Hey there, friend! If you’re wondering, “how can I raise my FICO score 20 points,” you’ve landed in the right spot. I’ve been down that road, stressing over every lil’ point on my credit report, and I’m here to spill the beans on how to nudge that score up fast. Whether you’re eyeing a better loan rate or just wanna feel financially fancy, a 20-point boost can make a real diff. We’re talkin’ actionable steps—some quick, some steady—that can get you there. So, let’s dive in and get that score movin’!

What’s a FICO Score, and Why’s 20 Points a Big Deal?

Before we get to the juicy stuff, lemme break down what a FICO score even is. Think of it as your financial report card—a three-digit number between 300 and 850 that tells lenders how trustworthy you are with money. The higher the better. It’s cooked up by the Fair Isaac Corporation (that’s the “FICO” part) based on your credit history. A score over 740 is like an A+ while below 670 might get you a “needs improvement” note.

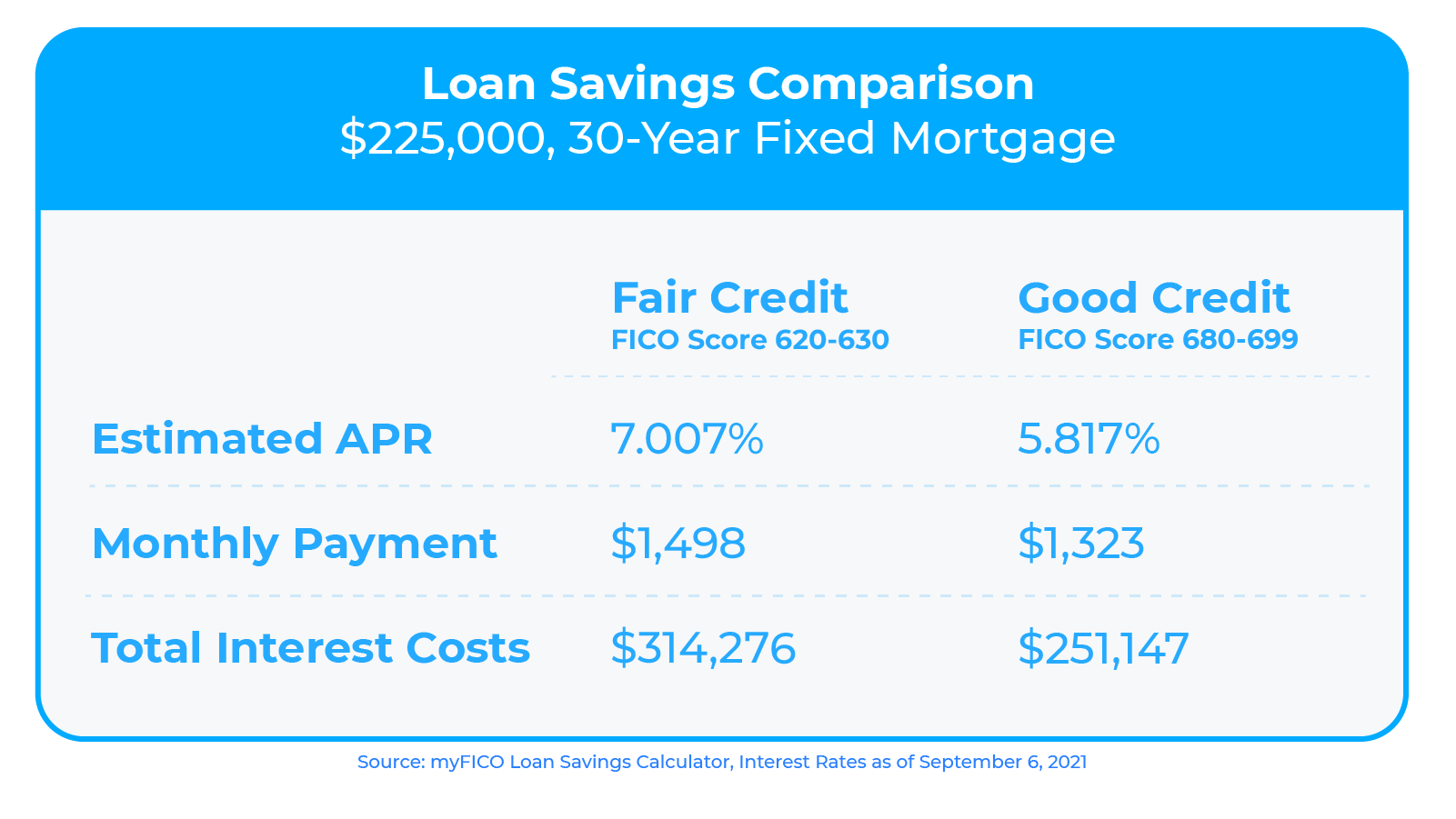

Now, why fuss over just 20 points? Well, that lil’ jump can shift you from “fair” to “good” or “good” to “excellent” in a lender’s eyes. That could mean lower interest rates on a car loan or mortgage, savin’ you thousands over time. Heck, it might even help with job apps or insurance rates in some spots. Me? I’ve seen a 20-point bump open doors I didn’t even know were locked. So, yeah, it’s worth the hustle.

The Big Factors Behind Your FICO Score

To raise that score, you gotta know what’s draggin’ it down or liftin’ it up. Here’s the breakdown of what matters most:

- Payment History (35%): This is the biggie. Payin’ bills on time shows you’re reliable. Miss a payment, and it sticks on your report for up to 7 years. Ouch.

- Credit Utilization (30%): How much of your available credit you’re usin’. Lower is better—think under 30%, or even 10% for max impact.

- Length of Credit History (15%): How long you’ve had accounts open. Older accounts boost your score, so don’t close ‘em just ‘cause you ain’t usin’ ‘em.

- Credit Mix (10%): Having diff types of credit—like a credit card and a car loan—looks good. Shows you can juggle.

