Everyone I talk to, from new clients to longtime neighbors to business contacts, tells me the same story. I tell them I’m a financial advisor, and we start talking about money, investments, and eventually retirement. They say to me, “I also have this thing… I think it’s called an annuity? My guy at (fill in the name of a large broker dealer) told me it would make my retirement easier. ”.

That statement often makes me pause and take a deep breath. Why? Because I know that annuities are far from the simple, cure-all retirement solution they’re often presented as.

I’ll start with the spoiler alert: I (mostly) hate annuities. In my fifteen years in wealth management, I have yet to be excited about an annuity a new client shows up with. I’ve only recommended an annuity in a small handful of cases. Nine times out of ten, I think of annuities as a hammer in search of a nail. They are products that are hocked as solutions, unnecessarily complicated for consumers, extremely restrictive, and generally quite expensive. Those are four big negatives that are hard to overcome.

But the careful reader will note my use of the word “mostly”. I concede that there are circumstances in which annuities can be useful. But how is a consumer to know when that’s the case? What should you be aware of with annuities, and most importantly, how do you know if an annuity is right for you?.

Have you ever wondered if financial advisors really suggest annuities to their clients or if they’re just trying to make a commission? I’ve spent years researching different ways to plan for retirement and I’ve seen that this subject is very confusing. Today I’m going to explain the truth about annuities and what advisors say.

