Are you standing at the crossroads of retirement planning wondering if patience will literally pay off when it comes to your Social Security benefits? You’re not alone! This question keeps many soon-to-be retirees up at night do I get more Social Security if I wait until age 70?

In short, yes, you do get more money every month. But (and this is a big BUT) that doesn’t mean it’s the best choice for everyone. I’ll explain everything you need to know about this important retirement choice in simple language.

The Basic Facts: How Much More Do You Really Get?

Let’s start with the cold, hard facts about what happens when you delay claiming Social Security

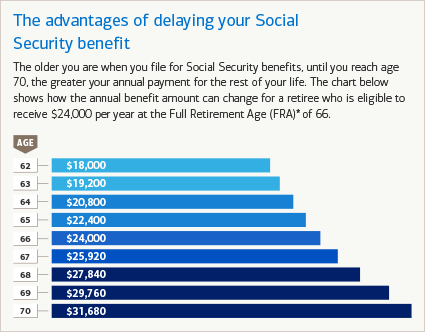

- Yes, your monthly check increases by approximately 8% for each year you delay benefits after your full retirement age (FRA) until age 70

- No more increases after 70 – the benefit growth stops completely once you hit the big 7-0

- Overall increase can be around 77% more if you wait from 62 to 70

According to the Social Security Administration (SSA), the exact increase depends on your birth year:

| Year of Birth | 12-Month Rate of Increase |

|---|---|

| 1943 or later | 8.0% |

| 1941-1942 | 7.5% |

| 1939-1940 | 7.0% |

| 1937-1938 | 6.5% |

| 1935-1936 | 6.0% |

| 1933-1934 | 5.5% |

It’s likely that most of the people reading this were born in 1944 or later, which means you’ll get that full 8% annual increase for delayed retirement credits.

Why Waiting Isn’t Always the No-Brainer It Seems

We’ve all heard the conventional wisdom: “Wait till 70 to maximize your benefits!” But here’s where things get complicated.

The Break-Even Analysis

When you delay benefits, you’re essentially making a bet on your longevity. According to a 2019 United Income study referenced in The Motley Fool, waiting until 70 is the optimal choice for about 57% of seniors. That means for 43% of people, it’s NOT the best choice!

The key consideration is how long you’ll live. It usually pays off to wait if you live well into your 80s or 90s. But if you don’t, filing earlier could give you more benefits over the course of your life.

Think about it this way: if you claim at 62 instead of 70, that’s 8 years of smaller checks you’re collecting while the person waiting gets zero. It takes time to make up that difference!

Health Considerations Matter Hugely

Be honest with yourself about your health situation:

- Family history of longevity? If your parents and grandparents lived into their 90s, waiting might be smart

- Chronic health conditions? Earlier claiming might make more sense

- Current lifestyle and health? Be realistic about your personal situation

As The Motley Fool points out, “You have an information edge when it comes to your decision about when to claim Social Security. Make sure you use it.”

Financial Risks of Waiting Until 70

The Sequence of Return Risk

Most advisors don’t talk about this enough: putting off retirement until 70 means relying more on your own savings in your 60s. There is a risk here that financial planners call “sequence of return risk.” “.

What’s that? Well, if the market performs poorly in the early years of your retirement while you’re withdrawing from your accounts (instead of taking Social Security), you could deplete your nest egg faster than expected. By the time you start collecting Social Security at 70, the damage to your portfolio might already be done.

The Motley Fool notes that “Even though you’ll be able to significantly reduce your withdrawal rate once you start collecting benefits at 70, it could be too late at that point to make up the difference.”

Other Financial Considerations

- Medicare enrollment is still at 65 – regardless of when you claim Social Security

- Part B premiums (currently $174.70 per month in 2024) must be paid whether you’re collecting Social Security or not

- Missing out on potential investment opportunities with the money you could have received

The Spouse Factor: A Game-Changer in Your Decision

Here’s where things get REALLY complicated – if you’re married, your decision affects more than just you.

Spousal Benefits Coordination

If you have a spouse who might claim benefits based on your record, waiting until 70 might not be ideal. According to Kiplinger, “Spousal benefits max out at FRA. So, if you wait until 70 to claim and your spouse has reached FRA, they could be collecting less than they would’ve been if you were the higher earner and had claimed benefits earlier.”

For spousal benefits to kick in, both spouses must be claiming benefits. This creates a situation where sometimes it makes more sense for at least one spouse to claim earlier.

Survivor Benefits Consideration

On the flip side, survivor benefits can be worth as much as the deceased beneficiary was receiving before they passed away. So delaying until 70 could potentially leave your surviving spouse with higher monthly checks for the rest of their life.

This is why the Motley Fool article states, “The dynamics of spousal benefits can make it so neither spouse should wait until age 70 to claim benefits. In most cases, at least one spouse should claim earlier.”

