This article contains general information and is not intended to provide information that is specific to American Express products and services. Similar products and services offered by different companies will have different features and you should always read about product details before acquiring any financial product.

Closing a credit card with a zero balance could impact your credit score. See the pros and cons of closing a zero balance credit card.

You finally sent in that last payment and your credit card has a zero balance. After you’ve congratulated yourself for paying it off, you plan to call the lender and close your card.

But before you do, it’s important to note that closing down a card with a zero balance may not be the best move for your credit score. Let’s explore some situations where closing down a credit card with no balance may, or may not, be a good idea.

Closing a credit card account with a zero balance can potentially hurt your credit score. However, the impact depends on your specific credit profile and history. In some cases, it may not affect your score much or at all. But in other situations, it could lower your score noticeably.

How Closing a Card Can Impact Your Credit Score

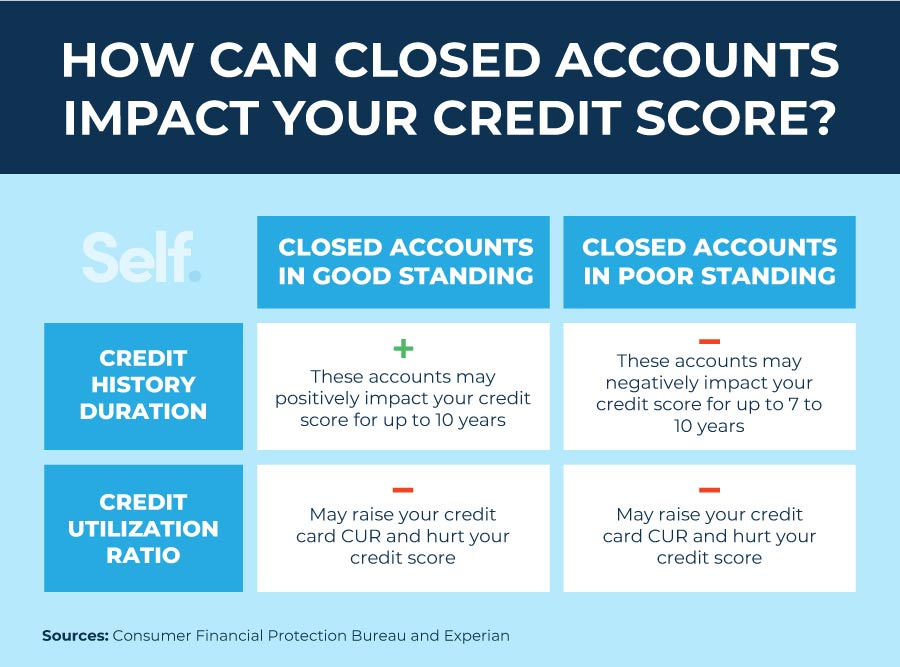

There are a few key ways that closing a credit card account can negatively affect your credit score

-

It lowers your total available credit When you close a card you lose that available credit, which causes your credit utilization ratio to increase. This ratio compares your balance to your total credit limit. The higher the ratio the more it hurts your score.

-

It reduces your credit mix Having different types of credit – like credit cards, auto loans, mortgages, etc. – improves your credit mix and score Removing a credit card lowers the mix.

-

It shortens your length of credit history: The average age of your accounts is factored into your score. By closing newer cards, you lower the average age and length of credit history.

-

It can impact your payment history: If the closed card has a strong payment history, losing this account could slightly worsen this aspect of your credit score.

When Closing a Card Won’t Hurt Your Credit Score

However, there are also situations where closing a credit card won’t damage your credit very much or at all:

-

You have excellent credit scores: If your credit scores are already high, closing an unused card likely won’t drop your scores enough to really impact your ability to get approved for new credit.

-

The card is relatively new: If the credit card is less than a few years old, closing it won’t significantly reduce the average age of your accounts, so the impact should be minor.

-

You have ample total credit: With high total credit limits across multiple other cards, closing one card won’t increase your credit utilization ratio by much.

-

The card has no payment history: For a new card you’ve never used, there’s no payment data to lose by closing the account.

-

You apply for new credit months later: If you wait many months after closing the card to apply for any new credit, your scores will have time to recover.

So it generally won’t hurt much to close a new card in good standing if you already have very good credit scores, high total limits, and a long credit history. The effect fades over time too.

How to Close a Credit Card Without Damaging Your Credit

If you do decide to close your credit card account, here are some tips to avoid harming your credit:

-

Pay the balance down to zero before closing the card.

-

Check your credit reports 60+ days after closing to make sure the account is marked “closed by consumer.”

-

Be cautious about applying for new credit soon after closing the card.

-

Consider product changing to another card instead of closing the account.

-

Leave old accounts open if possible – even if unused.

-

Use your remaining credit responsibly to keep utilization low.

-

Continue making on-time payments and maintaining positive financial habits.

