure we’re on the same page about what they actually are.

Dividends are portions of a company’s profits paid out to shareholders. Think of it as your slice of the company’s success pie! Companies typically pay these dividends quarterly (every three months), though some pay monthly or semi-annually.

For example, if you own 30 shares in a company that pays $2 in annual dividends per share, you’ll receive $60 per year in dividend payments. That might not sound like much, but imagine owning hundreds or thousands of shares across multiple dividend-paying companies!

How Dividends Actually Work

The process of receiving dividends follows a pretty straightforward path:

- A company earns profits from its business operations

- The board of directors approves a dividend payment to share those profits with shareholders

- The company announces dividend details including the amount and important dates

- You receive the payment if you own shares by the required date

Important Dividend Dates You Need to Know

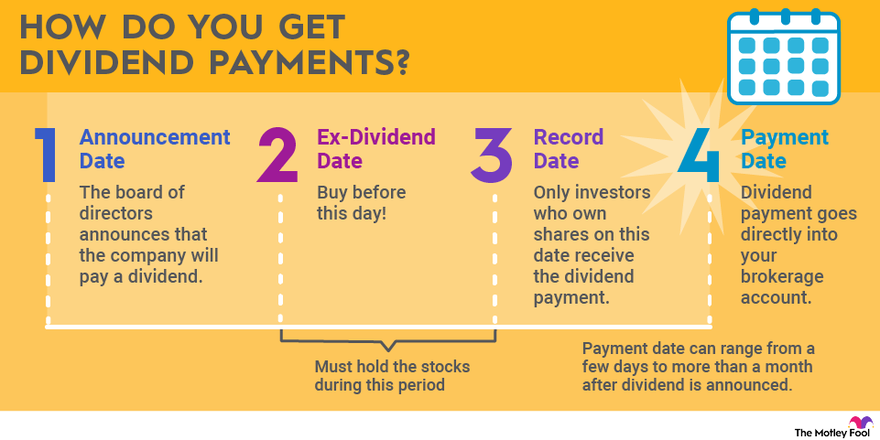

When it comes to dividends, timing is everything! There are several key dates that determine whether you’ll receive a dividend

- Declaration Date: When the company announces it will pay a dividend

- Ex-Dividend Date: The cutoff date for dividend eligibility – you must own the stock before this date to receive the payment

- Record Date: The date when the company checks its records to see who owns shares

- Payment Date: When the dividend money actually hits your account

The ex-dividend date is super important – if you buy a stock on or after this date, you won’t get the upcoming dividend payment However, if you sell after the ex-dividend date, you’ll still receive the dividend even if you no longer own the shares when they’re paid out

How to Start Getting Dividends in 5 Simple Steps

Now for the part you’ve been waiting for – how do you actually start collecting dividend payments? Here’s my step-by-step guide:

Step 1: Open a Brokerage Account

First things first, you need a place to buy and hold your dividend stocks. Opening a brokerage account is quick and easy these days. Some popular options include:

- Charles Schwab

- Fidelity

- Robinhood

- Public

- Coinbase

Most brokerages offer commission-free trading now, so you won’t have to pay fees for buying your dividend stocks.

Step 2: Research Dividend-Paying Companies

Not all companies pay dividends. Typically, more established companies with stable cash flows are more likely to pay dividends than younger, fast-growing companies.

Industries known for reliable dividends include:

- Basic materials

- Oil and gas

- Banks and financial institutions

- Healthcare and pharmaceuticals

- Utilities

- REITs (Real Estate Investment Trusts)

For beginners, I recommend looking into “Dividend Aristocrats” – these are elite S&P 500 companies that have increased their dividends every year for at least 25 consecutive years. Examples include Exxon Mobil, Target, IBM, Sherwin-Williams, and Johnson & Johnson.

Step 3: Evaluate the Quality of Dividend Stocks

Don’t just chase the highest dividend yield! That can be a trap. Instead, look at these key metrics:

Dividend Yield: This is the annual dividend payment divided by the stock price, expressed as a percentage. For example, if a $100 stock pays $4 in dividends annually, its yield is 4%.

Dividend Payout Ratio: This shows what portion of a company’s earnings goes toward dividends. A payout ratio over 100% means the company is paying more in dividends than it earns – a potential red flag that the dividend might be cut in the future.

Dividend Growth Rate: Companies that consistently increase their dividends year after year are often more attractive investments.

Step 4: Purchase Dividend Stocks

Once you’ve identified quality dividend stocks, it’s time to buy! Through your brokerage account, place orders for the shares you want to own.

You don’t need a ton of money to start – many brokerages allow you to buy fractional shares, meaning you can invest with as little as $5 or $10.

Step 5: Set Up Dividend Reinvestment (Optional but Recommended)

Many brokerages offer Dividend Reinvestment Plans (DRIPs) that automatically use your dividend payments to buy more shares of the same stock. This is an awesome way to compound your returns over time!

For example, if you receive a $10 dividend payment and the stock costs $100, the DRIP would automatically buy 0.1 additional shares for you. Over time, these additional shares generate their own dividends, creating a snowball effect.

