A 401(k) can be a great tool to help you save and invest for retirement. Pre-tax contributions to a traditional 401(k) can help reduce your taxable income today, and you won’t owe taxes until you make withdrawals, usually in retirement. But you might wonder: What if I need some or all of my 401(k) money now? Financial emergencies happen—and in some cases, drawing on your 401(k) may be your only option. Here are the different ways to access your 401(k) money, along with pros and cons to consider.

Are you eyeing that nest egg you’ve been building in your 401(k) and wondering if there’s any way to crack it open without Uncle Sam taking a big bite? I’ve been there too and lemme tell you – it’s not as straightforward as we might hope, but there are definitely some clever strategies worth exploring!

First things first – let’s be real. Traditional 401(k) withdrawals are never completely tax-free. That’s just how these accounts work. And don’t click away just yet! There are legal ways to reduce, manage, or temporarily avoid those tax hits when you take money out of your retirement account.

The Brutal Truth About Your 401(k) and Taxes

A lot of people believe that their 401(k) account is theirs and theirs alone. Surprise! That’s not entirely true. Since you didn’t pay taxes on your contributions or the matching contributions from your employer, the IRS is just waiting for their cut when you take the money out.

Here’s what typically happens with a traditional 401(k):

- Withdrawals are taxed as ordinary income

- Early withdrawals (before age 59½) typically incur an additional 10% penalty

- You’ll owe taxes even on the employer contributions and all the growth

A lot of my clients think this: “I have $1 million in my 401(k)!” But, depending on your tax bracket, that million could be worth a lot less after taxes.

Strategy #1: Take Out a 401(k) Loan Instead of a Withdrawal

A 401(k) loan is one of the easiest ways to get to your money without having to pay taxes right away. It’s not really a withdrawal; it’s a loan to yourself!

Here’s how it works:

- You can typically borrow up to 50% of your vested account balance (maximum $50,000)

- You’ll have 5 years to repay the funds with interest

- All money (including interest) goes back into your account

- No taxes or penalties as long as you repay according to the terms

The best part? You’re basically paying interest to yourself! However, there are some serious caveats:

⚠️ Warning: If you leave your job before repaying the loan, you might have to repay the entire balance quickly (often within 60-90 days). If you can’t, the outstanding amount becomes a withdrawal subject to taxes and possibly that nasty 10% penalty.

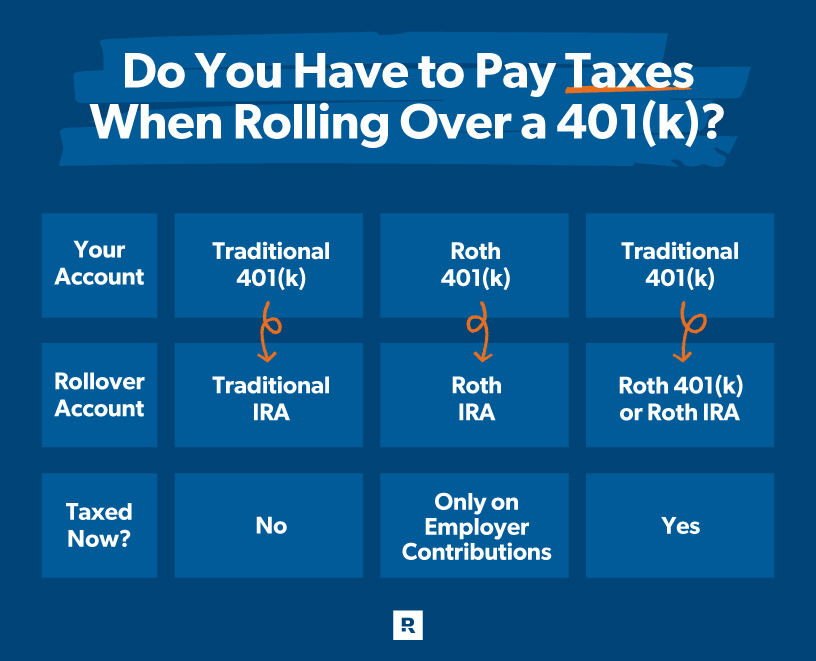

Strategy #2: Roll Over to a Roth IRA (Pay Now to Save Later)

While this strategy doesn’t avoid taxes entirely, it can be a smart long-term play. When you roll over funds from a traditional 401(k) to a Roth IRA:

- You’ll pay taxes on the converted amount in the year of the rollover

- Future qualified withdrawals (including earnings) will be completely tax-free

- You’ll avoid Required Minimum Distributions (RMDs) later

- Roth IRAs offer more flexibility for withdrawals

Regina McCann Hess, a certified financial planner, explains that “this strategy may decrease your future tax bill and potentially prevent you from jumping up a tax bracket when it comes time.”