As long as you practice good credit management behaviors, like the ones above, closing a single credit card with zero balance is unlikely to damage your credit scores too severely or for too long. Be sure to consider your entire credit profile and needs before making the decision.

Frequently Asked Questions

Closing a card usually impacts two credit score factors: credit utilization ratio and average age of credit.

When you cancel a card you lose access to that card’s credit limit, so your overall credit limit goes down. Unless you carry a zero balance on all your credit cards, this change leads to a higher credit utilization ratio which can negatively impact your credit score. This is especially important if the increase in your credit utilization will surpass 30% of your available credit.

Closing a credit account can impact your credit score, but there’s no one-size-fits-all formula to determine how many points your credit score will change.

The exact amount your credit score will change when you close an account could depend on a few factors like payment and credit history, how many other credit card accounts you have and their average ages, as well as your credit limit.

Some cardholders want to close a credit card with a zero balance if they don’t plan on making purchases with that credit card any longer. Others want to close a credit card account as soon as they make the last payment. This may be a good financial decision for cardholders who may be tempted to overspend using credit cards, since closing the account could help you limit your spending. But, regardless of the reason, closing a credit card could impact your credit score. So, if there’s no annual fee on the card or any other pressing reason to close the account, you may want to keep the credit card open indefinitely so you don’t hurt your score.

Keeping a credit card with a zero balance open may help you improve your credit score, since it can lower your credit utilization ratio and could increase your average age of credit. It also may serve as a safety net for unforeseen or emergency expenses. However, under certain circumstances, closing your account may make more sense for your financial well-being.

1 “What Is a VantageScore Credit Score?,” Experian

2 “What Should My Credit Utilization Ratio Be?,” myFICO

5 “How Credit Cards Can Affect Your Credit Score,” Experian

8 “Should I Cancel a Credit Card With an Annual Fee?,” Experian

9 “I want to close my credit card account. What should I do?,” Consumer Financial Protection Bureau

SHARE

Michael Grace is a personal finance and technology freelance writer based on Long Island, N.Y. All Credit Intel content is written by freelance authors and commissioned and paid for by American Express.

Need More Credit? Having a Zero Balance Credit Card May Help

If you plan to apply for additional credit for a big purchase – such as a mortgage, home equity line of credit, or car loan – within a year after paying off a credit card, keeping it open with a zero balance may keep your credit score strong. In this case, you would have a lower credit utilization ratio, longer age of credit, and strong payment history, all of which could contribute to your credit score. A zero balance card also may provide a safety net to help pay for any emergency or unplanned expenses, such as medical care or car repairs.

It may be helpful to know that after a long period of inactivity, sometimes a credit card company may lower your credit limit or even close your account.6,7 Using that credit card for automatic payments on small recurring expenses, such as a streaming service or gym membership, is one way you can avoid that.

Should I Close a Paid Credit Card Or Leave It Open?

FAQ

Is it bad to close a credit card with zero balance?

How to cancel a credit card without hurting your credit?

Is it better to close a credit card or let it go inactive?

Keeping an unused credit card open can benefit your credit score – as long as you follow good financial habits. If an unused credit card tempts you to unnecessarily spend or has an annual fee, you may be better off canceling the account.

Does it hurt your credit score to close a credit card you don’t use?

7 While you may have a good reason to cancel your card, you should not do so with the expectation of improving your credit score. Canceling an account can lower the average length of your credit history and increase your credit utilization, both of which can have a negative impact on your score.

What happens if you close a credit card with a zero balance?

Closing a credit card with a zero balance can affect your credit score. When you close a card, your total available credit decreases, which can raise your credit utilization ratio if you have balances on other cards. This higher utilization can lower your score.

Can a zero balance affect my credit score?

Unless you carry a zero balance on all your credit cards, this change leads to a higher credit utilization ratio which can negatively impact your credit score. This is especially important if the increase in your credit utilization will surpass 30% of your available credit. How many points will my credit score drop if I close a credit card?

What happens if you close an account with a zero balance?

If you close an account with a zero balance, it may initially hurt your credit score. But, if there were no late payments, outstanding debts, or other negative marks on the account, your credit score will likely return to normal within a few months.

How does closing a credit card affect your credit score?

When you close a card, your total available credit decreases, which can raise your credit utilization ratio if you have balances on other cards. This higher utilization can lower your score. Additionally, closing a long-standing credit card can reduce the average age of your credit accounts, another factor that impacts your score.

How important is a zero balance on a credit card?

It accounts for 30% of your credit score under the FICO scoring model and is labeled “extremely influential” under the VantageScore model.1,2 Experts recommend keeping your credit utilization ratio below 30%. If you choose to close a credit card with a zero balance, your total credit limit will decrease.

Should I Close my credit card to help my credit score?

If you still decide to close some accounts to help your credit score, start by looking at inactive accounts that you no longer use. Cards that you don’t use, but charge high annual fees, may be candidates for closure in order to save you money. When you close accounts, remember to keep at least one of your older credit accounts open.