- New Credit Inquiries (10%): Applyin’ for too much new credit at once can ding your score a bit. Each hard inquiry might drop it 5 points or so.

Knowin’ this we can zero in on quick wins and long-term plays to get that 20-point boost. Let’s start with the stuff that packs the biggest punch.

Step 1: Pay Every Dang Bill on Time

If there’s one thing I’ve learned, it’s that late payments are the devil for your FICO score. They’re the numero uno factor—35% of your score depends on whether you pay on time. Even one missed payment can tank your progress and linger on your report for years. So, step one? Become a payment ninja.

- Set reminders like crazy. Use your phone, sticky notes, whatever. Don’t let a due date sneak up.

- Automate it, baby! Set up auto-payments for at least the minimum on credit cards and loans. Just make sure your bank account ain’t empty, or you’ll get slapped with fees.

- If you’re behind, catch up now. Even if you can’t pay in full, payin’ the minimum keeps your account in “good standing.” That’s a start.

I remember missin’ a credit card payment by a day—yep just one day—and my score took a hit. Took me months to recover. Don’t be me. Get on top of this and if you’ve got a clean slate for a few months, you might see that 20-point jump sooner than you think.

Step 2: Slash That Credit Utilization Down Low

Next up, let’s talk credit utilization. This is a fancy way of sayin’ how much of your credit limit you’re usin’. If you’ve got a card with a $1,000 limit and you owe $500, you’re at 50% utilization. That’s too high. Lenders wanna see you usin’ less—way less. Under 30% is decent, but under 10%? That’s the sweet spot for a score boost.

- Pay down them balances. Focus on high-interest cards first. If you’ve got multiple cards, chip away at the one closest to its limit.

- Ask for a higher limit. If you’ve been payin’ on time, call your card company and beg for a bigger limit. More credit means lower utilization, just don’t go spendin’ it all!

- Spread out the debt. If one card’s maxed out, try movin’ some balance to another card with space. Keeps that percentage down.