This approach works especially well if:

- You’re currently in a lower tax bracket than you expect to be in retirement

- You have cash available to pay the taxes now

- You have many years until retirement (allowing the tax-free growth to compound)

Strategy #3: Use the In-Plan Roth Conversion Option

If you’re happy with your current employer but still want to make the Roth move, check if your employer offers an in-plan Roth conversion. This allows you to convert funds within your employer’s 401(k) plan rather than rolling them to an external Roth IRA.

Kevin M. Curley II, a wealth advisor, suggests: “Investors may have some income-light years where their tax rate is lower than in other years. This would be a good time to convert a portion of their 401(k) and save on taxes.”

Strategy #4: Wait Until Retirement for Strategic Withdrawals

Patience can be a virtue when it comes to tax planning. If you can wait until retirement, you might find yourself in a lower tax bracket, making withdrawals less costly from a tax perspective.

Even better, you can potentially:

- Keep your withdrawals small enough to stay in lower tax brackets

- Combine withdrawals from traditional 401(k)s with tax-free Roth withdrawals to manage your taxable income

- Potentially stay under the standard deduction amount ($13,850 for single filers in 2024), resulting in effectively tax-free withdrawals

McCann Hess explains: “You can use this as an opportunity to move portions of your traditional 401(k) money into [a Roth IRA] each year at a lower tax bracket. Then, if the money stays in the Roth for at least five years, you can avoid paying tax on the converted money and its growth.”

Strategy #5: The “Still Working” Exception

Here’s a strategy most people don’t know about! If you’re still working at age 73 (when Required Minimum Distributions typically must begin), you can delay taking RMDs from the 401(k) plan sponsored by your current employer.

This exception allows you to:

- Keep funds growing tax-deferred longer

- Avoid being forced into withdrawals that might push you into higher tax brackets

- Potentially wait until retirement when your income (and tax bracket) may be lower

The catch? This only applies to the 401(k) at your current employer – not other 401(k)s from previous jobs or IRAs you might have.

Strategy #6: Consider Charitable Giving Strategies

If you’re charitably inclined, you might be able to use a Qualified Charitable Distribution (QCD) strategy. While this technically applies to IRAs rather than 401(k)s, you could:

- Roll your 401(k) to an IRA

- Make direct distributions from the IRA to qualified charities (up to $108,000 in 2025)

- Satisfy your RMDs without counting toward your taxable income

This is a win-win – the charity gets your support, and you avoid paying taxes on that distribution amount!

What About Hardship Withdrawals?

If you’re facing a genuine financial emergency, your 401(k) plan might allow for hardship withdrawals. These still incur taxes, but in some specific circumstances, the 10% early withdrawal penalty might be waived:

- Medical expenses exceeding 7.5% of your adjusted gross income

- Payments to prevent eviction or foreclosure

- Certain expenses for the purchase of a principal residence

- College tuition and related educational expenses

- Funeral expenses

- Certain expenses for repairs to your principal residence

Remember though, even without the penalty, you’ll still owe income taxes on these withdrawals.

The Diversification Strategy: Don’t Put All Your Eggs in One Tax Basket

One of the best long-term strategies isn’t about getting money out tax-free – it’s about having diverse retirement savings vehicles to begin with!

By maintaining a mix of:

- Traditional 401(k)/IRA accounts (tax-deferred)

- Roth accounts (tax-free withdrawals)

- Taxable brokerage accounts (capital gains taxation)

- Cash value life insurance (potentially tax-advantaged access)

You’ll have much more flexibility to manage your tax situation in retirement.

The Bottom Line: There’s No Magic Bullet

I wish I could tell you there’s some secret loophole that lets you access your traditional 401(k) completely tax-free, but that would be misleading. The fundamental deal with these accounts is tax deferral, not tax elimination – the bill comes due eventually.

But with careful planning, strategic timing, and potentially some short-term tax costs for long-term tax benefits, you can definitely minimize the impact of taxes on your retirement savings.

