If you’ve inherited an individual retirement account (IRA), you may wonder about the tax implications of distributions.

If you’ve inherited an individual retirement account (IRA), you may wonder about the tax implications of distributions.

IRAs are tax-friendly while the account holder is alive, but there are different tax rules for people who inherit an IRA. Understanding these rules is essential to avoid unexpected tax bills and to make the most of your inheritance.

Inherited IRAs fall into two primary categories: traditional IRAs and Roth IRAs. The tax treatment of distributions depends on the type of account.

Distributions from an inherited traditional IRA are taxable as ordinary income. This is because contributions to traditional IRAs are tax-deferred, meaning the original account holder didn’t pay taxes on the money when it was contributed.

When you withdraw funds, the IRS treats them as taxable income. The tax rate you pay on money from an inherited IRA will depend on your income level in the year you take the money out.

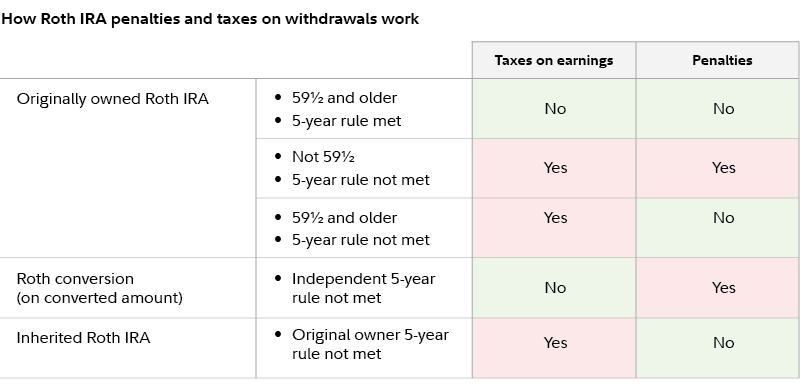

Roth IRAs are funded with after-tax dollars. That means the account holder has already paid taxes on the contributions when they were made. As a result, distributions from an inherited Roth IRA are tax-free if the account has been open for at least five years.

However, if the account hasn’t met the five-year rule, earnings on the account may be taxable.

Have you ever wondered what happens to the money in your parent’s or spouse’s Roth IRA when they die? I did, and let me tell you, it can be hard to figure out the tax consequences! I’m going to tell you everything you need to know about inheriting a Roth IRA and whether you’ll have to pay a tax bill.

The Quick Answer: Usually No Taxes (But There’s a Catch!)

If the Roth IRA was opened more than 5 years ago, most heirs don’t have to pay taxes on it. But there are some exceptions and rules you MUST follow or you will be punished. Let’s break this down.

Understanding Roth IRA Inheritance: The Basics

Someone can put money into a Roth IRA after taxes, and the money grows tax-free. When the person retires, the money comes out tax-free. When the account owner dies, these accounts go to beneficiaries without going through probate (as long as you’re listed as a beneficiary).

The beauty of inheriting a Roth IRA is that you can potentially enjoy years of tax-free growth and withdrawals if you follow the rules correctly.

Tax Treatment of Inherited Roth IRAs

Here’s what heirs need to know about taxes:

- Contributions: Always tax-free when withdrawn (the original owner already paid taxes)

- Earnings: Tax-free if the Roth IRA satisfies the 5-year rule

- 5-year rule: The account must have been open for at least 5 years before earnings can be withdrawn tax-free

If the 5-year rule isn’t met, you may have to pay income tax (but not penalties) on any money you take out.

How Your Relationship to the Original Owner Matters

The rules for inherited Roth IRAs vary dramatically based on your relationship to the deceased. Let’s explore:

Spouses Have the Most Options

If you inherit a Roth IRA from your spouse, you’ve got three main options:

-

Treat it as your own – Roll it into your existing Roth IRA or designate yourself as the owner

- No RMDs required

- Subject to early withdrawal penalties before age 59½

- Can make additional contributions

-

Open an inherited IRA

- Take RMDs over your lifetime

- No early withdrawal penalties

- Cannot make contributions

-

Take a lump-sum distribution

- No tax if 5-year rule is met

- No penalties

- Lose future tax-free growth

Most spouses choose the first option because it offers the most flexibility and growth potential.

Non-Spouse Beneficiaries (Children, Relatives, Friends)

If you’re inheriting from someone who’s not your spouse (like a parent), your options are more limited. The SECURE Act of 2020 changed everything!

For deaths occurring in 2020 or later:

- Most non-spouse beneficiaries must follow the 10-year rule

- You must withdraw all funds within 10 years of the original owner’s death

- No annual RMDs required, but the account must be empty after 10 years

- No taxes on withdrawals if the 5-year rule is satisfied

For deaths occurring before 2020:

- You could stretch distributions over your lifetime using IRS life expectancy tables

- Annual RMDs were required

- You could withdraw funds within 5 years

Eligible Designated Beneficiaries: The Exception to the 10-Year Rule

Some non-spouse beneficiaries can still stretch distributions over their lifetime even under the new rules. You’re an “eligible designated beneficiary” if you’re:

- A minor child of the original owner (until reaching age of majority)

- Disabled or chronically ill

- Not more than 10 years younger than the original owner

As a minor child, once you reach the age of majority (usually 18-26, depending on your state), the 10-year rule kicks in.