I had a buddy who dropped his utilization from 50% to 9% by payin’ off a chunk and gettin’ a limit increase. Boom—his score shot up 25 points in a month. It ain’t always that fast, but this move can work quick if you hustle.

Step 3: Hunt for Errors on Your Credit Report

Here’s a sneaky lil’ trick that might get you that 20 points without much sweat: check your credit report for mess-ups. I’m serious—mistakes happen more than you’d think. Stuff like old debts showin’ as unpaid or accounts that ain’t even yours can drag your score down.

- Grab your free reports. Head to AnnualCreditReport.com for a free peek at what Equifax, TransUnion, and Experian got on you. Do it once a year, no charge.

- Scan for weird stuff. Look for late payments you swear you made or debts that shoulda been cleared. Even small errors count.

- Dispute like a boss. If somethin’s wrong, file a dispute with the credit bureau. They gotta investigate, and if you’re right, they’ll fix it. That alone can bump your score.

I once found a paid-off loan still listed as “delinquent” on my report. Disputed it, got it fixed, and my score popped up 15 points in a couple weeks. Not quite 20, but close enough to keep me motivated.

Step 4: Deal with Them Pesky Collections

If you’ve got accounts in collections, they’re like a big ol’ anchor on your FICO score. Even if you’ve paid ‘em off, they can stick around and hurt ya. Tacklin’ this ain’t always easy, but it’s worth a shot for a quick boost.

- Verify the debt first. Don’t just pay whoever’s callin’. Ask for a debt verification letter to make sure you owe what they say. Banks sell debts, and you might pay the wrong folks.

- Negotiate if you can. Some collectors might agree to remove the mark if you pay up—tho’ not all do this anymore. Worth askin’.

- Keep pushin’ for removal. If it’s paid, dispute it with the bureaus or contact the original creditor to see if they’ll help get it off your report.

I’ve heard of folks gettin’ collections wiped after explainin’ a mix-up to the original lender. It don’t always work, but a clean report could easily net you 20 points or more.

Step 5: Play the Long Game with Credit History

This one ain’t as fast, but it’s still key. The longer your credit history, the better your score. Lenders like seein’ you’ve managed accounts for years—it screams “responsible.”

- Don’t close old cards. Even if you don’t use ‘em, keep ‘em open. Use ‘em once in a while for a coffee or somethin’ so the bank don’t shut ‘em down.

- Avoid too many new accounts. Each new app can ding your score a tad. If you’re close to needin’ that 20-point boost for a big purchase, hold off.

- Add variety if ya can. Got only credit cards? Maybe add a small loan or report utility payments (Experian lets ya do this) to mix things up.

When I kept my first card open from college—barely used it, mind you—it helped my average account age. Slow and steady, but it added points over time.

Quick Glance: Top Tips to Raise Your FICO Score 20 Points

Here’s a handy table to sum up the best moves. We’ve ranked ‘em by how fast they might work for ya.

| Strategy | Potential Speed | Impact Level | What to Do |

|---|---|---|---|

| Pay Bills on Time | Immediate to 1-2 Months | High | Automate payments, set reminders. |

| Lower Credit Utilization | 1-2 Months | High | Pay down debt, request limit increases. |

| Dispute Credit Report Errors | 1-2 Months | Medium to High | Check reports, file disputes for mistakes. |

| Handle Collections | Varies (1-3 Months) | Medium to High | Verify debt, negotiate removal. |

| Maintain Credit History | 3+ Months | Medium | Keep old accounts open, limit new apps. |

Bonus Moves for That Extra Push

If the basics ain’t cuttin’ it, here’s a couple wild cards to try:

- Become an Authorized User. Got a pal or family member with killer credit? Ask to be added to their card as an authorized user. Their good habits can rub off on your score. Just make sure they pay on time, or it backfires!

- Try a Secured Card or Credit Builder Loan. If your credit’s rough, these are baby steps to buildin’ it up. A secured card needs a deposit, but usin’ it right reports good stuff to the bureaus. Same with a credit builder loan—payments help over time.