Types of Dividends You Can Receive

There are several different types of dividends companies might pay:

- Cash Dividends: The most common type – money deposited directly into your brokerage account

- Stock Dividends: Instead of cash, you receive additional shares of stock

- Special Dividends: One-time payments that don’t recur regularly

- Preferred Dividends: Payments to owners of preferred stock (a hybrid between common stock and bonds)

For beginners, I’d suggest focusing primarily on companies that pay regular cash dividends.

Dividend Funds: An Easier Alternative

If researching individual stocks sounds too complicated or time-consuming, don’t worry! You can still get dividends by investing in dividend-focused mutual funds or ETFs (Exchange-Traded Funds).

These funds hold many dividend stocks in one investment, giving you instant diversification. Some popular dividend ETFs include:

- Vanguard Dividend Appreciation ETF (VIG)

- SPDR S&P Dividend ETF (SDY)

- iShares Select Dividend ETF (DVY)

With a dividend fund, you’ll still receive regular dividend payments, but the fund handles all the stock selection for you!

Don’t Forget About Taxes!

One thing many new dividend investors overlook is the tax implications. All dividends are taxable, but they’re not all taxed the same way:

- Qualified Dividends: Paid by U.S. companies to shareholders who have owned the stock for at least 60 days. These are taxed at lower capital gains tax rates.

- Non-Qualified Dividends: All other dividends are taxed at your ordinary income tax rate, which is typically higher.

Most brokerage firms will send you a 1099-DIV form at tax time showing how much you received in dividends and how they’re classified.

Companies That Pay Dividends vs. Those That Don’t

It’s important to understand why some companies pay dividends while others don’t. Here’s the basic breakdown:

Companies That Typically Pay Dividends:

- Established, mature companies with stable earnings

- Businesses in slow-growth industries

- Companies with limited expansion opportunities

Companies That Typically Don’t Pay Dividends:

- Young, high-growth companies (especially in tech and biotech)

- Businesses that need to reinvest profits for expansion

- Companies with unpredictable cash flows

Neither approach is inherently better – it just depends on the company’s situation and growth stage. For example, Apple didn’t pay dividends for many years while it was rapidly growing, but now pays a decent dividend as a more mature company.

How Dividends Impact Stock Prices

When a company pays a dividend, its stock price usually adjusts downward by approximately the amount of the dividend on the ex-dividend date. This makes sense because the company is literally giving away some of its value to shareholders.

For example, if a stock is trading at $60 and declares a $2 dividend, the share price might rise to $62 as investors buy in to receive the dividend. Then, on the ex-dividend date, the price might drop back down to around $60.

This doesn’t mean you’ve lost money – you now have the $2 dividend payment plus a share worth $60, for a total value of $62.

My Personal Tips for Dividend Investing Success

After years of dividend investing, here are some lessons I’ve learned:

- Be patient – Dividend investing is a long-term strategy that gets more powerful over time through compounding

- Don’t chase yield – Super-high dividend yields (like over 8%) often indicate trouble

- Diversify across industries – Don’t put all your eggs in one dividend basket

- Reinvest when possible – Unless you need the income now, reinvesting dividends accelerates your wealth building

- Look for dividend growth – A company that increases its dividend by 10% annually may be better than one with a higher current yield but no growth

Frequently Asked Questions About Getting Dividends

How much money do I need to start investing in dividend stocks?

You can start with as little as $1-$5 with brokerages that offer fractional shares. However, to generate meaningful income (like $100/month), you’d typically need a larger portfolio value of $30,000+ (assuming a 4% average dividend yield).

How often are dividends paid?

Most U.S. companies pay dividends quarterly (four times per year), but some pay monthly or semi-annually. Each company sets its own schedule.

Can I live off dividend income?

Absolutely! Many retirees do this. However, to generate enough income to live on (say $40,000 per year), you’d need approximately $1 million invested at a 4% dividend yield. Building this takes time and consistent investing.

Do all stocks pay dividends?

No, many companies don’t pay dividends, especially younger growth companies that reinvest profits back into the business. In fact, only about 84% of S&P 500 companies currently pay dividends.

Wrapping It Up

Getting dividends isn’t complicated, but it does require some knowledge and strategy. By following the steps I’ve outlined—opening a brokerage account, researching quality dividend stocks, making purchases, and potentially reinvesting—you can build a powerful income stream that grows over time.

Remember that dividend investing is a marathon, not a sprint. The real magic happens when you give your dividend investments years or even decades to compound and grow.

So, what are you waiting for? That first dividend payment won’t collect itself! Get started today, and your future self will thank you for the passive income stream you’ve created.

Have you started investing for dividends yet? What companies are in your dividend portfolio? Share your experiences in the comments below!

Dividend per share (DPS)

Companies that can increase dividends year after year are often more attractive to investors. The dividend per share calculation shows the amount of dividends distributed by the company for each share of stock during a certain time period. Keeping tabs on a company’s DPS allows an investor to see which companies are able to grow their dividends over time.

Special dividends

These dividends pay out on all shares of a company’s common stock, but don’t recur like regular dividends. A company often issues a special dividend to distribute profits that have accumulated over several years and for which it has no immediate need.