Opening an Inherited Roth IRA: Step-by-Step

If you decide to open an inherited Roth IRA, here’s what to do:

- Contact the financial institution holding the original Roth IRA

- Provide a death certificate and proof of your identity

- Complete the required forms to establish an inherited Roth IRA

- Choose your investments for the transferred funds

Remember, you cannot:

- Make additional contributions to an inherited Roth IRA

- Convert it to your own Roth IRA (unless you’re a spouse)

- Roll it into another retirement account you own

Common Questions About Taxes on Inherited Roth IRAs

What if the 5-year rule hasn’t been met?

If the original owner hadn’t held the Roth IRA for 5 years before passing away, only the contributions can be withdrawn tax-free. Earnings will be subject to income tax at your ordinary tax rate, but not the 10% early withdrawal penalty.

What happens if I miss a required distribution?

Under the old rules, failing to take RMDs could result in a 50% penalty on the amount you should have withdrawn! However, for beneficiaries subject to the 10-year rule, the IRS provided relief for missed RMDs in 2021 and 2022 under Notice 2022-53.

Can I just cash out the entire Roth IRA immediately?

Yes, all beneficiaries can take a lump-sum distribution. If the 5-year rule is satisfied, you’ll owe no taxes. But you’ll miss out on years of potential tax-free growth!

Special Scenarios Worth Noting

Inheriting from a Parent

When inheriting from a parent who died in 2020 or later:

- You must withdraw all funds within 10 years

- No annual RMDs are required

- Distributions are tax-free if the 5-year rule is met

Multiple Beneficiaries

If a Roth IRA has multiple beneficiaries, each should establish their own inherited IRA with their portion by September 30 of the year following the owner’s death. This allows each beneficiary to follow their own distribution schedule.

Entities as Beneficiaries

If the beneficiary is not an individual (like a charity or estate), different rules apply. The SECURE Act changes don’t apply, and they follow the pre-2020 rules regardless of when the owner died.

Strategic Withdrawal Planning

When inheriting a Roth IRA, you’ve got some decisions to make about how and when to take distributions:

For 10-Year Rule Beneficiaries

You’ve got flexibility within that 10-year period. Some options include:

- Take withdrawals evenly over 10 years

- Delay withdrawals until later years if you expect higher income now

- Accelerate withdrawals during lower-income years

- Wait until year 10 to take everything (maximizing tax-free growth)

For Lifetime Distribution Beneficiaries

If you’re an eligible designated beneficiary who can stretch distributions:

- Take only the required minimum each year to maximize tax-free growth

- Consider your current and future tax brackets when planning withdrawals

Common Mistakes to Avoid

- Missing the 10-year deadline – The account must be fully distributed by December 31 of the 10th year following the year of death

- Failing to open an inherited IRA – You can’t just add the funds to your existing retirement accounts

- Not considering tax implications – Plan withdrawals strategically based on your income

- Forgetting about the 5-year rule – Check when the original Roth IRA was established

- Trying to make contributions – Inherited IRAs can’t accept new contributions

Real-Life Example: Sarah’s Inheritance Strategy

Sarah inherited a $500,000 Roth IRA from her father who died in 2022. Since she’s not an eligible designated beneficiary, she must empty the account within 10 years.

Sarah’s strategy:

- Confirmed the account met the 5-year rule (her dad opened it in 2010)

- Decided to leave most funds invested to maximize growth

- Plans to take $50,000 annually for 10 years

- Will adjust timing if her income changes significantly

By following the rules, Sarah will receive $500,000+ tax-free over the next decade!

Final Thoughts: Maximize Your Inheritance

Inheriting a Roth IRA can provide significant financial benefits when managed correctly. The key takeaways:

- Most withdrawals are tax-free if the 5-year rule is met

- Follow the rules for your beneficiary type (spouse vs. non-spouse)

- Be aware of the 10-year rule for deaths after 2019

- Consider tax planning in your withdrawal strategy

While these rules can seem complicated, understanding them will help you maximize the tax benefits of your inheritance. When in doubt, consulting with a financial advisor or tax professional is always a smart move.

Disclaimer: This article is for informational purposes only and should not be considered tax or financial advice. Tax laws change frequently, and your situation may be unique. Please consult with a qualified tax professional or financial advisor before making decisions about inherited retirement accounts.

The 10-Year Rule for Inherited IRAs

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 significantly changed the rules for inherited IRAs. Most beneficiaries now fall under the 10-year rule, which requires the entire account to be emptied by the end of the tenth year following the original account holder’s death.

Under the 10-year rule:

- During the 10 years, you can take the money out at any time.

- Beneficiaries must take RMDs every year for 10 years, even if the original owner hadn’t started taking them yet. By the end of the 10 years, the whole balance must be paid off.

The amount you withdraw each year is taxable if the inherited account is a traditional IRA. With a Roth IRA, distributions are tax-free as long as the account meets the five-year rule.

Tax Considerations for Inherited IRA Distributions

Understanding the tax implications of inherited IRA distributions is critical to managing your finances effectively. Here are some key considerations:

When taking money out after the 10-year rule, be careful not to move into a higher tax bracket. Spreading distributions over several years may help minimize your overall tax liability.

Inherited IRA distributions are subject to federal income tax and may also be taxable at the state level. Check your state’s tax laws to understand how distributions will be treated.

Unlike the original account holder, beneficiaries are not subject to the 10% early withdrawal penalty, regardless of their age. This makes inherited IRAs more flexible in terms of access to funds.

Inherited IRA distributions can complicate your tax situation, especially if you have other sources of income. A tax professional can help you navigate the rules, calculate your tax liability, and optimize your withdrawal strategy.