My Personal Take

I’ve worked with clients for years on these strategies, and I’ve found the Roth conversion to be particularly powerful for many people. Yes, it hurts to pay taxes now, but the freedom of tax-free growth and withdrawals later is often worth it – especially if you convert during years when your income is temporarily lower.

The 401(k) loan can also be useful in certain situations, like bridging a temporary cash flow gap or making a down payment on a home. Just be super careful about job stability before taking this route!

Remember, everyone’s situation is unique, and what works best depends on your age, income, tax bracket, retirement timeline, and overall financial picture. Consulting with a financial advisor who understands tax strategies can be worth its weight in gold here.

Have you tried any of these strategies to minimize taxes on your retirement savings? I’d love to hear your experiences in the comments below!

Disclaimer: This article is for informational purposes only and does not constitute tax, legal, or financial advice. Always consult with qualified professionals regarding your specific situation.

Options if you need your 401(k) money now

There are a few different ways to access your 401(k) assets before you turn age 59½, after which there are no penalties for withdrawing. Some of these options don’t come with penalties either.

Qualified early withdrawal

A qualified early withdrawal, which is not subject to the early distribution penalty, is different from a hardship withdrawal in that an employer doesn’t determine what counts as one. Instead, the circumstance must meet certain IRS criteria, and the IRS sets limits for withdrawal amounts depending on the situation. If eligible, that 10% early withdrawal penalty would be waived. Here are some, but not all, qualifying situations and their respective withdrawal limits:

- Birth or adoption costs: up to $5,000 per child

- Death or total and permanent disability: no limit

- Disaster recovery: up to $22,000 per federally declared disaster

- Personal emergency expense: You can use up to $1,000 (or your vested account balance minus $1,000) each year for a personal or family emergency, as long as you pay it back or put it off. Otherwise, it’s once every 3 years.

- Medical expenses: any unreimbursed amount greater than 7. 5% of your adjusted gross income (AGI).

While qualified early withdrawals aren’t subject to the 10% penalty, you’d still need to pay income taxes on this money. You might also be taxed more heavily if you take money out of your account too soon, depending on how much you take out and how much money you make now. That could significantly bump up your tax bill in the year you made the withdrawal. Even if you’re retired, 401(k) withdrawals still count as taxable income, unless it’s from a Roth 401(k) or a return of after-tax contributions. Before you do this, keep in mind that you’ll be reducing your retirement savings and the money you might make in the future.

Early withdrawal

An early withdrawal is one you make before age 59½ at any time and for any reason. You will owe the early withdrawal 10% penalty. For traditional 401(k)s, you’d also have to pay federal income taxes—and possibly state taxes—on the withdrawal.

As with qualified early withdrawals, you should remember that you could move into a higher tax bracket and that you need to follow the rules of your plan.

401(k) loan

Instead of withdrawing from your 401(k), you could opt for a 401(k) loan. This can allow you to borrow up to 50% of your account’s vested balance or $50,000 (whichever is less), which is reduced by your highest outstanding loan balance over the last 12 months. You then repay what you’ve borrowed, plus interest, usually within 5 years of taking out your loan. The interest rate, which is set by your plan, is typically the prime rate, the interest rate charged by banks to their most creditworthy customers, plus 1% to 2%, which is relatively low compared to other types of loans.

The main benefit of a 401(k) loan is you don’t owe the early withdrawal penalty or taxes on the loan amount if you abide by the terms of the loan. And those interest payments? They go directly into your account, so you’re paying interest to yourself instead of to a lender.

401(k) loans still have potential drawbacks. On top of missing potential investment growth from money borrowed, if you leave your employer before you repay the loan, you may be required to pay it back in full all at once, even if you lose your job rather than quit. If you’re unable to cover those costs, you’d typically owe taxes and the early withdrawal penalty on the unpaid balance.

Hardship withdrawal

If you experience an immediate and heavy financial need, you may be able to make a hardship withdrawal from your 401(k). If you qualify based on your plan rules, you can withdraw up to the amount necessary to cover your need, plus the income taxes you’d be on the hook for. You may also have to pay a 10% early distribution penalty unless you are age 59½ or older.

The IRS has 7 circumstances that qualify for a 401(k) hardship withdrawal without needing documentation to prove hardship, including:

- Code Section 213(d) lets you deduct medical costs for yourself, your spouse, or your dependents.

- Costs related to buying your main home (most mortgage payments don’t count, unless they’re needed to keep your home from going into foreclosure).