Real Talk: When Waiting Till 70 Makes the Most Sense

I think waiting till 70 is particularly smart if:

- You’re still working in your 60s and don’t need the income

- You have longevity in your family and excellent health

- You’re the higher earner in your marriage and want to maximize survivor benefits

- You have enough savings to comfortably bridge the gap until 70

- You’re worried about outliving your money

When Claiming Earlier Might Be Better

On the other hand, claiming earlier could be wiser if:

- You have health concerns that might impact your longevity

- You need the income sooner rather than later

- You’re concerned about major market downturns affecting your retirement savings

- You’re the lower-earning spouse and coordination with your partner makes earlier claiming optimal

- You want to enjoy more money while you’re younger and potentially more active

Steps to Take Before Making Your Decision

Before you decide when to claim, I’d recommend:

- Calculate your break-even age – when would waiting start to pay off?

- Get an official estimate – create an account at SSA.gov to see your personalized benefit amounts

- Consider your full financial picture – Social Security is just one piece of your retirement puzzle

- Coordinate with your spouse – make decisions together that maximize household benefits

- Consult a professional – for complex situations, it might be worth getting personalized advice

A Word About Retroactive Benefits

Here’s a little-known fact from the SSA: if you’ve already reached full retirement age, you can choose to start receiving benefits for up to six months before the month you apply. However, they cannot pay retroactive benefits for any month before you reached full retirement age or more than six months in the past.

This could be useful if you intended to delay but suddenly need funds.

Don’t Forget Medicare Regardless of Your Decision

One crucial reminder from the SSA: “If you decide to delay your retirement, be sure to sign up for just Medicare at age 65. If you do not sign up at age 65, in some circumstances your Medicare coverage may be delayed and cost more.”

My Final Thoughts

There’s no one-size-fits-all answer to whether waiting until 70 is best. As Kiplinger notes, “Unfortunately, there’s no right answer when it comes to the best age to claim Social Security benefits. It’s a decision that needs to be made based on your situation and financial needs.”

The 8% annual increase for delayed retirement credits is significant, but you need to weigh it against your personal health, financial situation, marital status, and overall retirement goals.

Remember, Social Security is ultimately about providing financial security during your retirement years. The “best” claiming age is the one that helps you achieve your personal retirement goals with the greatest confidence.

So, do you get more Social Security if you wait until age 70? Yes, about 8% more per year after your full retirement age. But is that the right choice for YOU? That depends on factors only you can fully assess.

What’s your current thinking about when to claim? Are you leaning toward waiting or claiming earlier? I’d love to hear your thoughts in the comments!

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Everyone’s situation is different, and what works for one person may not work for another. Consider consulting with a financial advisor before making decisions about your Social Security benefits.

Collect Your Social Security at 62 Or Wait Until 70 For Maximum Benefits?

FAQ

How much more Social Security do you get if you wait until age 70?

Your Social Security benefit increases by 8% for each full year you delay taking it after your full retirement age (FRA), with the maximum increase occurring when you reach age 70. That is, if your FRA is 66 and you can get a $1,000 benefit, waiting until age 70 would make your monthly check $1,320.

What is the benefit of waiting until you are 70 years old?

If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase. If you start receiving benefits early, your benefits will be reduced a small percentage for each month before your full retirement age.

What will the 2026 Social Security increase be?

The official 2026 Social Security cost-of-living adjustment (COLA) is not yet announced, but analysts are projecting it to be around 2. 7% or higher, with some estimates ranging from 2. 7% to 2. 8%.

Why is it better to take Social Security at age 66 instead of 70?

If you retire before your full retirement age (FRA), you will get as much as 25% less in benefits than you would have gotten if you had waited.

Should you wait until 70 to claim social security?

When someone turns 70, they can start getting benefits, and most of the time, waiting until that age to claim increases their lifetime income from Social Security. But delaying benefits until 70 comes with some serious costs too. And sometimes, it doesn’t make sense to wait that long at all. Here’s the unfortunate truth about claiming Social Security at age 70.

Will my Social Security benefits increase if I’m 70?

Not only won’t your credits increase by claiming after age 70, but if you wait longer than half a year, you’ll start losing monthly benefits you would have otherwise received. The Social Security Administration (SSA) will pay you retroactively for benefits accrued up to six months after your 70th birthday, but that’s it.

When can I start receiving Social Security benefits?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits only when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

What age should I start taking social security?

Compare Social Security at age 62 vs. 67 vs. 70. While you can start taking Social Security at 62, you won’t receive the full benefit you have earned unless you wait until your full retirement age to sign up. This is usually age 66 or 67, and you can check to see when you are eligible for full Social Security benefits.

What happens if you wait to take Social Security?

For each year you wait to take Social Security past your full retirement age, your benefits grow by 8%. Here’s what to consider as you think about claiming Social Security at a later age: Waiting increases benefits. You might pay less in taxes. You may feel better. Consider reasons not to delay payments.

Should I take my own Social Security benefits early?

If you choose to take your own (not your spouse’s) Social Security benefit early, be aware that the payments will be permanently reduced by five-ninths of 1% for each month before your full retirement age.