Follow this path if you’re waiting until you turn 65 or older to collect Social Security benefits. When you’re ready, you’ll have to contact Social Security to sign up for Medicare. You might not want to sign up for Medicare as soon as you become eligible if you have health insurance through your job or if you are working.

When you turn 65, you reach a big point in your life: you can start planning for retirement and start getting Medicare and Social Security benefits. A question that comes up a lot is whether or not people need to call Social Security when they turn 65. The short answer is it depends on your situation. Here is a list of everything you need to know to be ready.

The Quick Answer

Yes, in most cases, you’ll need to contact Social Security when you turn 65, particularly for Medicare enrollment. However, there are some exceptions:

- If you’re already receiving Social Security benefits before 65, you’ll be automatically enrolled in Medicare Parts A and B

- If you’re still working with employer coverage, you might have different deadlines

- If you want to delay certain parts of Medicare, you’ll need to take specific actions

Let me explain the details so you don’t miss any important deadlines

When Social Security Contacts You vs. When You Contact Them

Automatic Enrollment Scenarios

If you are already getting Social Security benefits before you turn 65, Medicare Parts A and B will be automatically added to your account. It will arrive in the mail about three months before your 65th birthday.

But if you aren’t getting Social Security when you turn 65, you need to call Social Security to sign up for Medicare. This is a crucial point many people miss!.

As stated on FinanceBand. “If you don’t get Social Security, you need to sign up for Medicare three months before you turn 65,” says com. “.

How and When to Contact Social Security

If you need to contact Social Security about Medicare or retirement benefits, you have several options:

- Online: Visit www.ssa.gov (the easiest and often fastest method)

- Phone: Call 1-800-772-1213 (TTY 1-800-325-0778)

- In person: Visit your local Social Security office

For Medicare enrollment, the initial enrollment period starts 3 months before your 65th birthday month and continues for 3 months after. To avoid gaps in coverage, it’s best to apply during the first 3 months of this window.

What Happens If You Don’t Contact Social Security at 65?

Failing to sign up for Medicare when you’re first eligible can result in some serious consequences:

- Late enrollment penalties for Medicare Part B that last for as long as you have Medicare

- Gaps in your health coverage

- Delayed start of benefits

According to FinanceBand.com: “If you don’t sign up for Medicare Part B when you’re first eligible, you may have to pay a late enrollment penalty for as long as you have Medicare coverage.“

Special Circumstances: Still Working at 65

If you’re still working at 65 and have health insurance through your employer, your situation might be different:

- If your employer has 20 or more employees, you can usually delay Medicare enrollment without penalties

- If your employer has fewer than 20 employees, Medicare typically becomes your primary insurance, and you should enroll at 65

The Medicare.gov website notes: “Depending on whether you’re working and if you have health coverage through your employer, you might not want to sign up for Medicare as soon as you become eligible.“

Social Security Benefits vs. Medicare Enrollment

It’s important to understand that enrolling in Medicare at 65 and claiming Social Security retirement benefits are two separate decisions:

- You can enroll in Medicare at 65 even if you delay claiming Social Security benefits