- Payments you need to make on a mortgage in order to keep your main home and avoid being evicted or losing it to foreclosure

- The cost of fixing damage to your main home that happened because of a casualty under IRC Section 165

- Tuition or other related school costs, like room and board, for the next 12 months of college for you, your spouse, or your dependents

- Funeral expenses for you, your spouse, children, or dependents

- expenses and losses that participants had because of a FEMA-declared disaster, as long as the participant’s main home or place of work at the time of the disaster was in a FEMA-designated area

While these reasons don’t require proof, your employer may require documentation to certify your hardship. Even if you don’t have to provide documentation, it’s smart to record all facts, bills, and receipts related to your 401(k) hardship withdrawal in case of an audit. As with a regular early withdrawal, this option reduces the amount of money—plus any additional gains—you’ll have to draw on in retirement.

Here’s the full list of IRS :

Rule of 55 distributions

If you have a 401(k) and leave your employer for any reason—whether you quit or lose your job—in the year you turn age 55, the Rule of 55 allows you to access that money without incurring the 10% early withdrawal penalty. But just because these withdrawals are penalty-free doesn’t mean they’re tax-free—you may owe income taxes on any early withdrawals, including those made under the Rule of 55.

Other alternatives to early 401(k) withdrawals

If you’re in a pinch and need money fast, you may not need to dip into your 401(k). Consider one of the following alternatives:

Emergency savings

If you have robust cash reserves for emergencies, this is a good time to draw from it. (We generally suggest keeping 3 to 6 months of expenses in cash, such as in a checking or savings account, as emergency savings.) If you withdraw from emergency savings, though, you should start to replenish those dollars as soon as you can.

0% introductory credit card

Many credit cards offer a promotional introductory period with 0% interest. Using one could be good for covering an emergency expense if you’d be able to pay off the balance before the introductory period ends. However, if you aren’t able to pay off the balance by then, your interest rate could be 20% or more.

Home equity loan

If you own a home and have significant equity because you’ve paid off a lot of your mortgage, you own your home outright, or your home has increased in value, you may be able to take out a home equity loan or home equity line of credit (HELOC) with a competitive interest rate. That keeps your 401(k) balance safe. Keep in mind that the penalty for not repaying the loan according to the terms could be losing your home.

Personal loan

Unlike a home equity loan, you might not need to offer any collateral with a personal loan. Interest rates on this kind of loan can be fixed or variable. The stronger your credit, the more likely you are to secure a favorable rate.

In any of these cases, it’s important to avoid borrowing more money than you can realistically repay by the deadlines.

How to take an early withdrawal from your 401(k)

To make an early withdrawal from your 401(k), you’ll likely need to do the following:

- Reach out to your HR department or 401(k) plan administrator

- Find out if early withdrawals are possible and how the process works.

- You may need to tell your plan administrator why you need the money in order for them to decide if your withdrawal is a hardship or qualified withdrawal.

- If your request is approved, you should get the money within 10 business days, minus any taxes that need to be taken out.

- If you owe extra 2010 taxes on early withdrawals, you will also need to report the early distribution during tax season.

How can I get my 401k money without paying taxes?

FAQ

How can I withdraw money from my 401k without paying taxes?

You generally cannot withdraw money from a traditional 401(k) without paying taxes and potentially a 10% penalty if you’re under age 59½. If you want to keep your 401(k) money tax-free, you could roll it over into a Roth IRA, borrow money from your 401(k) and pay it back, or wait until retirement, when Roth 401(k) withdrawals are tax-free.

What proof do I need for a 401k hardship withdrawal?

To get a 401(k) hardship withdrawal, you need to document an immediate and heavy financial need, such as a medical expense, home purchase, or educational cost, and prove that you don’t have other reasonable means to cover it, such as loans or other assets.

How much tax will I pay if I withdraw my 401k?

Unless you qualify for an exception, you will usually have to pay federal and state income taxes on traditional 401(k) withdrawals. These are taxed at your normal income rate, plus you may have to pay a penalty for taking money out too soon if you are under the age of 59. For Roth 401(k)s, withdrawals in retirement are usually tax-free, but early withdrawals may still be subject to penalties and taxes on earnings.

What is the smartest way to withdraw a 401k?

The 4% rule is a strategy that says you should withdraw 4% of your retirement savings in your first year of retirement. In subsequent years, tack on an additional 2% to adjust for inflation. For example, if you have $1 million saved under this strategy, you would withdraw $40,000 during your first year in retirement.