I’ve seen a friend piggyback on their spouse’s card and gain almost 30 points in a few months. Ain’t a guarantee, but it’s a neat trick if you got the right connection.

Patience, Grasshopper—It Ain’t Instant

Now, I gotta be real with ya. Raisin’ your FICO score by 20 points might not happen overnight. Some moves, like droppin’ utilization or fixin’ an error, can show results in a month or two. Others, like buildin’ history, take longer. Don’t get all bummed if it’s slow—keep at it. Once you hit around 760, the perks are pretty much maxed out anyway, so aim for steady progress.

Tools to Keep You on Track

We live in a dope era where free tools can help. Check your credit reports at AnnualCreditReport.com—no cost, just facts. Some apps or sites got credit score simulators to guess how actions might affect your score. And if you’re feelin’ lost, non-profit credit counselin’ agencies can point ya in the right direction. Me and my crew use these to stay sharp—why not you?

Why We Care So Much About This

Lemme tell ya why I’m so hyped to share this. A better FICO score ain’t just numbers on a page. It’s savin’ cash on loans, gettin’ approved for that dream house, or even landin’ a gig where they check credit. I’ve been stuck with high interest rates before, and it sucked the life outta my wallet. Raisin’ my score—even by 20 measly points—felt like winnin’ a small lottery. I want that for you too.

Wrappin’ It Up: Start Today, Champ!

So, there ya have it—my no-BS guide to raisin’ your FICO score by 20 points. Start with the heavy hitters: pay on time, cut that utilization, and check for errors. Then, tackle collections if ya got ‘em and play smart with your credit history. It ain’t rocket science, but it takes grit. We’re rootin’ for ya at every step, so don’t wait—pick one tip and roll with it today. Got a trick that worked for you? Drop a comment below; I’d love to hear your story! Let’s get them scores up, fam!

If your credit score is below average, there are ways to improve it — some provide quicker results than others. Experts share tips on how to quickly raise your credit score.Updated Mon, May 20 2024

When you have a good credit score, you can get better terms and lower interest rates on loan products and credit cards. But its not always easy to just boost your credit score overnight. First, you need to consider why your score is low.

“Understanding the specific circumstances as to what is impacting your score is your first step in understanding how to quickly increase your credit score,” Jim Triggs, president and CEO of nonprofit credit counseling agency Money Management International, Inc (MMI), tells CNBC Select.

Below, we get advice from Triggs and a couple other experts on how quickly your credit score can increase and tips for making it happen.

Pay down your revolving credit balances

If you have the funds to pay more than your minimum payment each month, you should do so. Chipping away at your revolving debt can have a major impact on your credit score because it helps to keep your credit utilization rate low.

“How quickly [your score can go up] depends on how quickly the individual creditors report the paid balance on the consumers credit report.” Triggs says. “Some creditors report within days of the payment, some report at a specific time each month.” Credit card companies typically report your statement balance to the credit bureaus monthly, but this could vary depending on your issuer. You can call or chat online with your card issuer to find out when they report balances to the bureaus.

The sooner you can pay off your balance each month the better. You can also make multiple payments toward your balance throughout the month so it is easier to track your spending, and it keeps your balance low. And although it helps to even pay off a portion of your debt, paying off the entire balance will have the biggest and fastest impact on your credit score.

BOOST Your Credit Score 20+ Points With THIS Small Change.

FAQ

How to raise FICO score 20 points?

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

What is the fastest way to increase FICO score?

- Paying your loans on time.

- Not getting too close to your credit limit.

- Having a long credit history.

- Making sure your credit report doesn’t have errors.

How long does it take your credit score to go up 20 points?

The length of time it will take to improve your credit scores depends on your unique financial situation, but you may see a change as soon as 30 to 45 days after you have taken steps to positively impact your credit reports.

Why did my FICO score drop 20 points?