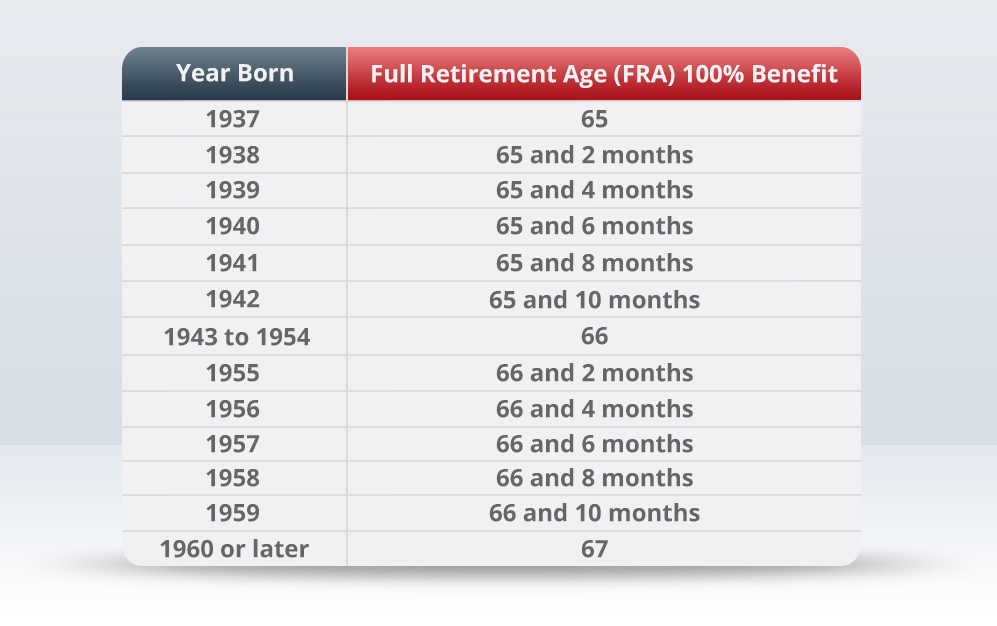

- Your full retirement age for Social Security is likely 66 or 67 (depending on birth year), not 65

- Delaying Social Security benefits increases your monthly amount (up to age 70)

Your Retirement Checklist: What to Consider

When approaching 65, here’s a handy checklist of things to consider:

- Determine if you’ll be automatically enrolled in Medicare or need to contact Social Security

- Decide if you want to delay Part B (if you have qualifying employer coverage)

- Consider when to claim Social Security benefits (65, full retirement age, or later)

- Review what Medicare will cost you (premiums, deductibles, etc.)

- Explore supplemental coverage options (Medigap, Medicare Advantage)

- Consider how work might affect your benefits if you continue working

Medicare Costs at Age 65

Many people are surprised by Medicare costs. Here’s what to expect:

- Part A (Hospital Insurance) is premium-free for most people who paid Medicare taxes

- Part B (Medical Insurance) has a standard premium ($144.60 in 2020, but this changes annually)

- Additional costs include deductibles, copayments, and coinsurance

How to Apply for Medicare at 65

When you’re ready to apply for Medicare, follow these steps:

- Gather your documents (birth certificate, proof of citizenship/lawful presence, etc.)

- Choose your application method (online, phone, or in person)

- Complete your application during your initial enrollment period

- Decide on additional coverage (Medicare Advantage, Part D drug coverage, or Medigap)

Common Questions About Turning 65 and Social Security

Do I automatically get Medicare when I turn 65?

Not necessarily. If you’re already receiving Social Security benefits, you’ll be automatically enrolled in Medicare Parts A and B. Otherwise, you need to apply.

What if I’m still working at 65?

If you have employer health coverage through your own or your spouse’s current employment, you might be able to delay Medicare enrollment without penalties. However, rules vary based on employer size.

How much does Medicare cost at 65?

In 2020, most people paid $144.60 monthly for Part B, with a $198 annual deductible. Part A is typically premium-free if you or your spouse paid Medicare taxes for at least 10 years.

Do I have to take Social Security at 65?

No, you don’t have to claim Social Security retirement benefits at 65. In fact, your full retirement age is likely 66 or 67, and delaying benefits increases your monthly amount.

When should I contact Social Security before turning 65?

If you need to sign up for Medicare, contact Social Security 3 months before your 65th birthday to ensure timely enrollment.

My Experience with This Process

When I helped my mom navigate this process last year, we almost missed her enrollment period! We didn’t realize she needed to contact Social Security because she wasn’t receiving benefits yet. We ended up calling the Social Security Administration about 2 months before her 65th birthday, and thankfully, we were still within the enrollment window.

The representative was super helpful and walked us through the whole process. They explained that even though she wasn’t ready to claim retirement benefits, she should still enroll in Medicare to avoid penalties. We ended up handling most of the process online, which was much easier than we expected.

Final Thoughts

Navigating Social Security and Medicare as you approach 65 can be confusing, but understanding when and why you need to contact Social Security is crucial. Here’s my advice:

- Mark your calendar 3-4 months before your 65th birthday to check your specific situation

- Don’t assume anything will happen automatically if you’re not already receiving Social Security benefits

- Consider consulting with a benefits specialist if your situation is complicated (working past 65, coordinating with spouse benefits, etc.)

Remember, while turning 65 might seem overwhelming with all these decisions, taking the time to understand your options will help ensure you don’t miss out on benefits you’ve earned throughout your working life.

Have you gone through this process yet? What was your experience like? I’d love to hear about it in the comments!

Step 2: Preview your coverage options

There are 2 main ways to get your Medicare coverage: Original Medicare and Medicare Advantage. Explore this section to understand your options and figure out what’s best for you, before you make a decision.

Step 3: Sign up for Part A & Part B when you’re ready

Get information about signing up for Medicare Part A (Hospital Insurance) & Part B (Medical Insurance). There are important deadlines you need to know.