The Surprising Truth About Annuity Recommendations

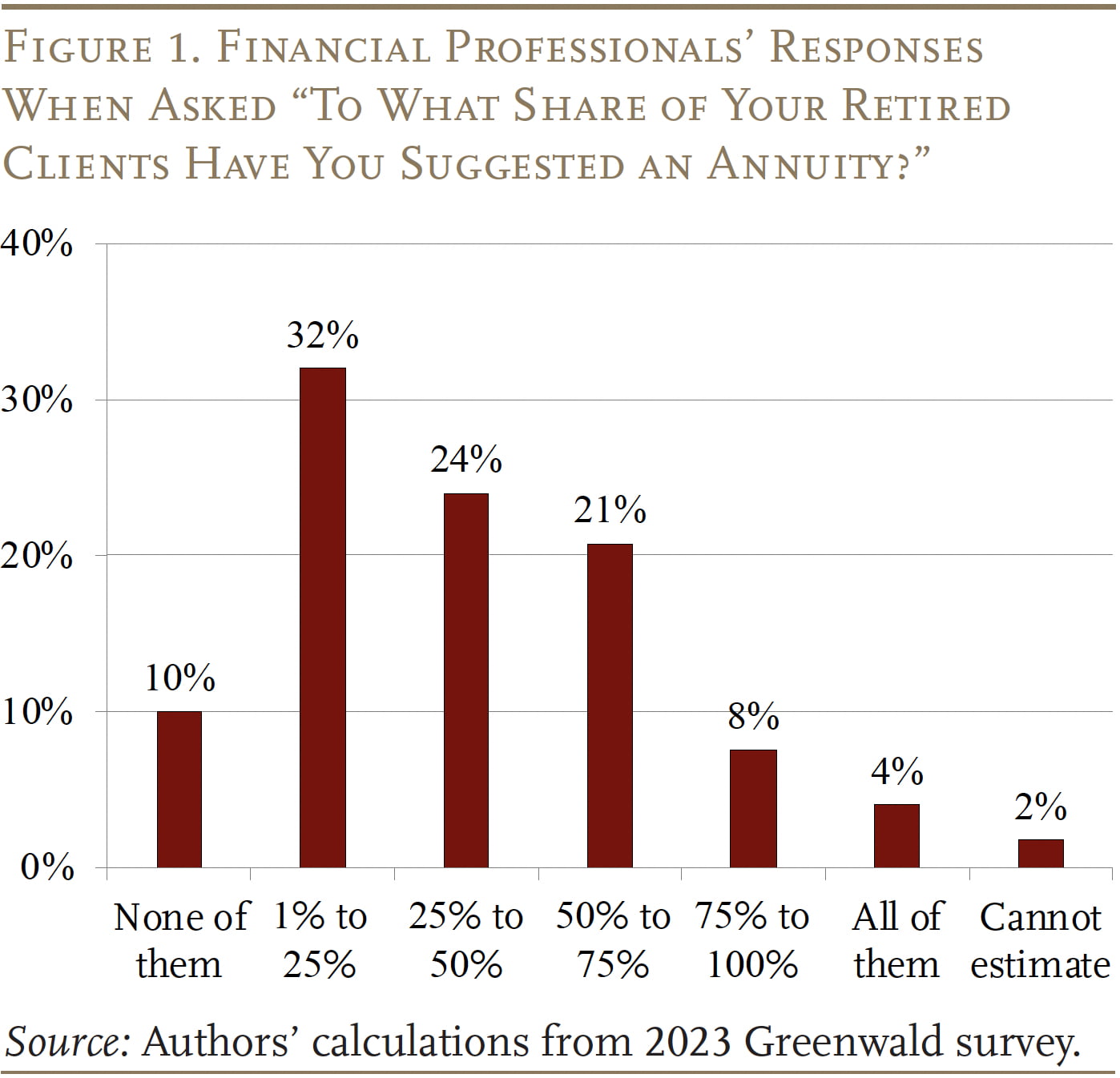

Contrary to what many believe, financial advisors don’t always push annuities In fact, a study from the Center for Retirement Research at Boston College found that even though most financial professionals understand the risk of outliving one’s savings, they rarely suggest annuities as the solution In some cases, advisors may bring up the option — but many clients dismiss it, according to the survey.

This is pretty shocking when you think about it! If annuities provide guaranteed income that can prevent retirees from outliving their money why aren’t more advisors recommending them?

Why Some Advisors DO Recommend Annuities

When advisors do suggest annuities, they typically have legitimate reasons

1. Guaranteed Income for Life

For clients worried about outliving their savings, annuities offer something almost no other investment can: guaranteed income for as long as you live. This is particularly valuable for those without traditional pension plans.

2. Protection from Market Volatility

Some advisors recommend annuities to risk-averse clients who can’t stomach market fluctuations. As one financial planner told me, “My clients who lose sleep over market drops are often better candidates for fixed annuities than those who can ride out the volatility.”

3. Tax-Deferred Growth

Annuities allow investment gains to grow tax-deferred until withdrawal, which can be beneficial for clients who’ve maxed out their other tax-advantaged accounts like 401(k)s and IRAs.

4. For Those with Longevity in Their Family

If your clients tend to live into their 90s, an annuity can be a smart hedge against the risk of outliving savings. The longer you live, the better deal a lifetime annuity becomes.

Types of Annuities Advisors Might Recommend

Not all annuities are created equal. Here are the main types that advisors might suggest:

-

Fixed annuities offer a steady stream of income and a rate of return that is guaranteed. They’re simple but may lose purchasing power due to inflation.

-

Variable annuities let you invest in sub-accounts, which are a lot like mutual funds. They have the potential to grow, but they also carry more risk and usually charge more.

-

Equity-Indexed Annuities – A hybrid that offers some market exposure with downside protection. These can be complex and often carry high commissions.

-

Immediate vs. If you choose a deferred annuity, the payments will start at a later date than with an immediate annuity.

The Conflict of Interest Question

Let’s address the elephant in the room: commissions. Some advisors may recommend annuities because they offer substantial commissions, sometimes exceeding 5% of the contract value.

As a financial blogger who talks to advisors regularly, I can tell you this is a real concern. One advisor candidly told me, “I’ve seen colleagues push variable annuities with 7% commissions when a simple index fund would’ve been better for the client.”

But not all advisors operate this way. Those who work as fiduciaries are legally required to put client interests first. This brings us to an important distinction:

Fiduciary vs. Non-Fiduciary Advisors

- Fiduciary Advisors (like Registered Investment Advisors) must legally act in your best interest at all times.

- Non-Fiduciary Advisors (like insurance agents or broker-dealer representatives) may follow a “suitability” standard, which is a lower bar.

