Hey there! If you’ve been wondering whether pensioners receive a P60, you’re definitely not alone. This question pops up all the time, especially for those approaching retirement or who’ve recently started receiving pension payments. Let’s clear this up once and for all!

The Short Answer: Yes, Pensioners Do Get a P60!

Pensioners who receive a pension – whether it’s a state pension, private pension, or workplace pension – typically get a P60 form each tax year This important document summarizes your pension income and any tax you’ve paid during the tax year

What Exactly is a P60 and Why Does it Matter?

A P60 is an official document that shows

- How much pension income you’ve received throughout the year

- The total amount of tax you’ve paid

- Your tax code

- Your personal details including your National Insurance number

Your P60 is like a report card for your pension income every year. It’s very important because it helps you

- Verify your tax records are correct

- Claim tax allowances you’re entitled to

- Complete your tax return if you need to file one

- Prove your income for various applications

When Will You Receive Your Pension P60?

Usually, you get your P60 after the tax year ends. In the UK, the tax year runs from April 6 to April 5. The Local Pensions Partnership Administration (LPPA) says that you should get your P60 by May 31 of each year. Mark that date in your calendar!.

How Your Pension P60 Works Depending on Your Pension Type

If You Get State Pension and a Private Pension

Things are a little different when you get both a state pension and a private pension. Your private pension provider will usually:

- Take off any tax you owe before paying you

- Include any tax you owe on your State Pension

- Issue you a P60 at the end of the tax year showing all tax paid

If you get payments from multiple providers (like from both a workplace and personal pension), HMRC will ask one of your providers to handle the tax for your State Pension too.

If State Pension is Your Only Income

If your State Pension is the only money coming in:

- And you go over your Personal Allowance, HMRC will send you a Simple Assessment tax bill

- After your first year of receiving State Pension, you’ll pay tax based on 52 weeks of payments

- If your income stays below your Personal Allowance, you usually won’t need to pay tax

If You’re Working While Getting a Pension

Working while receiving a pension? Here’s what happens:

- Your employer typically takes tax off your earnings, including any tax on your pension

- If you’re self-employed, you’ll need to complete a Self Assessment tax return declaring all income sources

How to Access Your P60 Online

Many pension providers now offer digital access to your P60. Here’s how you can view yours online:

Through My Pension Online

- Sign in to your My Pension Online account

- Navigate to the “My Payments” tab

- Look for the “P60 End of Year Certificates” section

- Click on the P60 you want to view or download

Through PensionPoint (for LPPA members)

If LPPA manages your pension payroll:

- Log into PensionPoint

- Visit the “My Documents” page

- Locate and view your P60

I’ve found the PensionPoint system pretty straightforward to use, even for someone like me who isn’t the most tech-savvy!

What if You Prefer Paper Copies?

Not everyone likes digital documents, and that’s totally ok! If you’ve opted out of electronic communications, your pension provider should send your P60 through the post. Just be sure to keep it somewhere safe when it arrives.

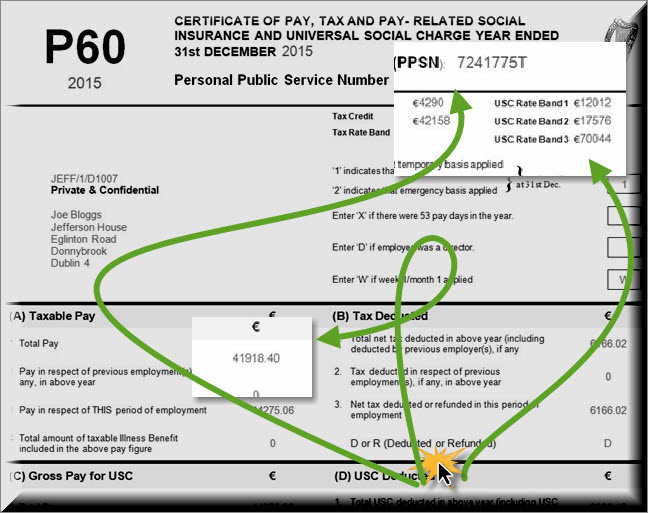

Understanding the Key Information on Your P60

When you look at your P60, you’ll find several important sections:

-

Personal Information

- Your name, address, and National Insurance number

-

Pension Provider Details

- Name and address of your pension provider

-

Income and Deductions

- Summary of your total pension income for the tax year

- Details of tax deductions

-

Tax Code

- Your tax code which determines how much tax you pay

-

Taxable Pay

- The amount of your pension income subject to tax

-

Tax Paid

- Total amount of tax paid on your pension income

What If My P60 Information Is Wrong?

Mistakes happen! If you spot something that doesn’t look right on your P60, don’t panic. The best course of action is to contact HMRC directly. Make sure you have:

- Your National Insurance Number

- Your PAYE Reference (found on your P60)

You can reach HMRC at 0300 200 3300 or write to them at:

Pay As You Earn

HM Revenue and Customs

BX9 1AS

Special Cases: Different Pension Funds

Not all pension funds are managed the same way. For example, if you’re a member of Ealing, Havering, or Newham funds, you may need to contact your payroll department directly to receive your P60.

Frequently Asked Questions About Pension P60s

Do I need a P60 if I have a pension?

Yes! If you’re retired but continue to draw a pension from a previous employer or pension provider, you should receive a P60 detailing the pension you’ve received and any tax deducted.

How do I get my retired P60?

The simplest way is usually through your pension provider’s online portal. Alternatively, you can request a paper copy if you prefer.

Do pension contributions reduce your taxable income in the UK?

Yes, you can get tax relief on private pension contributions worth up to 100% of your annual earnings. The way you get this relief depends on your pension scheme and income tax rate.

What are the disadvantages of working after retirement in the UK?

Working after retirement while accessing your pension might push you into a higher income tax band. However, if you work past State Pension age, you won’t pay any National Insurance on your earnings.

Why Your P60 is Worth Keeping Safe

I always tell my friends to treat their P60 like gold dust. It’s not just another piece of paper – it’s proof of your income and tax status. You might need it for:

- Applying for loans or credit

- Claiming benefits

- Sorting out tax issues

- Proving your income for rental applications

Tips for Managing Your Pension Tax Paperwork

Here are some handy tips I’ve picked up over the years:

- Create a dedicated folder – either physical or digital – for all your pension documents

- Keep P60s for at least 22 months after the end of the tax year they relate to

- Scan paper copies as backups if you’re worried about losing them

- Check your tax code on your P60 to make sure it’s correct

- Compare year-to-year to spot any unusual changes in your tax situation

Final Thoughts

So there you have it! Pensioners do indeed get a P60, and it’s a pretty important document to keep track of. Whether you get your State Pension, a private pension, or both, your P60 gives you a clear picture of your pension income and tax situation.

We all know dealing with tax stuff can be a bit boring and confusing sometimes, but keeping on top of these things makes life easier in the long run. And remember – if you’re ever unsure about anything on your P60, don’t hesitate to contact HMRC or your pension provider for clarification.

What is a P60?

It’s a legal document that shows how much money you got as a salary or pension over the course of the year. It also confirms your total tax and national insurance contributions.

How will I receive my P60?

If LPPA looks after the payroll for your pension scheme, you will be able to access your P60 online by logging into PensionPoint. It only takes a couple of minutes to get started and once you’re up and running, you can view your P60 as often as you like via the My Documents page.

We don’t handle the payroll for the Ealing, Havering, or Newham pension funds. If you are a member of one of these plans, please get a copy of your P60 from the fund itself.

If you have opted out of electronic communications, you will receive your P60 through the post.