If you’re getting annuity recommendations, it’s crucial to understand which standard your advisor follows.

Who Should Consider an Annuity?

Based on Investopedia’s guidance and my own research, annuities make the most sense for:

- Retirees seeking income security – Those who want guaranteed monthly income for budgeting purposes

- Risk-averse investors – People who prioritize principal protection over growth potential

- Individuals with longevity concerns – Those in good health with a family history of long lifespans

Who Should Probably Avoid Annuities?

Annuities aren’t for everyone. They’re generally not ideal for:

- Growth-focused investors – If you’re seeking high returns, annuities will likely disappoint

- Those with short time horizons – Annuities are long-term products with surrender charges for early withdrawal

- People sensitive to fees – Many annuities carry high internal costs that eat into returns

Red Flags: When to Question an Annuity Recommendation

If your advisor suggests an annuity, watch for these warning signs:

- They can’t clearly explain how the annuity works

- They minimize or dismiss the surrender charges or fees

- They seem more focused on the benefits than potential drawbacks

- They’re pressuring you to make a quick decision

- They recommend putting a large percentage of your assets into annuities

How to Tell if an Advisor Has Your Best Interests at Heart

When evaluating annuity recommendations, ask these questions:

- “Are you acting as a fiduciary when recommending this product?”

- “How are you compensated for selling this annuity?”

- “What alternatives did you consider before recommending this annuity?”

- “What are the total fees, including mortality and expense charges?”

- “How long is the surrender period, and what are the penalties?”

An advisor who gives straightforward, transparent answers is more likely to be looking out for your interests.

Alternatives to Annuities

If guaranteed income is your goal, there are other options to consider:

- Dividend-paying stocks – Provide income and potential growth but with market risk

- Bond ladders – Creating staggered bond maturities can generate predictable income

- Municipal bonds – Offer tax advantages for income-seeking investors

- Systematic withdrawals – Drawing income from a diversified portfolio at a sustainable rate

- Delayed Social Security – Waiting to claim benefits can substantially increase lifetime payments

My Personal Take on Annuity Recommendations

In my experience tracking this industry, I’ve noticed that the best advisors don’t automatically recommend or dismiss annuities. Instead, they evaluate each client’s specific situation, needs, and goals.

I’ve seen retirees who sleep better at night knowing they have guaranteed income from an annuity. I’ve also watched others regret locking up large portions of their savings in high-fee products they didn’t fully understand.

What’s most concerning is that the research shows many advisors aren’t even bringing annuities up as an option, despite their potential benefits for longevity protection. This suggests a possible knowledge gap even among professionals.

A Real-World Example

Let me share a story about my friend’s parents. They met with two different advisors:

- Advisor #1 immediately suggested putting 70% of their $500k savings into a variable annuity with a 6% commission

- Advisor #2 discussed their goals, risk tolerance, and income needs before suggesting a smaller fixed annuity (20% of assets) to create an income floor

The difference? Advisor #2 was a fee-only fiduciary, while Advisor #1 worked on commission. My friend’s parents went with the second option and have been satisfied with the balance of security and flexibility.

Making the Right Decision for YOUR Retirement

When considering annuities, remember:

- Understand the product completely before signing anything

- Know how your advisor is compensated

- Consider the purpose the annuity will serve in your overall plan

- Compare alternatives that might accomplish the same goal

- Start small if you’re uncertain – you don’t have to annuitize all your assets

Final Thoughts

So, do financial advisors recommend annuities? The surprising answer is: not as often as you might think, despite their potential benefits for addressing longevity risk. When they do, the recommendation may be completely appropriate for certain clients – or it might be influenced by commission structures.

Your best protection is education and working with a fiduciary advisor who’s legally obligated to put your interests first. Remember that annuities can be valuable tools in the right situations but are never a one-size-fits-all solution.

What’s your experience with annuities? Have you been recommended one? I’d love to hear about your experiences in the comments below!

Disclaimer: This article provides general information and should not be considered personalized financial advice. Always consult with a qualified financial professional before making investment decisions.

Finance tips delivered straight to your inboSign up for monthly finance tips and updates from Abacus financial advisors.

Let’s start with the facts. An annuity is essentially an insurance product. Insurance agents, financial advisors, and brokers who work on commission often sell them as a retirement tool. Their claim to fame is the promise of stability – a stable income stream that is partially or wholly insulated from market movements. You put some money into an annuity, and then at some point, that big chunk of money turns into regular payments back to you.

Some annuities track the stock market, others don’t. Some pay out immediately, while others won’t pay out for decades. Some have riders that offer benefits while the owner is alive, and other benefits when an owner dies. There are also many types of annuities that all behave differently, so it’s important to understand that each type has its own risks, advantages, costs, and restrictions. If I went through every kind of annuity and customization possible, I would definitely lose you as a reader – so let’s focus on the pros and cons of these products.

The Hidden Costs of Annuities: Fees That Can Eat Away Your Retirement Savings

Annuities offer many different options, and none of them are cheap. If an annuity promises to insulate you from the downside of market movements, you can be assured that they will charge you a pretty penny to do so. When you start layering on the administrative fees, investment fees, rider/add-on fees, and mortality fees (to name a few), the numbers really add up. Finally, if you decide to cash out your annuity, be ready to pay surrender fees that can be as high as 7% of your original investment.

Do Financial Advisors Recommend Annuities? – AssetsandOpportunity.org

FAQ

Why don’t financial advisors like annuities?

Generally the bad rep for Annuities is a hold-over from years and decades ago when they genuinely were bad. Most were expensive and heavily weighted in favor of the insurance companies, lacked any sort of liquidation clause and were over-sold by less than ethical financial representatives chasing commissions.

What do financial experts say about annuities?

Experts point to a few annuity pros to know today: Guaranteed lifetime income: “Annuities are the only investments that can guarantee income for life,” says Hawley. This matters more as people live into their 90s and beyond. Market volatility protection: Fixed and indexed options protect your money when markets fall.

Do financial advisors make money on annuities?

Potential Incentives and Conflicts of Interest Annuities are often sold through arrangements that include built-in compensation for the advisor or insurance agent. The issuing insurance company often pays these commissions, which vary based on the type of annuity.

Why do financial advisors push annuities?

Advisors promote annuities because they offer guaranteed income and downside protection, which are real problems that people face in retirement. Annuities also have a strong psychological appeal for buyers and a good pay structure for sellers.

Are annuities a good investment?

Annuities may not be suitable for investors seeking high growth or those with short-term financial goals. Understanding personal financial goals is crucial before deciding on an annuity. An annuity is a lifetime income plan.

Should you invest your money in an annuity?

If you’re looking to invest your money to achieve a specific financial goal, such as retiring in a few years or making a big purchase like a new car, an annuity is probably not the right option. Annuities are designed to provide consistent income during retirement, not significant financial gains in the near term.

Why should a retirement planner consider an annuity?

One of the primary reasons retirement planners may consider an annuity is for guaranteed monthly income. Especially with a fixed annuity, you’ll know exactly what your monthly income will be, so you can carefully plan your budget. This is a great choice for people who think they might not be able to handle their retirement savings well.

What should I know before buying an annuity?

Understanding personal financial goals is crucial before deciding on an annuity. An annuity is a lifetime income plan. In exchange for premiums, people are promised a steady or changing stream of income, either now or in the future. Generally, there are two different ways to purchase annuities.

Should I buy an annuity?

Read the fine print before purchasing an annuity. For example, some fixed annuities may have a minimum guaranteed interest rate of 0%. So, while you won’t lose the principal, your money will not grow. Additionally, some annuities offer a higher guaranteed interest rate that only lasts for the first year, otherwise known as a “teaser rate.”

Are variable annuities a good investment?

Variable annuities provide investment accounts called “sub-accounts,” which function similarly to mutual funds and allow you to take advantage of market growth. This type of annuity is popular since there’s a lower risk of your income stream being eroded by inflation compared with fixed-rate annuities.